‘Fork in the road’: How a failed nuclear plot locked in Australia’s renewable future

The Age By Nick Toscano, June 1, 2025

hen Australians went to the polls and voted Anthony Albanese back as prime minister, they also voted for something that will outlive the next election: the power industry’s guaranteed switch from coal to renewable energy.

What they didn’t vote for were state-owned nuclear reactors, forced delays of coal-fired power station closures and a slew of other Coalition promises widely viewed as threats to the country’s era-defining challenge of cutting harmful emissions while keeping electricity supply and prices steady.

Although times remain testing in the energy sector, a feeling of relief is clear. “The nuclear conversation is dead and buried for the foreseeable future,” said an executive at one of Australia’s biggest power suppliers, who asked not to be named. Even as the Nationals keep arguing for a nuclear future, any genuine suggestion that atomic facilities could still be built in time to replace retiring coal plants after the next election rolls around was now downright “ridiculous”, said another, adding that renewable energy was on track to surpass 60 per cent of the grid by 2028. “That’s great for the energy sector – it simplifies the path forward,” they said.

Make no mistake, a seismic shift across the grid has been well under way for years now. Australia’s coal-fired power stations – the backbone of the system for half a century – have been breaking down often and closing down earlier, with most remaining plants slated to shut within a decade.

At the same time, power station owners including AGL, Origin Energy and EnergyAustralia are joining a rush of other investors in piling billions of dollars into large-scale renewables and batteries to expand the share of their power that comes from the sun, wind and water. The federal government has an ambitious target for renewable energy to make up 82 per cent of the grid by 2030.

Moving to a system dominated by less-predictable renewables will not be easy. It will take much greater preparation to match supply and demand and require the multibillion-dollar pipeline of private investment in the transition to continue. But ousted opposition leader Peter Dutton, before losing the May 3 federal election and his own seat, hatched a plan to change the course dramatically. A grid powered mainly by renewables would never be able to “keep the lights on”, Dutton insisted.

Instead, he declared, a Coalition government would tear up Australia’s legislated 2030 emissions-reduction commitments, cut short the rollout of renewables, force the extensions of coal-fired generators beyond their owners’ retirement plans and eventually replace them with seven nuclear-powered generators, built at the taxpayer’s expense, sometime before 2050

For Australians who wanted to see urgent action to tackle climate change – and investors at the forefront of the shift to cleaner power – the campaign to dump near-term climate targets in favour of nuclear energy came at the worst possible time. Some likened it to a “near-death experience” for the momentum of the shift to a cleaner, modern energy system that would have wiped out investor confidence and killed off billions of dollars of future renewable projects.

“When you reflect on the significance of energy in the campaign, it’s reasonable to say this was a fork in the road,” said Kane Thornton, outgoing chief executive of the Clean Energy Council……………………………………………..

Dutton argued for months that nuclear plants would be the best way to keep prices down, even though almost no one agreed with him.

“I’m very happy for the election to be a referendum on energy – on nuclear,” he said.

In the end, the idea proved too toxic for voters. It delivered big swings against Dutton’s candidates in electorates chosen to host reactors, while support for Labor grew in many of the places selected to develop massive offshore wind farms, which the Coalition had planned to scrap.

The decisive election result “locks in” the government’s ambitious push for an electricity grid almost entirely powered by renewables, said Leonard Quong, the head of Australian research at BloombergNEF.

“The Labor Party’s landslide victory … is a win for climate, clean energy and the country’s decarbonisation trajectory,” he said…………………………………………..https://www.theage.com.au/business/the-economy/fork-in-the-road-how-a-failed-nuclear-plot-locked-in-australia-s-renewable-future-20250523-p5m1qa.html

Solar puts Australia in fast lane to 100% renewables

A massive increase in solar power generation capacity is already putting Australia on the fast track to a 100% renewable energy future.

An academic living in cold Canberra retired his gas heaters a few years

ago and installed electric heat pumps for space and water heating. His gas

bill went to zero. He also bought an electric vehicle, so his gas bill went

to zero. He installed rooftop solar panels that export enough solar

electricity to the grid to pay for electricity imports at night, so his

electricity bill also went to zero. That Canberra academic will get his

money back from these energy investments in about eight years. I am that

academic and I’m experiencing how rooftop solar coupled with

electrification of everything provides the cheapest domestic energy in

history. Solar energy is also causing the fastest energy change in history.

Along with support from wind energy, it offers unlimited, cheap, clean and

reliable energy forever. With energy storage effectively a problem solved,

the required raw materials impossible to exhaust – despite some

misconceptions in the community – and an Australian transition gathering

pace, solar and wind are becoming a superhighway to a future of 100%

renewable energy.

PV Magazine 29th May 2025 https://www.pv-magazine.com/2025/05/29/solar-puts-australia-in-fast-lane-to-100-renewables/

More Renewables – or more nuclear?

May 24, 2025, https://renewextraweekly.blogspot.com/2025/05/more-renewables-or-more-nuclear.html

In my last post, I looked at how, despite renewable expansion, emissions were still rising. I focussed mainly on coal, but clearly it’s wider than that: multi-billion fossil fuel investment continues. In this post I will look at what is arguably another big issue- the attempt, to rebrand nuclear as a solution. Certainly some people in the UK and elsewhere think that there is a case for nuclear as part of a low carbon answer to climate change, although others do not agree. Even leaving aside the safety, security and waste issues, they say it’s too expensive and takes too long to build compared with renewables.

That debate continues, but in terms of what’s actually happening on the ground, the battle has arguably been won by renewables – they are expanding very rapidly around the world, leaving nuclear mostly stalled. Even China’s nuclear programme, currently at around 60 GW, is tiny compared with its renewables capacity, which hit 1.82 TW last year and is still expanding fast.

However, nuclear is still in the game in some locations, with, for example, Russia trying to export its nuclear technology and fuel services. And more generally, while the nuclear industry may mostly have to accept a lesser role globally, as renewables expand to high percentages of overall power, that in fact may be seen by them as a new opportunity- on the argument that nuclear will be needed to back up variable renewables.

The latest example seems to be Denmark, famed for its anti-nuclear ‘Atomkraft Nein Danke’ stance, with renewables now supplying over 80% of its power and aiming to get to 100% of all energy by 2050. That will require new grid balancing capacity, the most obvious being storage- with excess renewable output being stored in batteries or converted to hydrogen for use when there is renewable supply lull or a peak in demand. But evidently there is also now government interest in nuclear- and the idea of small modular reactors (SMR). It’s hard to see how this would be viable for occasional backup. Large conventional nuclear plants are expensive to build and inflexible to run, and current designs for SMRs are no better – and trying to make them flexible is likely add even more to the cost. So it seems very odd.

Spain also has a high renewable percentage, Portugal too, though, unlike Denmark and Portugal, Spain does have some nuclear plants. But it is planning to phase them out. Certainly they were no use in avoiding the recent large-scale total Iberian blackout- Spain’s nuclear plants evidently can’t run competitively when renewables are at peak. So, as it seems happens regularly, they were throttled back- most of the power was coming from wind and solar. We still don’t know what exactly went wrong, but it does seem that the remaining nuclear plants tripped out due to a grid overload signal, and PV solar also cut out for some reason. Perhaps a bit prematurely, the Spanish prime minister said that ‘there is no empirical evidence that the incident was caused by a surplus of renewables or a lack of nuclear power plants in Spain.’

He added ‘we are not going to deviate a single millimetre from the energy road map we have planned since 2018. Not only are renewables our country’s energy future, they are our only and best option. They are the only way to re-industrialise Spain.’

It may turn out have been a simple line fault, but it’s also possible that it was due to lack of synchronous inertia on the grid system. Large conventional fossil fuel fired or nuclear plants have large heavy spinning turbo-generators that help balance short-term output perturbations. PV solar has none, wind turbines only a small amount. But it would be crazy to build large expensive fossil or nuclear plants to provide rotational inertia for usually rare events.

There has been talk in the past of using just the turbo-generator sets of old closed plants, unpowered except for grid power, to provide ‘spinning reserve’ rotational inertia. However, if its needed, there may be easier and cheaper ways to do this electronically, via fast response storage and inverter systems- virtual synchronous inertia. Tidal lagoons and barrages are another option- they offer large scale energy storage capacity along with significant rotational inertia. So too do hydro projects. So inertia issues are not necessarily a major problem.

Needless to say though, despite there being no poof as to what actually happened as yet, there was a rush to early judgement and speculation by some of the media – along the lines that ‘you can’t rely on renewables’ and ‘this is what you get with net zero’! So far though, most of this invective has bounced off. Anti-nuclear Germany, currently gets around 63% of its power from renewables, and aims to get to net zero carbon with no nuclear. Occasionally there has ben some pressure to go back to nuclear but it has been resisted and certainly the ‘baseload for grid balancing’ case for nuclear seems very weak.

Meanwhile, the UK is getting 50% of its power from renewables, but is struggling to fund its proposed new nuclear plant at Sizewell: EdF evidently is no longer able to help out- it has enough financial and operational problems with its troubled EPR programme in France. It has also halted its initial SMR programme. The UK however is still keen to promote SMRs, although Westinghouse has pulled out of the race. The basic problem with nuclear technology, old or new, small or large, is cost – renewables like wind and solar are far cheaper, and storage backup is also now getting cheap.

The UK does need to get moving on hydrogen storage for the longer term, and also heat storage, which some see as better than heat pumps in some locations, possibly with green AD biogas as a storable energy source. Tidal lagoon power, though still a bit too costly, is also beginning to be talked up again. All of these are arguably a lot more promising for balancing than new nuclear.

So what’s likely to happen? There’s no question that the nuclear lobby has been pushing hard to get back in the game after the 2011 Fukushima disaster in Japan, which had led to nuclear programme reversals around the world, but in Asia especially. There were huge public demonstrations of opposition. But, in time, the phase out or cut back programmes planned by some Asian governments (including Japan, Taiwan and Thailand) faded away and nuclear is back in favour- although renewables are now seen as the main energy supply options in most cases. Not least since, even there, though lower than in the West, the constructions costs and investment risks of new nuclear are high, compared with solar and wind.

However, some also see carbon removal and biomass carbon capture playing a carbon negative role, especially in countries where there are a lot of agricultural carbon emissions- and also land. But as I noted in my last post, although there may be some exceptions, the economic and ecological viability of that approach on a large scale is debatable- expanding renewables even faster looks like a better bet. Though, as with nuclear, the debate continues…

Two stories: Denmark’s soaring renewable success and global nuclear construction disaster

Denmark will soon achieve 100% electricity from wind and solar; but across the world nuclear power construction cost overruns soar

David Toke, May 22, 2025, https://davidtoke.substack.com/p/two-stories-denmarks-soaring-renewable

Two stories emerged on May 19th giving diametrically opposed results; one is very positive news for the booming deployment of renewable energy but the other is crushingly bad for nuclear power prospects. Renewables will make up more than of Danish 100% electricity in a couple of years time and just wind and solar not long after that. On the other hand a new study concludes that, around the world, nuclear power projects have cost overruns that are over 100%. Solar and wind have very low, if any cost overruns.

Danish renewables to reach 100 per cent of electricity

You can see the shares of electricity generation for Denmark in 2024 in Figure 1. Wind and solar already make up 69 per cent of generation and together with bioenergy they made up 87 per cent of electricity generation. But wind and solar generation is increasing rapidly. The different shares of power production can be seen in Figure 1.

Denmark blazed the trail for wind power starting in the 1970s as farmers and wind cooperatives put up their own wind turbines. Initially the turbines were only 20 kW in peak output. But the latest planned offshore windfarm will have turbines of 20 MW in size – a thousand times bigger! The early start for wind power in Denmark boosted its industry tremendously. Today Denmark also hosts Vestas, the largest wind generator manufacturer in the world.

There are still a trickle of onshore wind turbines being built. However, these days most of the new wind capacity is coming from offshore wind. The 1.08GW Thor windfarm that is currently being built will be fully operational in 2027. [on original]…………………………………………………………………………

Academic study reveals enormous average nuclear cost overruns around the world

Meanwhile, on the same day as the announcement of the forthcoming auction for the Danish offshore windfarms, an academic paper was announced which showed truly awful results for the nuclear industry. The study scoured the world for details on as many energy infrastructure projects that coud reliably be found – 662 in all – including 204 nuclear power plant constructions.

The researchers found that the average cost overrun for nuclear power plant was a staggering 102.5 per cent. That means that the construction costs were more than double the cost that was originally estimated before the construction started. What makes this figure all the more remarkable is that this was an average across the whole of the world.

The study includes Eastern countries like China. In these states there is still the specialist industrial skills (and more relaxed health and safety at work regulations) required to deliver nuclear power stations at anywhere near their projected construction time. Yet, in western countries, the construction cost overruns are much worse. Essentially, in western conditions, it has become impossible to deliver nuclear power plant at anything below astonomical costs.

I should add that there is an incredible amount of nonsense being spouted at the moment about how ‘small modular reactors’ are some way of saving nuclear power. Apart from occasioning a small amount of ultra-expensive nuclear capacity they are nothing of the sort. They are much worse in economic terms than even conventional reactors. See my discussion ‘Why small modular reactors do not exist – history gives the answer’. See HERE.

It is a completely different matter for renewable energy projects of course, where cost overruns are very low. But, from the press coverage, you would not guess all of this!

Conclusion

As we can see from this post Denmark is, within a few years, about to be the first country in the world with a net surplus of wind and solar power. Interestingly this is the country that turned its head against nuclear power forty years ago, although it never bult any nuclear power plant before then. I have heard an incredible amount of what could be described as nonsensical disinformation in the mainstream press about how nuclear power is accelerating around the world and even that is some sort of way renewables are in crisis. The reality is the exact opposite as the information in this post demonstrates.

Nuclear has highest investment risk; solar shows lowest, say US researchers

Nuclear power plants exceed construction budgets by an average of 102.5%, costing $1.56 billion more than planned, according to a study by Boston University’s Institute for Global Sustainability.

May 21, 2025 Pilar Sánchez Molina, https://www.pv-magazine.com/2025/05/21/nuclear-power-carries-highest-investment-risk-solar-shows-lowest-say-us-researchers/

A new study by the Institute for Global Sustainability at Boston University found that energy infrastructure projects exceeded planned construction costs in more than 60% of cases. Researchers analyzed data from 662 projects across 83 countries, spanning builds from 1936 to 2024 and totaling $1.358 trillion in investment.

The study covered a wide range of project types. These included thermoelectric power plants fueled by coal, oil or natural gas, as well as nuclear reactors, hydroelectric facilities and wind farms. It also examined large-scale PV and concentrated solar installations, high-voltage transmission lines, bioenergy and geothermal plants, hydrogen production sites, and carbon capture and storage systems

Researchers modeled projects with minimum thresholds: power plants with more than 1 MW of installed capacity, transmission lines over 10 km, and carbon capture systems processing more than 1,000 tons of CO₂ per year.

In the study, “Beyond economies of scale: Learning from construction cost overrun risks and time delays in global energy infrastructure projects,” published in Energy Research & Social Science, the authors found that energy infrastructure construction takes 40% longer than planned – on average, a delay of roughly two years.

Nuclear power plants had the highest cost overruns and delays, with average construction costs exceeding estimates by 102.5%, or $1.56 billion. Hydroelectric projects followed at 36.7%, then geothermal (20.7%), carbon capture (14.9%), and bioenergy (10.7%). Wind projects averaged a 5.2% cost increase, while hydrogen projects came in at 6.4%.

By contrast, PV plants and transmission infrastructure recorded cost underruns of 2.2% and 3.6%, respectively.

Construction delays also varied by technology. Nuclear, hydro, and geothermal projects experienced average delays of 35, 27, and 11 months, respectively. PV and transmission builds had the best performance, typically completing ahead of schedule or with only minimal delays – averaging one month if delayed at all.

The study concluded that projects exceeding 1,561 MW in capacity face significantly higher cost escalation risks, while smaller, modular renewable builds may lower financial exposure and improve forecasting. Once construction delays surpassed 87.5%, cost increases rose sharply.

Solar Power Set to Surpass Nuclear Generation This Summer

By Tsvetana Paraskova – May 21, 2025, https://oilprice.com/Latest-Energy-News/World-News/Solar-Power-Set-to-Surpass-Nuclear-Generation-This-Summer.html

This summer, solar power generation globally could exceed electricity from nuclear power plants for the first time ever, as solar capacity soars and sunlight and daylight hours are long in the northern hemisphere.

Global solar power generation jumped by 34% in the first quarter of 2025 from the same period in 2024, according to data from Ember cited by Reuters columnist Gavin Maguire.

If the pace of growth is sustained though June, July, and August, solar output is set to top 260 terawatt hours (TWh) in the summer months. This would beat the average 223 TWh of global nuclear power generation from 2024, Maguire notes.

Last year, record growth in renewables led by solar helped push clean power above 40% of global electricity in 2024, Ember said in its Global Electricity Review 2025 last month. However, heatwave-related demand spikes led to a small increase in fossil generation, too, the clean energy think tank said.

“Solar generation has maintained its high growth rate, doubling in the last three years, and adding more electricity than any other source over that period,” Ember’s analysts wrote in the report.

More than half, or 53%, of the increase in solar generation in 2024 was in China, with China’s clean generation growth meeting 81% of its demand increase in 2024, according to Ember.

China and Europe are driving solar power’s global surge, but in Europe, the solar boom has led to negative power prices more frequently.

At the end of April, for example, a sunny weekend in northwest Europe plunged power prices in the region to hundreds of euros below zero as solar generation soared.

Negative power prices, while beneficial for some consumers in some countries, generally discourage investments in new capacity as renewable power generators don’t profit from below-zero prices.

The more frequent occurrences of negative prices amid soaring solar output aren’t conducive to increased investment in generation only, and highlight the need of energy storage solutions to store the excess power and discharge it at evenings when it’s most needed.

We did the math on AI’s energy footprint. Here’s the story you haven’t heard

Tallies of AI’s energy use often short-circuit the conversation—either by scolding individual behavior, or by triggering comparisons to bigger climate offenders. Both reactions dodge the point: AI is unavoidable, and even if a single query is low-impact, governments and companies are now shaping a much larger energy future around AI’s needs.

“It’s not clear to us that the benefits of these data centers outweigh these costs,”

Tallies of AI’s energy use often short-circuit the conversation—either by scolding individual behavior, or by triggering comparisons to bigger climate offenders. Both reactions dodge the point: AI is unavoidable, and even if a single query is low-impact, governments and companies are now shaping a much larger energy future around AI’s needs.

“It’s not clear to us that the benefits of these data centers outweigh these costs,”

The emissions from individual AI text, image, and video queries seem small—until you add up what the industry isn’t tracking and consider where it’s heading next.

James O’Donnell, Casey Crownhart, MIT Technology Review, May 20, 2025

AI’s integration into our lives is the most significant shift in online life in more than a decade. Hundreds of millions of people now regularly turn to chatbots for help with homework, research, coding, or to create images and videos. But what’s powering all of that?

Today, new analysis by MIT Technology Review provides an unprecedented and comprehensive look at how much energy the AI industry uses—down to a single query—to trace where its carbon footprint stands now, and where it’s headed, as AI barrels towards billions of daily users.

This story is a part of MIT Technology Review’s series “Power Hungry: AI and our energy future,” on the energy demands and carbon costs of the artificial-intelligence revolution.

We spoke to two dozen experts measuring AI’s energy demands, evaluated different AI models and prompts, pored over hundreds of pages of projections and reports, and questioned top AI model makers about their plans. Ultimately, we found that the common understanding of AI’s energy consumption is full of holes.

We started small, as the question of how much a single query costs is vitally important to understanding the bigger picture. That’s because those queries are being built into ever more applications beyond standalone chatbots: from search, to agents, to the mundane daily apps we use to track our fitness, shop online, or book a flight. The energy resources required to power this artificial-intelligence revolution are staggering, and the world’s biggest tech companies have made it a top priority to harness ever more of that energy, aiming to reshape our energy grids in the process.

Meta and Microsoft are working to fire up new nuclear power plants. OpenAI and President Donald Trump announced the Stargate initiative, which aims to spend $500 billion—more than the Apollo space program—to build as many as 10 data centers (each of which could require five gigawatts, more than the total power demand from the state of New Hampshire). Apple announced plans to spend $500 billion on manufacturing and data centers in the US over the next four years. Google expects to spend $75 billion on AI infrastructure alone in 2025.

This isn’t simply the norm of a digital world. It’s unique to AI, and a marked departure from Big Tech’s electricity appetite in the recent past. From 2005 to 2017, the amount of electricity going to data centers remained quite flat thanks to increases in efficiency, despite the construction of armies of new data centers to serve the rise of cloud-based online services, from Facebook to Netflix. In 2017, AI began to change everything. Data centers started getting built with energy-intensive hardware designed for AI, which led them to double their electricity consumption by 2023. The latest reports show that 4.4% of all the energy in the US now goes toward data centers.

the US average.

Given the direction AI is headed—more personalized, able to reason and solve complex problems on our behalf, and everywhere we look—it’s likely that our AI footprint today is the smallest it will ever be. According to new projections published by Lawrence Berkeley National Laboratory in December, by 2028 more than half of the electricity going to data centers will be used for AI. At that point, AI alone could consume as much electricity annually as 22% of all US households.

Meanwhile, data centers are expected to continue trending toward using dirtier, more carbon-intensive forms of energy (like gas) to fill immediate needs, leaving clouds of emissions in their wake. And all of this growth is for a new technology that’s still finding its footing, and in many applications—education, medical advice, legal analysis—might be the wrong tool for the job or at least have a less energy-intensive alternative.

Tallies of AI’s energy use often short-circuit the conversation—either by scolding individual behavior, or by triggering comparisons to bigger climate offenders. Both reactions dodge the point: AI is unavoidable, and even if a single query is low-impact, governments and companies are now shaping a much larger energy future around AI’s needs.

We’re taking a different approach with an accounting meant to inform the many decisions still ahead: where data centers go, what powers them, and how to make the growing toll of AI visible and accountable.

That’s because despite the ambitious AI vision set forth by tech companies, utility providers, and the federal government, details of how this future might come about are murky. Scientists, federally funded research facilities, activists, and energy companies argue that leading AI companies and data center operators disclose too little about their activities. Companies building and deploying AI models are largely quiet when it comes to answering a central question: Just how much energy does interacting with one of these models use? And what sorts of energy sources will power AI’s future?

This leaves even those whose job it is to predict energy demands forced to assemble a puzzle with countless missing pieces, making it nearly impossible to plan for AI’s future impact on energy grids and emissions. Worse, the deals that utility companies make with the data centers will likely transfer the costs of the AI revolution to the rest of us, in the form of higher electricity bills.

It’s a lot to take in. To describe the big picture of what that future looks like, we have to start at the beginning.

ning.

Part One: Making the model|…………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

At each of these centers, AI models are loaded onto clusters of servers containing special chips called graphics processing units, or GPUs, most notably a particular model made by Nvidia called the H100.

This chip started shipping in October 2022, just a month before ChatGPT launched to the public. Sales of H100s have soared since, and are part of why Nvidia regularly ranks as the most valuable publicly traded company in the world.

Other chips include the A100 and the latest Blackwells. What all have in common is a significant energy requirement to run their advanced operations without overheating.

A single AI model might be housed on a dozen or so GPUs, and a large data center might have well over 10,000 of these chips connected together.

Wired close together with these chips are CPUs (chips that serve up information to the GPUs) and fans to keep everything cool.

Some energy is wasted at nearly every exchange through imperfect insulation materials and long cables in between racks of servers, and many buildings use millions of gallons of water (often fresh, potable water) per day in their cooling operations.

Depending on anticipated usage, these AI models are loaded onto hundreds or thousands of clusters in various data centers around the globe, each of which have different mixes of energy powering them.

They’re then connected online, just waiting for you to ping them with a question.

Part Two: A Query……………………………

Part Three: Fuel and emissions………………………………………………………

Part four: The future ahead|……………………………………………………………………………………..

The Lawrence Berkeley researchers offered a blunt critique of where things stand, saying that the information disclosed by tech companies, data center operators, utility companies, and hardware manufacturers is simply not enough to make reasonable projections about the unprecedented energy demands of this future or estimate the emissions it will create. They offered ways that companies could disclose more information without violating trade secrets, such as anonymized data-sharing arrangements, but their report acknowledged that the architects of this massive surge in AI data centers have thus far not been transparent, leaving them without the tools to make a plan.

“Along with limiting the scope of this report, this lack of transparency highlights that data center growth is occurring with little consideration for how best to integrate these emergent loads with the expansion of electricity generation/transmission or for broader community development,” they wrote. The authors also noted that only two other reports of this kind have been released in the last 20 years.

We heard from several other researchers who say that their ability to understand the emissions and energy demands of AI are hampered by the fact that AI is not yet treated as its own sector. The US Energy Information Administration, for example, makes projections and measurements for manufacturing, mining, construction, and agriculture, but detailed data about AI is simply nonexistent.

Individuals may end up footing some of the bill for this AI revolution, according to new research published in March. The researchers, from Harvard’s Electricity Law Initiative, analyzed agreements between utility companies and tech giants like Meta that govern how much those companies will pay for power in massive new data centers. They found that discounts utility companies give to Big Tech can raise the electricity rates paid by consumers. In some cases, if certain data centers fail to attract the promised AI business or need less power than expected, ratepayers could still be on the hook for subsidizing them. A 2024 report from the Virginia legislature estimated that average residential ratepayers in the state could pay an additional $37.50 every month in data center energy costs.

“It’s not clear to us that the benefits of these data centers outweigh these costs,” says Eliza Martin, a legal fellow at the Environmental and Energy Law Program at Harvard and a coauthor of the research. “Why should we be paying for this infrastructure? Why should we be paying for their power bills?”

When you ask an AI model to write you a joke or generate a video of a puppy, that query comes with a small but measurable energy toll and an associated amount of emissions spewed into the atmosphere. Given that each individual request often uses less energy than running a kitchen appliance for a few moments, it may seem insignificant.

But as more of us turn to AI tools, these impacts start to add up. And increasingly, you don’t need to go looking to use AI: It’s being integrated into every corner of our digital lives.

Crucially, there’s a lot we don’t know; tech giants are largely keeping quiet about the details. But to judge from our estimates, it’s clear that AI is a force reshaping not just technology but the power grid and the world around us.

We owe a special thanks to Jae-Won Chung, Mosharaf Chowdhury, and Sasha Luccioni, who shared their measurements of AI’s energy use for this project. https://www.technologyreview.com/2025/05/20/1116327/ai-energy-usage-climate-footprint-big-tech/?utm_source=Global+Energy+Monitor&utm_campaign=689b47e840-EMAIL_CAMPAIGN_2025_05_19_12_14&utm_medium=email&utm_term=0_-689b47e840-621514978

Solar and wind make up 98 pct of new US generation capacity in Trump’s first three months

Stillwater plant combines 33 MW of the original baseload geothermal, 26 MW of solar PV and 2 MW of solar thermal power generation

Enel Green Power North America

Joshua S Hill, May 13, https://reneweconomy.com.au/solar-and-wind-make-up-98-pct-of-new-us-generation-capacity-in-trumps-first-three-months/

A new analysis of government data has revealed that solar and wind accounted for nearly 98 per cent of new electricity generating capacity in the United States through the first quarter of 2025, despite efforts by the new president to unravel clean energy efforts.

The Sun Day Campaign, a non-profit research and educational organisation founded by Ken Bossong, has been fighting the good fight since 1992, and has been an invaluable tool for journalists covering clean energy in the United States.

A review conducted by the Sun Day Campaign of data recently published by the US government’s Federal Energy Regulatory Commission (FERC) demonstrates the momentum driving the clean energy industry, even in the face of extreme political adversity.

According to the government’s own data, solar and wind accounted for nearly 98 per cent of new US electrical generating capacity added in the first quarter of 2025, and solar and wind were the only sources of new capacity in March – a month that was the nineteenth in a row that saw solar stand out as the largest source of new capacity.

A total of 447MW of solar was installed in March along with the 223.9MW Shamrock Wind & Storage Project in Crockett County, Texas.

Over the first three months of 2025, a total of 7,076MW of solar and wind was installed, accounting for 97.8 per cent of new capacity.

The remainder was made up with 147MW of new natural gas capacity and 11MW from oil.

On its own, solar accounted for two-thirds of all new generating capacity placed into service in March, and 72.3 per cent of new capacity through the first quarter of the year. That makes solar the largest source of new generating capacity per month since September 2023.

This also brings the total installed capacity of solar and wind up to 22.5 per cent of the country’s total available installed utility-scale generating capacity, accounting for 10.7 per cent and 11.8 per cent respectively.

On top of that, approximately 30 per cent of US solar capacity is considered small-scale, or rooftop solar, and is not in fact reflected in FERC’s data. If small-scale solar is added to utility-scale solar and wind, that brings the total share to a quarter of America’s total.

Adding other renewable energy sources – including hydropower (7.7%), biomass (1.1%) and geothermal (0.3%) – renewables accounts for 31.5 per cent of total US utility-scale generating capacity.

FERC itself also expects a “high probability” that new solar capacity additions between April 2025 and March 2028 will total 89,461MW – by far and away the largest source of new capacity. For comparison, over that period, FERC expects 129,609MW of new capacity to be installed, meaning that there is a “high probability” that solar will account for 69 per cent. The next highest source of “high probability” generating capacity is wind energy, with 22,279MW, followed by 16,947MW worth of natural gas.

Conversely, FERC expects there to be no new nuclear capacity installed in its three-year forecast, while coal and oil are projected to contract by 24,372-MW and 2,108-MW respectively. And while new natural gas capacity is expected, that 16,947MW is offset by 15,209MW worth of retirements, resulting in an expansion of only 1,738MW.

“Thus, adjusting for the different capacity factors of gas (59.7%), wind (34.3%), and utility-scale solar (23.4%), electricity generated by the projected new solar capacity to be added in the coming three years should be at least 20 times greater than that produced by the new natural gas capacity while the electrical output by new wind capacity would be over seven times more than gas,” said Sun Day.

Finally, the Sun Day Campaign is currently predicting that all utility-scale renewables will account for 37.5 per cent of total available installed utility-scale generating capacity by April 1, 2028, “rapidly approaching” that of natural gas (40.2 per cent).

“If those trendlines continue, utility-scale renewable energy capacity should surpass that of natural gas in 2029 or sooner,” says Sun Day.

“Notwithstanding the Trump Administration’s anti-renewable energy efforts during its first 100+ days, the strong growth of solar and wind continues,” said Ken Bossong, Sun Day Campaign’s executive director.

“And FERC’s latest data and forecasts suggest this will not change in the near-term.”

Joshua S. Hill is a Melbourne-based journalist who has been writing about climate change, clean technology, and electric vehicles for over 15 years. He has been reporting on electric vehicles and clean technologies for Renew Economy and The Driven since 2012. His preferred mode of transport is his feet.

Techno-optimism alone won’t fix climate change.

Sussex Energy Group 12th May 2025 by Ruby Loughman , https://blogs.sussex.ac.uk/sussexenergygroup/2025/05/12/techno-optimism-alone-wont-fix-climate-change/

This blog post was originally published by the Energy Demand Research Centre (EDRC), 2 May 2025, written by Professor Mari Martiskainen.

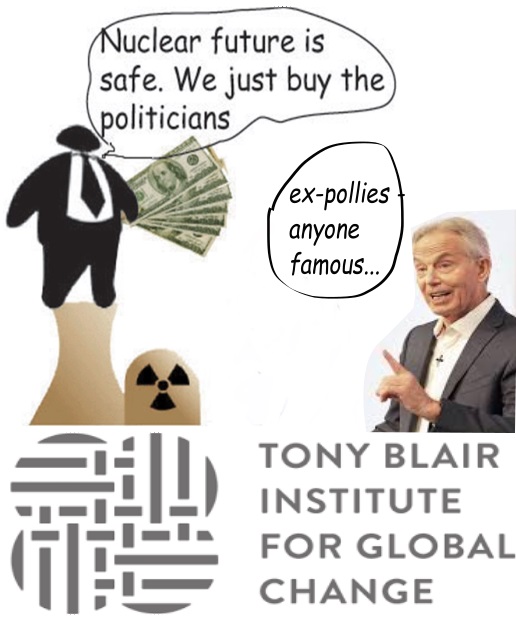

Ex-prime minister Tony Blair was making headlines this week by saying that current Net Zero policies are ‘doomed to fail’. In a new report by the Tony Blair Institute (TBI), he argues that voters “feel they’re being asked to make financial sacrifices and changes in lifestyle when they know the impact on global emissions is minimal”. It is an unprecedented call from a former prime minister whose party has been leading climate action in the UK. I will pick up on three key points in relation to the importance of climate action.

The science on climate change is clear

First, the science is clear. Unless we take action, climate change is going to have even more devastating impacts on our societies and the global economy. Countries such as China are seeing this as a big financial opportunity in winning the green race. The evidence on the economic prize is sound and clear: the opportunity for the UK economy is enormous relative to the impact we can have on global emissions, where green growth should be seen as this century’s central opportunity for growing more equitable prosperity.

People want climate action and clear government leadership

Second, people want to take climate action, and for that they want clear leadership from government. While the TBI report questions people’s willingness to undertake lifestyle choices, for example, it is clear from a host of academic and policy studies that people want to act and are ready to change, as long as they get clarity on what is expected. For example, the world’s largest standalone survey on climate change by UNDP found that 80% of people globally want their country to do more on climate change, and 72% want their country to move away from fossil fuels to clean energy quickly.

An academic survey of 125 countries by Andre and colleagues found that “69% of the global population expresses a willingness to contribute 1% of their personal income, 86% endorse pro-climate social norms and 89% demand intensified political action.” Many people have important conditions for this transition, such as it being fair. Crucial issues for policy attention include ensuring that people can have confidence on the value that their own financial commitments will deliver, privately and publicly. This means also the government committing to a genuinely ‘just transition’ in terms of jobs and delivering greener growth.

People must be at the centre of climate solutions

Third, the report calls for ‘actions for positive disruption’, and by this it means accelerating and scaling technologies that capture carbon, harnessing the power of AI, investing in frontier energy solutions, and scaling nature-based solutions. The latter are very welcome, but a major focus on nuclear, carbon capture and AI relates to techno-optimism and the widely debunked approach that technology alone will fix the world’s problems.

This approach leaves out a range of positive socio-technical approaches where people are at the centre of climate solutions. It also misses out on the numerous benefits that could be achieved by engaging citizens in the energy transition. A truly positive disruptive action would be for example to question the high-consuming lifestyles and excess energy consumption that many countries have, including some of those petrostates that TBI has worked for.

It also needs to recognise the opportunity that energy demand action can have in reducing emissions while also enabling a better quality of life for many. The TBI report for example claims that “proposed green policies that suggest limiting meat consumption or reducing air travel have alienated many people rather than bringing them along”. However, our research with people in the UK, for example, has found that there is support for a substantial shift in diets, including reduced meat and dairy consumption.

Addressing climate change needs to be a joined-up, global effort. This needs trusted, robust and impartial evidence applied in a world of vested interests and misinformation. Net zero policies themselves have not become toxic for the majority, yet we should not discount people’s concerns about the changes needed. Technology alone, however, is not the solution.

How Miliband can make renewables cheaper – but there is really no alternative to renewables

giving longer term contracts to renewable energy developers will make solar and wind schemes even cheaper

In a world where the costs of building all sorts of power plants are

increasing, the Government has a powerful card up its sleeve to keep down

the cost of new renewable energy projects. The Government is considering

extending the contract length under which new renewable energy projects

receive their fixed payments per MWh that is generated.

If contracts for

difference (CfDs) are issued to last for 20 years instead of 15 years, this

could reduce the price of power from the renewable projects by at least 10

per cent (according to my calculations). By offering lower annual returns

over a longer period, the projects can be delivered for a lower fixed price

per MWh that is generated. Such a cost reduction seems likely to offset any

temporary (Trump-induced) cost increases for renewables.

The ‘Trump

effect’ may have led Orsted to discontinue its massive 2.4 GW Hornsea 4

offshore wind project near East Anglia. However, some commentators such as

Jerome Guillet argue that Orsted should have planned better to avoid this

outcome. Other countries operating the CfD system for renewable energy

employ 20-year contracts, and it has always been a mystery to me why the UK

Treasury plumped for a 15 year period. This is an artificially short period

compared to the project lifetime of 25 or 30 years.

Hinkley C, by contrast,

was given a 35-year premium price contract. Meanwhile, the French

Government is pressing the UK Government to put more money into the

long-delayed construction of the Hinkley C power plant. This, it seems, is

part of the price for EDF agreeing to the construction of the successor

Sizewell C plant. This is even though Hinkley C was given a contract that

pays it over £130 per MWh in today’s prices.

That compares to the most

recent auctions of wind and solar PV, whose contracts are worth £71-£83

per MWh at 2025 prices. As I write this, there appears to be a standoff in

negotiations over the terms for Sizewell C between the British and French

governments.

Quite apart from the cost, the idea that nuclear power is

going to be delivered anytime soon is fanciful. The idea that so-called

small modular reactors are any sort of alternative to the big ones is

ridiculous. They are just more expensive still!

At the end of the day,

energy efficiency and renewables are the only real options. After all, over

90 per cent of the new generation being deployed in the world last year was

renewable, almost all of it being solar or wind. The reason this is

happening is that their costs are falling and they continue to fall.

Renewables are the present and future. We need more electricity to

electrify transport, heating, and much else. Sceptics may rail and sneer at

Miliband’s clean power programme. If it has any faults, it is because it

is too mainstream, wasting money and time on carbon capture and storage and

nuclear power.

Dave Toke’s Blog 8th May 2025 https://davidtoke.substack.com/p/how-milband-can-make-renewables-cheaper

Rooftop solar can be torn out of capital’s hands

Decentralised solar has the potential to support co-operative, municipal

and other forms of community ownership and control. Solar power is

expanding across the global south, growing faster in China, India and

Brazil than in older, richer solar developers like the US, Japan and

Germany.

Big, corporate-owned solar farms now account for most of the

world’s solar capacity, but decentralised rooftop solar comes a close

second. Rooftop panels are often owned by households, especially in rich

countries, but overall are more likely to be owned by businesses – energy

companies that lease the rooftops, or industrial firms that generate

electricity for their own use.

Nevertheless, I will argue here, because of

its scale and simplicity, decentralised solar has the potential to support

co-operative, municipal and other forms of community ownership and control.

It can play a role in struggles to supercede the domination of capital with

a socially just society, and to forestall disastrous climate change.

Ecologist 7th May 2025, https://theecologist.org/2025/may/07/rooftop-solar-can-be-torn-out-capitals-hands

Dispatch from France | May ’25

Clean Energy Wire, 02 May 2025, Camille Lafrance

Against the backdrop of the major blackout on the Iberian Peninsula in late April, which also affected parts of France, the country is heading for controversial discussions about its energy strategy for the coming decade. A focus will be on the future roles of renewables and nuclear power. The launch of France’s new generation of nuclear power plants was postponed for several years, while the country’s older reactors continue to cause problems.

- Delay to new generation of nuclear power plants – France’s new generation of nuclear power plants (known as EPR2) is set to go online three years later than previously planned. It is now meant to become operational by 2038, instead of 2035. EPR2 reactors are supposed to be simpler and cheaper to build. The EPR2 programme will be financed by a government loan, which should cover at least half the construction costs. EDF has called for more state money in order to reign in debt.

- Uranium supply and diplomacy – France could lose a large part of its uranium stockpile in Niger as that country’s hostile military leadership might sell it to Russia or China. The mine was operated by French state-owned uranium company Orano’s local subsidiary until the end of 2024. France is entirely dependent on uranium imports. In response, state-owned uranium company Orano is planning to mine the raw material needed for France’s fleet of 57 nuclear reactors in Uzbekistan………………………..

- The Flamanville saga continues – A new malfunction at the controversial Flamanville nuclear power plant has reignited a debate about the future of France’s ageing fleet of nuclear reactors. One of its reactors suffered a steam leak in late March. The incident occurred just one week after the reactor returned to the grid following a two-month maintenance shutdown. The plant already has a twelve-year history of delays and a ballooning budget (from 3.3 billion to 13.2 billion euros)………………………………….. https://www.cleanenergywire.org/news/dispatch-france-may-25

Nuclear Free Local Authorities call for more NGO cash and solar panels on Sellafield nuke plant.

Responding to the Nuclear Decommissioning Authority’s consultation on its latest three-year draft Business Plan (2025 – 8), the NFLAs have made modest calls for more cash for nuclear groups engaged in stakeholder consultation and for Sellafield to install solar panels to reduce electricity use.

Reiterating a request made forcefully by the NFLA Secretary to last year’s NDA Stakeholder Summit, we once more requested financial support for non-government organisations engaged in stakeholder dialogue. At present, a wide range of NGOs are represented on two Forums, one generalist, but the other specialising in examining the challenges attendant to the Geological Disposal Facility. Delegates invited to in-person Forum meetings or other events have historically had expenses reimbursed but have never received an honorarium. At the last Stakeholder Summit, NGO participants were refused reimbursement of travel costs and, facing the possibility of being substantially out of pocket, attendance declined. By way of pushback, we stated in our response: ‘If the NDA truly valued stakeholder consultation it would set out in this Business Plan a commitment to provide some financial support to the NGO community.’

The NFLAs have also made an appeal for GDF Community Partnerships to be granted cash and autonomy to commission third-party independent research and advice. At present, Nuclear Waste Services has a tight hold on the purse-strings and any request for information initiated by GDF panel members is vetted by NWS who draw on NDA group resources or go to other approved external sources.

In the second core strand of our response, we returned to a past aspiration – that the NDA generate ‘an increasing proportion of the energy that it consumes in the course of its work from installing renewable energy technologies on its estate’. Sellafield places great demands on the national grid; the business may have made a great play on replacing its carbon-guzzling shunting locomotives with electric ones, yet, on a recent visit, the NFLA Secretary saw that there was currently zero renewable electricity generation on site. There are a huge number of buildings, many of which will not be decommissioned and demolished for decades, so there must be possible to install solar panels on many of them. The NDA also has significant land holdings around Sellafield that could accommodate wind turbines.

AI’s Energy Demands and Nuclear’s Uncertain Future

Challenges for Nuclear Power

The primary obstacle for nuclear energy, particularly SMRs, is cost—and the fact that they currently do not exist and are therefore unproven. Since the 1960s, only extra-large reactors (600–1,400 MWe) have been economically viable due to economies of scale: it is more cost-effective to build a single large reactor than many smaller ones. SMRs, despite their promise, face similar financial hurdles.

Allison Macfarlane, April 16, 2025 https://gjia.georgetown.edu/2025/04/16/ais-energy-demands-and-nuclears-uncertain-future/

The closing months of 2024 witnessed a series of deals between the nuclear industry and AI technology companies. These agreements may represent a step toward ensuring a steady energy supply for AI while providing much-needed revenue for nuclear power companies. This article examines the challenges of nuclear power meeting AI’s energy demands and argues that these challenges are significant, the demand itself remains uncertain, and a more cautious approach to government investment in this sector is warranted.

The New Deals

In recent months, AI companies have seen a surge in interest in nuclear energy, driven by the increasing power demands of data centers. Tech giants are looking for reliable, low-carbon power sources to sustain their operations, leading to strategic investments in nuclear projects. However, the nature of these investments varies significantly, with some focusing on established technology and others betting on unproven innovations.

In September 2024, Microsoft signed an agreement with Constellation Energy to purchase power for its data centers by restarting the Three Mile Island plant in Pennsylvania. Closed in 2019 due to economic challenges, it is yet to be determined whether Microsoft’s agreement will be financially viable. The $1.6 billion plan involves refurbishing the plant, renewing its operating license, and resuming operations by 2028.

The following month, both Google and Amazon announced investments in small modular reactors (SMRs)—nuclear reactors producing less than 300 MWe—to power future AI data centers. Amazon partnered with X-Energy—a designer of high-temperature gas reactors—and other firms, committing $500 million to reactor design, licensing, and TRISO fuel fabrication. Additionally, Amazon secured an agreement with X-Energy and Energy Northwest, a consortium of Washington state utility companies, to procure at least 320 MWe from four reactor modules.

Meanwhile, Google signed a Master Plant Development Agreement with Kairos, a company developing molten salt-cooled, TRISO fuel-powered reactors. The deal aims to deploy 500 MWe by 2035, with the first reactor expected online by 2030. Kairos is ahead of X-Energy in development, receiving a US Nuclear Regulatory Commission construction license in November 2024 for its small-scale Hermes 35 MWe demonstration reactor in Oak Ridge, Tennessee.

It is essential to distinguish between these agreements. Microsoft is investing in a proven, decades-old nuclear power plant, betting on established technology with the potential for continued operation. In contrast, Amazon and Google are investing in speculative projects. No SMRs currently operate in the United States or Europe. While Russia has deployed a floating SMR and China has a single demonstration SMR, no such reactors exist in the Western world, and their performance and economic viability remain unproven.

Despite the enthusiasm surrounding these deals, their potential to tangibly increase nuclear power remains uncertain. Identifying successful collaboration models between AI companies and the nuclear industry, if any exist, will be crucial. Governments must carefully evaluate the soundness of their investments in this evolving sector and compare them with more immediate, cost-effective solutions such as wind, solar, geothermal, and storage.

The Reality of AI’s Energy Demand

AI data centers may consume vast amounts of electricity, and future expansions could increase energy demand. However, a recent McKinsey report suggests that the primary challenge in the United States is not increasing energy production but overcoming limitations in grid connections and transmission. Expanding transmission infrastructure and using existing and mature energy technology may be a more practical solution.

Moreover, AI’s energy needs may not escalate as anticipated. Emerging innovations, such as in-memory computing, optical data transmission, and 3D stacked computing, could significantly reduce AI’s power consumption. Additionally, increased model efficiency and potential shifts in AI usage patterns could further curb demand.

The Chinese model DeepSeek, for example, demonstrates that significantly less energy may be required for AI advancement. DeepSeek, whose product is similar to OpenAI’s ChatGPT, reportedly consumes ten to forty times less energy than its counterparts due to more efficient chip usage.

Government intervention could also temper AI’s energy consumption. Regulatory bodies have already taken steps to ensure grid stability, as seen when the US Federal Energy Commission blocked a proposed deal between Amazon, Talen Energy’s Susquehanna nuclear plant, and PJM Interconnection. The commission ruled that diverting power to Amazon’s data centers would jeopardize grid reliability and consumer prices.

Challenges for Nuclear Power

The primary obstacle for nuclear energy, particularly SMRs, is cost—and the fact that they currently do not exist and are therefore unproven. Since the 1960s, only extra-large reactors (600–1,400 MWe) have been economically viable due to economies of scale: it is more cost-effective to build a single large reactor than many smaller ones. SMRs, despite their promise, face similar financial hurdles.

NuScale, for example, initially designed a 50 MWe reactor and obtained US Nuclear Regulatory Commission (NRC) design certification, only to later pivot to a more cost-effective 77 MWe model currently under review at the NRC. Oklo Inc., a microreactor designer, followed a similar trajectory, moving from a 1 MWe model to a 15 MWe design, and is now considering a 75 MWe reactor.

Furthermore, claims that factory production of nuclear reactors will reduce costs remain unproven. The Westinghouse AP-1000 reactor, designed for modular assembly and built in a factory, ultimately faced quality control issues that resulted in cost and schedule overruns and contributed to Westinghouse’s 2017 bankruptcy. The two AP-1000 reactors at Georgia’s Vogtle plant took over a decade to complete and cost over $35 billion, far exceeding the original $14 billion estimate.

Construction delays are another persistent issue. Recent reactor projects in France, Finland, the United Kingdom, China, and the UAE have all experienced significant schedule overruns, ranging from three to fourteen years. Cost overruns are similarly widespread, with some projects exceeding initial estimates by factors of two or four

Beyond financial concerns, SMRs introduce additional challenges, including waste disposal, security, and nuclear proliferation risks. The United States has no long-term plan for nuclear waste disposal, as progress towards a deep geologic repository for disposal of high-level nuclear waste remains at an impasse, with Congress last appropriating funds in 2010. Advanced reactors could exacerbate this issue with increased waste volumes and complex processing requirements. Additionally, higher fuel enrichment levels and potential reprocessing needs will necessitate stringent security and safeguard measures, further raising costs.

The Path Forward

Investing in nuclear power—especially unproven SMRs—would require tens to hundreds of billions of dollars, a level of funding dependent on government support. The critical question is whether this investment will yield sufficient returns.

Interest in nuclear-powered AI data centers is growing worldwide, with countries like France exploring nuclear options for new data centers. While expanding nuclear capacity in established nuclear nations may be feasible, introducing nuclear power in non-nuclear countries presents significant hurdles. Establishing legal and regulatory frameworks, securing financing, and integrating reactors into existing grids would take decades and require substantial investment.

Governments must therefore invest carefully. SMRs are unlikely to be ready to meet significant electricity needs for another twenty years or more, by which time electricity markets will have evolved, with cheaper storage and renewables more widely available. The most viable short-term nuclear option—Microsoft’s approach of reviving existing plants—is limited, as few shut-down but not decommissioned plants remain. In the interim, governments should prioritize investments in proven energy sources, such as wind, solar, geothermal, and storage technologies. For non-nuclear nations, a rigorous cost-benefit analysis of nuclear energy, including full lifecycle costs and deployment challenges, is essential. If, in the coming decade, nuclear power—particularly SMRs—proves economically unfeasible, investments in the sector will be for naught.

TIDES, NUKES AND BIRDS

Over the years, I’ve been hugely critical of what I call the ‘all of

the above’ brigade – made-up largely of nuclear enthusiasts who don’t

want to be seen trashing renewables in public but are desperate to keep new

nuclear (both big and small) in the mix to meet future electricity demand

here in the UK – even though it’s abundantly clear that nuclear cannot

compete with renewables on cost, construction time or even reliability. We

now have a wonderful opportunity to do a properly rigorous analysis of

‘nuclear vs renewables’ – this time, with the focus on tidal energy

rather than wind or solar as is usually the case. The biggest threat to the

potential for tidal energy on the Severn is the Government’s obsessive

support for nuclear power – including the prospect of a massive new power

station at Sizewell C on the Suffolk coast (with a Final Investment

Decision said to be “imminent”), as well as ‘in principle’ support

for so-called ‘ Small Modular Reactors.’

Jonathon Porritt 16th April 2025 https://jonathonporritt.com/tidal-energy-severn-estuary-nuclear-vs-nature/

-

Archives

- February 2026 (115)

- January 2026 (308)

- December 2025 (358)

- November 2025 (359)

- October 2025 (376)

- September 2025 (258)

- August 2025 (319)

- July 2025 (230)

- June 2025 (348)

- May 2025 (261)

- April 2025 (305)

- March 2025 (319)

-

Categories

- 1

- 1 NUCLEAR ISSUES

- business and costs

- climate change

- culture and arts

- ENERGY

- environment

- health

- history

- indigenous issues

- Legal

- marketing of nuclear

- media

- opposition to nuclear

- PERSONAL STORIES

- politics

- politics international

- Religion and ethics

- safety

- secrets,lies and civil liberties

- spinbuster

- technology

- Uranium

- wastes

- weapons and war

- Women

- 2 WORLD

- ACTION

- AFRICA

- Atrocities

- AUSTRALIA

- Christina's notes

- Christina's themes

- culture and arts

- Events

- Fuk 2022

- Fuk 2023

- Fukushima 2017

- Fukushima 2018

- fukushima 2019

- Fukushima 2020

- Fukushima 2021

- general

- global warming

- Humour (God we need it)

- Nuclear

- RARE EARTHS

- Reference

- resources – print

- Resources -audiovicual

- Weekly Newsletter

- World

- World Nuclear

- YouTube

-

RSS

Entries RSS

Comments RSS