Security planning for small modular reactors ‘not where it should be’, academic says.

28 Nov, 2024 By Tom Pashby

The security planning for the forthcoming wave of small modular reactor (SMR) developments in the UK is “not where it should be” according to an academic who supports the industry.

SMRs have risen up the agenda with Great British Nuclear’s (GBN) competition for developers to get access to government support for deployment making progress, as well as other novel

nuclear energy companies like Last Energy UK saying it will deploy

micro-reactors in Wales by 2027.

Big technology companies like Google,

Amazon and Oracle have said they want SMRs to power their AI data centres,

to overcome grid power constraints.

And in the UK, the Civil nuclear:

roadmap to 2050 stated: “To deliver energy security while driving down

costs our long-term ambition is the deployment of fleets of SMRs in the

UK.” Proponents of SMRs, such as big tech companies, want them because of

the additional flexibility they offer in location. They don’t need to be

built far away from people because of their size, or near water because

SMRs can be air-cooled.

This opens up questions about appropriate security

arrangements, because traditional gigawatt-scale nuclear sites in the UK

benefit from having long sight lines and layers of physical security such

as fences, patrol paths and armed guards.

New Civil Engineer 28th Nov 2024 https://www.newcivilengineer.com/latest/security-planning-for-small-modular-reactors-not-where-it-should-be-academic-says-28-11-2024/

Small nuclear reactors are at risk from military attacks, so should be built underground

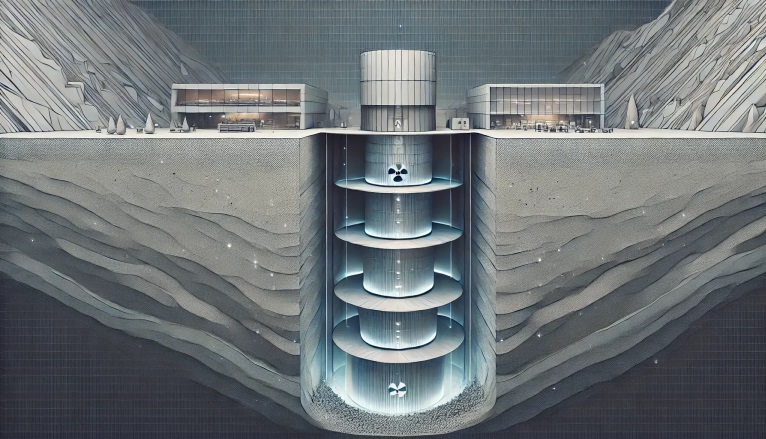

Small modular reactors (SMRs) should be built underground, including in

city centres, to protect them from military attacks, seismic activity and

other natural hazards, according to a new academic study.

Nucnet 27th Nov 2024

https://www.nucnet.org/news/underground-plants-could-be-built-in-city-centres-11-3-2024

Will New Brunswick choose a “small, modular” nuclear reactor – that’s not small at all (among other problems)?

There is nothing modular about this reactor. The idea that such an elaborate structure can just be trucked in, off-loaded, and ready to go, is a fantasy cultivated by the nuclear industry as a public relations gimmick.

by Gordon Edwards, November 23, 2024, https://nbmediacoop.org/2024/11/23/will-new-brunswick-choose-a-small-modular-nuclear-reactor-thats-not-small-at-all-among-other-problems/

NB Power seems determined to build at least two experimental reactors at the Point Lepreau nuclear site, but their chosen designs are running into big problems.

One possible alternative is the reactor design Ontario Power Generation (OPG) hopes to build at the Darlington nuclear site on Lake Ontario. OPG is promoting it as a “small, modular” nuclear reactor.

Consider a building that soars 35 metres upwards and extends 38 metres below ground. That’s 10 stories up, 11 stories down. At 73 metres, that’s almost as tall as Brunswick Square in Saint John, or Assumption Place in Moncton, the tallest buildings in New Brunswick. Would you call such a structure small?

That’s the size of the new reactor design, the first so-called “Small Modular Nuclear Reactor” (SMNR) to be built in Canada, if the Canadian Nuclear Safety Commission gives OPG the go-ahead in January. It’s an American design by GE Hitachi that requires enriched uranium fuel – something Canada does not produce. If the reactor works, it will be the first time Canada will have to buy its uranium fuel from non-Canadian sources.

The new project, called the BWRX-300, is a “Boiling Water Reactor” (BWR), completely different from any reactor that has successfully operated in Canada before. Quebec tried a boiling water CANDU reactor several decades ago, but it flopped, running for only 180 days before it was shut down in 1986.

The Darlington BWR design is not yet complete. Its immediate predecessor was a BWR four times more powerful and ten times larger in volume, called the ESBWR. It was licensed for construction in the U.S. in 2011, the same year as the triple meltdown at Fukushima in Japan. The ESBWR design was withdrawn by the vendor and never built.

The BWRX-300 is a stripped-down version of ESBWR, which in turn was a simplified version of the first reactor that melted down in Japan in 2011. To shrink the size and cut the cost, the BWRX-300 eliminates several safety systems that were considered essential in its predecessors.

For example, BWRX-300 has no overpressure relief valves, no emergency core cooling system, no “core catcher” to prevent a molten core from melting through the floor of the building. Instead, it depends on a closed-loop “isolation condenser” system (ICS) to substitute for those missing features.

But is the ICS up to the job? During a 1970 nuclear accident, the ICS failed in a BWR at Humboldt Bay in California. At Fukushima, the ICS system failed after a few hours of on-and-off functioning.

Because CNSC, the Canadian nuclear regulator, has no experience with Boiling Water Reactors, it has partnered with the US Nuclear Regulatory Commission (NRC). They both met with the vendor GE-Hitachi several times.

The regulatory approach of the two countries has been very different: in February 2024, the U.S. NRC staff told GE-Hitachi that a complete design is needed before safety can be certified or any licence can be considered. But In Canada, the lack of a complete design seems no obstacle.

CNSC public hearings in November 2024 and January 2025 are aimed at giving OPG a “licence to construct” the BWRX-300 – before the design is even complete, and before the detailed questions from U.S. NRC staff have been addressed.

Building the BWRX-300 will require a work force of 1,000 or more. The entire reactor core, containing the reactor fuel and control mechanisms, will be in a subterranean cylindrical building immersed in water, not far from the shore of Lake Ontario.

There is nothing modular about this reactor. The idea that such an elaborate structure can just be trucked in, off-loaded, and ready to go, is a fantasy cultivated by the nuclear industry as a public relations gimmick.

The BWRX-300 will not be small. It will not be modular. And so far, its design is incomplete. An initial analysis of the design has identified unanswered safety questions.

If CNSC is prudent, it will not grant OPG a licence to construct the reactor next year. There are too many unanswered safety-related questions.

And if OPG is prudent, It will count on a doubling or tripling of the estimated cost. Already we have seen SMR projects in Idaho and Chalk River in Ontario run into crippling financial roadblocks.

The financial problems of the current SMNR designs in New Brunswick are the latest examples of private capital shunning nuclear investments. If New Brunswick is prudent, it will think very hard before diving into another nuclear boondoggle. The potential fallout will not be small at all.

Dr. Gordon Edwards is the president of the Canadian Coalition for Nuclear Responsibility based in Montreal.

Shares in nuclear reactor company OKLO bite the dust

Sam Altman-Backed Oklo Slumps After Kerrisdale Says It’s Shorting Stock

By Carmen Reinicke and Will Wade, November 20, 2024 , https://www.bnnbloomberg.ca/investing/2024/11/20/sam-altman-backed-oklo-slumps-after-kerrisdale-says-its-shorting-stock/

Shares of Oklo Inc., the nuclear fission reactor company backed by OpenAI Inc’s Sam Altman, tumbled Wednesday after Kerrisdale Capital said it is shorting the stock.

The report alleges that “virtually every aspect of Oklo’s investment case warrants skepticism,” sending the stock down as much as 10%. Shares pared much of the decline and were down about 6% in midday trading in New York.

Oklo shares have whip-sawed recently, rallying more than 20% this week through Tuesday’s close after falling 25% on Friday following its earnings release and the expiration of a lockup period that allows key investors like Peter Thiel’s venture capital firm to start selling shares.

Oklo declined to comment.

Since the company went public via a special purpose acquisition merger in May, its shares have soared more than 150%.

“In classic SPAC fashion, Oklo has sold the market on inflated unit economics while grossly underestimating the time and capital it will take to commercialize its product,” the Kerrisdale report said.

The company is among a wave of firms developing so-called small modular reactors that are expected to be built in factories and assembled on site. Advocates say the approach will make it faster and cheaper to build nuclear power plants, but the technology is unproven. Only a handful have been developed, and only in Russia and China.

Oklo has said it expects its first system to go into service in 2027, but the Kerrisdale report highlights numerous technical and regulatory hurdles that may delay that schedule. Oklo is pursuing a new technology that it said will make its design safer and cheaper than conventional reactors in use today. The company’s design doesn’t have approval from the US Nuclear Regulatory Commission, a process that typically takes years.

Wall Street is split on the company thus far. Of the four analysts covering Oklo, two have buy-equivalent ratings and two are neutral. The average price target implies about 5% return from where shares are trading.

Besides Altman and Thiel, the company has another potentially high-profile connection. Board member Chris Wright was nominated by President-elect Donald Trump to lead the Energy Department last week.

Micro-reactor developer optimistic about connecting South Wales project by 2027

08 Nov, 2024 By Tom Pashby

The CEO of a micro nuclear reactor developer aiming to build in Wales this

decade has told NCE he is confident that grid connection reforms will help

keep his company’s ambitious plans on schedule.

Last Energy is a developer of micro-reactors, which fall within the overall category of

small modular reactors (SMRs). The firm is hoping to build and commission

four 20MW reactors in South Wales by 2027.

Details of its Prosiect Egni Glan Llynfi project in Bridgend County were released last month and raised eyebrows. Last Energy calls it, in English, the Llynfi Clean Energy Project

and is proposed on the site of the former coal-fired Llynfi Power Station

which was in operation from 1951 to 1977.

The SMR designs in Great British

Nuclear’s competition are subject to a generic design assessment (GDA) by

regulators of the UK nuclear sector. This allows the regulators to assess

the safety, security, safeguards and environmental aspects of new reactor

designs before site-specific proposals are brought forward.

Jenner said Last Energy is not going through the generic design assessment approach. He

said the ONR “stated that that’s not absolutely essential”. “It’s

one route you can take. We are going straight to the site licensing

route,” he said. “We are linking our project and our design straight to

our project in this case, is Llynfi in South Wales, so you go through the

same rigor, but it’s linked to a site.

” Even with all the benefits for

rapid deployment, the 2027 commission date seems ambitious. Jenner said

Last Energy had not commenced any works at the site yet. “When we expect

to is something that we are still working through the timeline on in our

discussions with the ONR (Office for Nuclear Regulation),” he said.

New Civil Engineer 8th Nov 2024,

https://www.newcivilengineer.com/latest/interview-micro-reactor-developer-optimistic-about-connecting-south-wales-project-by-2027-08-11-2024/

NextEra No Longer Bullish on Nuclear SMRs

By Alex Kimani – Oil Price , Oct 31, 2024,

NextEra Energy is exploring the reopening of the Duane Arnold nuclear plant amid rising data center interest but remains cautious on the viability of small modular reactors.

SMRs, though promising in terms of smaller size, lower fuel needs, and modular design, face significant challenges.

High production costs for HALEU, estimated to reach up to $25,725/kg, pose a substantial financial hurdle.

……………………..CEO John Ketchum said he was “not bullish” on small modular reactors (SMRs), adding that the company’s in-house SMR research unit has so far not drawn favorable conclusions about the technology.

“A lot of [SMR equipment manufacturers] are very strained financially,” he said. “There are only a handful that really have capitalization that could actually carry them through the next several years.”

Ketchum might have a valid point. …………………………………………….

The U.S. Department of Energy has so far spent $1.2B on SMR R&D and is projected to spend nearly $6B over the next decade. Last year, the U.S. Nuclear Regulatory Commission (NRC) certified NuScale Power Corp.(NYSE:SMR) VOYGR 77 MW SMR in Poland, the first ever SMR to be approved in the country.

But there’s a big problem here because the fuel required to power these novel nuclear plants might be really expensive.

Three years ago, U.S. Nuclear Regulatory Commission (NRC) approved Centrus Energy Corp.’s (NYSE:LEU) request to make High Assay Low-Enriched Uranium (HALEU) at its enrichment facility in Piketon, Ohio, becoming the first company in the western world outside Russia to do so. A year later, the U.S. Department of Energy (DoE) announced a ~$150 million cost-shared award to American Centrifuge Operating, LLC, a subsidiary of Centrus Energy. HALEU is a nuclear fuel material enriched to a higher degree (between 5% and 20%) in the fissile isotope U-235. According to the World Nuclear Association, applications for HALEU are currently limited to research reactors and medical isotope production; however, HALEU will be needed for more than half of the SMRs currently in development. HALEU is only currently available from TENEX, a Rosatom subsidiary.

………..A 2023 survey by the Nuclear Energy Institute on U.S. advanced reactor developers estimated that the total market for HALEU could reach $1.6 billion by 2030 and $5.3 billion by 2035.

Last year, the Nuclear Innovation Alliance (NIA) published a report wherein they discussed production costs for HALEU. Here’s an excerpt from the report:

‘‘Calculated HALEU production cost for uranium enriched to 19.75% is $23,725/kgU for HALEU in an oxide form and $25,725 for HALEU in a metallic form under baseline economic assumptions but could be higher.’’

The report claims that a SWU (Separative Work Unit) is going to cost a lot more in a HALEU enrichment cascade compared to a standard LEU (Low-Enriched Uranium) enrichment cascade.

……………….NIA reckons it might cost ~$2000/kgU to make HALEUF6 into HALEUO2, and as much as $4000/kgU to make HALEUF6 into HALEU-metal. At the end of the day, you’d end up with HALEU with 28 times the fissile content of natural uranium at over 100 times the price.

https://oilprice.com/Alternative-Energy/Nuclear-Power/NextEra-No-Longer-Bullish-on-Nuclear-SMRs.html

The Rise and Fall of NuScale: a nuclear cautionary tale

Kelly Campbell, October 29, 2024 ,

https://oregoncapitalchronicle.com/2024/10/29/the-rise-and-fall-of-nuscale-a-nuclear-cautionary-tale/

A decade ago, NuScale, the Oregon-based small modular nuclear company born at Oregon State University, was on a roll. Promising a new era of nuclear reactors that were cheaper, easier to build and safer, their Star Wars-inspired artist renditions of a yet to be built reactor gleamed like a magic bullet.

As of last year, NuScale was the furthest along of any reactor design in obtaining Nuclear Regulatory Commission licensing and was planning to build the first small modular nuclear reactor in the United States. Its plan was to build it in Idaho to serve energy to a consortium of small public utility districts in Utah and elsewhere, known as UAMPS.

This home-grown Oregon company was lauded in local and national media. According to project backers, a high-tech solution to climate change was on the horizon, and an Oregon company was leading the way. It seemed almost too good to be true.

And it was.

image

Turns out, NuScale was a house of cards. The UAMPS project’s price tag more than doubled and the timeline was pushed back repeatedly until it was seven years behind schedule. Finally, UAMPS saw the writing on the wall and wisely backed out in November, 2023.

After losing their customer, NuScale’s stock plunged, it laid off nearly a third of its workforce, and it was sued by its investors and investigated for investor fraud. Then its CEO sold off most of his stock shares.

NuScale’s project is the latest in a long line of failed nuclear fantasies.

Why should you care? A different nuclear company, X-Energy, now in partnership with Amazon, wants to build and operate small modular nuclear reactors near the Columbia River, 250 miles upriver from Portland.

Bill Gates’s darling, the Natrium reactor in Wyoming is also plowing ahead. Both proposals are raking in the Inflation Reduction Act and other taxpayer funded subsidies. The danger: Money and time wasted on these false solutions to the climate crisis divert public resources from renewables, energy efficiency and other faster, more cost-efficient and safer ways to address the climate crisis.

A recent study from the Institute for Energy Economics and Financial Analysis concluded that small modular nuclear reactors are still too expensive, too slow to build and too risky to respond to the climate crisis.

While the nuclear industry tries to pass itself off as “clean,” it is an extremely dirty technology, beginning with uranium mining and milling which decimates Indigenous lands. Small modular nuclear reactors produce two to thirty times the radioactive waste of older nuclear designs, waste for which we have no safe, long-term disposal site. Any community that hosts a nuclear reactor will likely be saddled with its radioactive waste – forever. This harm falls disproportionately on Indigenous and low-income communities.

For those of us downriver, X-Energy’s plans to build at the Hanford Nuclear Site on the Columbia flies in the face of reason, as it would add more nuclear waste to the country’s largest nuclear cleanup site.

In Oregon, we have a state moratorium on building nuclear reactors until there is a vote of the people and a national waste repository. Every few years, the nuclear industry attempts to overturn this law at the Oregon Legislature, but so far it has been unsuccessful. This August, Umatilla County Commissioners announced they’ll attempt another legislative effort to overturn the moratorium. Keeping this moratorium is wise, given the dangerous distraction posed by the false solution of small modular nuclear reactors. Let’s learn from the NuScale debacle and keep our focus on a just transition to a clean energy future–one in which nuclear power clearly has no place.

Will AI’s huge energy demands spur a nuclear renaissance?

Contracts with Google and Amazon could help, but bringing new types of reactor online will take larger investments — and time.

Davide Castelvecchi, Nature , 25vOct 24

Last week, technology giants Google and Amazon both unveiled deals supporting ‘advanced’ nuclear energy, as part of their efforts to become carbon-neutral.

Google announced that it will buy electricity made with reactors developed by Kairos Power, based in Alameda, California. Meanwhile, Amazon is investing approximately US$500 million in the X-Energy Reactor Company, based in Rockville, Maryland, and has agreed to buy power produced by X-energy-designed reactors due to be built in Washington State.

Both moves are part of a larger [??] green trend that has arisen as tech companies deal with the escalating energy requirements of the data centres and number-crunching farms that support artificial intelligence (AI). Last month, Microsoft said it would buy power from a utility company that is planning to restart a decommissioned 835-megawatt reactor in Pennsylvania.

The partnerships agreed by Google and Amazon involve start-up companies that are pioneering the design of ‘small modular reactors’, which are intended to be assembled from prefabricated pieces………….they still have a way to go before they become a reality.

Nature talked to nuclear-energy researchers to explore the significance and possible implications of these big-tech investments.

Could these deals spur innovation in the nuclear industry?

Building nuclear power stations — a process often plagued by complex permit procedures, construction delays and cost overruns — is financially risky, and betting on unproven technologies is riskier still…………..

the details of the deals are murky, and the level of support provided by Amazon and Google is likely to be “a drop in the bucket” compared with the billions these start-ups will ultimately need, says physicist Edwin Lyman, director of nuclear power safety at the Union of Concerned Scientists in Washington DC. “The PR machine is just going into overdrive,” says Lyman, but “private capital just doesn’t seem ready yet to take that risk”.

Allison Macfarlane, director of the School of Public Policy and Global Affairs at the University of British Columbia in Vancouver, Canada, and former chair of the US Nuclear Regulatory Commission (NRC), says that the speed of progress in computer science raises another question. “If we’re talking 15 years from now, will AI need that much power?”

Are there safety advantages to the small modular designs?

“The smallest reactors, in theory, could have a high degree of passive safety,” says Lyman. When shut down, the core of a small reactor would contain less residual heat and radioactivity than does a core of the type that melted down in the Fukushima Daiichi disaster that followed the cataclysmic 2011 tsunami in Japan.

The companies also say that the proposed pebble-bed reactors are inherently safer because they are not pressurized, and because they are designed to circulate cooling fluids without the help of pumps (it was the loss of power to water pumps that caused three of the Fukushima plant’s reactors to fail).

But Lyman thinks it is risky to rely on potentially unpredictable passive cooling without the backup of an active cooling option. And as reactors become get smaller, they become less efficient. Another start-up company, NuScale Power, based in Portland, Oregon, originally designed its small modular reactor — which was certified by the NRC — to produce 50 MW of electricity, but later switched to a larger, 77-MW design. The need to make the economics work “makes passive safety less credible”, Lyman says.

Do small modular reactors carry extra risks?

In some cases, small modular reactors “could actually push nuclear power in a more dangerous direction”, says Lyman. “Advanced isn’t always better.”

In particular, Lyman points out that the pebble-bed designs drawn up by X-energy and Kairos would rely on high-assay low-enriched uranium (HALEU), which comprises 10–20% uranium-235 — compared with the 5% enrichment level required by most existing reactors (and by NuScale’s reactor). HALEU is still classified as low-enrichment fuel (as opposed to the highly enriched uranium used to make nuclear bombs), but that distinction is misleading, Lyman says. In June, he and his collaborators — including physicist Richard Garwin, who led the design of the first hydrogen bomb — warned in a Science article that a bomb could be built with a few hundred kilograms of HALEU, with no need for further enrichment1.

Smaller reactors are also likely to produce more nuclear waste and to use fuel less efficiently, according to work reported in 2022 by Macfarlane and her collaborators2. In a full-size reactor, most of the neutrons produced by the splitting of uranium travel through a large volume of fuel, meaning that they have a high probability of hitting another nucleus, rather than colliding with the walls of the reactor vessel or escaping into the surrounding building. “When you shrink the reactor, there’s less material in there, so you will have more neutron leakage,” Macfarlane says. These rogue neutrons can be absorbed by other atomic nuclei — which would then themselves become radioactive.

Will small reactors be cheaper to build?

The capacity to build components in an assembly line could drastically cut reactors’ construction costs. But there are also intrinsic economies of scale in building larger reactors, says Buongiorno. “Don’t believe people blindly” when they say smaller reactors will produce cheaper energy, he says: nuclear energy has a lot going for it, but “it ain’t cheap” — and that is unlikely to change significantly.

Will all of these efforts help to combat climate change?

…………….. whether building new reactors is the best way to rapidly cut emissions is debated. Macfarlane points out that solar panels and wind turbines can be deployed at a much faster rate.

https://www.nature.com/articles/d41586-024-03490-3

Mini-Nukes, Big Bucks: The Interests Behind the SMR Push

The “billionaires’ nuclear club”

The 2015 Paris climate talks featured what cleantechnica.com called a “splashy press conference” by Bill Gates to announce the launch of the Breakthrough Energy Coalition (BEC) – a group of (originally) 28 high net-worth investors, aiming “to provide early-stage capital for technologies that offer promise in bringing affordable clean energy to billions.”

Though BEC no longer makes its membership public, the original coalition included such familiar names as Jeff Bezos (Amazon), Marc Benioff (Salesforce), Michael Bloomberg, Richard Branson, Jack Ma (Alibaba), David Rubenstein (Carlyle Group), Tom Steyer, George Soros, and Mark Zuckerberg. Many of those names (and others) can now be found on the “Board and Investors” page of Breakthrough Energy’s website.

Why Canada is now poised to pour billions of tax dollars into developing Small Modular Reactors as a “clean energy” climate solution

by Joyce Nelson, January 14, 2021, story. Mini-Nukes, Big Bucks: The Interests Behind the SMR Push | Watershed Sentinel

Back in 2018, the Watershed Sentinel ran an article warning that “unless Canadians speak out,” a huge amount of taxpayer dollars would be spent on small modular nuclear reactors (SMRs), which author D. S. Geary called “risky, retro, uncompetitive, expensive, and completely unnecessary.” Now here we are in 2021 with the Trudeau government and four provinces (Saskatchewan, Ontario, New Brunswick, and Alberta) poised to pour billions of dollars into SMRs as a supposed “clean energy” solution to climate change.

It’s remarkable that only five years ago, the National Energy Board predicted: “No new nuclear units are anticipated to be built in any province” by 2040.

So what happened?

The answer involves looking at some of the key influencers at work behind the scenes, lobbying for government funding for SMRs.

The Carney factor

When the first three provinces jumped on the SMR bandwagon in 2019 at an estimated price tag of $27 billion, the Green Party called the plan “absurd” – especially noting that SMRs don’t even exist yet as viable technologies but only as designs on paper.

According to the BBC (March 9, 2020), some of the biggest names in the nuclear industry gave up on SMRs for various reasons: Babcock & Wilcox in 2017, Transatomic Power in 2018, and Westinghouse (after a decade of work on its project) in 2014.

But in 2018, the private equity arm of Canada’s Brookfield Asset Management Inc. announced that it was buying Westinghouse’s global nuclear business (Westinghouse Electric Co.) for $4.6 billion.

“If Wall Street and the banks will not finance this, why should it be the role of the government to engage in venture capitalism of this kind?”

Two years later, in August 2020, Brookfield announced that Mark Carney, former Bank of England and Bank of Canada governor, would be joining the company as its vice-chair and head of ESG (environmental, social, and governance) and impact fund investing, while remaining as UN Special Envoy for Climate Action and Finance.

“We are not going to solve climate change without the private sector,” Carney told the press, calling the climate crisis “one of the greatest commercial opportunities of our time.” He considers Canada “an energy superpower,” with nuclear a key asset.

Carney is an informal advisor to PM Trudeau and to British PM Boris Johnson. In November, Johnson announced £525 million (CAD$909.6 million) for “large and small-scale nuclear plants.”

SNC-Lavalin

Scandal-ridden SNC-Lavalin is playing a major role in the push for SMRs. In her mid-December 2020 newsletter, Elizabeth May, the Parliamentary Leader of the Green Party, focused on SNC-Lavalin, reminding readers that in 2015, then-PM Stephen Harper sold the commercial reactor division of Atomic Energy of Canada Ltd. (AECL) “to SNC-Lavalin for the sweetheart deal price of $15 million.”

May explained, “SNC-Lavalin formed a consortium called the Canadian National Energy Alliance (CNEA) to run some of the broken-apart bits of AECL. CNEA has been the big booster of what sounds like some sort of warm and cuddly version of nuclear energy – Small Modular Reactors. Do not be fooled. Not only do we not need new nuclear, not only does it have the same risks as previous nuclear reactors and creates long-lived nuclear wastes, it is more tied to the U.S. military-industrial complex than ever before. That’s because SNC-Lavalin’s partners in the CNEA are US companies Fluor and Jacobs,” who both have contracts with US Department of Energy nuclear-weapons facilities.”

But, states May, “Natural Resources Minister Seamus O’Regan has been sucked into the latest nuclear propaganda – that ‘there is no pathway to Net Zero [carbon emissions] without nuclear’.”

Terrestrial Energy

Then there’s Terrestrial Energy, which in mid-October 2020 received a $20 million grant for SMR development from NRCan’s O’Regan and Navdeep Bains (Minister of Innovation, Science and Industry). The announcement prompted more than 30 Canadian NGOs to call SMRs “dirty, dangerous, and distracting” from real, available solutions to climate change.

The Connecticut-based company has a subsidiary in Oakville, Ontario. Its advisory board includes Stephen Harper; Michael Binder, the former president and CEO of the Canadian Nuclear Safety Commission; and (as of October) Dr. Ian Duncan, the former UK Minister of Climate Change in the Dept. of Business Energy and Industrial Strategy (BEIS).

Perhaps more important, Terrestrial Energy’s advisory board includes Dr. Ernest Moniz, the former US Secretary of the Dept. of Energy (2013-2017) who provided more than $12 billion in loan guarantees to the nuclear industry. Moniz has been a key advisor to the Biden-Harris transition team, which has come out in favour of SMRs, calling them “game-changing technologies” at “half the construction cost of today’s reactors.”

In 2015, while the COP 21 Paris Climate Agreement was being finalized, Moniz told reporters that SMRs could lead to “better financing terms” than traditional nuclear plants because they would change the scale of capital at risk. For years, banks and financial institutions have been reluctant to invest in money-losing nuclear projects, so now the goal is to get governments to invest, especially in SMRs.

That has been the agenda of a powerful lobby group that has been working closely with NRCan for several years.

The “billionaires’ nuclear club”

The 2015 Paris climate talks featured what cleantechnica.com called a “splashy press conference” by Bill Gates to announce the launch of the Breakthrough Energy Coalition (BEC) – a group of (originally) 28 high net-worth investors, aiming “to provide early-stage capital for technologies that offer promise in bringing affordable clean energy to billions.”

Though BEC no longer makes its membership public, the original coalition included such familiar names as Jeff Bezos (Amazon), Marc Benioff (Salesforce), Michael Bloomberg, Richard Branson, Jack Ma (Alibaba), David Rubenstein (Carlyle Group), Tom Steyer, George Soros, and Mark Zuckerberg. Many of those names (and others) can now be found on the “Board and Investors” page of Breakthrough Energy’s website.

“As long as Bill Gates is wasting his own money or that of other billionaires, it is not so much of an issue. The problem is that he is lobbying hard for government investment.”

Writing in Counterpunch (Dec. 4, 2015) shortly after BEC’s launch, Linda Pentz Gunter noted that many of those 28 BEC billionaires (collectively worth some $350 billion at the time) are pro-nuclear and Gates himself “is already squandering part of his wealth on Terra Power LLC, a nuclear design and engineering company seeking an elusive, expensive and futile so-called Generation IV traveling wave reactor” for SMRs. (In 2016, Terra Power, based in Bellevue, Washington, received a $40 million grant from Ernest Moniz’s Department of Energy.)

According to cleantechnica.com, the Breakthrough Energy Coalition “does have a particular focus on nuclear energy.” Think of BEC as the billionaires’ nuclear club.

By 2017, BEC was launching Breakthrough Energy Ventures (BEV), a $1 billion fund to provide start-up capital to clean-tech companies in several countries.

Going after the public purse

Bill Gates was apparently very busy during the 2015 Paris climate talks. He also went on stage during the talks to announce a collaboration among 24 countries and the EU on something called Mission Innovation – an attempt to “accelerate global clean energy innovation” and “increase government support” for the technologies. Mission Innovation’s key private sector partners include the Breakthrough Energy Coalition, the World Economic Forum, the International Energy Agency, and the World Bank.

An employee at Natural Resources Canada, Amanda Wilson, was appointed as one of the 12 international members of the Mission Innovation Steering Committee.

In December 2017, Bill Gates announced that the Breakthrough Energy Coalition was partnering with Mission Innovation members Canada, UK, France, Mexico, and the European Commission in a “public-private collaboration” to “double public investment in clean energy innovation.”

Canada’s Minister of Natural Resources at the time, Jim Carr, said the partnership with BEC “will greatly benefit the environment and the economy. Working side by side with innovators like Bill Gates can only serve to enhance our purpose and inspire others.”

Dr. M.V. Ramana, an expert on nuclear energy and a professor at the School of Public Policy and Global Affairs at UBC, told me by email: “As long as Bill Gates is wasting his own money or that of other billionaires, it is not so much of an issue. The problem is that he is lobbying hard for government investment.”

Dr. Ramana explained that because SMRs only exist on paper, “the scale of investment needed to move these paper designs to a level of detail that would satisfy any reasonable nuclear safety regulator that the design is safe” would be in the billions of dollars. “I don’t see Gates and others being willing to invest anything of that scale. Instead, they invest a relatively small amount of money (compared to what they are worth financially) and then ask for government handouts for the vast majority of the investment that is needed.”

Kevin Kamps, Radioactive Waste Specialist at Beyond Nuclear, told me by email that the companies involved in SMRs “don’t care” if the technology is actually workable, “so long as they get paid more subsidies from the unsuspecting public. It’s not a question of it working, necessarily,” he noted.

Gordon Edwards, President of the Canadian Coalition for Nuclear Responsibility, says governments “are being suckers. Because if Wall Street and the banks will not finance this, why should it be the role of the government to engage in venture capitalism of this kind?”

“Roadmap” to a NICE future

By 2018, NRCan was pouring money into a 10-month, pan-Canadian “conversation” about SMRs that brought together some 180 individuals from First Nations and northern communities, provincial and territorial governments, industry, utilities, and “stakeholders.” The resulting November 2018 report, A Call to Action: A Canadian Roadmap for Small Modular Reactors, enthusiastically noted that “Canada’s nuclear industry is poised to be a leader in an emerging global market estimated at $150 billion a year by 2040.”

At the same time, Bill Gates announced the launch of Breakthrough Energy Europe, a collaboration with the European Commission (one of BEC’s five Mission Innovation partners) in the amount of 100 million euros for clean-tech innovation.

Gates’ PR tactic is effective: provide a bit of capital to create an SMR “bandwagon,” with governments fearing their economies would be left behind unless they massively fund such innovations.

NRCan’s SMR Roadmap was just in time for Canada’s hosting of the Clean Energy Ministerial/Mission Innovation summit in Vancouver in May 2019 to “accelerate progress toward a clean energy future.” Canada invested $30 million in Breakthrough Energy Solutions Canada to fund start-up companies.

A particular focus of the CEM/MI summit was a CEM initiative called “Nuclear Innovation: Clean Energy (NICE) Future,” with all participants receiving a book highlighting SMRs. As Tanya Glafanheim and M.V. Ramana warned in thetyee.ca (May 27, 2019) in advance of the summit, “Note to Ministers from 25 countries: Prepare to be dangerously greenwashed.”

Greenwash vs public backlash

While releasing the federal SMR Action Plan on December 18, O’Regan called it “the next great opportunity for Canada.”

Bizarrely, the Action Plan states that by developing SMRs, our governments would be “supporting reconciliation with Indigenous peoples” – but a Special Chiefs Assembly of the Assembly of First Nations passed a unanimous 2018 resolution demanding that “the Government of Canada cease funding and support” of SMRs. And in June 2019, the Anishinabek Chiefs-in-Assembly (representing 40 First Nations across Ontario) unanimously opposed “any effort to situate SMRs within our territory.”

Some 70 NGOs across Canada are opposed to SMRs, which are being pushed as a replacement for diesel in remote communities, for use in off-grid mining, tar-sands development, and heavy industry, and as exportable expertise in a global market.

Whether SMRs work or not, Mission Innovation members will be throwing tax-dollars at them like there is no tomorrow.

On December 7, the Hill Times published an open letter to the Treasury Board of Canada from more than 100 women leaders across Canada, stating: “We urge you to say ‘no’ to the nuclear industry that is asking for billions of dollars in taxpayer funds to subsidize a dangerous, highly-polluting and expensive technology that we don’t need. Instead, put more money into renewables, energy efficiency and energy conservation.”

No new money for SMRs was announced in the Action Plan, but in her Fall Economic Statement, Finance Minister Chrystia Freeland touted SMRs and noted that “targeted action by the government to mobilize private capital will better position Canadian firms to bring their technologies to market.” That suggests the Canada Infrastructure Bank will use its $35 billion for such projects.

It will take a Herculean effort from the public to defeat this NICE Future, but along with the Assembly of First Nations, three political parties – the NDP, the Bloc Quebecois, and the Green Party – have now come out against SMRs.

Award-winning author Joyce Nelson’s latest book, Bypassing Dystopia, is published by Watershed Sentinel Books. She can be reached via www.joycenelson.ca.

Small nuclear reactors won’t be ready in time for the needs of energy-guzzling needs of Artificial Intelligence.

As of last month, when [data centres] were classed as critical national

infrastructure, data centres are on a par with utilities, meaning the

government would step in were there a risk to connectivity. Nonetheless, as

Rohan Kelkar, the executive vice-president of power products at Schneider

Electric, puts it, the “lack of grid capacity puts UK’s AI and data

centre ambitions and energy transition goals at risk”.

So much so that we have seen the boroughs of Hillingdon, Ealing and Hounslow all rejecting

data centre projects in order to retain supply for housing. This is far

from a UK-specific issue. In Ireland, the pressure on the national grid

from computing needs is so acute they have had to pause some data centre

approvals over concerns that excessive demand from data centres could lead

to blackouts.

On the other side of the Atlantic, Big Tech companies are

also grappling with the energy conundrum: how to find low-carbon, reliable

sources of power for their power-hungry warehouses without jeopardising

customer needs or their net zero goals. Along with renewable energy and

improving battery storage, right now they all seem to be turning in one

direction: towards nuclear power. Microsoft signed a deal last month to

help resurrect a unit of the Three Mile Island plant in Pennsylvania.

Amazon bought a nuclear-powered data centre earlier in the year. On Monday,

Google became the latest to announce a nuclear energy deal to meet the

needs of its data centres, looking at mini reactors developed by a

Californian company.

A cocktail of technological innovation means this

could happen in the UK, too. Rolls-Royce, the engineer, is at the forefront

of developing mini reactors and is already having conversations with

operators in the UK about their use. While mini nukes would not have been

commercially viable in the past, now that demand for data centres has

jumped exponentially, their potential use has become more feasible. Another

key component in the future marriage of computing and nuclear power is that

data centres are becoming less location driven because of improvements in

latency, the time it takes for data to travel from one point to another.

The immediate problem with the introduction of small nuclear reactors?

Rolls-Royce estimates that they remain a decade or more away, with none

currently operating and generating electricity in the UK. In the meantime,

connection to the “constrained” grid, remains all-important headache

for those looking to build data centres.

Times 16th Oct 2024

TODAY. Media enthusiasm for dodgy “cutting edge Lego-like micro-nuclear power plants” , (but doubts creep in).

modules assembled “like a LEGO kit” and designed to be fabricated, transported, and assembled within 24 months”

BUT -“the tech is still in the early stages and faces a myriad of hurdles.”

“has yet to obtain licensing and planning approvals“

“How the new fleet of SMRs will be funded has yet to be established. The technology is not yet generating power anywhere in the world”

I am fascinated with the way that the media continues to obediently trot out the official dogma that small nuclear reactors are the new great white hope – for everything – jobs, reduce carbon emissions, revitalise the economy, cheap, clean, plentiful energy, – blah blah. The interesting thing is that, in the midst of their enthusiasm, some respectable news outlets occasionally now slip in a little bit of doubt.

A couple of examples of doubt from the UK.:

Guy Taylor, Transport and Infrastructure Correspondent at City A.M. enthuses over a “hotly anticipated tender“ surrounding the development of Small Modular Reactors (SMR)’s in the UK. A micro reactor project in Wales will bring energy for 244,000 UK homes – “will pump around £30m into the local economy”.

But he also mentions that “the tech is still in the early stages and faces a myriad of hurdles.”

Ian Weinfass, in Construction News gives a positive, optimistic, story on this micro nuclear reactor development, but clearly states that the company (Last Energy) “has yet to obtain licensing and planning approvals for its technology.“ He tellingly concludes “How the new fleet of SMRs will be funded has yet to be established. The technology is not yet generating power anywhere in the world”

However, don’t fret, little nuclear rent-seekers! Most of the media is still obedient, and they know which side their bread is buttered on . Sion Barry, writing in Wales Online, describes the same “24/7 clean energy” project as “of national significance“. There’s a reassuring note about wastes, and the barest mention of “planning and licensing approvals“. Business Green discusses the Last Energy plan as “clean energy” – modules assembled “like a LEGO kit” and designed to be fabricated, transported, and assembled within 24 months”

News media, on the whole, are happy to uncritically trot out a nuclear company’s line – as we find this same project touted in Reuters, in Power, Sustainable Times, in New Civil Engineer. On Google News today, there are 15 similar articles, with only Yahoo! News including a tad of doubt about local public reaction.

And by the way, Tom Pashby in New Civil Engineer also adds to the joy by telling us that the company involved, Last Energy is working with Nato on military applications of micro-reactors.

NuScale Power Is Great. Here’s Why You Shouldn’t Buy It.

The Motley Fool, By Reuben Gregg Brewer – Sep 14, 2024

NuScale Power (SMR 12.17%) is at the leading edge of the nuclear power sector. It is doing great things and making important progress toward its goal of mass-producing small-scale modular nuclear reactors. In a world increasingly looking toward carbon-free energy sources, it is positioning itself well for a bright future. But it won’t be a good fit for every investor. Here’s why you might want to buy the stock and why you might not want to buy it.

NuScale is moving (slowly) toward the nuclear future

Today, nuclear reactors are giant infrastructure assets that cost huge sums of money to build and years of effort to get up and running. NuScale Power is working to upend that inefficient model by offering small, modular reactors that would be built in a factory and then delivered where they are needed.

If one reactor isn’t enough, they can be linked to create a larger reactor………….

Adding to the allure here is a balance sheet with zero debt and $136 million in cash. In other words, it is working from a strong financial position. Also, NuScale Power’s largest shareholder is Fluor (FLR 2.21%), a large construction company.

Clearly, Fluor has its own motives in backing NuScale, like supporting the growth of a new market (small-scale nuclear power plant construction), but it means that NuScale has a strong parent to help it along. That’s showing up right now, too, as a project from Fluor is going to help add revenue to NuScale’s earnings statement, helping the upstart nuclear power company pay for its own product development plans.

There are indeed some good reasons to like the future prospects for NuScale power, including that, as management likes to highlight, it is “the only SMR certified by the U.S. Nuclear Regulatory Commission.” So, it basically has a leg up on the competition right now.

NuScale Power comes with some big risks

Despite the positives, NuScale Power is not going to be a good fit for every investor. In fact, only aggressive types should really be looking at the stock today. There are a host of reasons.

For starters, NuScale Power’s product plans are approved by U.S. regulators, but not fully approved to the point where it can start building and selling units. So, there’s more work to be done before NuScale Power even has a product to sell. And while it has inked a tentative deal to sell its first units, it can’t actually do that yet. It has to spend even more money on the effort to get the final government nod to start building and delivering a product.

That, in turn, means more red ink. NuScale Power is basically still in start-up mode, so it isn’t unusual that more money would be going out the door than coming in. The revenue from the work with Fluor will help, but the income statement is likely to look ugly for years to come. That’s because it will still have to ramp up its production abilities even after it gets all the approvals it needs. All in all, NuScale Power has a great story, but that story is still in its early chapters.

NuScale Power is an acquired taste

To highlight the risks here, it helps to look at the stock price. Over the past year, the stock has gone from a low of roughly $2 per share to a high of just over $15, and it currently sits at around $7. If you can’t handle price swings like that, you definitely don’t want to own this nuclear power start-up.

That said, investors with a high tolerance for risk might be interested in NuScale power, given that it has achieved a great deal on its path to producing small-scale modular nuclear reactors. But for most investors, the risks are likely too great at this point in time to justify hitting the buy button. https://www.fool.com/investing/2024/09/14/nuscale-power-is-great-heres-why-you-shouldnt-buy/

Why SMRs Are Taking Longer Than Expected to Deploy

Oil Price, By Felicity Bradstock – Sep 14, 2024

“…………………………………………..Several energy companies and startups, such as Terrapower – founded by Bill Gates, are developing SMR technology. The founders of Terrapower decided the private sector needed to take action in developing advanced nuclear energy to meet growing electricity needs, [?] mitigate climate change and lift [?] billions out of poverty.

Several SMR projects are also being backed by government financing. For example, in the U.S., the Department of Energy announced $900 million in funding to accelerate the deployment of Next-Generation Light-Water SMRs. In addition, many companies, such as Microsoft, have signed purchase agreements with energy companies to use SMRs, or are developing their own SMR strategies, to power operations with [?]clean energy.

While there is huge optimism around the deployment of SMR technology, many of the companies developing the equipment have faced a plethora of challenges, which has led to delays and massive financial burdens. At present, only three SMRs are operational in the world, in China and Russia, as well as a test reactor in Japan. Most nuclear energy experts believe SMRs won’t reach the commercial stage in the U.S. until the 2030s.

NuScale cancelled plans to launch an SMR site in Idaho in 2023 after the cost of the project rose from $5 billion to $9 billion owing to inflation and high interest rates. This is a common issue, as companies must predict the costs of a first-of-a-kind project. Once one SMR site is launched and companies can establish tried-and-tested methods of deployment, a second site is expected to be cheaper and faster to develop. A trend that will continue as companies gain more experience. Eric Carr, the president of nuclear operations at Dominion Energy, explained, “Nobody exactly wants to be first, but somebody has to be.” Carr added, “Once it gets going, it’s going to be a great, reliable source of energy for the entire nation’s grid.”

Another issue is access to uranium. Russia is currently the only commercial source of high-assay low- enriched uranium (HALEU), which companies require to power their reactors. In late 2022, Terrapower announced it would be delaying the launch of its first SMR site in Wyoming due to a lack of fuel availability. However, the U.S. is developing its domestic production capabilities. The Biden administration is expected to award over $2 billion in the coming months to uranium enrichment companies to help jumpstart the supply chain. Meanwhile, Terrapower announced this summer that it is finally commencing construction on its Wyoming SMR site and is working with other companies to develop alternate supplies of HALEU. https://oilprice.com/Energy/Energy-General/Why-SMRs-Are-Taking-Longer-Than-Expected-to-Deploy.html

Small Modular Nuclear Reactors (SMRs) in Canada

While civil society opposition to SMRs is broad and substantial in Canada, ultimately the exorbitant cost of SMRs will be their undoing. Conclusive analysis shows that SMRs cannot compete economically with wind, solar and storage systems.

SMRs will last as long as governments are willing to pour public funds into them, and SMRs will start to disappear after the money tap is turned off. Already the nuclear hype in Canada is turning back to big reactors.

WISE/NIRS Nuclear Monitor, August 29, 2024 | Issue #918, By Brennain Lloyd and Susan O’Donnell

Introduction: CANDUs versus SMRs

Canada developed the CANDU reactor, fueled with natural uranium mined in Canada and cooled and moderated with heavy water. All 19 operating power reactors in Canada – 18 in Ontario on the Great Lakes and one in New Brunswick on the Bay of Fundy – are CANDU designs with outputs ranging from about 500 to 900 MWe.

It’s been more than 30 years since the last CANDU was completed and connected to the grid in Canada. Attempts to build new ones were halted over high projected costs, and CANDU exports have dried up. To keep itself alive, in 2018 the nuclear industry launched a “roadmap” to develop smaller reactors and kick-start new nuclear export opportunities.

From 2020 to 2023, the Canadian government funded six so-called “Small Modular Nuclear Reactor” (SMR) designs. Only one – Terrestrial Energy’s Integral Molten Salt Reactor (IMSR) design – is Canadian.

The six designs are not only unlike the CANDU but also different from each other. The fuels range from low-enriched uranium, TRISO particles and HALEU (High-Assay, Low-Enriched Uranium) to plutonium-based fuel, and the different cooling systems include high-temperature gas, molten salt, liquid sodium metal and heat pipes. One design – Moltex – requires a separate reprocessing unit to extract plutonium from used CANDU fuel to make fuel for its proposed SMR.

Only one of the grid-scale SMR designs seems plausible to be built – the GE Hitachi 300 MWe boiling water reactor (BWRX-300) being developed at the Darlington nuclear site on Lake Ontario. This design uses low-enriched uranium fuel and is cooled by ordinary water. The Darlington site owner, the public utility Ontario Power Generation (OPG), is planning to build four of them.

Canada gave OPG a $970 million “low-interest” loan to help develop the BWRX-300 design. The other five SMR designs received considerably less federal funding, from $7 million to $50.5 million each, and most SMR proponents have been struggling to source matching funds. One design, Westinghouse’s off-grid eVinci micro-reactor, had early development costs funded by the U.S. military and now seems to have independent funding.

The Canadian Nuclear Laboratories (CNL) at Chalk River received more than $1.2 billion in 2023. CNL is operated by a private-sector consortium with two U.S. companies involved in the nuclear weapons industry and the Canadian firm Atkins-Réalis (formerly SNC Lavalin) which is also involved in almost every SMR project in Canada. CNL and Atomic Energy of Canada Limited are building an “Advanced Nuclear Materials Research Centre” at Chalk River, one of the largest nuclear facilities ever built in Canada, that will conduct research on SMRs.

Canada recently released a report suggesting that SMRs will be in almost all provinces by 2035, although most provincial electrical utilities have expressed no interest, and only Ontario, New Brunswick, Saskatchewan and Alberta are promoting SMRs. Alberta says it wants SMRs to reduce the GHG emissions generated in tar sands extraction.

SMR “project creep”

Proponents of most of the SMR designs keep changing the description of their projects. This is not unique to Canada, but is certainly apparent in Canada, and the regulator, the Canadian Nuclear Safety Commission (CNSC), aids and abets that practise for those SMRs in the review stream.

In the case of the BWRX-300 proposed for the Darlington site, the CNSC not only accepted a 2009 environmental assessment for very different reactors as a stand-in for the BWRX-300 but also is carrying out the current review as if for a single reactor. The nuclear regulator made this decision despite Ontario Power Generation very publicly stating its intent to construct four reactors in rapid succession at the Darlington site.

The proposed “Micro Modular Reactor” (MMR) for the Chalk River site in Ontario is another example of “project creep” and demonstrates just how flexible “scope of project” is in the domain of the CNSC.

Earlier this year, CNSC staff released a document outlining communications from the MMR proponent, Global First Power, describing significant project changes. The proponent wants to triple power output, and to operate with fuel enrichment levels from 9.75% (LEU+) up to 19.75%.

Global First Power also wants a shift from no need to refuel in a 20-year operating life to provision for on-site refueling and defueling with periods varying from three to 13.5 years. They also want to double their facility design life from 20 years to 40 years.

Despite all these significant changes to key elements of the design, the CNSC staff concluded that the Global First Power MMR project remained within scope of its initial (very different) description.

Another example of SMR project creep is in New Brunswick. In June 2023, the provincial utility NB Power applied to the CNSC for a licence to clear a site for the ARC-100 design at the Point Lepreau nuclear site on the Bay of Fundy. The design for the sodium-cooled reactor requires HALEU fuel, which is scarce because of sanctions imposed on Russia, the sole supplier.

News reports have suggested the ARC-100 design might need to change because changing the fuel means changing the design. Meanwhile the ARC company CEO left suddenly, and staff received layoff notices. Despite these obvious problems, the application under CNSC review and a provincial environmental assessment underway with the CNSC are continuing with the original design.

SMRs complicate radioactive waste management

One of the (many) false promises floated about SMRs is that they will alleviate the significant challenges of managing radioactive wastes. This is patently false. Some of this misleading rhetoric stems from the notion of “recycling” and claims by some SMR promoters that their particular design of reactor will use high-level radioactive wastes as “fuel” for their reactor.

But the reality is that the introduction of so-called “next generation” designs of reactors in Canada will only complicate the already complex set of problems related to the caretaking of these extremely hazardous materials.

……………………………………………..The shift from natural uranium to enriched uranium in commercial power reactors in Canada will fundamentally change the nature and characteristics of the spent fuel waste and will take away one of the nuclear industry’s favourite pitch points for the CANDU design: that there is no potential for criticality after the fuel is removed from the reactor.

The new potential for the irradiated enriched fuel wastes to “go critical” is only one of the many problems being overlooked by both government and industry.

Another very obvious shift is in the dimensions of the fuel, from the relatively uniform dimensions of CANDU fuel to the widely divergent shapes and sizes of fuel being depicted for the various small modular reactor designs.

The CANDU fuel bundles are approximately 50 cm long and 10 cm in diameter. In contrast, the fuel waste dimensions are significantly different for SMRs. For example, the BWRX-300 fuel bundles are much larger, the casks much heavier, and the reactor will generate higher level activity wastes. These differences will require different approaches and designs for interim and long-term dry storage of used fuel.

SMR wastes not considered in Canada’s repository design

As a fleet, small modular reactors will generate more waste per energy unit than the larger conventional reactors that preceded them. But in Canada they will also require redesign of the “concept” plan currently being promoted for the long-term dispositioning of the used fuel to a deep geological repository (DGR).

Since 2002 an association of the nuclear power companies, operating as the Nuclear Waste Management Organization (NWMO), have been pursuing a single site to bury and then abandon all of Canada’s high-level nuclear waste.

Their siting process, launched in 2010, caught the interest of 22 municipalities that allowed themselves to be studied for the “$16-24 billion national infrastructure project.” Hundreds of millions of dollars later – with tens of millions going directly into the coffers of the participating municipalities – the NWMO is now down to two candidate sites in Ontario.

The NWMO say they will make their final selection by the end of 2024. But even at this late date they have produced only “conceptual” descriptions of their repository project, including for key components such as the packaging plant where the fuel waste would be transferred into that final container, and the DGR itself. But all of the conceptual work is premised on the characteristics and dimensions of the CANDU fuel bundle.

The process lines of the used fuel packaging plant, the final container, and the spacing requirements for the repository will all need to be redone for different SMR wastes with their very different dimensions and characteristics.

While it could be said that the NWMO design progress has been surprisingly slow given their target of selecting a site this year and beginning the regulatory and licensing process next year, it will be back to square one if their proposed DGR is to accommodate SMR wastes.

There is, however, a strong possibility that the regulator, the CNSC, will allow the NWMO to skate through at least the first license phase with large information gaps, as the CNSC is doing with the plan to construct four BWRX-300s at the Darlington site.

As mentioned in the example of “project creep,” earlier this year the CNSC announced it would accept an environmental assessment approval of a generic 2009 reactor proposal instead of requiring that the BWRX-300 be subject to an impact assessment. This was despite the marked differences between the technologies assessed in 2009 and the BWRX-300 technology.

These differences will impact the management of the project’s radioactive waste. For example, the BWRX-300 public dose rates are estimated to be 10 x higher for one accident scenario (pool fire) and 54% higher in a dry storage container accident, the waste contains different proportions of radionuclides than the waste that was assessed in 2009, radio-iodine and carbon-14 emissions will be higher, alpha and beta-gamma activity per cubic metre of waste will be higher and the BWRX-300 will generate higher activity spent fuel.

Despite the NWMO having successfully wooed two small municipalities, there is broad opposition to the transportation, burial and abandonment of all of Canada’s high-level radioactive wastes in a single location, either in the headwaters of two major watersheds in northern Ontario or the rich farm lands of southwestern Ontario.

This opposition is amplified by concerns about SMR wastes and the NWMO’s open ticket to add other operations to their DGR site. Of particular concern are the potential for the NWMO to add an SMR to power their repository site or even to add a reprocessing plant at the site to extract plutonium from the used fuel. The Canadian government’s refusal to include an explicit ban on commercial reprocessing in the 2022 review of the national radioactive waste policy heightened the latter concern.

Who/what is behind the SMR push in Canada?

Although proponents claim that SMRs will contribute to climate action, critics are sceptical. It is doubtful that any SMR will be built in time to contribute to Canada’s target to decarbonize the electricity grid by 2035, and independent research found that SMRs will cost substantially more than alternative sources of grid energy.

The high cost and lengthy development timelines of SMRs, the questionable claims of climate action, as well as the significant challenges related to SMR wastes, raises an obvious question: who is pushing SMRs and why?

A central reason is a political imperative to keep the Canadian nuclear industry alive. The industry is small in Canada, but nuclear power looms large in the political imagination. Canada sees itself as a global leader in the peaceful use of nuclear energy.

Without a nuclear weapons industry, Canada needs nuclear exports to keep its domestic industry alive and ensure Canada’s membership in the international nuclear club. Earlier this year, Canada released an action plan to get nuclear projects built faster and ensure that “’nuclear energy remains a strategic asset to Canada now and into the future.”

Since the start of the nuclear age, Canada has spent a disproportionate amount of research funding on nuclear reactor development. Politicians see the CANDU design as a success, despite its costly legacy and lackluster exports. The CANDU reactors in Canada have all required significant public subsidies, and the CANDUs sold for export have been heavily subsidized by Canada as well.

Selling more CANDUs outside Canada is unlikely in the foreseeable future. But Canada wants a nuclear industry, and that requires choosing and aggressively marketing at least one nuclear reactor design. Despite being a U.S. design, the G.E. Hitachi BWRX-300 is the chosen favourite in Canada. The reactor, in early development at the Darlington site, is being promoted globally by Ontario Power Generation as part of an international collaboration with GE Hitachi Nuclear Energy, the Tennessee Valley Authority, and Synthos Green Energy.

What’s the future for SMRs in Canada?

Since the nuclear industry and its government partner Natural Resources Canada (NRCan) launched their SMR roadmap in 2018, the political and business hype for SMRs has been intense. The SMR buzz is meant to attract private sector investment, but so far that strategy is failing.

Almost everyone understands now that SMRs, like the CANDUs, are expensive projects that will need continuous massive public subsidies. To date, taxpayers have provided just over $1.2 billion in direct subsidies to SMR proponents in Canada, not nearly as much as the industry will need to develop an SMR fleet in the country.

A broad coalition of groups – from climate activists to Indigenous organizations and other groups protecting lands and waters from radioactive waste – have been pushing back against public funding for SMRs. A 2020 statement signed by 130 groups called SMRs “dirty, dangerous distractions” from real climate action. In March this year, 130 groups in Canada also signed the international declaration against new nuclear energy development launched in Brussels at the Nuclear Summit organized by the International Atomic Energy Agency.

While civil society opposition to SMRs is broad and substantial in Canada, ultimately the exorbitant cost of SMRs will be their undoing. Conclusive analysis shows that SMRs cannot compete economically with wind, solar and storage systems.

SMRs will last as long as governments are willing to pour public funds into them, and SMRs will start to disappear after the money tap is turned off. Already the nuclear hype in Canada is turning back to big reactors.

The Bruce Nuclear Generating Station on Lake Huron in Ontario, with eight CANDU reactors, is already the largest operating nuclear plant in the world. Bruce Power recently began the formal process to develop four new big reactors at the site, to generate another 4,800 megawatts of electricity. It remains to be seen if the sticker shock for the proposed big nuclear reactors will, like it has for SMRs, scare off investors.

Although more than six years of SMR promotion in Canada has produced almost no private investor interest, the SMR buzz remains strong. The SMR star may be fading but the SMR story is far from over.

Brennain Lloyd is the coordinator of Northwatch in Ontario. Susan O’Donnell is the lead researcher for the CEDAR project at St. Thomas University in New Brunswick and a spokesperson for CRED-NB. https://crednb.ca/small-modular-nuclear-reactors-smrs-in-canada/

Last Energy nabs $40M to realize vision of super-small nuclear reactors

These investors are joining the wave in public and private financing of nuclear energy that has swelled to $14 billion so far this year — double last year’s total, according to Axios. Investment in new fission technologies, such as microreactors, has increased tenfold from 2023.

The startup wants to mass-manufacture 20MW nuclear reactors that can be built and shipped within 24 months. It’s looking to get its first reactor online in Europe.

By Eric Wesoff, 29 August 2024

A startup looking to build really small nuclear reactors just announced a big new funding round.

Last Energy, a Washington, D.C.–based next-generation nuclear company, announced that it closed a $40 million Series B funding round, a move that will add more financial and human capital to the reinvigorated nuclear sector.

The startup aims to eventually deploy thousands of its modular microreactors, though to date it has not brought any online. The first reactor might appear in Europe as soon as 2026, assuming Last Energy manages to meet its extremely aggressive construction, financial, and regulatory timelines — not a common occurrence in the nuclear industry. Venture capital heavyweight Gigafund led the round, which closed early this year but was revealed only today. The startup has raised a total of $64 million since its 2019 founding.

Last Energy is part of a cohort of companies betting that small, replicable, and mass-produced reactors will overcome the economic challenges associated with building emissions-free baseload nuclear power — and restore the moribund U.S. nuclear industry to its former glory. But the microreactor dream has yet to be realized; few of these small modular reactors (SMRs) have been built worldwide. None have been completed in the U.S., though one design from long-in-the-tooth startup NuScale Power has gotten regulatory approval.

The 20-megawatt size of Last Energy’s microreactor stands in stark contrast to that of a conventional nuclear reactor like the recently commissioned Vogtle units in Georgia, which each generate about 1,100 megawatts. A Last Energy microreactor, the size of about 75 shipping containers, might power a small factory, while a Vogtle unit can power a city.

Instead of the cathedral-style stick-built construction of modern large reactors, SMRs and microreactors are meant to be manufactured at scale in factories, transported to the site, and assembled on location. Rather than develop an advanced reactor design with exotic fuels — an approach taken by other SMR hopefuls, including the Bill Gates–backed TerraPower — Last Energy chose to scale down the well-established light-water reactor technology that powers America’s 94 existing nuclear reactors.

“We came to the conclusion that using the existing, off-the-shelf technology was the way to scale,” CEO Bret Kugelmass said in a 2022 interview with Canary Media. “We don’t innovate at all when it comes to the nuclear process or components — we do systems integration and business-model innovation.”

The startup claims that its microreactor is designed to be fabricated, transported, and built within 24 months, and is the right size to serve industrial clients. Under its business model, Last Energy aims to build, own, and operate its power plant at the customer’s site, avoiding the yearslong wait times to plug a new generation project into the power grid.

Like an independent power producer, Last Energy doesn’t sell power plants; instead, it sells electricity to customers through long-term power-purchase contracts.

“Data centers and heavy industry are trying to grapple with a very complex set of energy challenges, and Last Energy has seen them realize that micro-nuclear is the only capable solution,” said Kugelmass, who claims in today’s press release that the startup has inked commercial agreements for 80 units — with 39 of those units destined to serve power-hungry data center customers.

Last Energy isn’t the only microreactor company attracting venture funding. There are several other examples from this month alone: Aalo Atomics raised $27 million from 50Y, Valor Equity Partners, Harpoon Ventures, Crosscut, SNR, Alumni Ventures, Preston Werner, Earth Venture, Garage Capital, Wayfinder, Jeff Dean, and Nucleation Capital to scale up a 85-kilowatt design from the U.S. Department of Energy’s MARVEL program. While Deep Fission, a startup aiming to bury arrays of microreactors 1 mile underground, just raised $4 million led by 8VC, a venture firm founded by Joe Lonsdale.

These investors are joining the wave in public and private financing of nuclear energy that has swelled to $14 billion so far this year — double last year’s total, according to Axios. Investment in new fission technologies, such as microreactors, has increased tenfold from 2023.

Investors happen to be backing startups in a heavily subsidized market. Tens of billions of dollars from the Bipartisan Infrastructure Law, the U.S. DOE’s Loan Programs Office, and the Inflation Reduction Act support the development of a non-Russian supply of enriched uranium; the IRA also introduced a ridiculously generous $15-per-megawatt-hour production tax credit, meant to keep today’s existing nuclear fleet competitive with gas and renewables, as well as a similarly charitable investment tax credit to incentivize new plant construction.

The flood of funding comes as nuclear power enjoys the most public support it has had in years. Nuclear now has a favorable public opinion, with the majority of Americans supporting atomic energy and its record of safety and performance. And nuclear energy is one of the few topics that Democrat and Republican politicians have been able to agree on in recent memory.

Still, despite the rising financial, political, and public support, the U.S. nuclear industry remains frozen, plagued by a legacy of cost and timeline overruns for conventional reactors and regulatory challenges around new designs. It’s unclear when the country will get another nuclear reactor online — as of last year, the leading contender was an SMR project from NuScale, but that fell apart due to cost. In all likelihood, the next reactor to plug into the grid will be the mothballed Palisades nuclear plant in Michigan, which won government support for an unprecedented effort to recommission the plant by the end of next year.

For its part, Last Energy is not banking on the U.S. to lead the charge; it’s targeting industrial customers in Poland, Romania, and the U.K. for its initial sites, in the hopes that it will find a more favorable regulatory and financial environment.

Ryan McEntush of investment firm a16z suggests in an essay that “the success of nuclear power is much more about project management, financing, and policy than it is cutting-edge engineering or safety.”

That’s Last Energy’s philosophy too — and it’s going to need more money and more years to prove it’s the right one.

-

Archives

- January 2026 (306)

- December 2025 (358)

- November 2025 (359)

- October 2025 (376)

- September 2025 (258)

- August 2025 (319)

- July 2025 (230)

- June 2025 (348)

- May 2025 (261)

- April 2025 (305)

- March 2025 (319)

- February 2025 (234)

-

Categories

- 1

- 1 NUCLEAR ISSUES

- business and costs

- climate change

- culture and arts

- ENERGY

- environment

- health

- history

- indigenous issues

- Legal

- marketing of nuclear

- media

- opposition to nuclear

- PERSONAL STORIES

- politics

- politics international

- Religion and ethics

- safety

- secrets,lies and civil liberties

- spinbuster

- technology

- Uranium

- wastes

- weapons and war

- Women

- 2 WORLD

- ACTION

- AFRICA

- Atrocities

- AUSTRALIA

- Christina's notes

- Christina's themes

- culture and arts

- Events

- Fuk 2022

- Fuk 2023

- Fukushima 2017

- Fukushima 2018

- fukushima 2019

- Fukushima 2020

- Fukushima 2021

- general

- global warming

- Humour (God we need it)

- Nuclear

- RARE EARTHS

- Reference

- resources – print

- Resources -audiovicual

- Weekly Newsletter

- World

- World Nuclear

- YouTube

-

RSS

Entries RSS

Comments RSS