Finally Some Accountability for Georgia’s Costly Nuclear Power Mistake

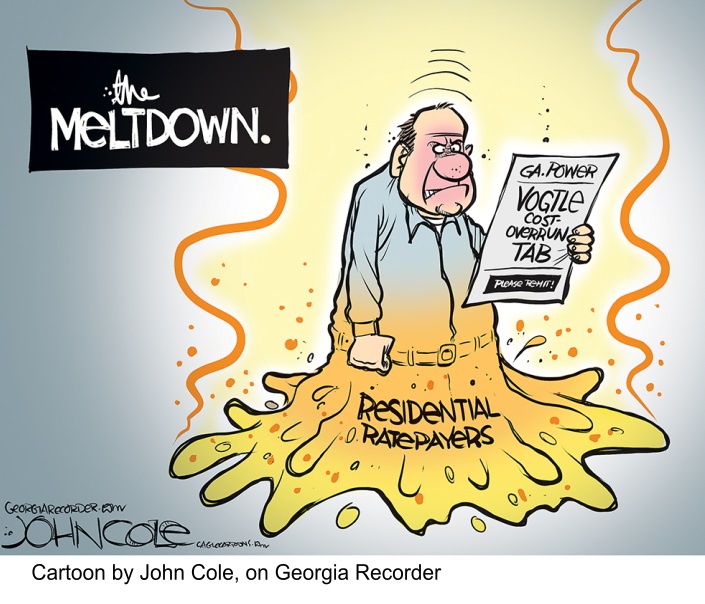

Vogtle stands as the only new nuclear reactor built in the last 30 years, and its fallout offers a bleak prognosis for any supposed “renaissance” and its supporters in statehouses across the country. We can look back to 2017 when the main contractor, Westinghouse, filed for bankruptcy due to the extreme cost overruns at Vogtle. At that critical moment, the Georgia PSC ignored its own staff, energy experts, and public outcry, choosing to burden ratepayers with the project’s continuation.

By Kim Scott.15 Nov 25 https://nuclearcosts.org/finally-some-accountability-for-georgias-costly-nuclear-power-mistake/

The story of Plant Vogtle’s two new nuclear reactors in Georgia is not a triumph of a “nuclear renaissance”; it’s a cautionary tale written in soaring electric bills and a growing political fallout. The people of Georgia are paying the price, literally, as their utility bills have skyrocketed by over 40% – and now, following last Tuesday’s Public Service Commission election in Georgia, it seems those that allowed this to happen in the first place are starting to feel the pinch as well. It’s about damn time!

Georgia voters delivered a stunning message by unseating two Republican utility commissioners, Tim Echols and Fitz Johnson, who rubber stamped and championed the costly mistakes leading to a 41% increase in Georgians’ electric bills. This election, which saw Democrats Alicia Johnson and Peter Hubbard championing fair rates, affordability and renewable energy, was a clear referendum on Plant Vogtle’s enormous price tag and more importantly, nuclear power as a not so clean future power resource both here in Georgia and elsewhere.

The stunning defeat of utility backed incumbents sends a powerful signal to utility regulators nationwide that consumers will not tolerate being forced to pay for multi-billion-dollar nuclear boondoggles. If they aren’t paying attention, Wall Street sure is, downgrading Southern Co.’s stock immediately following the election, citing the increased risk and the new difficulty the company will face in pushing through further rate hikes to pay for Plant Vogtle and other projects in their pipeline. Georgia customers will pay an additional $36 billion to $43 billion over the 60-80 year lifespan of the two Vogtle reactors compared to cheaper alternatives.

Vogtle stands as the only new nuclear reactor built in the last 30 years, and its fallout offers a bleak prognosis for any supposed “renaissance” and its supporters in statehouses across the country. We can look back to 2017 when the main contractor, Westinghouse, filed for bankruptcy due to the extreme cost overruns at Vogtle. At that critical moment, the Georgia PSC ignored its own staff, energy experts, and public outcry, choosing to burden ratepayers with the project’s continuation.

The consequences of those decisions, subsequent rate increases and soaring electric bills are not abstract—they are impacting the most vulnerable among us and the most overlooked i.e. middle class/working class Georgians. Disconnection rates for the inability to pay have soared by 30% in 2024. For retirees on fixed incomes, the rate increases to pay for Plant Vogtle mean the difference between making ends meet and falling into destitution. This summer, when brutal heat waves descended, vulnerable Georgians had their power shut off, creating life-threatening conditions because they could no longer afford to cool their homes.

The ratepayer backlash in Georgia is also being fueled by the projected massive energy demands of AI data centers, which are forcing utilities like Southern Co. to reckon with costly new generation and transmission projects. Instead of aggressively pushing nuclear power—as evidenced by the Trump administration’s recent $80 billion deal to buy reactors from Westinghouse, the same company bankrupted by Vogtle—we must demand that elected politicians focus on fast and affordable energy solutions like solar and battery energy storage systems.

The painful lesson learned in Georgia is that new nuclear power is simply too expensive and takes too long. The reality is that for half the cost and in less than a quarter of the time, we could have built more than twice the capacity using solar, wind, or battery storage technologies. But corruption won out and Vogtle is here for the foreseeable future. Georgians will be paying for this mistake for decades to come… I’m just glad there’s finally some accountability headed our way.

Kim Scott is Executive Director of Georgia WAND, is a native Georgian, and has a Chemical Engineering degree from Vanderbilt University in Nashville, TN.

Bechtel Chief Says U.S. Must Subsidize Trump’s Nuclear Revival.

By Leonard Hyman & William Tilles – Nov 153, 2025 https://oilprice.com/Alternative-Energy/Nuclear-Power/Bechtel-Chief-Says-US-Must-Subsidize-Trumps-Nuclear-Revival.html5,

- Bechtel CEO Craig Albert said the U.S. government should help cover the costs of new nuclear plants under Trump’s proposed expansion.

- Nuclear power relies on layers of government subsidies for insurance, fuel, and waste disposal.

- If more reactors are truly needed, the government—not private firms—should build and operate them to lower capital costs

Well, someone important finally said it. Craig Albert, head of construction firm Bechtel, credited by the Financial Times for “rescuing” the Vogtle nuclear project in Georgia (we think “finishing“ it would be a better description), told that august paper that if the government wanted to get Donald Trump’s nuclear construction expansion going, it should be willing to pick up part of the costs. That is, subsidize the seemingly inevitable cost overruns? All the stories that followed talked about encouraging the “early movers” as if nobody had been building nuclear plants for the past seventy years, with cost overruns a common feature of construction in the US and Europe for at least 40 years.

We’ve said, and written in blogs and books, that building nuclear power plants in the USA (and a lot of other places) is not and has never been a commercial business venture. And maybe not a rational one, either. (The list of government subsidies for the industry like insurance, fuel procurement, nuclear waste disposal etc. go on and on.)

And Mr. Albert’s comments seem to bear that out. Just about every other electricity source is cheaper. If you don’t believe in climate change, then why not build more coal and gas? The USA has large domestic supplies of both. They run around the clock, too. If you believe in climate change, wind and solar assisted by batteries and better transmission can do the same job as a base load plant at about the same price points. And the wind and sun don’t have to be imported. But the Chinese control the rare earths that go into those facilities. Yes, but there are plenty of rare earths to be found elsewhere (“rare” being a misnomer). The problem is that the Chinese control the processing. So, would it take more time to build a nuclear plant or to build rare earth processing facilities in friendly places?

Or, if we really were worried about national security or the climate and were looking for an economical way out, we might want to do something about our outsize consumption of electricity, roughly 50-100% higher than in similarly developed countries in similar climates. For years, energy economists have argued that saving energy is a lot cheaper than producing it. A nonstarter nowadays. (Ever since 1977 when Jimmy Carter caused a controversy by turning down the thermostats and putting on a sweater in the White House to encourage energy conservation this has been a political nonstarter. Sad.)

Here’s the point. We need lots of electricity, but we don’t need nuclear power. So why should we subsidize the risk? This is not a new technology. Our first commercial reactor entered service in 1957. It’s an old, extremely complicated technology that never met its promised potential. A workable fusion reactor might change the world, but not more fission nukes. However, if the powers that be really want more nukes, we suggest that the government build and run them. It couldn’t do worse than the private generating companies. It would open the nuclear subsidy to public scrutiny and it would save a bundle on capital costs. (The government can always finance things much more cheaply than the private sector.) Our conclusion is that nuclear power is not a place for the private sector because it is not, and has never been, a commercially viable business.

Sizewell C. Taxpayers likely to see ‘no return’ on £6.4bn public funds put in as equity

taxpayers are getting no return whatsoever on the £6.4bn they are putting in as equity, so from a taxpayer point of view it is dreadful.

10 Nov, 2025, By Tom Pashby, New Civil Engineer

Taxpayers will see “no return whatsoever” on the £6.4bn that the government is committing in equity to Sizewell C, according to an energy policy expert.

Earlier in November 2025, Sizewell C reached financial close with a £5bn funding injection from 13 banks paving the way for full-scale construction.

The deal secures around £5.5bn of new financing consisting of a £5bn export credit-backed facility arranged by Bpifrance Assurance‑Export (BpifranceAE) with support from Sfil, and a separate £500M working capital facility.

These facilities sit alongside a term loan provided by the UK’s National Wealth Fund and the equity that was raised earlier this year following the Final Investment Decision (FID) for the Suffolk nuclear power plant in July.

In April 2025, the government announced that a further £2.7bn of taxpayer cash had been made available for Sizewell C, bringing the total to £6.4bn ahead of the FID on the nuclear power station.

The agreements on private investment to build the new nuclear power station have been reached through the government agreeing to use the Regulated Asset Base (RAB) model. RAB works by having consumers pay a surcharge on their bills during the construction phase, which helps lower the cost of capital and reduces the financial risk for investors. This surcharge will be added to bills through the construction and for the first three years of operation. It goes towards paying back the private entities for their investment and, according to the government, will mean lower bills for consumers over the long term. Ofgem, as the regulator, sets the allowed revenue to ensure costs are incurred efficiently and consumers get value for money.

However, University of Greenwich emeritus professor of energy policy Steve Thomas is scptical about this, given that the current official estimate of £38bn to build Sizewell C is at the lower end of the range of likely costs and this is in 2024 prices, with inflation pushing it up all the time.

Additionally, there is no official timeline for construction completion. As has been seen with Hinkley Point C, cost and schedule overruns come with the territory.

He told NCE: “From 1 December 2025, consumers will start to pay a surcharge on the electricity bills to pay for the return being paid to investors (10.8% real) on their equity contribution (35% of the costs) and the interest payments on the loans, expected to be 4.5% (real).

“A bit of arithmetic suggests the surcharge will be split 44% interest payments and 56% rate of return on equity.

“The Low Carbon Contracts Company has said the surcharge in the period up to the end of March 2027 will be £3.54/MWh.”

He added that the £3.54/MWh figure would subsequently be updated annually based on the latest cost calculations.

“Ofgem says the average domestic consumer uses 2,700kWh per year so that amounts to about £9.56 per consumer in the first year,” he said. He believes this could rise to £62.70 per year by the end of the surcharge period.

“The government has said it will recycle its income from the surcharge back to electricity consumers, but we don’t know and nor does the government how it will do this and what proportion of the surcharge it receives will go back to consumers.

“Recycling the income means the government is giving consumers the interest that is paid to the National Wealth Fund on borrowing of £11.8bn and taxpayers are getting no return whatsoever on the £6.4bn they are putting in as equity, so from a taxpayer point of view it is dreadful.

Sizewell C ‘fails miserably’ on transparency – campaigner

Stop Sizewell C executive director Alison Downes said: “If Sizewell C can publicly state it expects the project to cost £38bn, why won’t they tell us when we can expect to see first power?

“Given that the British public is largely paying for Sizewell C through our taxes and energy bills, don’t we have the right to know how long it will take?

“Cynically this sounds like a ‘learning’ from Hinkley Point C – don’t tell people when it will be finished so you can’t be criticised for missing your deadlines. As an exercise in transparency, it fails miserably.”………………. https://www.newcivilengineer.com/latest/sizewell-c-consumers-like-to-see-no-return-on-6-4bn-public-funds-put-in-as-equity-10-11-2025/

EDF boss vows to speed up nuclear projects and narrow gap to Asian peers

EDF’s new boss has vowed to speed up the delivery of new nuclear reactors in an increasingly competitive market, after costly overshoots in the past weighed on the French energy group.

The company wants to use the

development of the UK’s Sizewell C nuclear power station to show that huge reactors capable of powering millions of homes can be delivered at speed, in the hope that this will help it attract private funding and compete with more efficient rivals, including those from Asia.

Bernard Fontana, chief executive, said the state-owned group remained “open to international markets” and hoped to export more of its designs beyond the projects it is undertaking in the UK and France. EDF has been tasked with

delivering at least six new French reactors from 2038 onwards and is due to deliver two for the £38bn Sizewell C project in the middle to late 2030s.

Fontana’s push for efficiency comes as EDF, weighed down by a net debt of €50bn, needs to finance €30bn of investments annually over the next five years, including on maintaining current sites, according to estimates by France’s budget watchdog. EDF operates 57 French reactors.

FT 9th Nov 2025, https://www.ft.com/content/cc39da49-6ebf-40e2-bfbe-296ee2596ce9

Destroying Europe in order to save it: Extortion, theft, and the EU’s two disastrous choices

Strategic Culture Foundation, Joaquin Flores, November 5, 2025

Europe can postpone recognition of failure, but it cannot postpone the bill.

Europe now faces a stark choice forced by its disastrous war policy against Russia: either allow the EU to successfully move toward a centralized state over the heads of its member states, risking a mass Eurexit that may or may not succeed in reaction to that gamble, or delay the larger crisis through member states quietly accepting one of several schemes that will cripple the economy and create social strife regardless.

The Union must decide whether to use frozen Russian sovereign assets to finance a €140 billion “reparation” loan for Ukraine, or to issue joint debt through Eurobonds.

Both paths carry severe legal risks and impose heavy costs on citizens: one through contingent liabilities, the other through immediate taxes, austerity, and political instability. Pushing through the Eurobond option would amount to a structural coup, a radical re-engineering of the EU against its current form. A recent Politico piece framed these in terms of Option A and B, which helps to contrast these two potential ways forward.

Commission President Ursula von der Leyen’s scheme from the European Commission reveals the depths of EU tyranny in its failed gambit to defeat Russia and guarantee investment outcomes in Ukraine.

SAFE, (Security Action for Europe), a €150 billion defense loan program, was initially proposed in March by von der Leyen with the goal of stimulating rapid defense investment. By May, EU ministers had given their final approval to the program, without consulting the European Parliament, provoking a suit from the Parliament.

Whether or not the Eurobond or Russian asset-seizure (theft) scheme is being proposed in light of (perhaps) likely-to-succeed challenges to the SAFE loan program, or if the Commission is trying to actually raise a total of nearly €300 billion, remains to be seen. What is certain is the push for SAFE comes chronologically after there was significant push-back from EU member states and ministers themselves on the feasibility of spending seized/frozen Russian assets (including interest on the moneys, for war against Russia, or anything else). And the Commission push for this Eurobond scheme comes after the EU Parliament presented a suit against SAFE.

What the Eurobond scheme and SAFE both have in common, nevertheless, is the mechanism for implementation, recklessly assuming authority to do so under a radically broadened interpretation of its powers re Article 122 TFEU.

The Commission is using threats to force member states to spend the frozen Russian assets. Refuse and each government faces a political crisis. Eurobonds are deeply unpopular because the mutualized debt falls on the population, leading to the overturning of governments at the ballot-box, and imposing them unilaterally would break EU treaties, leading to an emboldened Eurexit movement. Member states are being pushed to approve the use of unlawfully seized assets, completing the illegal expropriation through their own consent.

The stakes are far higher than money. This is a coup against the EU as it was conceived, a total re-envisioning of the Union itself. Ursula von der Leyen is not merely leveraging bonds to secure Ukraine funding. She is playing a game of chicken that risks the Union’s structure………………………………

Option A: Frozen Russian assets – huge legal risk, long-term cost to citizens

Legally, tapping frozen Russian assets is precarious………………………………….

….sovereign assets normally enjoy immunity from seizure under international law and bilateral treaties, reflected in the United Nations Convention on Jurisdictional Immunities of States and Their Property (2004) and the 1989 Belgium–Russia bilateral investment treaty.…………………………………………………………………………………..

Option B: Eurobonds – unconstitutional overreach and overt social burden

Unilateral Eurobonds generally collide with the EU’s treaty architecture: the Commission cannot force the issuing of mutualized debt; joint borrowing requires unanimous backing and national ratification.

To do otherwise requires violating the EU’s treaty itself. Brussels is signaling it might act first and fight legal challenges later. …………………………………………………………………………………………………………………..

If forced, citizens face higher taxes, constrained public services, and renewed austerity. Debt obligations do not disappear with elections; social unrest could deepen inequality, provoke Euroscepticism, and trigger exit pressures. Constitutionally, this makes the Commission behave as a sovereign treasury without legitimacy.

€140 bn in debt spread across 200 million workers equals €700 per worker. At 3 % annual interest, servicing costs €21 bn/year, or €105 per worker annually over ten years. Principal plus €42 bn interest totals €182 bn, or €910 per worker. This translates into grandmothers skipping groceries, students delaying college, and curtailed public services. Trade unions, left-wing groups, and small-business forces could trigger a pan-European ‘Yellow Vests’-style crisis.

Conclusion: Evergreening, sunk costs, and Who pays

Both options are evergreening: keeping failing policies alive to avoid losses. Option A buries legal risk and hands latent liabilities to future citizens; Option B openly burdens taxpayers and risks constitutional rupture. And even worse, both scenarios ignore the chronic economic hazard to Europe if it continues its course of sanctions on Russian energy, which could make it the least competitive economy in the developed world.

In both options, the EU is pouring billions either directly into Ukraine or into arms to supply it yet the war is almost certainly lost and the billions spent on expected returns from reconstruction of Russian-liberated territories will never be recovered, turning these investments into sunk costs that serve only to prolong the illusion of economic coherence.

Europe suffers a paradigm problem and an existential crisis at the level of its ‘Eurocracy.’ Paradoxically, the policies that are politically hardest to enact at this bureaucratic level are also the most necessary and potentially fruitful. Since the EU proposes to embark upon a radical reconstruction of the Union itself, perhaps it is appropriate to presume something as radical, but in the direction of stability, growth, and peace: 1) reversing its war-footing; 2) rapprochement with Russia along the U.S.-Russia model; 3) restoring energy pipelines like Nord Stream 2; 4) recognizing Ukraine as Russia’s legitimate sphere of influence; 5) joint investment with Russia in the post-Warsaw Pact sphere; 6) building on the OSCE and 1975 Helsinki Final Act framework; 7) developing a joint Eurasian economic and security architecture. This ensures stability, development, and prosperity for generations.

For Europe, this requires overcoming chronic Russophobia and eschewing Atlanticist paranoia. Europe can postpone recognition of failure, but it cannot postpone the bill. Who will be left holding it, and will there even be an EU that can pull this off? https://strategic-culture.su/news/2025/11/05/destroying-europe-in-order-to-save-it-extortion-theft-and-the-eus-two-disastrous-choices/

Legalising the theft of Russian assets

There are, I’m afraid to say, still too many truly believers in the Russia total defeat delusion. Ukraine can still win! With what troops and, critically, what money?

With Glenn Diesen, Ian Proud. Nov 10, 2025

Following my recent article on the topic of the so-called EU reparations loan (a cheap ruse to fund the Ukrainian state for another 2-3 catastrophic years of war), I discussed the issue in more detailed with Glenn Diesen,

The more I consider this issue, the more clear it becomes that attempting to exproprirate Russian assets is a desperate measure to prevent EU Member States from giving Ukraine the money themselves, money which they do not have.

The Commission idea, should the Russian asset option continue to be blocked by Belgium, to borrow the money on international markets and then lend it to Ukraine, which can’t borrow money itself, appears similarly desperate. Who will make repayments on that loan? Becauses Ukraine won’t.

Suddenly, the EU idea of common debt becomes more worrying still. Who wants to give Kaja Kallas a blank cheque to fund proxy wars in other countries, with repayments being share among Member States?

Amid all of this, with Pokrovsk falling, Kupiansk and Siversk almost lost, the Russian army pushing into Zaporizhia, does anyone in Brussels take a step back and ask whether, in fact, it would be better to support the US in leveraging Zelensky to settle?

There are, I’m afraid to say, still too many truly believers in the Russia total defeat delusion. Ukraine can still win! With what troops and, critically, what money?

EDF Braces for More Delays at UK Hinkley Point Nuclear Project.

The Hinkley Point nuclear project in the UK, ridden by repeated delays and cost overruns, is bracing for yet more setbacks. The latest schedule for

completion around the end of the decade is likely to be pushed back by at

least another year as operator Electricite de France SA continues to

grapple with the installation of electrical systems, a person familiar with

the matter said, asking not to be named discussing private information. The

delay may stretch for 12 months or more if corrective action plans continue

to prove challenging, another person said.

Bloomberg 7th Nov 2025, https://www.bloomberg.com/news/articles/2025-11-07/edf-braces-for-more-delays-at-uk-hinkley-point-nuclear-project

The $17bn nuclear start-up without any revenue

A nuclear technology company backed by Sam Altman is riding a wave of investor enthusiasm

Publicly-listed Oklo sits at the intersection of two hot areas for Wall Street: artificial intelligence and energy companies. This year alone, Oklo’s share price has jumped more than 400 per cent. But the business hasn’t generated any revenue. It hasn’t built a nuclear reactor, and it hasn’t secured any binding contracts with customers. The FT’s US energy editor Jamie Smyth explains the enthusiasm for Oklo, its links to the Trump administration and whether it can live up to the hype. company backed by Sam Altman is riding a wave of investor enthusiasm.

Clips from New York Stock Exchange, The White House, a16z – – – – – – – – – – – – – – – – – – – – – – – – – – For further reading: Inside Oklo: the $20bn nuclear start-up without any revenue US and investors gambling on unproven nuclear technology, warn experts Donald Trump’s assault on US nuclear watchdog raises safety concerns

Subscribers only –https://www.ft.com/content/d87cb0ac-b599-46b9-8a4d-9a8b55541ab2

TRANSCRIPT – Michela Tindera speaks to Jamie Smyth

Nov 5 2025 Audio transcript of podcast.

“……………………………. Jamie Smyth

Oklo’s valuation soared to more than $25bn in just 18 months, and this really caught my eye. I’ve been tracking quite a lot of these smaller nuclear companies over the last 18 months, but nothing had reacted like this.

They want to power the artificial intelligence revolution using nuclear energy, but a new type of nuclear energy, which hasn’t been in use to date in the commercial nuclear world.

Michela Tindera But here’s the thing. This high-flying start-up Oklo, it doesn’t have revenues, licenses to operate, nor does it have any contracts with customers. So what’s going on with this company? That is what Jamie and our colleagues have been digging int

Jamie Smyth Oklo has become a symbol of the AI boom and the ongoing nuclear renaissance because of the astonishing rise in the value of its shares and its close relationship with the Trump administration. How the company fares could have a big influence in whether nuclear energy powers this AI revolution.

Michela Tindera

I am Michela Tindera from The Financial Times. Today on Behind The Money, is Oklo’s promise justified, or is it just riding the wave of AI hype?

Jamie Smythe…………………………………………………………..

So Oklo started in 2013 by a couple called Jacob and Caroline DeWitte……………. back in 2013, they met Sam Altman of OpenAI fame …………………….he decides to invest in Oklo………………….He later agrees to chair the company and steer its stock market listing. Now that happens in May 2024 through a Spac or a special purpose acquisition company deal.

…………………Oklo’s share price initially. In fact, it fell on the first day of the listing. But after Donald Trump’s election, and particularly with his inauguration, he really ratcheted up the focus on energy dominance and also gave this strong support for nuclear power.

…………………….And then in May 2025, you get Oklo’s chief executive Jacob DeWitte visiting the White House and speaking in the Oval Office………….

You have Trump sitting in the Oval Office, launching several executive orders on nuclear energy pledging to quadruple capacity by 2050, and he’s invited Jacob and a couple of other CEOs of nuclear companies. You’ve got the chief executive of Constellation Energy standing there beside him, the chief executive of General Matter, an enrichment company, standing there.

……………The room is really packed full of celebrities and there’s Jacob DeWitte in amongst them all.

Jacob DeWitte audio clip………………… The physics are on our side and these things help unleash this innovation to actually realise that. So it’s never been more exciting.

Donald Trump audio clip

Very exciting indeed. Go ahead, please.

Jamie Smyth This platform to speak from the Oval Office next to Trump, I think was a huge endorsement of the company for investors. You really start to see the stock price jump from there, and then it really goes through the roof. It’s made the DeWittes paper billionaires. They own just under 18 per cent of the company, though they’ve made a large chunk of real money too by selling some of their stock. In the past six months, they’ve made about $250mn in share sales according to some Bloomberg data analysed by the FT.

……………………………….Well, I think Oklo really sits at the intersection of these two stock market booms in artificial intelligence and energy companies. The AI revolutions being driven by Nvidia, Microsoft, Amazon and other big tech giants, and this realisation that data centres, which are driving the AI technology, they’re gonna require huge amounts of electricity. So that’s why you’re seeing shares in energy companies, utilities like Constellation Energy, gas turbine makers such as GE Vernova and Siemens and other nuclear start-ups, all their shares are soaring.

………………………………. the Trump factor. The administration is spending big on nuclear.

Michela Tindera

Like Jamie mentioned earlier, the Trump administration has pledged to quadruple US nuclear capacity by 2050

Jamie Smyth It has very ambitious plans to build out 10 large-scale reactors and support this new technology that Oklo is developing. And specifically, Oklo has benefited from this. They have been offered a place on a fast-tracking programme for their nuclear reactor. They’ve also been offered a place on a fuel programme as well. And they are being given a very specialised, scarce form of fuel, which they require to run their type of reactor. So I think investors are responding to this and they’re getting very excited.

……………………………Bank of America have actually said that this support from the Trump administration is one element that gives the company an edge over its rivals. Democrats, however, have alleged that it really creates an appearance of impropriety, and they have asked a series of questions of the administration about its relationship with Oklo.

………………Oklo wants to build a new type of nuclear reactor, something called a small modular reactor or an SMR…………And what’s interesting about Oklo’s SMR is that it wants to use liquid sodium as a coolant rather than the standard of water.

……………………………Oklo would say their reactor could be safer than a water-cooled reactor in terms of a Chernobyl-style accident. It’s just not gonna happen. But there are downsides to sodium-cooled reactors. You know, the big question with these sodium-cooled reactors are, we’ve had four or five of them actually already built in the United States over the last 40 years on a test basis, but none of them have actually managed to become commercially viable, so they didn’t take off. ……………………………………….

Michela Tindera So Oklo’s plan here sounds pretty ambitious. First, they wanna build a new kind of nuclear reactor that hasn’t been sold commercially in the US before. And second, they also have this untested business model. They wanna sell the nuclear power themselves instead of offloading that to a utility company.

………………..Jamie Smyth

Oklo have a very ambitious goal of commercially beginning to sell power through their SMRs by 2027……………..

They haven’t yet built their nuclear reactor. They haven’t got a licence for their nuclear reactor. They haven’t got any revenue and they haven’t got a legally binding contract with a customer.

Michela Tindera Not any customers at all?

Jamie Smyth They don’t have legally binding par purchase agreements with customers. What they’ve got is they’ve got MOUs or memorandums of understandings. So companies have come to them and said, we’d like to talk about and draw out an outline of an agreement, but there’s no legally binding agreement yet in place. So until it can do that, I think there’ll always be a question mark over the sustainability of the company.

Michela Tindera A lot of what Oklo is pursuing is untested, the technology, but also the business model of both building the reactors and selling the power they generate. And as its market valuation source, analysts are increasingly pointing out that the company’s valuation is stretched.

The business has attracted the attention of short sellers. That’s people who bet on a stock’s price going down. Oklo’s short sellers have borrowed roughly 13 per cent of the stock. They believe that the DeWittes have underestimated the amount of time and money that’s required to commercialise their technology. One area they’ve particularly struggled with is licensing.

Jamie Smyth One of the issues to do with Oklo is, it’s one of the few companies that has had a licence application rejected by the Nuclear Regulatory Commission in the United States. That is quite a big thing.

……………………..Jamie Smyth………….And then in 2022, the NRC didn’t award the licence. So that really raises the question mark about whether Oklo was able to secure one of these licences. Oklo has strongly criticised the NRC decision to not award them a licence. They even alleged the NRC staff engaged in inappropriate behaviour for a regulator.

………………Michela Tindera In the years since, Oklo has successfully lobbied the government to streamline the NRC licensing process. Jamie Smyth So the Trump administration has set up a separate pathway for SMR developers to build test reactors on federal land under the oversight of the Department of Energy, which is run by energy secretary Wright. And beyond that, the Trump administration has piled extraordinary pressure on the NRC to approve reactors within short timeframes, much shorter than previously.

Michela Tindera But as Oklo moves forward, it’s a space that everyone will be watching closely.

Jamie Smyth I suppose one of the risks with Oklo is, if they try to move too fast, they try to race ahead with their technology and they hit a wall, then it could impact the rest of the industry. And this nuclear renaissance that we’re beginning to see could be hurt by that. Safety is of key importance in the nuclear industry. If something goes wrong, you have seen it in the past, then the whole industry suffers.

Michela Tindera So to recap, this is a company with no customers and no contracts, and . . .

Jamie Smyth At the minute the company has generated zero revenue, yet it is currently one of the highest-valued pre-revenue companies listed in the US. And that makes people nervous.

……………………………..Jamie Smyth So the thing about Oklo is, because it’s based in Silicon Valley, it takes a very Big Tech approach to how it’s gonna operate, which is very different than other nuclear companies have worked in the past. You know, move fast and break things is the motto in Silicon Valley.

……………………………………………………………………………Jamie Smyth I think what investors probably want to see is they need to see delivery now. They need to see progress on a licence with the Nuclear Regulatory Commission. Oklo says they’re working towards that, but they also need to see some contracts which are going to bring in some revenue, and most importantly of all, they need to see that these reactors are going to work and that they’re going to work on a commercial basis. ………………….. https://www.ft.com/content/3e84e4d4-bf72-44f7-8fdd-0bdf36c806f6

Bpifrance helps UK nuclear reactor to financial close.

6 November 2025 By Jacob Atkins

French export credit agency Bpifrance is covering a £5bn loan from 13

commercial banks to help finance the construction of the Sizewell C nuclear

power station in England. The facility, structured as a green loan, sits

alongside a £36.5bn term loan from the UK’s National Wealth Fund, which

was announced earlier this year, as well as a £500mn working capital

facility. Bpifrance has secured refinancing from French public development

bank Sfil, according to a November 4 statement. BNP Paribas acted as joint

debt advisor to Sizewell C, with HSBC as French authorities and green loan

co-ordinator, and Santander as documentation co-ordinator on the Bpifrance

facility. The other lenders on the Bpifrance loan are ABN Amro, BBVA,

Crédit Agricole, CaixaBank, Citibank, Crédit Industriel et Commercial

(CIC), Lloyds Bank, Natwest, Natixis and Société Générale.

Global Trade Review 6th Nov 2025, https://www.gtreview.com/news/europe/bpifrance-helps-uk-nuclear-reactor-to-financial-close/

Canadian government happily splashing tax-payers’ money on wasteful things nuclear

Gordon Edwards, 6 Nov 2025

A comment on https://www.msn.com/en-ph/technology/general/the-smr-boom-will-soon-go-bust/ar-AA1PJi1U

This is your ultraconservative radical, Gordon, sounding a note of caution.

The fact that our utilities are publicly owned means that ordinary economic rules need not apply.

The military brings in little or no revenue but the government still funds it.

Gentilly-2 in Quebec was a loser always, and I told reporters to ask Hydro Quebec to give just one good economic reason why the G-2 reactor should not be shut down. No economic reason was forthcoming but the government of Quebec said “we want to maintain a minimal level of expertise in the nuclear field.”

So do not expect SMRs in Canada to be cancelled just because they are uneconomic.

Who cares? It’s not THEIR money they are spending, it’s OURS.

Trump’s Westinghouse Nuclear Fiasco: Wasting Money on a Corrupt Game of Hot Potato.

By now, it is evident that no one is buying Westinghouse’s reactors, so it must be up to the U.S. government to do it. But why?

That still means someone will have to pay the cost of $80 billion-112 billion, plus interest, for loans and/or investor returns, plus the costs of operating, fueling, decommissioning, and nuclear waste storage. Taxpayers will likely pay that cost, too.

On Tuesday, the White House announced an $80 billion deal with Westinghouse to finance construction of eight large new reactors in the U.S. There is not enough in the way of actual details about the deal, resulting in even more unanswered questions. But the promise of a large, direct investment in a pack of new reactors has predictably revved up talk of yet another “Nuclear Renaissance” and made it look like the DJT 2.0 administration is making good on big nuclear power goals from a group of executive orders issued in May.

$80 billion sure sounds like a lot! And the news that the announced $80 billion is going to come from Japanese taxpayers and not U.S. taxpayers sounds like a sweet deal!

If we were talking about just about any other energy source, it would be a lot. $80 billion could build:

- 58,000 megawatts of solar power, or

- 38,000 MW of wind power, or

- 48,000 MW of wind and solar combined, or

- 14,000 MW of geothermal power plants.

Any of those options would produce about the same amount of electricity each year as 14-16 large-sized nuclear reactors – twice as many as the Westinghouse deal promises to build.

But $80 billion is only enough to build, at most, four Westinghouse AP1000 reactors. That’s because the cost of building nuclear reactors is four to 10 times more than wind, solar, or geothermal power. Even wind and solar paired with battery storage are still several times cheaper than new nuclear reactors.

But where would the other $80+ billion for eight reactors come from? U.S. taxpayers? Ratepayers? In this case, probably taxpayers. The reactors would probably receive low-interest loans from the Department of Energy’s (DOE) loan guarantee program, and, following construction, they would be eligible to claim the Clean Energy Investment Tax Credit, which provides a 30-50% subsidy for the cost of a new energy project. That would mean $80 billion or more in loans up front, and, later, $48-80 billion in rebates from U.S. taxpayers.

That still means someone will have to pay the cost of $80 billion-112 billion, plus interest, for loans and/or investor returns, plus the costs of operating, fueling, decommissioning, and nuclear waste storage. Taxpayers will likely pay that cost, too. One of the projects that would probably be included in the deal is the proposed four-reactor Donald J. Trump Nuclear Power Plant (DJT NPP), which former Energy Secretary Rick Perry’s new company Fermi, Inc. has proposed. Fermi’s stock price surged on Tuesday after the Westinghouse deal was announced. The DJT NPP is to be built at the DOE’s Pantex nuclear weapons plant in Texas, to power AI data centers that Fermi also plans to build there. The reactors and data centers are likely to be categorized as “critical defense facilities”, per Executive Order 14299. Presumably, federal taxpayers would pay for the data centers and their power bills through DOE’s budget.

Another feature of the deal is a U.S. government profit-sharing and partial ownership in Westinghouse. The company’s Canadian owners – Brookfield Renewable Partners (BRP, an equity investment firm) and uranium company Cameco – would give the U.S. government a 20% share of Westinghouse profits, after the company earns its first $17.5 billion. Then, if Westinghouse’s corporate value reaches $30 billion, Brookfield and Cameco would have to take Westinghouse public on the stock market – and give the U.S. government at least 8.3% of the company’s stock.

This would benefit Brookfield and Cameco, but not U.S. taxpayers. Another Brookfield affiliate bought Westinghouse from Toshiba when it went bankrupt in 2017 due to soaring costs of building four AP1000 reactors for utilities in South Carolina and Georgia. The South Carolina reactors (V.C. Summer 2&3) were canceled, and the Georgia reactors (Vogtle 3&4) were completed in 2024, seven years late and $23 billion over budget. Brookfield Business Partners (BBP) was unable to sell Westinghouse after pulling it out of bankruptcy, but after countries started sanctioning Russia over its war on Ukraine, it looked like Westinghouse could replace Russia as the largest supplier of reactor fuel and services, so BBP sold the company to Brookfield Renewable Partners and Cameco.

Westinghouse’s value hasn’t exactly seen explosive growth, so it has been seeking deals to sell AP1000 reactors in Poland, Ukraine, Slovenia, the Czech Republic, and other countries, in partnership with the U.S. government, which has become increasingly convinced that it must retake global leadership in reactor construction from Russia and China. The Biden administration tried to convince states and utilities that all of the problems with Westinghouse’s AP1000 reactor had been resolved. But still, no state or utility has taken the plunge.

By now, it is evident that no one is buying Westinghouse’s reactors, so it must be up to the U.S. government to do it. But why? Japan’s offer to pitch in $80 billion will soften the blow to U.S. taxpayers. It may even be enough to build the four reactors Rick Perry wants to name after the president. But we would still end up paying the rest of the cost of too-expensive power and never-ending nuclear waste storage, from reactors that mostly will not be providing electricity to our homes and businesses, but to data centers to power AI. Westinghouse is being passed around like a hot potato and we’ll likely be on the hook when the music stops.

The SMR boom will soon go bust

by Ben Kritz, 3 Nov 25, https://www.msn.com/en-ph/technology/general/the-smr-boom-will-soon-go-bust/ar-AA1PJi1U

ONE sign that the excessively hyped concept of small modular reactors (SMRs) is now living on borrowed time is the lack of enthusiasm in the outlook from energy market analysts, whether they are individuals such as Leonard Hyman, William Tilles and Vaclav Smil, or big firms such as JP Morgan and Jones Lang LaSalle. None of them are optimistic that the sector will be productive before the middle of next decade, and the more critical ones are already predicting that it will never be, and that the “SMR bubble” will burst before the end of this one. My frequent readers will already know that I stand firmly with the latter view; basic market logic, in fact, makes any other view impossible.

In a recent commentary for Oil Price.com, one of the rather large number of online energy market news and analysis outlets, Hyman and Tilles predicted that the SMR bubble will burst in 2029. They based this on the reasonable observation that power supply forecasts are typically done on a three- to five-year timeframe. The fleet of SMRs that are currently expected to be in service between 2030 and 2035 simply will not be there, so energy planners will, at a minimum, omit them from the next planning window, and might decide to forget about them entirely. Deals will dry up, investors will dump their stocks or stop putting venture capital into SMR developers, and those developers will find themselves bankrupt.

That is an entirely plausible and perhaps even likely scenario, but the SMR bubble may burst much sooner than that, perhaps even as soon as next year, because of the existence of the other tech bubble, artificial intelligence, or AI, an acronym that in my mind sounds like “as if.” The topic of the AI bubble is an enormous can of worms, too complex to discuss right now, but the basic problem with it that is relevant to the SMR sector is that AI developers need a great deal of energy immediately. It has reached a point where AI-related data centers are described in terms of their energy requirements — in gigawatt increments — rather than their processing capacity. The availability of power determines whether or not a data center can be built; if the power is not already available, it must be within the relatively short time it will take to complete the data center’s construction.

Even if SMRs were readily available, their costs would discourage customers; AI developers are not too concerned with energy costs now, but they will be as their needs to start actually generating a profit become more acute. On a per-unit basis, SMRs are and are likely to always be more expensive than conventional, gigawatt-scale nuclear plants, and for that matter, most other power supply options. Hyman and Tilles estimate that on a per-unit cost basis (e.g., cost per megawatt-hour or gigawatt-hour), SMRs will be about 30 percent higher than the most efficient available gigawatt-scale large nuclear plants. Being smaller, SMRs would — hypothetically, as they do not actually exist yet — certainly cost less up front than large nuclear or conventionally fueled power plants, but their electricity would cost much more in the long run. That might not be an issue in some applications, but it certainly would if SMRs were intended to supply electricity to a national or regional grid.

Some analyses point out that some early adopters of SMRs, that is, customers who have put down money or otherwise promised to order one or more SMR units if and when they become available, may not be particularly price-sensitive; for example, military customers, governments taking responsibility for supplying electricity to remote areas, or some industrial customers. However, they would still be tripped up by the fragmented nature of the SMR sector, which was caused by the “tech bro” mindset of ignoring almost 70 years of experience in nuclear development and trying to reinvent the wheel.

JP Morgan’s 2025 energy report noted that there are only three SMRs in existence, with one additional one under construction; there is one in China, two in Russia, and the one not yet completed is in Argentina. All of them had construction timelines of three to four years, but took 12 years to complete; or in Argentina’s case, 12 years and counting. Argentina’s project has had cost overruns of 700 percent so far, while China and Russia’s projects were 300 percent and 400 percent over budget, respectively.

These are all essentially one-off, first-of-a-kind units, so some of these problems are to be expected, such as regulatory delays, design and manufacturing inefficiencies, and challenges from building supply chains from scratch. These problems would be resolved over time, except that there are literally hundreds of different SMR designs all competing for the same finite, niche-application market.

If the SMR developers listened to the engineers and policymakers who built up nuclear energy sectors that took advantage of economies of scale by standardizing a few designs and distributing the workload, they might get somewhere. That is not happening; potential customers, whether they have power cost concerns or not, are reluctant to jump in because it is not at all certain which SMRs will survive the competition. They might be willing to experiment to see if one design or another actually works — that is why the Chinese and Russian SMRs exist — but the fragmented SMR sector prevents them from trying more than one and making comparisons, at least not in a timely or financially rational manner.

I think the bubble begins to burst this coming year. The timeframe for construction to startup in most SMR pitches is four years. That’s entirely too optimistic, of course, but even if it is taken at face value, once we get a few months into 2026 without any tangible development happening, everyone will catch on that there won’t be any SMRs by 2030, and interest will turn elsewhere. It already is, among the data center sector, as was explained above.

UK’s nuclear waste problem lacks a coherent plan.

The [GDF] will comprise vaults and tunnels of a size that may be

approximate to Bermuda, but without the devilish tax evaders, coupled with

a 1 km square surface site that will periodically swallow up trainloads of

toxic radioactive waste. It would be unsurprising if Nuclear Waste

Services, the agency charged with finding and building the site, placed a

job advert for its own Hades to manage this dystopic underworld and if the

postholder engaged Cerberus to guard the entrance.

The plan comes with an enormous bill for taxpayers which will scare the ‘bejeebers’ out of taxpayers. Previously the Government’s new National Infrastructure and Service Transformation Authority (NISTA) had identified in its August 2025 report that the GDF facility may have a whole life cost estimated to range from £20 billion to £53 billion.

Now PAC members have had a further frightener placed on them because these headline figures were based on 2017/18 prices and they have found that, when adjusting to the present, the undersea radioactive monster might cost over £15 billion more. It would be far cheaper to hire Godzilla.

The Public Accounts Committee Chair Geoffrey Clifton-Brown has called on the Government to produce a ‘coherent plan’ to manage the UK’s stockpile of radioactive waste

NFLA 31st Oct 2025, https://www.nuclearpolicy.info/news/trick-not-treat-nuclear-dump-is-full-of-nasty-surprises-not-sweet-treats/

Who is paying for Britain’s nuclear revival?

Ultimately, the UK taxpayer is paying for both power stations……………..If Sizewell’s total costs rise above around £47 billion, private investors are not obliged to inject additional equity, leaving the taxpayer exposed to cost overruns.

15th October 2025 by Sol Woodroffe, https://www.if.org.uk/2025/10/15/who-is-paying-for-britains-nuclear-revival/

In this article, IF volunteer Sol Woodroffe, considers the intergenerational fairness of the government’s financing models for Hinkley Point C and Sizewell C.

Building a nuclear power station: an intergenerational decision

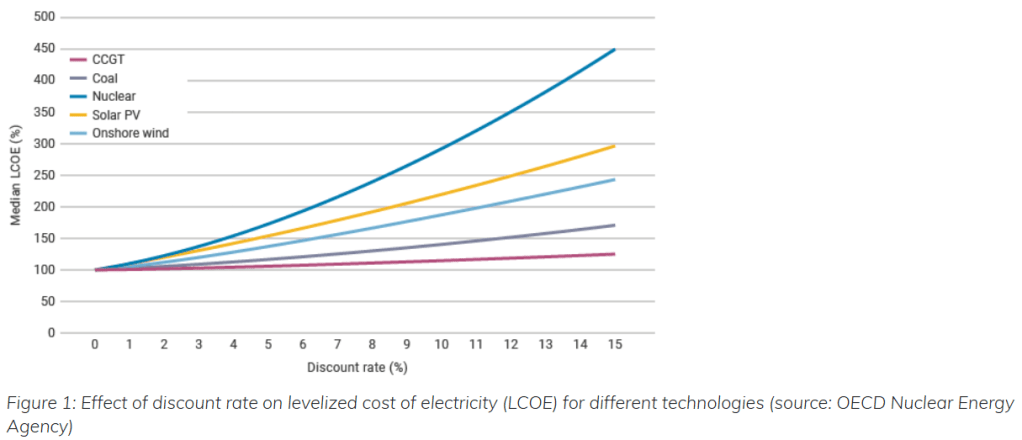

Building a nuclear reactor is very expensive. In fact, the financing costs are the most expensive part. According to the World Nuclear Association, capital costs for new nuclear power stations account for at least 60% of their Levelised Cost of Electricity (LCOE). The LCOE is the total cost to build and operate a power plant over its lifetime divided by the total electricity output dispatched from the plant over that period. This means that when we talk about the price of nuclear, we are really talking about the price of borrowing to cover the upfront costs.

Specifically, when determining whether a government should invest in nuclear power, the cost depends on how much the government values cheap electricity for future generations. The decision to build a nuclear power station is a truly intergenerational one. This graph from the World Nuclear Association highlights how different discount rates affect the value for money of nuclear energy compared with other energy sources:

This shows that the relative capital intensity of building a nuclear power station means that the more we discount future generations, the less worth it nuclear energy seems from today’s standpoint.

The discount rate the government chooses to use on public infrastructure projects is, to some extent, determined by interest rates. But it is also an ethical choice about how much the government cares about future generations. The lower the value placed on future generations, the higher the discount rate used, and so the more expensive nuclear energy seems.

On the face of it, the UK government’s decision to build two enormous nuclear reactors should be a source of optimism for young people. Nuclear energy is one of the safest and cleanest forms of energy. In many parts of the world, it is also one of the cheapest. Decarbonisation, energy security and industrial strategy are all part of the motivation for building these reactors. Many of the UK’s current reactors were built in the 70s and 80s and will retire by the early 2030s. Without new capacity, the UK will lose a major source of low carbon power. Arguably, it’s a sign of the UK government daring to invest for future generations. And yet, a closer look at the financing of the two reactors tells a different story…

What are Hinkley Point C and Sizewell C

Hinkley Point C is the first new UK nuclear station in a generation. It uses the European Pressurised Reactor (EPR) design and, when complete, will be one of the largest nuclear power stations in Europe. According to EDF Energy, each of its two reactors will produce enough electricity to supply roughly 7% of the UK’s electricity demand. Construction was authorised by Theresa May’s government in September 2016. The original target was to have it running by 2025, but EDF now forecasts first power no earlier than 2029–2031.

Sizewell C is a close imitation of Hinkley planned for the Suffolk coast. The UK government approved the development in July 2022 and committed public equity financing in November 2022. Because the Hinkley supply chain and licensing work already existed, ministers argued that a second EPR project would reduce design and regulatory costs. Sizewell C will have enough capacity to power around six million homes when operating.

What went wrong and why?

Both projects are running well behind their initial projected timelines, and both have run worryingly over budget. These two things are interrelated. Long construction periods push up financing costs. Again, the cost of finance here is all-important. Over a long construction period, during which there are no revenue streams from the project, the interest on funds borrowed can compound into very significant amounts (World Nuclear Association, 2023).

HPC’s original cost estimate was about £18 billion but now is projected to a whopping £31–£35 billion. Moreover, our research on the “nuclear premium” estimated the additional cost of power from Hinkley Point C for its 35-year initial contract period, compared to onshore wind and solar power, would be £31.2 billion and £39.9 billion respectively. Sizewell C’s projected cost has ballooned from an initial estimate of around £20 billion to £38 billion (in 2025 pricing), nearly doubling the original figure.

The cause of these cost overruns is clear. EDF has complained that the UK lacks the building infrastructure and productive capacity for such a massive project. This kind of capacity is built up over time and requires beginning with smaller projects and then gradually scaling up. To some extent, the government has acknowledged this mistake and so began to invest in the small modular reactor programme in the UK, but from the perspective of the taxpayer, it all seems too little too late.

Who is paying for these power station?

Ultimately, the UK taxpayer is paying for both power stations. But from an intergenerational fairness perspective, the key questions are which taxpayers and when. The government has an option to borrow and shield the current taxpaying generation from footing the bill, but rising UK borrowing costs and increasingly jittery bond markets mean this would come at a serious cost.

Hinkley Point: paid for by Gen Z and Gen Alpha

The financing model for each power station is very different. For Hinkley point, the government has agreed on a Contract for Difference. This means that private companies must cover the upfront costs, with the knowledge that they receive a guaranteed price for their energy when the costs are finished.

EDF, the French national energy company, and CGN, the Chinese national energy company, shouldered much of the initial capital cost. In return, the government guarantees a price of £92.50/MWh (in 2012 £) for 35 years of output.

There were serious advantages to this model from a public financing perspective. The main advantage was that the investors took on the construction-cost risk: the UK taxpayer has arguably not been punished because Hinkley Point’s financial costs have so enormously overrun.

Nonetheless, this model ultimately kicks the financial burden down the road. Ultimately, today’s Gen-Z and Gen Alpha will be made to pay for this deal.

This is because the guaranteed price will likely be a rip-off. The average price of energy today in terms of 2012 pounds is £50–55/MWh. The falling price of clean energy alternatives means that we should expect the real price of energy to fall over the next few decades. Therefore, it seems highly likely that the fixed price will be a seriously uncompetitive rate for future UK consumers.

Sizewell C: a fairer distribution of costs

The financing of Sizewell distributes the financing costs more fairly between generations. To pay for the reactor, the government switched to a Regulated Asset Base (RAB) model. This means that consumers begin contributing to the project’s financing through small charges on their energy bills while the plant is still under construction, rather than waiting until it generates electricity. The model provides investors with a regulated return during construction, reducing their exposure to financing risk.

The RAB model allows investors to share construction and operational risks with consumers, which in theory lowers the cost of capital. Since capital costs make up the majority of nuclear project expenses, this could make Sizewell C substantially cheaper overall, if delivered as planned.

The key drawback is that taxpayers and consumers shoulder significant risk. If total costs rise above around £47 billion, private investors are not obliged to inject additional equity, leaving the taxpayer exposed to cost overruns.

From an intergenerational fairness perspective, the financing model is somewhat fairer as it smooths the cost of construction between generations. Nonetheless, the future taxpayers are the ones most exposed to the risk of cost overruns.

The cost of decommissioning

Historically, the cost of decommissioning nuclear power stations has been gravely underestimated in the UK. Decommissioning costs will be faced by generations well into the future, and so whether the state considers them massively depends on the chosen discount rate. Ultimately, the more the government values future consumers, the more seriously they must take these massive costs.

Sizewell and Hinkley both have operating lives of 60 years. However, with Sizewell, future taxpayers are exposed to the risk of ballooning decommissioning costs, whereas with Hinkley the operator must fully cover these costs.

Think of the children

When these large public infrastructure projects are discussed, the focus is often on whether government has negotiated value for money for UK taxpayers. But if the government wants to claim nuclear is a forward-looking investment, it must prove future generations won’t be the ones footing the bill.

“It is unacceptable that the EDF tariff reform is being adopted quietly, to the detriment of the users”

With electricity bills reaching record highs and 7 million people facing

energy poverty, it’s time to acknowledge the failure of a model. Twenty

years of brutal energy sector liberalization have failed to bring about

either lower prices or the investment promised by private operators in

exchange for regulated access to historical nuclear electricity (ARENH).

Created in 2011 to allow alternative suppliers to purchase EDF’s nuclear

production at a fixed and highly advantageous price, this mechanism was

supposed to generate sustainably competitive offers. On the contrary, it

has led to instability, private rent-seeking, industrial fragmentation, and

debt for EDF.

Le Monde 29th Oct 2025,

https://www.lemonde.fr/idees/article/2025/10/29/il-est-inacceptable-que-la-reforme-des-tarifs-d-edf-soit-adoptee-discretement-au-detriment-des-usagers_6650111_3232.html

-

Archives

- February 2026 (115)

- January 2026 (308)

- December 2025 (358)

- November 2025 (359)

- October 2025 (376)

- September 2025 (258)

- August 2025 (319)

- July 2025 (230)

- June 2025 (348)

- May 2025 (261)

- April 2025 (305)

- March 2025 (319)

-

Categories

- 1

- 1 NUCLEAR ISSUES

- business and costs

- climate change

- culture and arts

- ENERGY

- environment

- health

- history

- indigenous issues

- Legal

- marketing of nuclear

- media

- opposition to nuclear

- PERSONAL STORIES

- politics

- politics international

- Religion and ethics

- safety

- secrets,lies and civil liberties

- spinbuster

- technology

- Uranium

- wastes

- weapons and war

- Women

- 2 WORLD

- ACTION

- AFRICA

- Atrocities

- AUSTRALIA

- Christina's notes

- Christina's themes

- culture and arts

- Events

- Fuk 2022

- Fuk 2023

- Fukushima 2017

- Fukushima 2018

- fukushima 2019

- Fukushima 2020

- Fukushima 2021

- general

- global warming

- Humour (God we need it)

- Nuclear

- RARE EARTHS

- Reference

- resources – print

- Resources -audiovicual

- Weekly Newsletter

- World

- World Nuclear

- YouTube

-

RSS

Entries RSS

Comments RSS