Nuclear, CCS & LNG Are Distractions As Shipping Goes Low Carbon

Forbes, Michael Barnard, 8 Jan 24

“……………………………………………… About a year ago I created a series of sexy vs meh quadrants charts for different aspects of decarbonization, covering ground transportation, aviation & aerospace, electricity & grid storage, carbon drawdown, heat and most pertinently, the maritime industry.

When I first created the visual, it didn’t occur to me to add nuclear-powered ships to it. Having gone deep and wide on nuclear generation’s past and present, I knew that nuclear-powered ships were fit for purpose for a handful of affluent countries with big militaries, a subset of the ones with nuclear weapons.

There are still many nuclear-powered submarines and aircraft carriers on and under the seas. Unsurprisingly, the USA has eleven of the twelve aircraft carriers, with France’s Charles de Gaulle being the sole non-American example of the class. There are over a hundred nuclear-powered submarines, with the USA again having the most, but China, France, Russia and the United Kingdom all having vessels, although some are awaiting decommissioning at significant expense. Further, there are a handful of nuclear ice breakers operating in Arctic waters, all Russian.

I knew that the first commercial nuclear reactors were repurposed military vessel reactors and that they had proven deeply uneconomic, requiring scaling the small reactors up to gigawatt sizes to achieve thermal efficiencies for cheaper electricity. That’s part of the problem with the current hype around small modular nuclear reactors, that they forego that scaling for efficiency and hence are proving uneconomic, mostly recently with the cancellation of the NuScale deployment in Utah.

I knew that nuclear cargo ships had been tried 70 years ago, and failed miserably. Most ports wouldn’t accept them and New Zealand passed a law banning them that’s still on their books. And I knew that nuclear decommissioning was very expensive, for example with the UK nuclear submarine effort costing almost US$100 million per vessel.

So I was surprised when I was invited by Elisabet Liljeblad, Head of Climate & Energy Transition with Stena Teknik, to debate maritime decarbonization at a Stena technical leaders offsite to find that there was a proponent of nuclear-powered shipping participating, along with a methanol-industry representative and a battery electrification firm’s sales director.

Is it technically feasible to build a nuclear-powered container or bulk ship? Of course. But there are major headwinds facing it. The first is that the current interest is aligned with small modular nuclear reactors being commercialized and being able to be repurposed at relatively low cost for ships. As those reactors are almost entirely on the drawing board, with exactly one 200 MW version in commercial operation in China as of late 2023 and design progressing for a deployment in Ontario, it’s going to be a long wait with little likelihood of success.

One of the major problems that small modular reactors face is that they virtually all depend on high assay low enrichment uranium or HALEU. Over the past decades, the supply chain has devolved to the point where only Russia is a supplier of the material, with obvious concerns. At present the USA is attempting to develop a coalition of nations to create a new supply chain, but it’s fraught.

The likelihood of small reactors being commercially viable for electricity is already low due to the thermal efficiency challenge, and there are far too many designs and technologies under development to make it possible for a single design to be built enough times to lower costs.

Every commercial nuclear reactor has seven circles of overlapping security around it, and with the exception of the Russian Arctic icebreaker fleet, where remoteness and harsh conditions provide security, those circles would have to be recreated for commercial vessels. Submarines depend on stealth, but air craft carriers travel in a fleet of escort vessels.

The cost of the reactor for a large commercial vessel is likely to be as high or higher than the rest of the ship, making current multi-million dual-fuel engine capital expenditures look like pocket change. And the owner vs operator conflict which makes any excess capital expenditures problematic would apply as well, with the operator accruing the benefits but the owner paying. That high decommissioning cost will also be prohibitive.

There is only one commercial nuclear cargo ship in operation at present, the Soviet-built Sevmorput. For context for the cost, the small 1,328 container capacity ship cost roughly US$265 million. By contrast, Maersk’s dual-fuel, 9,000 container capacity ships cost US$115 million each. The Sevmorput’s history is a cautionary tale as well. Multiple Soviet port cities refused to let it enter their ports over safety concerns. The Port of Vancouver refused entry as well as the port’s safety and emergency plans didn’t include nuclear accident preparedness. It also has a history of maintenance issues. The combination has led to it being inactive more than active since built, and mostly it has been used to transport Russian military materiel to Arctic region bases.

This isn’t stopping various organizations from undertaking designs, but the likelihood of seeing nuclear-powered commercial ships on our oceans is low. Every port they entered would have to have security, operational and emergency procedures upgrades, and so most will simply refuse entry.

Nuclear energy is a distraction, and it gets so little hype compared to foils, green hydrogen and green synthetic fuels that I’ve put it in the foolish and meh quadrant……………………………………………………………………………………………………………………………………………………………….

And so, the end of the also rans in my projection of maritime repowering. Batteries will be dominating inland and near shore shipping. Some oceanic shipping will be boosted a bit by wind power, mostly parafoils in my opinion. Ammonia need not apply, with the minor exception of actual ammonia tankers, which won’t be growing in numbers. Nuclear and LNG power are distractions. Up next, the real decarbonization fuel of the future. https://www.forbes.com/sites/michaelbarnard/2024/01/08/nuclear–lng-are-distractions-as-shipping-goes-low-carbon/?sh=22f290124da7

Touting a ‘new age of nuclear fusion’

West Burton, a sprawling site that is also home to a gas-fired station,

has been chosen as the location for a nuclear fusion plant that the

government aims to have in operation by 2040.

It is an ambitious plan.

Fusion has been the next big thing in energy since the 1950s, but it still

faces big technical obstacles to becoming a reality. It also will be a race

against a big field of international rivals.

The largest developed

economies, in particular the United States and Japan, are pouring billions

into fusion research, as are a gaggle of deep-pocketed technology

billionaires.

Before Brexit, Britain was a leading member of a

multinational effort spearheaded by the European Union. The West Burton

plan represents it striking out on its own.

It will not be a small

undertaking. Paul Methven, the executive in charge of the project, says it

is too early to estimate the likely cost, but suggests that the plant and

its associated infrastructure will be of a similar size to Hinkley Point C,

the nuclear power station being built in Somerset by EDF. That scheme’s

latest budget estimate is £33 billion.

Times 7th Jan 2024

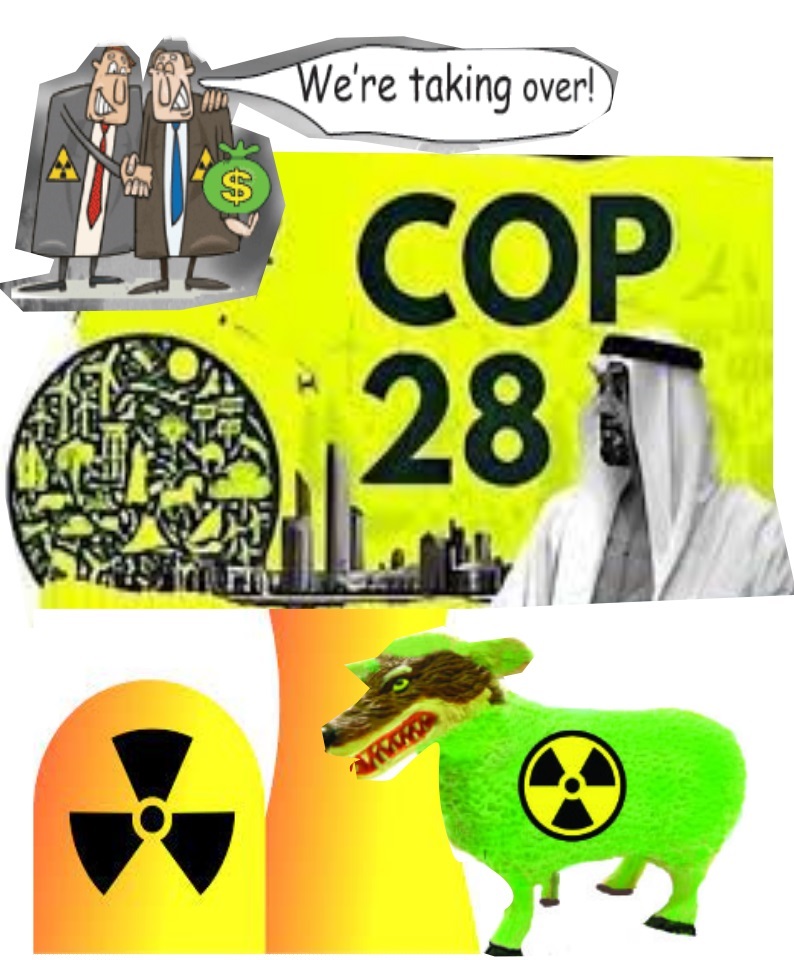

The real reason why the USA pushed for the world to “triple nuclear power” at COP 28.

While China dominates the wind- and solar-power sectors, nuclear energy is one area where officials believe the U.S. could compete with its long menu of newer reactor types and fuels.

U.S. puts diplomatic clout behind sales of cutting-edge reactors that have yet to show commercial success

Washington Heats Up Nuclear Energy Competition With Russia, China

By William Mauldin and Jennifer Hiller, Jan. 6, 2024 https://www.wsj.com/politics/national-security/washington-heats-up-nuclear-energy-competition-with-russia-china-f2f18e75

WASHINGTON—To compete with its biggest geopolitical rivals, the U.S. government is looking toward small nuclear reactors.

Not a single so-called small modular reactor has been sold or even built in the U.S., but American officials are trying to persuade partner countries to acquire the cutting-edge nuclear reactors still under development by U.S. firms. The goal: to wrest nuclear market share from Russia—the global industry giant—and defend against China’s fast-growing nuclear-technology industry.

The U.S. hopes that putting its clout behind a new technology can cement future commercial and diplomatic relationships and chip away at China’s and Russia’s ability to dominate their neighbors’ energy supply.

The Biden administration also sees nuclear energy as a way to export reliable green (?) energy, since nuclear-power plants split atoms and don’t burn carbon-based fuels that contribute most to climate change. With Russia’s broad 2022 invasion of Ukraine sending Poland and other European countries looking for new energy partners, U.S. officials and industry leaders see a potential opening in the market for U.S. exports to compete with China’s growing nuclear ambitions.

While China dominates the wind- and solar-power sectors, nuclear energy is one area where officials believe the U.S. could compete with its long menu of newer reactor types and fuels. The U.S. aims to sign agreements for partnerships lasting 50 years or longer to provide U.S. technology to Moscow’s former energy partners and to fast-growing countries in Southeast Asia worried about overreliance on Chinese and Russian energy.

“If we’re the supplier, we support the energy security of our allies and partners,” said Ted Jones, head of national security and international programs at the Nuclear Energy Institute, a U.S. industry group. “We help prevent them from finding themselves in the situation of Europe with respect to Russian gas and nuclear.”

At the core of the U.S. campaign is a technology, yet-unproven in the U.S., called a small modular reactor, or SMR. SMRs generate about one-third the energy of a conventional nuclear reactor and can be prefabricated and shipped to the site. Among other potential advantages, they are intended to be cheaper than larger reactors, which often have to be custom designed, and they can be installed to meet growing demand for energy, according to the International Atomic Energy Agency.

‘Very, very long-term strategic partnership’

U.S. officials say they are working with developers of SMRs, and the government-run Export-Import Bank and the U.S. International Development Finance Corp., to win overseas orders that will bring down costs and build an order book for the new technology, all while linking the countries’ energy systems to the U.S. and its allies. By 2035, the U.S. Nuclear Energy Agency estimates that the global SMR market could reach 21 gigawatts of power, enough to power two billion LED lightbulbs.

“It’s important that the United States maintains that leadership in the transition from the laboratory to the grid and deployment and commerciality,” said Geoffrey Pyatt, the State Department’s assistant secretary of energy resources. “It’s about building a very, very long term strategic partnership.”

To make nuclear-energy exports a viable tool of foreign policy, U.S. companies will have to prove they can deliver smaller reactors for export on time and budget, a goal that has eluded larger nuclear-power plants in the West.

The U.S. has yet to build an SMR, and none is yet under construction in the U.S. The concept’s economics remain unproven, as does the timeline for building such a reactor. One company, Kairos Power, recently received construction approval for a demonstration project in Tennessee. It plans to focus on the domestic market. NuScale Power, one of the major U.S. players, recently canceled an SMR project in Idaho when a group of utilities in the Mountain West couldn’t get enough members to commit.

To make the concept work, most SMRs’ developers would need a pipeline of orders so they could move into factory-style production, lowering unit costs.

Among the potential customers U.S. industry and government officials are looking at are Polish energy company Orlen, which wants to build SMRs designed by GE Hitachi Nuclear Energy.

The U.S. Export-Import Bank and U.S. International Development Finance Corp. have offered to arrange up to $4 billion in financing for a plant planned by NuScale in Romania, with an aim of going online in 2029 or 2030. U.S. officials also say they are in discussions with Bulgaria, Ghana, Indonesia, Kazakhstan and the Philippines on new nuclear projects.

China is leading the world in reactor construction and recently started commercial operations of a plant with two SMRs. The country is now building 22 of the 58 reactors under construction around the world, according to the International Atomic Energy Agency. China has built reactors in Pakistan and aims to join Russia as a major exporter of nuclear technology.

Last year, China and the U.S. were jockeying to provide civilian nuclear technology to Saudi Arabia. Washington appeared close to a deal, part of a regional pact with Israel, but it was derailed by Hamas’s attack on Israelis in October and the subsequent war in Gaza.

U.S. sales pitch: We’re less risky than Russia and China

Russia’s state-owned Rosatom, meanwhile, is a major exporter of both reactors and nuclear fuel.

According to the latest World Nuclear Industry Status Report, it was building 24 reactors: 19 large reactors in countries from Turkey to Bangladesh, a barge to be equipped with two small reactors under construction in China but intended for use in Russia, and three reactors at home. Of the reactors under construction in Russia, two are large; the third is an SMR that would use liquid metal for cooling. Rosatom started commercial operations of two SMRs on a floating barge in 2020, though that project took longer and cost more than expected.

Washington is counting on partner countries’ interest in working with U.S. firms and what officials are selling as a less risky tie-up than working with Moscow and Beijing on projects that have a lifespan of 50 years or more.

“It’s never good if our allies are dependent on a potential adversarial country for energy,” said Bret Kugelmass, chief executive of nuclear-power startup Last Energy, which plans to build microreactors that would generate 20 megawatts of electricity and be sited near factories.

The process for hammering out a network of government and commercial deals can take years, with U.S. officials working alongside foreign counterparts, export credit agencies, nuclear-energy firms and utilities, not to mention the U.S. Congress. Russia and China have the advantage of state-led financial sectors to fund projects that can span a decade until power flows.

U.S. industry executives and government officials say they are now working on shortcuts to marketing reactors, including setting up a single government-to-government deal that includes corporate contracts and public and private financing assistance.

The new deals are designed to appeal to partner countries that want a simpler path to getting a reactor, without the heavy dose of Chinese financing that U.S. officials say might have strings attached.

Rokkasho redux: Japan’s never-ending nuclear reprocessing saga

By Tatsujiro Suzuki | December 26, 2023, https://thebulletin.org/2023/12/rokkasho-redux-japans-never-ending-reprocessing-saga/

The policy seeks to at least begin to deal with the huge stocks of plutonium Japan has amassed

According to a recent Reuters report, Japan Nuclear Fuel Ltd (JNFL) still hopes to finish construction of Japan’s long-delayed Rokkasho reprocessing plant in the first half of the 2024 fiscal year (i.e. during April-September 2024). The plant—which would reprocess spent nuclear fuel from existing power plants, separating plutonium for use as reactor fuel—is already more than 25 years behind schedule, and there are reasons to believe that this new announcement is just another wishful plan that will end with another postponement.

One indication of further possible delays: On September 28, 2023, Naohiro Masuda, president of JNFL, stated that the safety review of the reprocessing plant by Japan’s Nuclear Regulation Authority will be difficult to complete by the end of 2023. He nevertheless insisted that the company could still meet completion target date in 2024.

Here is a partial history of past key developments that make completion in 2024 seem unlikely:

1993: Construction starts.

1997: Initial target for completion.

2006-2008: Hot tests conducted, revealing technical problems with the vitrification process for dealing with waste produced during reprocessing.

2011: Fukushima Dai-ichi nuclear plant accident.

2012: New safety regulation standards introduced.

2022: Completion target date postponed to June 2024)

The 2022 postponement was the 26th of the Rokkasho project.

Why so many postponements? There seem to be at least five underlying reasons for the postponements for the Rokkasho plant. First, JNFL lacks relevant expertise to manage such a technologically complex and hazardous project, which is owned by nine nuclear utilities plus all other major companies associated with nuclear power in Japan. Most of the firm’s senior executives are from shareholding companies (especially utility companies) and are not necessarily experts in the field of reprocessing spent nuclear fuel.

Second, the technologies in the plant came from different companies and institutions. The management of the project is therefore technically complex.

Third, the post-Fukushima-accident nuclear facility safety licensing review process is much more stringent than what existed before the accident. For example, the Nuclear Regulation Authority told JNFL at their November 25, 2023 meeting: “JNFL should immediately make improvements because it is clear that JNFL does not understand the contents of the permit well enough to confirm the adequacy of the design of the facilities on site and has not visited the site.”

Fourth, the financial costs to JNFL of postponement are covered by the utilities’ customers, because the utilities must pay a “reprocessing fee” every year, based on the spent fuel generated during that year, whether or not the reprocessing plant operates. The system by which the Nuclear Reprocessing Organization of Japan decides the reprocessing fee is not transparent.

Fifth, the project lacks independent oversight. Even though JNFL’s estimate of the cost of building and operating the Rokkasho plant has increased several-fold, no independent analysis has been done by a third party. One reason is that some of the shareholders are themselves contractors working on the plant and have no incentive to scrutinize the reasons for the cost increases or the indefinite extension of the construction project.

After so many postponements, there is reason to wonder whether the plant will ever operate, but the government and utilities continue to insist that the plant will open soon. Even if Rokkasho were to operate, it may suffer from the same kinds of problems that marked Britain’s light-water reactor spent fuel reprocessing experience, as described in Endless Trouble: Britain’s Thermal Oxide Reprocessing Plant (THORP).

Why does Japan’s commitment to reprocessing continue?

Despite the serious and longstanding problems the Rokkasho plant has faced (and continues to face), Japanese regulators and nuclear operators have doggedly pursued the project. There are four reasons:

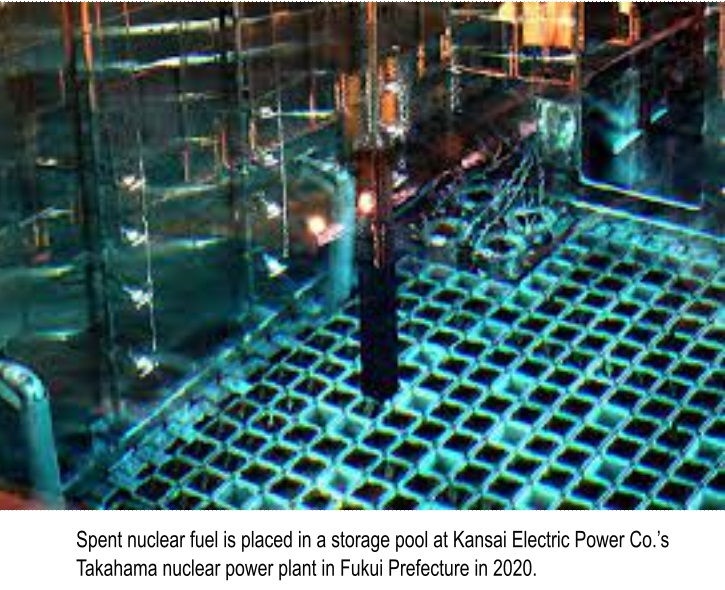

Spent fuel management. Currently, most of Japan’s spent nuclear fuel is stored in nuclear power plant cooling pools. But the pool capacities are limited, and the 3,000-ton-capacity Rokkasho spent fuel pool is also almost full. The nuclear utilities must therefore start operating the Rokkasho plant unless they can create additional spent fuel storage capacity, either on- or off-site. The Mutsu spent fuel storage facility is a candidate for additional capacity, but due to the concern that spent fuel could stay there forever, Mutsu city refuses to accept spent fuel unless the Rokkasho reprocessing plant begins to operate. The Rokkasho plant design capacity is 800 tons of spent fuel per year.

Legal and institutional commitments. Under Japan’s nuclear regulations, utilities must specify a “final disposal method” for spent fuel. The law on regulation of nuclear materials and nuclear reactors states that “when applying for reactor licensing, operators must specify the final disposal method of spent fuel” (Article 23.2.8). In addition, there was a clause that “disposal method” should be consistent with implementation of the government policy, which specified reprocessing as the disposal method. Although that clause was deleted in the 2012 revision of the law after the Fukushima accident, the Law on Final Disposal of High-Level Radioactive Waste still bans direct disposal of spent fuel. In addition, the 2016 Law on Reprocessing Fees legally requires utilities to submit reprocessing fees for all spent fuel generated every year since they stated in their applications that “final disposal method” for their spent fuel would be reprocessing.

Commitments to hosting communities. The nuclear utilities committed—albeit tacitly—to the communities hosting nuclear power plants that they would remove the spent fuel to reprocessing plants, since that was the national policy. Separately, JNFL signed an agreement with Rokkasho village and Aomori prefecture that says that if the Rokkasho reprocessing plant faces “severe difficulties,” other measures will be considered—including the return of spent fuel stored at Rokkasho to the nuclear power plants.

Local governments hosting nuclear power plants were not involved in this deal, however. They could therefore just refuse to receive spent fuel from Aomori.

In fact, after the Fukushima accident, when the government was considering amending the nuclear fuel cycle policy to include a “direct disposal option” for spent fuel in a deep underground repository, the Rokkasho village parliament (at the behind the scenes suggestion by the then JNFL president, Yoshihiko Kawai), issued a strong statement asking for “maintenance of the current nuclear fuel cycle policy.”

The statement continued that, if Japan’s fuel cycle policy changed, Rokkasho would: refuse to accept further waste from the reprocessing of Japan’s spent fuel in the UK and France; require the removal of reprocessing waste and spent fuel stored in Rokkasho; no longer accept spent fuel; and seek compensation for the damages caused by the change of the policy.

Institutional and bureaucratic inertia. In Japan, bureaucrats rotate to new positions every two or three years and are reluctant to take the risk of changing existing policies. They therefore tend to stick with past commitments. Institutional inertia becomes stronger as a project becomes bigger. The Rokkasho reprocessing project is one of the largest projects ever in Japan. Changing the project is therefore very difficult.

Will Japan’s new plutonium capping policy have any real impact? In 2018, Japan’s Atomic Energy Commission announced a new policy on “Basic Principles on Utilization of Plutonium” (see also this post). Under the new policy, the commission proposed that Japan would reduce its stockpile of separated plutonium, starting with a commitment not to increase it, and that reprocessing would take place only when a credible plan to use the separated plutonium existed.

The policy seeks to at least begin to deal with the huge stocks of plutonium Japan has amassed, both in European separation facilities (some 36.7 tons) and in Japan (10.5 tons), in anticipation of using the plutonium widely to fuel nuclear reactors—which so far has not materialized. In conjunction with the new Reprocessing Fee Law, the new plutonium policy gives the government legal authority to control the pace of reprocessing.

But it is not clear how the “capping policy” will be implemented. It is not a legally binding document, and no regulation has been introduced to control reprocessing. Utilities must submit specific plans for plutonium use to the Atomic Energy Commission for its review before reprocessing of their fuel begins. But the commission can only give advice to the government about the credibility of these plans, giving rise to questions about whether the policy will lead to sustained changes in reprocessing activity. A similar “paper rule” on plutonium has existed since 2003.

A way out. Japan could extricate itself from its reprocessing and plutonium problems in several ways. All involve significant changes in policy that would:

Find additional spent fuel storage capacity, on- or off-site. Local communities may be more willing to accept on-site dry cask storage of spent fuel if they are told that it is safer than spent fuel pool storage. For example, Saga Prefecture and Genkai-town, which host Kyushu Electric’s Genkai Nuclear Power Plant, have agreed to host dry cask storage starting in 2027. Host communities may want guarantees that spent fuel will be removed after a specified storage period. Such a guarantee could be given by the central government.

Amend the law on final disposal of high-level radioactive waste. An amendment could allow direct disposal of spent nuclear fuel in a deep underground repository. This would provide more flexibility in spent fuel management and make it easier for communities to host interim spent fuel storage.

Amend the Reprocessing Fee Law and shut down Rokkasho. An amendment to the law on reprocessing fees could allow the government to use reprocessing funds to implement a shutdown of the Rokkasho reprocessing plant. Such a plan could include payment of the debt JNFL has incurred while pursuing the Rokkasho project and funds for dry cask interim storage. This would enable the government to finally end the problem-plagued Rokkasho reprocessing plant project.

Mass layoffs at small nuclear reactor companies

Pioneering Nuclear Startup Lays Off Nearly Half Its Workforce. NuScale is the second major U.S. reactor company to cut jobs in recent months.

Huff Post, By Alexander C. Kaufman, Jan 5, 2024,

Almost exactly one year ago, NuScale Power made history as the first of a new generation of nuclear energy startups to win regulatory approval of its reactor design ― just in time for the Biden administration to begin pumping billions of federal dollars into turning around the nation’s atomic energy industry.

But as mounting costs and the cancellation of its landmark first power plant have burned through shrinking cash reserves, the Oregon-based company is laying off as much 40% of its workforce, HuffPost has learned.

At a virtual all-hands meeting Friday afternoon, the company announced the job cuts to remaining employees. HuffPost reviewed the audio of the meeting. Two sources with direct knowledge of NuScale’s plans confirmed the details of the layoffs.

NuScale did not respond to a call, an email or a text message seeking comment.

Surging construction costs are imperiling clean energy across the country. In just the past two months, developers have pulled the plug on major offshore wind farms in New Jersey and New York after state officials refused to let companies rebid for contracts at a higher rate.

But the financial headwinds are taking an especially acute toll on nuclear power. It takes more than a decade to build a reactor, and the only new ones under construction in the U.S. and Europe went billions of dollars over budget in the past two decades. Many in the atomic energy industry are betting that small modular reactors ― shrunken down, lower-power units with a uniform design ― can make it cheaper and easier to build new nuclear plants through assembly-line repetition.

The U.S. government is banking on that strategy to meet its climate goals. The Biden administration spearheaded a pledge to triple atomic energy production worldwide in the next three decades at the United Nations’ climate summit in Dubai last month, enlisting dozens of partner nations in Europe, Asia and Africa.

The two infrastructure-spending laws that President Joe Biden signed in recent years earmark billions in spending to develop new reactors and keep existing plants open. And new bills in Congress to speed up U.S. nuclear deployments and sell more American reactors abroad are virtually all bipartisan, with progressives and right-wing Republicans alike expressing support for atomic energy…………

Until November, NuScale appeared on track to debut the nation’s first atomic energy station powered with small modular reactors. But the project to build a dozen reactors in the Idaho desert, and sell the electricity to ratepayers across the Western U.S. through a Utah state-owned utility, was abandoned as rising interest rates made it harder for NuScale to woo investors willing to bet on something as risky a first-of-its-kind nuclear plant.

In 2022, NuScale went public via a SPAC deal, a type of merger that became a popular way for debt-laden startups to pay back venture capitalists with a swifter-than-usual initial public offering on the stock market.

In its latest quarterly earnings, NuScale reported just under $200 million in cash reserves, nearly 40% of which was tied up in restricted accounts……………………………………..

NuScale, which has four other projects proposed in the U.S. and tentative deals in at least eight other countries, isn’t the only nuclear startup navigating choppy waters.

In October, Maryland-based X-energy, which is working with the federal government to develop a next-generation reactor using gas instead of water for cooling, cut part of its workforce and scrapped plans to go public.

In September, California-based Oklo appeared to lose a $100 million contract to build its its salt-cooled “micro-reactors” at an Air Force base in Alaska, as the independent Northern Journal newsletter first reported. ………. https://www.huffpost.com/entry/nuscale-layoffs-nuclear-power_n_65985ac5e4b075f4cfd24dba

DOE docs: Carbon removal proposal bets on rare nuclear reactors

E & E News, ClimateWire, By Corbin Hiar | 01/03/2024

A climate technology startup aims to suck carbon from the atmosphere using a new type of nuclear power plant that’s never been built in the United States.

The use of so-called small modular reactors could provide a steady supply of electricity that’s free of climate pollution to a major carbon removal facility planned in Wyoming, according to Energy Department documents obtained by POLITICO’s E&E News. But some experts worry that relying on a novel nuclear plants could jeopardize the development of a federally funded proposal to develop direct air capture, an emerging industry that uses fans, filters, heat and piping to siphon carbon dioxide from the sky.

“It adds complication upon complication,” said Wil Burns, the co-director of American University’s Institute for Carbon Removal Law and Policy. “You’re starting off with a complex new technology, and now you’re trying to wed another complex technology, including one that’s in transition.”

The interest in small nuclear reactors by CarbonCapture, the lead developer of the carbon removal proposal, is among several previously undisclosed components of its initial concept for the Wyoming Regional Direct Air Capture Hub, outlined in documents released by the DOE via a Freedom of Information Act request.

The revelation comes as the Biden administration is moving to pour billions of dollars into commercializing direct air capture technologies while also resuscitating the nuclear power industry. The administration considers the success of both, which is far from assured, to be essential in the fight against climate change.

There are currently only two commercial-scale direct air capture facilities in operation worldwide that remove carbon dioxide from the air and store it underground or in long-lasting products like concrete. Building direct air capture plants and other types of carbon removal facilities — while rapidly weaning the world off of fossil fuels — is necessary to avoid the worst impacts of global warming, climate scientists say.

In theory, nuclear power plants could provide direct air capture developers with a steady supply of carbon-free electricity and heat.

Yet only two new reactors have come online in the U.S. over the past quarter-century. Small modular reactors have been promoted by the administration and nuclear energy advocates as a way to address concerns about cost and waste that derailed the nuclear industry in the 1990s.

That vision was thrown into doubt in November when a nuclear power company — facing spiraling costs and fleeing customers — pulled the plug on a $1.4 billion project to develop the nation’s first small modular reactors………………………………………………………

For Burns, who also teaches at Northwestern University and has reviewed carbon removal business plans for the payments company Stripe, the new details about CarbonCapture’s initial project designs suggest more due diligence is warranted.

“Government needs to be thinking this through before we commit a lot more money,” he said…………………………………………… https://www.eenews.net/articles/doe-docs-carbon-removal-proposal-bets-on-rare-nuclear-reactors/.

Microsoft is training an AI to help get nuclear reactors approved

The company wants the reactors to power generative AI systems.

Freethink, By Kristin Houser, December 26, 2023

Microsoft is training an AI to generate the paperwork needed to get next-gen nuclear reactors approved by regulators — all so that the reactors can power Microsoft data centers running generative AIs.

Power hungry: As of November 2023, 100 million people were using OpenAI’s ChatGPT on a weekly basis, and answering all their queries requires a lot of computing power.

Tech giant Microsoft is shouldering much of that burden — in addition to investing a reported $13 billion into OpenAI, it also built the massive supercomputer used to train the startup’s generative AIs, and its data centers provide the processing power used to run the models.

Nuclear vision: Microsoft appears keen to use nuclear energy — specifically from small modular reactors (SMRs) — to meet the increased electricity demand that generative AI is putting on its data centers……………………

There aren’t any SMRs in operation in the US yet, though, and getting one approved by regulators is an expensive, complex process. The only company to do it, NuScale, spent $500 million, and its application was 12,000 pages long, with more than 2 million pages of supporting documents.

What’s new? In the hope of streamlining this process, Microsoft has teamed up with Terra Praxis, a nonprofit that promotes decarbonization, to train a generative AI to help create the documents needed to get new nuclear reactors approved.

Looking ahead: Ingersoll estimates that the AI could cut the number of human hours needed to get a new SMR approved by 90%, and while it’s too soon to say whether he’s right, Microsoft appears hopeful that its bet on generative AI to accelerate its nuclear vision will pay off.

“We’re really excited about the game-changing potential for AI in this space,” Michelle Patron, Microsoft’s senior director of sustainability policy, told the WSJ. https://www.freethink.com/energy/nuclear-reactors-microsoft

The failed Nuscale project lets Utah down — again

Every time we gamble on a nuclear project like Nuscale to deliver carbon-free power, we are hampering our ability to meet critical climate goals by 2030.

By Lexi Tuddenham | For The Salt Lake Tribune, Dec. 29, 2023 https://www.sltrib.com/opinion/commentary/2023/12/29/opinion-failed-nuscale-project/

Early last month, Nuscale made headlines by canceling its 462 MW proposal for a small modular nuclear reactor (SMNR) at the Idaho National Laboratory. Here in Utah, the news was met with little surprise.

For the past six years, we’ve been raising crucial questions about the viability of the so-called “Carbon Free Power Project” (CFPP). Was it a project that could deliver power on time and at a reasonable cost to ratepayers? How much would taxpayers and ratepayers ultimately pay, and who would bear the environmental, public health and financial risks? Could it meet our energy needs at a time when electrification is more critical than ever?

In 2015, the Nuscale project was eight years out. In 2022, it was still eight years out. As we watched other nuclear power projects be abandoned or blunder online years late and billions of dollars over cost, there was a sense of inevitability about who would suffer when this project failed: the communities who had placed their faith in its fantastical promises of affordable, reliable and “clean” power.

We were told that these SMNRs would be revolutionary — smaller, more cost-effective and with cutting-edge technology, but as we watched the costs swell from $55/MWh to $89/MWh and well beyond, even with huge federal subsidies, it was clear the financial risks were only mounting. With the collapse of the hypothetical project, Utah Associated Municipal Power Systems (UAMPS) member communities in rapidly growing areas like Hurricane and Washington City are now left with the reality of scrambling for alternatives to meet their future energy needs.

As we see nuclear projects around the country experience delay after delay, the Nuscale experience is one reason why we continue to watch the developments of the Terrapower Natrium reactor in Kemmerer, Wyoming, with a mix of skepticism and concern. The other reason is that the Terrapower project has promised not just electricity to Pacificorp customers, but also jobs in a community that desperately needs them. This is irresponsible at best.

The projected timeline for the Terrapower reactor to come online has already been pushed to 2030, which Terrapower external affairs director Jeff Navin admits is “cutting it close.” In addition, the community faces an economic abyss between the projected closure of the coal plant and the startup of the nuclear facility, and federal officials recently noted that with no permanent waste repository existent in the U.S., spent nuclear fuel will be stored “temporarily” on-site. Similar concerns can and should be raised about the proposed nuclear plants at Hunter and Huntington in Utah. At the end of the day, it is workers who are being let down, and it is communities who have to deal with the long term consequences.

We know that the next few years are of critical importance in our ability to combat the worst effects of climate change before we kick off even more warming feedback loops. Every time we gamble on a nuclear project like Nuscale to deliver carbon-free power, we are hampering our ability to meet critical climate goals by 2030. As timelines for such projects are inevitably dragged out, in the interim we continue to burn fossil fuels that choke the air that people breathe and force the climate ever closer to its tipping point.

The hard truth is that there is no silver bullet for climate change. Relying on nuclear power maintains dependence on a flawed energy system that primarily benefits industries that have historically profited from past harms. Now they promise to seamlessly plug in nuclear power and conduct business as usual.

According to the latest estimates, about a billion dollars was sunk into the now-abandoned Nuscale CFPP. This is a drop in the bucket compared to some other nuclear projects this country has seen over the last 30 years. But imagine that $1 billion spent elsewhere on legacy cleanups of the nuclear and uranium mining industry, aiding Downwinders or boosting renewable energy capacity that we know can work. There is an opportunity cost for investing in nuclear when we have faster, lower-risk options that we can prioritize now. Instead, we can take on climate change with what has been called “rational hope,” by investing in wind, solar, geothermal power, storage, grid improvements and efficiency technologies that offer cost-effective climate solutions. And Utah’s potential in these areas is immense.

But this energy future requires a reimagining. It requires permitting and energy-sourcing processes that put the health and vitality of communities front and center. It means changing course to avoid mistakes of the past.

Here at HEAL Utah, we collaborate with communities to shape an energy future crafted by the people it serves. This future prioritizes clean air, a healthy environment and family-sustaining jobs, all powered by accessible, sustainable and affordable renewable energy sources. In short, this is rational hope in practice. Together, we can make it a reality.

Lexi Tuddenham is the executive director of the Healthy Environment Alliance of Utah (HEAL Utah).

How green is the UK Government’s nuclear energy strategy?

Small modular reactors have been touted as a solution to reaching net-zero – but how safe are they and will they do the job?

By Lucie Heath, Environment Correspondent, 28 Dec 23, https://inews.co.uk/news/how-green-is-the-governments-nuclear-energy-strategy-2824596

The Government has pledged to boost the country’s nuclear energy capacity, setting itself a target to power a quarter of the national grid with nuclear energy by 2050.

But i has revealed that the transition to nuclear energy has been beset by delays, prompting former prime pinister Boris Johnson to urge Rishi Sunak to “get on with it”.

Mr Johnson has been a vocal supporter of nuclear energy and has championed the development of new small modular nuclear reactors (SMRs).

SMRs have been touted as a key solution as the world transitions towards a net-zero future, but some have raised questions regarding the green credentials and viability of the technology.

Here i fact-checks the key claims with regards to SMRs.

Nuclear is low carbon

True or False: True

Ed. comment. That’s as long as you don’t count the CO2 emissions from the full nuclear fuel cycle, and the waste disposal methods.

Nuclear power is considered to be a low carbon source of energy. It has a minimal carbon footprint of around 15–50 grams of CO2 per kilowatt hour (gCO2/KWh), compared to an average footprint of around 450 gCO2/KWh for a gas powered generator and 1,050 gCO2/KWh for coal.

According to the International Energy Association (IEA), over the past 50 years the use of nuclear power has reduced CO2 emissions by over 60 gigatonnes – nearly two years’ worth of global energy-related emissions.

While nuclear produces far less CO2 than fossil fuels, environmentalists dispute its green credentials, not least due to the high volume of radioactive waste created as part of the fuel cycle.

SMRs will play a key role in the energy transition

True or False: Jury’s out

Small modular reactors have many potential benefits that overcome some of the hurdles of traditional nuclear reactor sites.

Their smaller size means that can be placed in locations not suited to large power plants and the modular nature of their design means they should be cheaper and quicker to build.

But as of 2023, only Russia and China have successfully built operational SMRs, and neither are in commercial use.

Mr Johnson’s plan to have the UK’s first SMRs contributing to the grid by 2030 looks increasingly unlikely. Rolls-Royce, which was one of the winners of a Government competition to develop them in the UK, recently told MPs its project could be contributing to the grid by 2031-32 at the very earliest.

MPs sitting on the Science, Innovation and Technology Committee recently published a report that described the Government’s nuclear strategy as more of a “wish list” and said ministers need to make it clearer what role SMRs will play in the energy transition.

SMRs are cheaper to build

True or False: Unclear

This section fails to mention the one and only commercial application of small nuclear reactors - the NuScale attempt in the USA, which was a financial fiasco, and had to be cancelled.

One of the largest hurdles to the deployment of nuclear energy are the huge costs of developing new plants. In theory, SMRs should be cheaper to build due to their size and modular nature, allowing for prefabrication.

However, it is not known exactly what the cost will be to the public purse of developing new SMRs in the UK.

The Environmental Audit Committee recently launched an inquiry into the topic, saying it was “currently unclear what financing models will be used to fund SMRs”.

Critics of nuclear argue it would be wiser to spend money on the deployment of renewable energy, which is cheaper to build.

SMRs are safer

True or false: True in theory

Safety has proved to be a massive issue preventing wider uptake of nuclear energy in the past. Incidents such as the 2011 Fukushima nuclear accident have sparked greater fears regarding the vulnerability of plants during a natural disaster, while nuclear stations can also be a risk during times of conflict, such as in Ukraine.

Proponents of SMRs say they are safer than traditional reactors, partly because their smaller core produces less heat, reducing the likelihood of overheating. A number of other innovations exist in their design which in theory should reduce the risk of failure.

While seen as being safer than large plants, SMRs are still associated with many of the same risks as traditional nuclear.

Why Artificial Intelligence is a disaster for the climate.

What this excellent article does not go on to explain is that the “tech gods” (that’s Musk, Gates, Bezos etc) are happy to have nuclear power expand – to fill the endless hunger for electricity of artificial intelligence and the rest of the digital marvels to come.

AI requires staggering amounts of computing power. And since computers require electricity, and the necessary GPUs (graphics processing units) run very hot (and therefore need cooling), the technology consumes electricity at a colossal rate. Which, in turn, means CO2 emissions on a large scale – about which the industry is extraordinarily coy, while simultaneously boasting about using offsets and other wheezes to mime carbon neutrality.

Guardian, John Naughton, 24 December 23

Amid all the hysteria about ChatGPT and co, one thing is being missed: how energy-intensive the technology is.

What to do when surrounded by people who are losing their minds about the Newest New Thing? Answer: reach for the Gartner Hype Cycle, an ingenious diagram that maps the progress of an emerging technology through five phases: the “technology trigger”, which is followed by a rapid rise to the “peak of inflated expectations”; this is succeeded by a rapid decline into the “trough of disillusionment”, after which begins a gentle climb up the “slope of enlightenment” – before eventually (often years or decades later) reaching the “plateau of productivity”.

Given the current hysteria about AI, I thought I’d check to see where it is on the chart. It shows that generative AI (the polite term for ChatGPT and co) has just reached the peak of inflated expectations. That squares with the fevered predictions of the tech industry (not to mention governments) that AI will be transformative and will soon be ubiquitous. This hype has given rise to much anguished fretting about its impact on employment, misinformation, politics etc, and also to a deal of anxious extrapolations about an existential risk to humanity.

All of this serves the useful function – for the tech industry, at least – of diverting attention from the downsides of the technology that we are already experiencing: bias, inscrutability, unaccountability and its tendency to “hallucinate”, to name just four. And, in particular, the current moral panic also means that a really important question is missing from public discourse: what would a world suffused with this technology do to the planet? Which is worrying because its environmental impact will, at best, be significant and, at worst, could be really problematic.

How come? Basically, because AI requires staggering amounts of computing power. And since computers require electricity, and the necessary GPUs (graphics processing units) run very hot (and therefore need cooling), the technology consumes electricity at a colossal rate. Which, in turn, means CO2 emissions on a large scale – about which the industry is extraordinarily coy, while simultaneously boasting about using offsets and other wheezes to mime carbon neutrality.

The implication is stark: the realisation of the industry’s dream of “AI everywhere” (as Google’s boss once put it) would bring about a world dependent on a technology that is not only flaky but also has a formidable – and growing – environmental footprint. Shouldn’t we be paying more attention to this?

Fortunately, some people are, and have been for a while. A study in 2019, for example, estimated the carbon footprint of training a single early large language model (LLM) such as GPT-2 at about 300,000kg of CO2 emissions – the equivalent of 125 round-trip flights between New York and Beijing. Since then, models have become exponentially bigger and their training footprints will therefore be proportionately larger.

But training is only one phase in the life cycle of generative AI. In a sense, you could regard those emissions as a one-time environmental cost. What happens, though, when the AI goes into service, enabling millions or perhaps billions of users to interact with it? In industry parlance, this is the “inference” phase – the moment when you ask Stable Diffusion to “create an image of Rishi Sunak fawning on Elon Musk while Musk is tweeting poop emojis on his phone”. That request immediately triggers a burst of computing in some distant server farm. What’s the carbon footprint of that? And of millions of such interactions every minute – which is what a world of ubiquitous AI will generate?……………………………………………………more https://www.theguardian.com/commentisfree/2023/dec/23/ai-chat-gpt-environmental-impact-energy-carbon-intensive-technology

Policy makers should plan for superintelligent AI, even if it never happens

Bulletin, By Zachary Kallenborn | December 21, 2023

Experts from around the world are sounding alarm bells to signal the risks artificial intelligence poses to humanity. Earlier this year, hundreds of tech leaders and AI specialists signed a one-sentence letter released by the Center for AI Safety that read “mitigating the risk of extinction from AI should be a global priority alongside other societal-scale risks such as pandemics and nuclear war.” In a 2022 survey, half of researchers indicated they believed there’s at least a 10 percent chance human-level AI causes human extinction. In June, at the Yale CEO summit, 42 percent of surveyed CEOs indicated they believe AI could destroy humanity in the next five to 10 years.

These concerns mainly pertain to artificial general intelligence (AGI), systems that can rival human cognitive skills and artificial superintelligence (ASI), machines with capacity to exceed human intelligence. Currently no such systems exist. However, policymakers should take these warnings, including the potential for existential harm, seriously.

Because the timeline, and form, of artificial superintelligence is uncertain, the focus should be on identifying and understanding potential threats and building the systems and infrastructure necessary to monitor, analyze, and govern those risks, both individually and as part of a holistic approach to AI safety and security. Even if artificial superintelligence does not manifest for decades or even centuries, or at all, the magnitude and breadth of potential harm warrants serious policy attention. For if such a system does indeed come to fruition, a head start of hundreds of years might not be enough.

Prioritizing artificial superintelligence risks, however, does not mean ignoring immediate risks like biases in AI, propagation of mass disinformation, and job loss. An artificial superintelligence unaligned with human values and goals would super charge those risks, too……………………………………

The threat. Traditional existential threats like nuclear or biological warfare can directly harm humanity, but artificial superintelligence could create catastrophic harm in myriad ways……………………………………………………………………………………………………………… more https://thebulletin.org/2023/12/policy-makers-should-plan-for-superintelligent-ai-even-if-it-never-happens/?utm_source=Newsletter&utm_medium=Email&utm_campaign=MondayNewsletter12252023&utm_content=DisruptiveTechnologies_SuperintelligentAI_12212023

SMR – Spending Money Recklessly

Spending Money Recklessly: This video explains why the nuclear industry

has been stagnating for the last 25 years, and why nuclear promoters are

desperate to obtain government fundings for SMRs (Small Modular Reactors)

despite the fact that nuclear power is the slowest, costliest, and most

speculative approach to fighting climate change.

Energy efficiency and renewables with storage are far preferable, not least because they are

do-able. Gordon Edwards gives the Keynote address on Small Modular Reactors

(SMRs) at the AGM of the Alliance to Halt Fermi-3 (Detroit Michigan), on

December 3, 2023. Edwards is prudent of the Canadian Coalition for Nuclear

Responsibility: www.ccnr.org .

Gordon Edwards 23rd Dec 2023

Talen Energy Is Building Data Centers That Run on Nuclear Power. Now, It Needs to Find Buyers

A potential partnership for data campus can boost independent power producer’s earnings

WSJ, By Soma Biswas, Dec. 27, 2023

Independent nuclear power company Talen Energy is betting its future on supplying power to technology companies that are looking for carbon-free energy sources to develop their artificial-intelligence capabilities.

Talen, which exited bankruptcy this year, is developing a 1,200-acre data-center campus with dedicated power supply from the Susquehanna nuclear plant in Berwick, Pa., according to the company’s public presentations. Talen could lease, sell or form a joint venture with technology companies such as Google, Microsoft or Amazon.com to operate the facility, according to Talen shareholders and a report by investment bank Oppenheimer.

In December, Oppenheimer analysts initiated coverage of the company, and added that such a deal could boost the company’s cash flow by $50 million annually. A power-supply contract to a tenant or buyer would yield higher rates than what Talen would earn in the wholesale power market since commercial customers, such as data centers, pay more for electricity, the company has said. ……………………………. (Subscribers only) more https://www.wsj.com/articles/talen-energy-is-building-data-centers-that-run-on-nuclear-power-now-it-needs-to-find-buyers-c9c8c4a9—

Grand plan to triple nuclear energy with small nuclear reactors, but where’s the funding?

1 US nuclear start-ups battle funding challenge in race to curb emissions.

Reactors pioneered by Oklo, X-energy and NuScale suffer financing setbacks

as well as regulatory headwinds.

US plans to build up its nuclear industry

face big funding and regulatory challenges which could delay a new

generation of smaller, more efficient reactors touted by advocates as

critical to fighting climate change.

Industry experts told the Financial

Times a declaration signed last week by Washington and 21 other nations at

the COP 28 climate summit to triple the amount of installed nuclear energy

by 2050 was a step forward, given the sector’s ability to provide

(?)emissions-free power.

But a sharp fall in market support for start-ups

developing so-called small modular reactors and other advanced nuclear

facilities threaten US ambitions, they said. Last month NuScale Power Corp

cancelled plans to build the first SMR in the US, despite receiving $1.4bn in government cost-sharing pledges.

Not enough power utilities expressed an

interest in purchasing electricity from the facility in Idaho when NuScale

increased power prices by more than 50 per cent over two years to $89 per

megawatt hour. The setback followed the collapse of a $1.8bn deal agreed

between X-energy and special purpose acquisition company Ares Acquisition,

which was intended to enable the developer of nuclear technologies to go

public.

Now the industry is focused on whether Oklo, a start-up chaired by

OpenAI chief executive Sam Altman, can successfully go public via a

blank-cheque company announced in July with AltC Acquisition Corp. The

merger was proposed at a valuation of $850mn and would provide Oklo with

$500mn to develop and commercialise its reactor design.

FT 12th Dec 2023

https://www.ft.com/content/c0700a01-c1e8-4e5e-8300-ac264bd25293

United Arab Emirates is using COP 28 Climate Summit to promote small nuclear reactor industry, as well as fossil fuel industries

Following the launch of a programme aimed at leveraging its experience in

successfully delivering a nuclear power plant project, the UAE’s Emirates

Nuclear Energy Corporation (ENEC) has signed a number of agreements with

small modular reactor and micro-reactor vendors to explore opportunities

for the commercialisation and global deployment of their designs.

World Nuclear News 5th Dec 2023

https://www.world-nuclear-news.org/Articles/ENEC-to-evaluate-deployment-of-SMRs-and-microreact

-

Archives

- January 2026 (246)

- December 2025 (358)

- November 2025 (359)

- October 2025 (376)

- September 2025 (258)

- August 2025 (319)

- July 2025 (230)

- June 2025 (348)

- May 2025 (261)

- April 2025 (305)

- March 2025 (319)

- February 2025 (234)

-

Categories

- 1

- 1 NUCLEAR ISSUES

- business and costs

- climate change

- culture and arts

- ENERGY

- environment

- health

- history

- indigenous issues

- Legal

- marketing of nuclear

- media

- opposition to nuclear

- PERSONAL STORIES

- politics

- politics international

- Religion and ethics

- safety

- secrets,lies and civil liberties

- spinbuster

- technology

- Uranium

- wastes

- weapons and war

- Women

- 2 WORLD

- ACTION

- AFRICA

- Atrocities

- AUSTRALIA

- Christina's notes

- Christina's themes

- culture and arts

- Events

- Fuk 2022

- Fuk 2023

- Fukushima 2017

- Fukushima 2018

- fukushima 2019

- Fukushima 2020

- Fukushima 2021

- general

- global warming

- Humour (God we need it)

- Nuclear

- RARE EARTHS

- Reference

- resources – print

- Resources -audiovicual

- Weekly Newsletter

- World

- World Nuclear

- YouTube

-

RSS

Entries RSS

Comments RSS