US to Own Nuclear Reactors Stemming From Japan’s $550 Billion Pledge.

The US government plans to buy and own as many as 10 new, large nuclear reactors that could be paid for using Japan’s $550 billion funding

pledge, part of a push to meet surging demand for electricity. The new

details of the unusual arrangement were outlined Wednesday by Carl Coe, the Energy Department’s chief of staff, about the non-binding commitment made by Japan in October to fund $550 billion in US projects, including as much as $80 billion for the construction of new reactors made by Westinghouse Electric Co.

Bloomberg 19th Nov 2025,

https://www.bloomberg.com/news/articles/2025-11-19/us-to-own-reactors-stemming-from-japan-s-550-billion-pledge

Energy Department loans $1B to help finance the restart of nuclear reactor on Three Mile Island.

The U.S. Department of Energy said Tuesday that it will loan $1 billion to

help finance the restart of the nuclear power plant on Pennsylvania’s

Three Mile Island that is under contract to supply power to data centers

for tech giant Microsoft. The loan is in line with the priorities of

President Donald Trump’s administration, including bolstering nuclear power

and artificial intelligence.For Constellation Energy, which owns Three Mile

Island’s lone functioning nuclear power reactor, the federal loan will

lower its financing cost to get the mothballed plant up and running again.

The 835-megawatt reactor can power the equivalent of approximately 800,000

homes, the Department of Energy said.

Daily Mail 18th Nov 2025, https://www.dailymail.co.uk/wires/ap/article-15304171/Energy-Department-loans-1B-help-finance-restart-nuclear-reactor-Three-Mile-Island.html

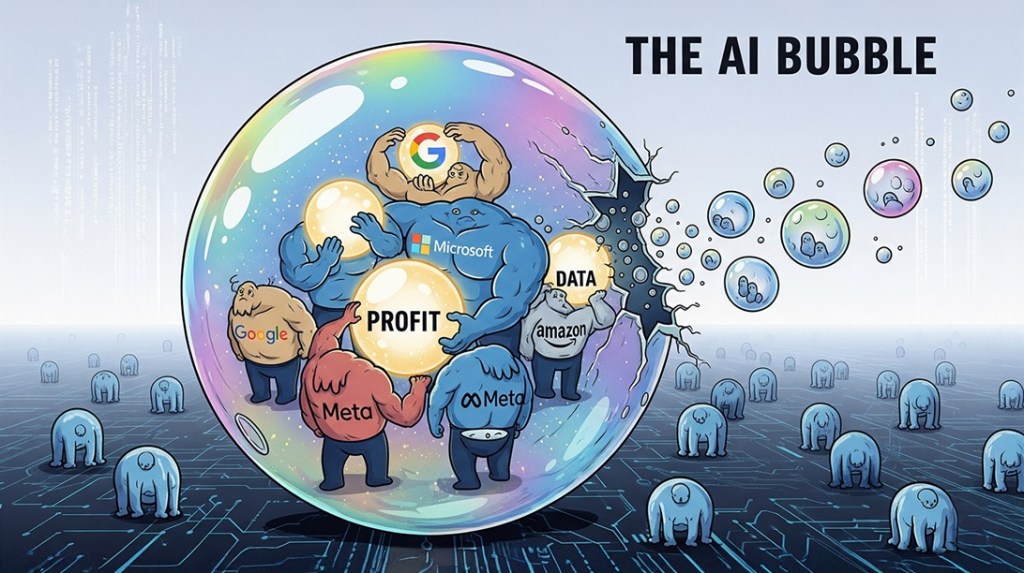

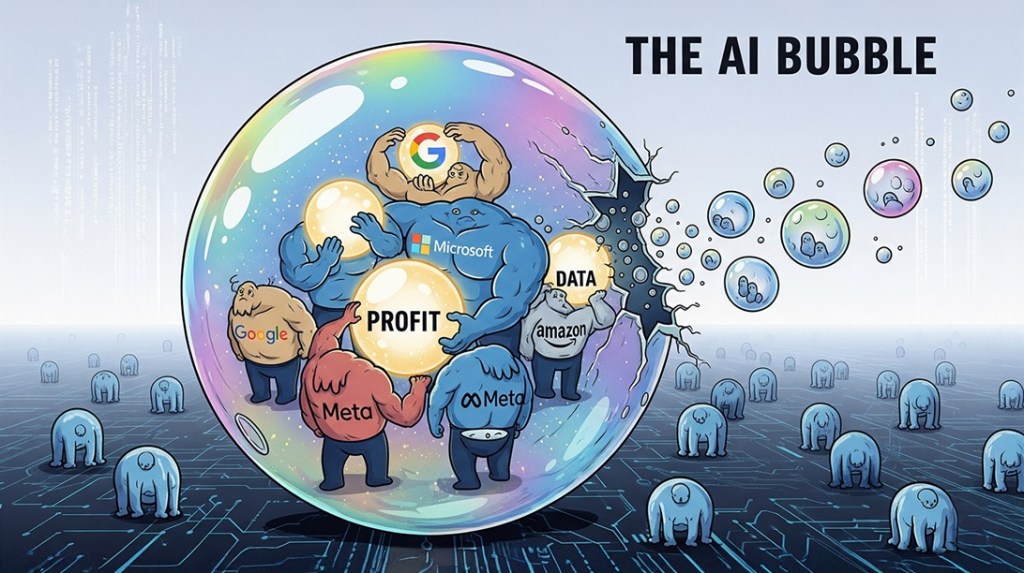

Google Boss Says Trillion-Dollar AI Investment Boom Has ‘Elements of Irrationality’

November 18, 2025, BBC, Faisal Islam, economics editor and Rachel Clun, business reporter

Every company would be affected if the AI bubble were to burst, the head of Google’s parent firm Alphabet has told the BBC.

Speaking exclusively to BBC News, Sundar Pichai said while the growth of artificial intelligence (AI) investment had been an “extraordinary moment”, there was some “irrationality” in the current AI boom.

It comes amid fears in Silicon Valley and beyond of a bubble as the value of AI tech companies has soared in recent months and companies spend big on the burgeoning industry.

Asked whether Google would be immune to the impact of the AI bubble bursting, Mr Pichai said the tech giant could weather that potential storm, but also issued a warning.

“I think no company is going to be immune, including us,” he said…………..

The interview comes as scrutiny on the state of the AI market has never been more intense.

Alphabet shares have doubled in value in seven months to $3.5tn (£2.7tn) as markets have grown more confident in the search giant’s ability to fend off the threat from ChatGPT owner OpenAI.

A particular focus is Alphabet’s development of specialised superchips for AI that compete with Nvidia, run by Jensen Huang, which recently reached a world first $5tn valuation.

As valuations rise, some analysts have expressed scepticism about a complicated web of $1.4tn of deals being done around OpenAI, which is expected to have revenues this year of less than one thousandth of the planned investment.

It has raised fears stock markets are heading for a repeat of the dotcom boom and bust of the late 1990s. This saw the values of early internet companies surge amid a wave of optimism for what was then a new technology, before the bubble burst in early 2000 and many share prices collapsed.

This led to some companies going bust, resulting in job losses. A drop in share prices can also hit the value of people’s savings including their pension funds.

In comments echoing those made by US Federal Reserve chairman Alan Greenspan in 1996, warning of “irrational exuberance” in the market well ahead of the dotcom crash, Mr Pichai said the industry can “overshoot” in investment cycles like this………………….https://www.bbc.com/news/articles/cwy7vrd8k4eo

A New Gold(en) Mine for Arms Contractors

Golden Dome seems like a marketing concept designed to enrich arms contractors and burnish Trump’s image rather than a carefully thought-out defense program.

William D. Hartung and Ashley Gate, November 16, 2025

“…………………………………………………………….as TomDispatch regulars Bill Hartung and Ashley Gate point out today, Trump has long been wildly in favor of building a “Golden Dome” nuclear defense system that would prove a remarkable (and remarkably costly) boon for the corporations of what still passes as the “defense” industry, even if it would do nothing whatsoever for the rest of us. Let them fill you in on that nightmare project of our moment and the president who seems intent on recreating a nuclear arms race globally on a planet that already has enough problems to deal with. What a nightmare! Tom

Doomed, Not Domed? The Wrath of the Con Man

By Ashley Gate and William D. Hartung

Kathryn Bigelow’s new nuclear thriller, A House of Dynamite, has been criticized by some experts for being unrealistic, most notably because it portrays an unlikely scenario in which an adversary chooses to attack the United States with just a single nuclear-armed missile. Such a move would, of course, leave the vast American nuclear arsenal largely intact and so invite a devastating response that would undoubtedly largely destroy the attacker’s nation. But the film is strikingly on target when it comes to one thing: its portrayal of the way one U.S. missile interceptor after another misses its target, despite the confidence of most American war planners that they would be able to destroy any incoming nuclear warhead and save the day.

At one point in the film, a junior official points out that U.S. interceptors have failed almost half their tests, and the secretary of defense responds by bellowing: “That’s what $50 billion buys us?”

In fact, the situation is far worse than that. We taxpayers, whether we know it or not, are betting on a house of dynamite, gambling on the idea that technology will save us in the event of a nuclear attack. The United States has, in fact, spent more than $350 billion on missile defenses since, more than four decades ago, President Ronald Reagan promised to create a leak-proof defense against incoming intercontinental ballistic missiles (ICBMs). Believe it or not, the Pentagon has yet to even conduct a realistic test of the system, which would involve attempting to intercept hundreds of warheads traveling at 1,500 miles per hour, surrounded by realistic decoys that would make it hard to even know which objects to target.

Laura Grego of the Union of Concerned Scientists has pointed out that the dream of a perfect missile defense — the very thing Donald Trump has promised that his cherished new “Golden Dome” system will be — is a “fantasy” of the first order, and that “missile defenses are not a useful or long-term strategy for defending the United States from nuclear weapons.”

Grego is hardly alone in her assessment. A March 2025 report by the American Physical Society found that “creating a reliable and effective defense against even [a] small number of relatively unsophisticated nuclear-armed ICBMs remains a daunting challenge.” Its report also notes that “few of the main challenges involved in developing and deploying a reliable and effective missile defense have been solved, and… many of the hard problems we identified are likely to remain so during and probably beyond” the 15-year time horizon envisioned in their study.

Despite the evidence that it will do next to nothing to defend us, President Trump remains all in on the Golden Dome project. Perhaps what he really has in mind, however, has little to do with actually defending us. So far, Golden Dome seems like a marketing concept designed to enrich arms contractors and burnish Trump’s image rather than a carefully thought-out defense program.

Contrary to both logic and history, Trump has claimed that his supposedly leak-proof system can be produced in a mere three years for $175 billion. While that’s a serious chunk of change, analysts in the field suggest that the cost is likely to be astronomically higher and that the president’s proposed timeline is, politely put, wildly optimistic. Todd Harrison, a respected Pentagon budget analyst currently based at the conservative American Enterprise Institute, estimates that such a system would cost somewhere between $252 billion and $3.6 trillion over 20 years, depending on its design. Harrison’s high-end estimate is more than 20 times the off-hand price tossed out by President Trump.

As for the president’s proposed timeline of three years, it’s wildly out of line with the Pentagon’s experience with other major systems it’s developed. More than three decades after it was proposed as a possible next-generation fighter jet (under the moniker Joint Strike Fighter, or JSF), for example, the F-35, once touted as a “revolution in military procurement,” is still plagued by hundreds of defects, and the planes spend almost half their time in hangars for repair and maintenance.

Proponents of the Golden Dome project argue that it’s now feasible because of new technologies being developed in Silicon Valley, from artificial intelligence to quantum computing. Those claims are, of course, unproven, and past experience suggests that there is no miracle technological solution to complex security threats. AI-driven weapons may be quicker to locate and destroy targets and capable of coordinating complex responses like swarms of drones. But there is no evidence that AI can help solve the problem of blocking hundreds of fast-flying warheads embedded in a cloud of decoys. Worse yet, a missile defense system needs to work perfectly each and every time if it is to provide leak-proof protection against a nuclear catastrophe, an inconceivable standard in the real world of weaponry and defensive systems.

Of course, the weapons contractors salivating at the prospect of a monstrous payday tied to the development of Golden Dome are well aware that the president’s timeline will be quite literally unmeetable. Lockheed Martin has optimistically suggested that it should be able to perform the first test of a space-based interceptor in 2028, three years from now. And such space-based interceptors have been suggested as a central element of the Golden Dome system. In other words, Trump’s pledge to fund contractors to build a viable Golden Dome system in three years is PR or perhaps PF (presidential fantasy), not realistic planning.

Who Will Benefit from the Golden Dome?

The major contractors for Golden Dome may not be revealed for a few months, but we already know enough to be able to take an educated guess about which companies are likely to play central roles in the program………………………………………………………………………………………………………………………………………………………………

Should the Golden Dome system indeed be launched (at a staggering cost to the American taxpayer), its “gold” would further enrich already well-heeled weapons contractors, give us a false sense of security, and let Donald Trump pose as this country’s greatest defender ever. Sadly, fantasies die hard, so job number one in rolling back the Golden Dome boondoggle is simply making it clear that no missile defense system will protect us in the event of a nuclear attack, a point made well by A House of Dynamite. The question is: Can our policymakers be as realistic in their assessment of missile defense as the makers of a major Hollywood movie? Or is that simply too much to ask? https://tomdispatch.com/doomed-not-domed/

Nuclear levy will increase UK energy bills from December

SMEs need to factor in a boost in their energy costs as the nuclear levy – a mandatory charge for both homes and businesses – is brought in by the Government.

.From next month, all energy bills will include the “nuclear levy”, a charge used by the Government to fund nuclear infrastructure. It is expected to add up to around £100 a year for small businesses, but this will vary with their energy usage.

Start-Ups 19th Nov 2025, https://startups.co.uk/news/nuclear-levy/

Nuclear Stocks Crash, With A Potential Payoff Still Years Away

Oil Price, By Alex Kimani – Nov 17, 2025

- Uranium prices have surged amid a structural supply deficit and a global policy-driven nuclear revival, but the sector faces long project timelines and mounting volatility.

- Despite major investment pledges like the U.S.–Canada $80 billion reactor partnership, nuclear and uranium stocks have plunged 15–45% in recent weeks.

- Investors confront the industry’s slow path to revenue.

‘…………………………………………… the harsh reality of the long lead and construction times of nuclear facilities, coupled with the fact that some stocks in the space with zero revenues are in nosebleed territory, has sent the sector into a tailspin. Nuclear and uranium stocks have pulled back sharply from recent highs, with many seeing double-digit losses: the sector’s popular benchmark, VanEck Uranium and Nuclear ETF (NYSEARCA:NLR) has declined -16.6% over the past 30 days, at a time when the S&P 500 has gained nearly 3%……………………………….

The market appears to be waking up to the reality that it could be up to a decade before we start to reap the benefits from the billions of dollars flowing into the sector. Whereas $80 billion can build enough reactors to power Virginia’s Data Center Alley, traditional reactors typically take 10 years or more to build. Meanwhile, the frequently touted small, modular reactors (SMRs) by the likes of NuScale Power, TerraPower and X-energy are still far from going mainstream primarily because the technology is still in early development and faces significant economic and regulatory hurdles.

While some prototype units are operational in countries like Russia and China, most designs are still in the theoretical or early construction phases………………………

Amazon has invested in X-energy with the goal of deploying up to 5 GW of SMRs by 2039.

Only Oklo Inc., Kairos Power and TerraPower have begun construction of their SMR plants; however, none have proven they can produce power at a commercial scale nor received regulatory approval to build a commercial system.

“There’s a lot going on, and nothing is going on,” BloombergNEF’s head nuclear analyst Chris Gadomski recently quipped.

To exacerbate matters, the markets have bid up these companies to absurd valuations despite many having no revenues to show for their troubles. To wit, Oklo’s market cap has at times exceeded $20 billion, despite the company having no operating reactors, no licenses to operate commercially, and no binding contracts to supply power. Wall Street analysts currently project Oklo will not generate significant revenue until late 2027 or 2028. Oklo’s current market cap is $15.3 billion…………………… https://oilprice.com/Alternative-Energy/Nuclear-Power/Nuclear-Stocks-Crash-With-A-Potential-Payoff-Still-Years-Away.html

Geoffrey Hinton: They’re spending $420 billion on AI. It pays off only if they fire you.

So the business case for AI isn’t “AI will help workers be more productive.” It’s “AI will replace workers entirely, and we’ll pocket the salary savings.”

Tasmia Sharmin, Nov 2, 2025, Published in Predict.

Let me translate what Geoffrey Hinton just said, because it’s important and most people are going to miss it.

Geoffrey Hinton literally invented the neural networks that power modern AI. He won a Nobel Prize for it. And this week, he went on Bloomberg TV and said something that tech CEOs have been dancing around for months:

Tech companies cannot profit from their AI investments without replacing human workers.

Not “might replace.” Not “could eventually replace.” Cannot profit without replacing.

That’s not a prediction. That’s him explaining the business model.

What He’s Actually Saying

Here’s Hinton’s point in plain English:

Tech giants are spending $420 billion next year on AI infrastructure. Microsoft, Meta, Google, Amazon. They’re building data centers, buying AI chips, training massive models.

That money only makes sense if AI replaces workers.

Think about it. If you spend $100 billion building AI systems, how do you make that money back?

You can’t just sell slightly better products. You need massive cost savings. And the biggest cost in any company is labor.

So the business case for AI isn’t “AI will help workers be more productive.” It’s “AI will replace workers entirely, and we’ll pocket the salary savings.”

Hinton is saying what everyone in Silicon Valley knows but won’t say publicly: the whole AI investment thesis depends on job elimination.

Why This Matters

When Amazon CEO Andy Jassy says the 14,000 layoffs are about “culture, ” Hinton is calling bullshit.

When tech companies say AI will “augment” human workers, Hinton is calling bullshit.

When they claim AI will create as many jobs as it destroys, Hinton, who literally invented this technology, is saying: I don’t believe that.

He told Bloomberg: “I believe that to make money you’re going to have to replace human labor.”

Not augment. Replace.

This is the guy who understands AI better than almost anyone on the planet. And he’s warning us that the tech industry’s entire AI strategy is built on eliminating jobs.

The Numbers Back Him Up

Since ChatGPT launched in November 2022, job openings have dropped 30%.

During that same time, the stock market went up 70%. So companies are doing great. Investors are happy. But jobs are disappearing.

Stanford research found that young workers (22–25) in AI-exposed fields saw employment drop 13% to 16%. Meanwhile, older workers in the same fields actually saw job growth.

What does that tell you?

Companies are replacing entry-level workers with AI while keeping experienced people for now.

The pattern is clear: AI isn’t creating a bunch of new jobs. It’s eliminating the bottom rungs of the career ladder.

What Hinton Sees That Others Won’t Say

Previous technological revolutions created jobs while destroying others. Cars eliminated horse-related jobs but created automotive manufacturing, gas stations, road construction, and suburbs.

Hinton thinks AI is different. He’s skeptical that AI will follow that historical pattern.

Why?

Because AI doesn’t just replace one type of job. It can potentially replace cognitive work across entire industries. Writing, analysis, coding, design, customer service, data entry, research, translation.

When factories automated, displaced workers could move to other sectors. When AI automates cognitive work, where do knowledge workers go?

Hinton doesn’t have an answer. Nobody does. And that’s what scares him.

The $420 Billion Question

Tech companies are projected to spend $420 billion on AI next year. OpenAI alone announced $1 trillion in infrastructure deals.

That is an insane amount of money.

The only way to justify spending that much is if you’re confident the returns will be massive . And the only way to get massive returns is through massive labor cost reduction.

Hinton is basically saying: look at the math. These companies aren’t investing hundreds of billions to make workers 10% more productive. They’re investing to eliminate positions entirely.

When a Bloomberg interviewer asked if AI investments could generate returns without job cuts, Hinton said he believes they can’t.

Think about what that means. The person who pioneered AI technology is telling you the business model requires job elimination. And companies are investing as if he’s right.

Why Amazon’s “Culture” Excuse is Bullshit

This week, Amazon fired 14,000 people. CEO Andy Jassy said it’s about culture and organizational layers, not AI.

But back in June, Jassy wrote a memo saying Amazon would need “fewer people doing some of the jobs that are being done today” because of AI efficiency gains.

So which is it, Andy?

Hinton is cutting through the corporate speak.

He’s saying: of course it’s about AI. The entire industry is betting on AI replacing workers. Stop pretending otherwise.

Amazon is just the first major wave. More are coming.

The Healthcare and Education Exception

Hinton isn’t totally pessimistic. He admits AI will have benefits in healthcare and education.

AI can help doctors diagnose diseases, analyze medical images, personalize treatment. It can help students learn at their own pace, provide tutoring, make education more accessible.

But even there, it’s not all upside.

Better diagnostic AI means you need fewer radiologists. Better educational AI means you need fewer tutors and teaching assistants.

The benefits are real. But so is the job displacement.

The Real Problem Hinton Identifies

Here’s the most important thing Hinton said, and most people will miss it:

The problem isn’t AI itself. It’s how we organize society.

Right now, we live in a system where most people need jobs to survive. Income comes from employment. No job means no money, no healthcare, no security.

So when AI eliminates jobs, that’s catastrophic for individuals even if it’s profitable for companies.

Hinton is pointing out that our entire social structure assumes full employment. When that assumption breaks, the system breaks.

Unless we restructure how society works, how wealth is distributed, and how people access resources, AI-driven job displacement creates a crisis.

What Makes This Warning Different

Lots of people warn about AI and jobs. But most of them are outside the industry, or they’re critics, or they’re trying to sell you something.

Hinton is different. He’s not some Luddite afraid of technology. He invented this technology. He won a Nobel Prize for work that made modern AI possible.

And he quit Google specifically so he could speak freely about AI risks without it reflecting on his employer.

When the person who created the technology warns you about its consequences, you should probably listen.

The Uncomfortable Truth

Here’s what Hinton is really saying, stripped of all politeness:

Tech companies are spending hundreds of billions on AI. That investment only pays off if they fire massive numbers of workers and pocket the salary savings. They know this. Their business plans depend on it.

Everything else, all the talk about augmentation and productivity and creating new jobs, is PR.

The actual business model is: build AI, replace workers, increase profits.

And unless society fundamentally changes how it works, this is going to devastate a lot of people while making shareholders very rich.

My Take

I think Hinton is right, and it’s terrifying that he’s right.

The math is simple. Companies are investing too much money in AI for the returns to come from anything other than large-scale job replacement. The spending only makes sense if the plan is to eliminate positions.

And they’re not going to admit that’s the plan until it’s already happening.

We’ll keep hearing about culture changes and organizational efficiency and digital transformation. But the reality is what Hinton described: companies betting on AI to replace human labor because that’s where the money is.

The scary part isn’t that one guy thinks this. The scary part is that he invented the technology, understands it better than almost anyone, and he’s warning us that the people building AI are building it specifically to replace jobs.

We should probably pay attention!!!

Do you think Hinton is right? Can tech companies make back their AI investments without massive job cuts? Or is he just stating the obvious that everyone else is too polite to say?

Because if he’s right, and I think he is, we’re not preparing for what’s coming. We’re still pretending this is about productivity tools and augmentation while companies are quietly planning for something much more disruptive.

Health Care Workers Spoke Out for Their Peers in Gaza. Then Came Backlash.

Medical institutions are silencing their staff and impeding efforts to build solidarity with medical workers in Gaza.

By Marianne Dhenin , Truthout, November 17, 2025

handra Hassan, an associate professor of surgery at the University of Illinois Chicago (UIC) College of Medicine, spent three weeks in Gaza in January 2024, treating patients who had survived tank shelling, drone strikes, and sniper fire amid Israel’s ongoing genocide. When Nasser Hospital in Khan Younis came under siege, Hassan and the MedGlobal doctors he was serving with were forced to flee. “We were evacuated when they bombed just across the street from the hospital [and] tanks were rolling in,” Hassan told Truth

When Hassan returned home to Chicago, he was eager to share his experiences and advocate for an end to Israel’s assault on Gaza, which has killed an estimated 68,000 Palestinians since October 2023. Among the dead are over 1,500 health care workers, including doctors and nurses Hassan worked alongside.

But instead of being welcomed like he had been after previous missions to conflict zones in Ukraine and Syria, Hassan soon found himself on the receiving end of a doxxing and harassment campaign. StopAntisemitism, a pro-Israel group that doxxes people it accuses of antisemitism, shared screenshots of some of Hassan’s LinkedIn posts to its X account. Hassan said his employer received around 1,500 emailed complaints the day StopAntisemitism posted his information.

“I was speaking up for the human rights of Palestinians [because] it’s like, you’re witnessing another genocide, you need to talk about it,” Hassan told Truthout. But StopAntisemitism “put my picture, and they wrote that I’m [an] antisemite.”

Hassan is one of more than 15 health care workers in eight states who told Truthout they faced silencing, harassment, or workplace retaliation for Palestine-related speech, including giving a talk on health issues in Palestine, endorsing statements condemning the killing of health care workers in Gaza, or wearing a keffiyeh or other symbols of Palestine solidarity at work. Many said they felt that their hospitals, clinics, or professional societies had become increasingly hostile working environments since October 2023.

The experiences that health care workers shared suggest that organized campaigns of complaints and harassment from pro-Israel groups against health care workers have intensified, and that anti-Palestinian racism is entrenched across health care institutions nationwide. In a 2024 survey, the Institute for the Understanding of Anti-Palestinian Racism (IUAPR) also found widespread anti-Palestinian racism in health care: More than half of the 387 health care provider respondents “reported experiencing silencing, exclusion, harassment, physical threat or harm, or defamation while advocating for Gaza and/or Palestinian human rights.” Half said they were “afraid to speak out.”

Many of those who spoke to Truthout shared that fear and expressed concerns for their patients and profession: “The reality on the ground is that racism is running unchecked throughout our medical institutions, and as a result, health care workers don’t have the training they need, accountability is not happening at the level of the medical institutions, and our communities are not being served,” Asfia Qaadir, a psychiatrist specialized in trauma-informed care for BIPOC youth, told Truthout. “Racism is about erasure, and ultimately, our patients are paying the price.”

A Pattern of Censorship……………………………..

OpenAI Oligarch Pre-Emptively Demands Government Bailout When AI Bubble Bursts.

Benjamin Bartee, Nov 15, 2025, https://www.sott.net/article/503004-OpenAI-oligarch-Altman-pre-emptively-demands-government-bailout-when-AI-bubble-finally-bursts

AI hype may soon meet fiscal reality — and, if history is any guide, the American taxpayer will be left raped, holding the bag, while the perpetrators of the bubble will face no real consequences whatsoever.

On the contrary, they’ll be rewarded for their recklessness — the classic “moral hazard.”

Via DW (emphasis added):

“Signs of a hangover are getting harder to ignore. AI usage by corporations is slipping, spending is tightening and the machine learning hype has massively outpaced the profits.

Many economists think usage concerns, barely three years into AI going mainstream, dropkick the prevailing narrative that AI would revolutionize how businesses operate by streamlining repetitive tasks and improving forecasting.

“The vast bet on AI infrastructure assumes surging usage, yet multiple US surveys show adoption has actually declined since the summer,” Carl-Benedikt Frey, professor of AI & work at the UK’s University of Oxford, told DW. “Unless new, durable use cases emerge quickly, something will give — and the bubble could burst.”…

As the gap widens between sky-high expectations and commercial reality, investor enthusiasm for AI is starting to fade.

n the third quarter of the year, venture-capital deals with private AI firms dropped by 22% quarter on quarter to 1,295, although funding levels remained above $45 billion for the fourth consecutive quarter, market intelligence firm CB Insights wrote last month.

“What perturbs me is the scale of the money being invested compared to the amount of revenue flowing from AI,” economist Stuart Mills, a senior fellow at the London School of Economics, told DW.”

In his characteristically weasely manner, in which coming out and saying anything straightforwardly is too toxically masculine or whatever, OpenAI’s Sam Altman, currently being sued by his sister for allegedly molesting her for the better part of a decade, has issued a pre-emptive demand that the government come to his company’s rescue when the financial speculation bonanza bubble around AI inevitably bursts.

“When something gets sufficiently huge, whether or not they are on paper, the federal government is kind of the insurer of last resort…So, I guess, given the magnitude of what I expect AI economic impact to look like, sort of, I do think the government ends up as, like, the insurer of last resort.”

“Like, totally! I’m just, like, sort of, a Valley Girl [upward vocal inflection] in a Valley world! Where’s, like, the cash, Sugar Daddy Warbucks?”

(Let’s not forget that OpenAI was founded as a “nonprofit” philanthropic organization that quietly morphed into a “public benefit corporation” before making Sam Altman a billionaire, much in the same way that Google quietly nixed its “Don’t Be Evil” slogan in the dead of night, like a scene out of Animal Farm, and now commits its evil in broad daylight because it knows no force on Earth is going to restrain it.)

Comment: Altman is a weasel, to be sure, and with AI heading for a cliff, he wants to be able to bail before it goes over:

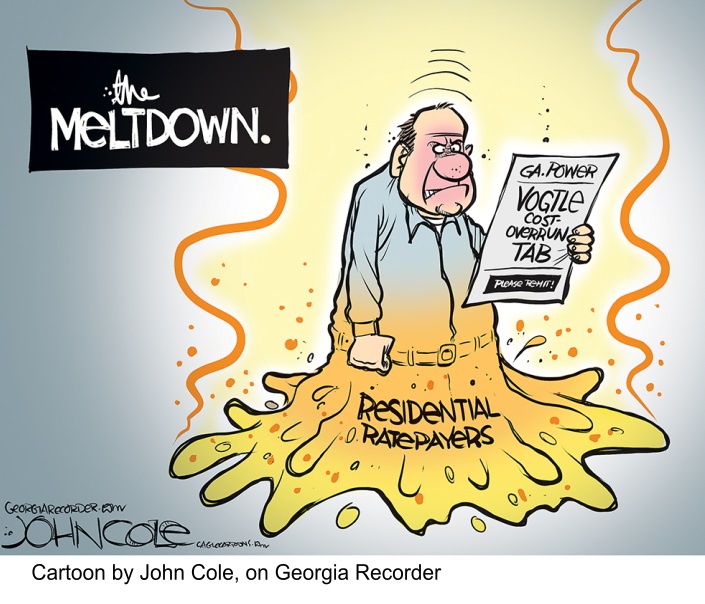

Finally Some Accountability for Georgia’s Costly Nuclear Power Mistake

Vogtle stands as the only new nuclear reactor built in the last 30 years, and its fallout offers a bleak prognosis for any supposed “renaissance” and its supporters in statehouses across the country. We can look back to 2017 when the main contractor, Westinghouse, filed for bankruptcy due to the extreme cost overruns at Vogtle. At that critical moment, the Georgia PSC ignored its own staff, energy experts, and public outcry, choosing to burden ratepayers with the project’s continuation.

By Kim Scott.15 Nov 25 https://nuclearcosts.org/finally-some-accountability-for-georgias-costly-nuclear-power-mistake/

The story of Plant Vogtle’s two new nuclear reactors in Georgia is not a triumph of a “nuclear renaissance”; it’s a cautionary tale written in soaring electric bills and a growing political fallout. The people of Georgia are paying the price, literally, as their utility bills have skyrocketed by over 40% – and now, following last Tuesday’s Public Service Commission election in Georgia, it seems those that allowed this to happen in the first place are starting to feel the pinch as well. It’s about damn time!

Georgia voters delivered a stunning message by unseating two Republican utility commissioners, Tim Echols and Fitz Johnson, who rubber stamped and championed the costly mistakes leading to a 41% increase in Georgians’ electric bills. This election, which saw Democrats Alicia Johnson and Peter Hubbard championing fair rates, affordability and renewable energy, was a clear referendum on Plant Vogtle’s enormous price tag and more importantly, nuclear power as a not so clean future power resource both here in Georgia and elsewhere.

The stunning defeat of utility backed incumbents sends a powerful signal to utility regulators nationwide that consumers will not tolerate being forced to pay for multi-billion-dollar nuclear boondoggles. If they aren’t paying attention, Wall Street sure is, downgrading Southern Co.’s stock immediately following the election, citing the increased risk and the new difficulty the company will face in pushing through further rate hikes to pay for Plant Vogtle and other projects in their pipeline. Georgia customers will pay an additional $36 billion to $43 billion over the 60-80 year lifespan of the two Vogtle reactors compared to cheaper alternatives.

Vogtle stands as the only new nuclear reactor built in the last 30 years, and its fallout offers a bleak prognosis for any supposed “renaissance” and its supporters in statehouses across the country. We can look back to 2017 when the main contractor, Westinghouse, filed for bankruptcy due to the extreme cost overruns at Vogtle. At that critical moment, the Georgia PSC ignored its own staff, energy experts, and public outcry, choosing to burden ratepayers with the project’s continuation.

The consequences of those decisions, subsequent rate increases and soaring electric bills are not abstract—they are impacting the most vulnerable among us and the most overlooked i.e. middle class/working class Georgians. Disconnection rates for the inability to pay have soared by 30% in 2024. For retirees on fixed incomes, the rate increases to pay for Plant Vogtle mean the difference between making ends meet and falling into destitution. This summer, when brutal heat waves descended, vulnerable Georgians had their power shut off, creating life-threatening conditions because they could no longer afford to cool their homes.

The ratepayer backlash in Georgia is also being fueled by the projected massive energy demands of AI data centers, which are forcing utilities like Southern Co. to reckon with costly new generation and transmission projects. Instead of aggressively pushing nuclear power—as evidenced by the Trump administration’s recent $80 billion deal to buy reactors from Westinghouse, the same company bankrupted by Vogtle—we must demand that elected politicians focus on fast and affordable energy solutions like solar and battery energy storage systems.

The painful lesson learned in Georgia is that new nuclear power is simply too expensive and takes too long. The reality is that for half the cost and in less than a quarter of the time, we could have built more than twice the capacity using solar, wind, or battery storage technologies. But corruption won out and Vogtle is here for the foreseeable future. Georgians will be paying for this mistake for decades to come… I’m just glad there’s finally some accountability headed our way.

Kim Scott is Executive Director of Georgia WAND, is a native Georgian, and has a Chemical Engineering degree from Vanderbilt University in Nashville, TN.

Bechtel Chief Says U.S. Must Subsidize Trump’s Nuclear Revival.

By Leonard Hyman & William Tilles – Nov 153, 2025 https://oilprice.com/Alternative-Energy/Nuclear-Power/Bechtel-Chief-Says-US-Must-Subsidize-Trumps-Nuclear-Revival.html5,

- Bechtel CEO Craig Albert said the U.S. government should help cover the costs of new nuclear plants under Trump’s proposed expansion.

- Nuclear power relies on layers of government subsidies for insurance, fuel, and waste disposal.

- If more reactors are truly needed, the government—not private firms—should build and operate them to lower capital costs

Well, someone important finally said it. Craig Albert, head of construction firm Bechtel, credited by the Financial Times for “rescuing” the Vogtle nuclear project in Georgia (we think “finishing“ it would be a better description), told that august paper that if the government wanted to get Donald Trump’s nuclear construction expansion going, it should be willing to pick up part of the costs. That is, subsidize the seemingly inevitable cost overruns? All the stories that followed talked about encouraging the “early movers” as if nobody had been building nuclear plants for the past seventy years, with cost overruns a common feature of construction in the US and Europe for at least 40 years.

We’ve said, and written in blogs and books, that building nuclear power plants in the USA (and a lot of other places) is not and has never been a commercial business venture. And maybe not a rational one, either. (The list of government subsidies for the industry like insurance, fuel procurement, nuclear waste disposal etc. go on and on.)

And Mr. Albert’s comments seem to bear that out. Just about every other electricity source is cheaper. If you don’t believe in climate change, then why not build more coal and gas? The USA has large domestic supplies of both. They run around the clock, too. If you believe in climate change, wind and solar assisted by batteries and better transmission can do the same job as a base load plant at about the same price points. And the wind and sun don’t have to be imported. But the Chinese control the rare earths that go into those facilities. Yes, but there are plenty of rare earths to be found elsewhere (“rare” being a misnomer). The problem is that the Chinese control the processing. So, would it take more time to build a nuclear plant or to build rare earth processing facilities in friendly places?

Or, if we really were worried about national security or the climate and were looking for an economical way out, we might want to do something about our outsize consumption of electricity, roughly 50-100% higher than in similarly developed countries in similar climates. For years, energy economists have argued that saving energy is a lot cheaper than producing it. A nonstarter nowadays. (Ever since 1977 when Jimmy Carter caused a controversy by turning down the thermostats and putting on a sweater in the White House to encourage energy conservation this has been a political nonstarter. Sad.)

Here’s the point. We need lots of electricity, but we don’t need nuclear power. So why should we subsidize the risk? This is not a new technology. Our first commercial reactor entered service in 1957. It’s an old, extremely complicated technology that never met its promised potential. A workable fusion reactor might change the world, but not more fission nukes. However, if the powers that be really want more nukes, we suggest that the government build and run them. It couldn’t do worse than the private generating companies. It would open the nuclear subsidy to public scrutiny and it would save a bundle on capital costs. (The government can always finance things much more cheaply than the private sector.) Our conclusion is that nuclear power is not a place for the private sector because it is not, and has never been, a commercially viable business.

Sizewell C. Taxpayers likely to see ‘no return’ on £6.4bn public funds put in as equity

taxpayers are getting no return whatsoever on the £6.4bn they are putting in as equity, so from a taxpayer point of view it is dreadful.

10 Nov, 2025, By Tom Pashby, New Civil Engineer

Taxpayers will see “no return whatsoever” on the £6.4bn that the government is committing in equity to Sizewell C, according to an energy policy expert.

Earlier in November 2025, Sizewell C reached financial close with a £5bn funding injection from 13 banks paving the way for full-scale construction.

The deal secures around £5.5bn of new financing consisting of a £5bn export credit-backed facility arranged by Bpifrance Assurance‑Export (BpifranceAE) with support from Sfil, and a separate £500M working capital facility.

These facilities sit alongside a term loan provided by the UK’s National Wealth Fund and the equity that was raised earlier this year following the Final Investment Decision (FID) for the Suffolk nuclear power plant in July.

In April 2025, the government announced that a further £2.7bn of taxpayer cash had been made available for Sizewell C, bringing the total to £6.4bn ahead of the FID on the nuclear power station.

The agreements on private investment to build the new nuclear power station have been reached through the government agreeing to use the Regulated Asset Base (RAB) model. RAB works by having consumers pay a surcharge on their bills during the construction phase, which helps lower the cost of capital and reduces the financial risk for investors. This surcharge will be added to bills through the construction and for the first three years of operation. It goes towards paying back the private entities for their investment and, according to the government, will mean lower bills for consumers over the long term. Ofgem, as the regulator, sets the allowed revenue to ensure costs are incurred efficiently and consumers get value for money.

However, University of Greenwich emeritus professor of energy policy Steve Thomas is scptical about this, given that the current official estimate of £38bn to build Sizewell C is at the lower end of the range of likely costs and this is in 2024 prices, with inflation pushing it up all the time.

Additionally, there is no official timeline for construction completion. As has been seen with Hinkley Point C, cost and schedule overruns come with the territory.

He told NCE: “From 1 December 2025, consumers will start to pay a surcharge on the electricity bills to pay for the return being paid to investors (10.8% real) on their equity contribution (35% of the costs) and the interest payments on the loans, expected to be 4.5% (real).

“A bit of arithmetic suggests the surcharge will be split 44% interest payments and 56% rate of return on equity.

“The Low Carbon Contracts Company has said the surcharge in the period up to the end of March 2027 will be £3.54/MWh.”

He added that the £3.54/MWh figure would subsequently be updated annually based on the latest cost calculations.

“Ofgem says the average domestic consumer uses 2,700kWh per year so that amounts to about £9.56 per consumer in the first year,” he said. He believes this could rise to £62.70 per year by the end of the surcharge period.

“The government has said it will recycle its income from the surcharge back to electricity consumers, but we don’t know and nor does the government how it will do this and what proportion of the surcharge it receives will go back to consumers.

“Recycling the income means the government is giving consumers the interest that is paid to the National Wealth Fund on borrowing of £11.8bn and taxpayers are getting no return whatsoever on the £6.4bn they are putting in as equity, so from a taxpayer point of view it is dreadful.

Sizewell C ‘fails miserably’ on transparency – campaigner

Stop Sizewell C executive director Alison Downes said: “If Sizewell C can publicly state it expects the project to cost £38bn, why won’t they tell us when we can expect to see first power?

“Given that the British public is largely paying for Sizewell C through our taxes and energy bills, don’t we have the right to know how long it will take?

“Cynically this sounds like a ‘learning’ from Hinkley Point C – don’t tell people when it will be finished so you can’t be criticised for missing your deadlines. As an exercise in transparency, it fails miserably.”………………. https://www.newcivilengineer.com/latest/sizewell-c-consumers-like-to-see-no-return-on-6-4bn-public-funds-put-in-as-equity-10-11-2025/

EDF boss vows to speed up nuclear projects and narrow gap to Asian peers

EDF’s new boss has vowed to speed up the delivery of new nuclear reactors in an increasingly competitive market, after costly overshoots in the past weighed on the French energy group.

The company wants to use the

development of the UK’s Sizewell C nuclear power station to show that huge reactors capable of powering millions of homes can be delivered at speed, in the hope that this will help it attract private funding and compete with more efficient rivals, including those from Asia.

Bernard Fontana, chief executive, said the state-owned group remained “open to international markets” and hoped to export more of its designs beyond the projects it is undertaking in the UK and France. EDF has been tasked with

delivering at least six new French reactors from 2038 onwards and is due to deliver two for the £38bn Sizewell C project in the middle to late 2030s.

Fontana’s push for efficiency comes as EDF, weighed down by a net debt of €50bn, needs to finance €30bn of investments annually over the next five years, including on maintaining current sites, according to estimates by France’s budget watchdog. EDF operates 57 French reactors.

FT 9th Nov 2025, https://www.ft.com/content/cc39da49-6ebf-40e2-bfbe-296ee2596ce9

Destroying Europe in order to save it: Extortion, theft, and the EU’s two disastrous choices

Strategic Culture Foundation, Joaquin Flores, November 5, 2025

Europe can postpone recognition of failure, but it cannot postpone the bill.

Europe now faces a stark choice forced by its disastrous war policy against Russia: either allow the EU to successfully move toward a centralized state over the heads of its member states, risking a mass Eurexit that may or may not succeed in reaction to that gamble, or delay the larger crisis through member states quietly accepting one of several schemes that will cripple the economy and create social strife regardless.

The Union must decide whether to use frozen Russian sovereign assets to finance a €140 billion “reparation” loan for Ukraine, or to issue joint debt through Eurobonds.

Both paths carry severe legal risks and impose heavy costs on citizens: one through contingent liabilities, the other through immediate taxes, austerity, and political instability. Pushing through the Eurobond option would amount to a structural coup, a radical re-engineering of the EU against its current form. A recent Politico piece framed these in terms of Option A and B, which helps to contrast these two potential ways forward.

Commission President Ursula von der Leyen’s scheme from the European Commission reveals the depths of EU tyranny in its failed gambit to defeat Russia and guarantee investment outcomes in Ukraine.

SAFE, (Security Action for Europe), a €150 billion defense loan program, was initially proposed in March by von der Leyen with the goal of stimulating rapid defense investment. By May, EU ministers had given their final approval to the program, without consulting the European Parliament, provoking a suit from the Parliament.

Whether or not the Eurobond or Russian asset-seizure (theft) scheme is being proposed in light of (perhaps) likely-to-succeed challenges to the SAFE loan program, or if the Commission is trying to actually raise a total of nearly €300 billion, remains to be seen. What is certain is the push for SAFE comes chronologically after there was significant push-back from EU member states and ministers themselves on the feasibility of spending seized/frozen Russian assets (including interest on the moneys, for war against Russia, or anything else). And the Commission push for this Eurobond scheme comes after the EU Parliament presented a suit against SAFE.

What the Eurobond scheme and SAFE both have in common, nevertheless, is the mechanism for implementation, recklessly assuming authority to do so under a radically broadened interpretation of its powers re Article 122 TFEU.

The Commission is using threats to force member states to spend the frozen Russian assets. Refuse and each government faces a political crisis. Eurobonds are deeply unpopular because the mutualized debt falls on the population, leading to the overturning of governments at the ballot-box, and imposing them unilaterally would break EU treaties, leading to an emboldened Eurexit movement. Member states are being pushed to approve the use of unlawfully seized assets, completing the illegal expropriation through their own consent.

The stakes are far higher than money. This is a coup against the EU as it was conceived, a total re-envisioning of the Union itself. Ursula von der Leyen is not merely leveraging bonds to secure Ukraine funding. She is playing a game of chicken that risks the Union’s structure………………………………

Option A: Frozen Russian assets – huge legal risk, long-term cost to citizens

Legally, tapping frozen Russian assets is precarious………………………………….

….sovereign assets normally enjoy immunity from seizure under international law and bilateral treaties, reflected in the United Nations Convention on Jurisdictional Immunities of States and Their Property (2004) and the 1989 Belgium–Russia bilateral investment treaty.…………………………………………………………………………………..

Option B: Eurobonds – unconstitutional overreach and overt social burden

Unilateral Eurobonds generally collide with the EU’s treaty architecture: the Commission cannot force the issuing of mutualized debt; joint borrowing requires unanimous backing and national ratification.

To do otherwise requires violating the EU’s treaty itself. Brussels is signaling it might act first and fight legal challenges later. …………………………………………………………………………………………………………………..

If forced, citizens face higher taxes, constrained public services, and renewed austerity. Debt obligations do not disappear with elections; social unrest could deepen inequality, provoke Euroscepticism, and trigger exit pressures. Constitutionally, this makes the Commission behave as a sovereign treasury without legitimacy.

€140 bn in debt spread across 200 million workers equals €700 per worker. At 3 % annual interest, servicing costs €21 bn/year, or €105 per worker annually over ten years. Principal plus €42 bn interest totals €182 bn, or €910 per worker. This translates into grandmothers skipping groceries, students delaying college, and curtailed public services. Trade unions, left-wing groups, and small-business forces could trigger a pan-European ‘Yellow Vests’-style crisis.

Conclusion: Evergreening, sunk costs, and Who pays

Both options are evergreening: keeping failing policies alive to avoid losses. Option A buries legal risk and hands latent liabilities to future citizens; Option B openly burdens taxpayers and risks constitutional rupture. And even worse, both scenarios ignore the chronic economic hazard to Europe if it continues its course of sanctions on Russian energy, which could make it the least competitive economy in the developed world.

In both options, the EU is pouring billions either directly into Ukraine or into arms to supply it yet the war is almost certainly lost and the billions spent on expected returns from reconstruction of Russian-liberated territories will never be recovered, turning these investments into sunk costs that serve only to prolong the illusion of economic coherence.

Europe suffers a paradigm problem and an existential crisis at the level of its ‘Eurocracy.’ Paradoxically, the policies that are politically hardest to enact at this bureaucratic level are also the most necessary and potentially fruitful. Since the EU proposes to embark upon a radical reconstruction of the Union itself, perhaps it is appropriate to presume something as radical, but in the direction of stability, growth, and peace: 1) reversing its war-footing; 2) rapprochement with Russia along the U.S.-Russia model; 3) restoring energy pipelines like Nord Stream 2; 4) recognizing Ukraine as Russia’s legitimate sphere of influence; 5) joint investment with Russia in the post-Warsaw Pact sphere; 6) building on the OSCE and 1975 Helsinki Final Act framework; 7) developing a joint Eurasian economic and security architecture. This ensures stability, development, and prosperity for generations.

For Europe, this requires overcoming chronic Russophobia and eschewing Atlanticist paranoia. Europe can postpone recognition of failure, but it cannot postpone the bill. Who will be left holding it, and will there even be an EU that can pull this off? https://strategic-culture.su/news/2025/11/05/destroying-europe-in-order-to-save-it-extortion-theft-and-the-eus-two-disastrous-choices/

Legalising the theft of Russian assets

There are, I’m afraid to say, still too many truly believers in the Russia total defeat delusion. Ukraine can still win! With what troops and, critically, what money?

With Glenn Diesen, Ian Proud. Nov 10, 2025

Following my recent article on the topic of the so-called EU reparations loan (a cheap ruse to fund the Ukrainian state for another 2-3 catastrophic years of war), I discussed the issue in more detailed with Glenn Diesen,

The more I consider this issue, the more clear it becomes that attempting to exproprirate Russian assets is a desperate measure to prevent EU Member States from giving Ukraine the money themselves, money which they do not have.

The Commission idea, should the Russian asset option continue to be blocked by Belgium, to borrow the money on international markets and then lend it to Ukraine, which can’t borrow money itself, appears similarly desperate. Who will make repayments on that loan? Becauses Ukraine won’t.

Suddenly, the EU idea of common debt becomes more worrying still. Who wants to give Kaja Kallas a blank cheque to fund proxy wars in other countries, with repayments being share among Member States?

Amid all of this, with Pokrovsk falling, Kupiansk and Siversk almost lost, the Russian army pushing into Zaporizhia, does anyone in Brussels take a step back and ask whether, in fact, it would be better to support the US in leveraging Zelensky to settle?

There are, I’m afraid to say, still too many truly believers in the Russia total defeat delusion. Ukraine can still win! With what troops and, critically, what money?

-

Archives

- January 2026 (61)

- December 2025 (358)

- November 2025 (359)

- October 2025 (377)

- September 2025 (258)

- August 2025 (319)

- July 2025 (230)

- June 2025 (348)

- May 2025 (261)

- April 2025 (305)

- March 2025 (319)

- February 2025 (234)

-

Categories

- 1

- 1 NUCLEAR ISSUES

- business and costs

- climate change

- culture and arts

- ENERGY

- environment

- health

- history

- indigenous issues

- Legal

- marketing of nuclear

- media

- opposition to nuclear

- PERSONAL STORIES

- politics

- politics international

- Religion and ethics

- safety

- secrets,lies and civil liberties

- spinbuster

- technology

- Uranium

- wastes

- weapons and war

- Women

- 2 WORLD

- ACTION

- AFRICA

- Atrocities

- AUSTRALIA

- Christina's notes

- Christina's themes

- culture and arts

- Events

- Fuk 2022

- Fuk 2023

- Fukushima 2017

- Fukushima 2018

- fukushima 2019

- Fukushima 2020

- Fukushima 2021

- general

- global warming

- Humour (God we need it)

- Nuclear

- RARE EARTHS

- Reference

- resources – print

- Resources -audiovicual

- Weekly Newsletter

- World

- World Nuclear

- YouTube

-

RSS

Entries RSS

Comments RSS