G7 Leaders Agree To Provide Ukraine With $50 Billion Using Frozen Russian Assets

The step will mark a significant escalation in the economic war against Russia

by Dave DeCamp June 13, 2024

Group of Seven leaders agreed at a summit in Italy on Thursday to give Ukraine $50 billion using frozen Russian Central Bank assets, a step that marks a significant escalation in the economic war against Russia.

The plan is to provide the $50 billion to Ukraine by the end of the year in the form of a loan, which will be paid back using profits from the approximately $280 billion in frozen Russian assets held by the US and its allies.

The idea is seen as a compromise between the US and Europe, as President Biden wanted to steal all of the frozen Russian funds to give to Ukraine. But the vast majority of the money is held in Europe, and EU leaders were hesitant to do that.

Instead, the EU devised a separate plan to provide Ukraine with about $3 billion per year using the interest made by the Russian assets. Ukraine said that amount wasn’t enough, and the US proposed the $50 billion loan.

“This has been something that the United States has put a lot of energy and effort into,” National Security Advisor Jake Sullivan told reporters. “We see proceeds from these assets as a valuable source of resources for Ukraine at a moment when Russia continues to brutalize the country, not just through military action on the front but through the attempted destruction of its energy grid and its economic vitality.”

Russia has made clear it would view either plan as the theft of its sovereign funds and is preparing to retaliate. Stealing the money makes reconciliation between Russia and the West even less likely since lifting sanctions would mean having to give assets back to Moscow that have already been spent. The move will also reduce faith in the Western banking system and speed up global de-dollarization.

Building Nuclear Power Is a Bridge Too Far for World’s Private Investors

- Taxpayers seen needing to backstop construction costs and risk

- Window on new nuclear power to mitigate climate change closing

Bloomberg, 14 June 24

The next generation of nuclear reactors will need to be financed by taxpayers because private investors aren’t willing to bear the risks associated with building new plants.

That was the warning from bankers at a meeting of industry and government officials in Prague this week. The Nuclear Energy Agency event underscored the hard decisions Western economies soon need to make to keep one of their biggest clean energy sources going. While the public have warmed to nuclear in recent years, spiraling project costs have made private equity cautious.

Officials have estimated that the world needs to spend $5 trillion to triple nuclear-power generation over the next 25 years. The problem is that years of delays and billion-dollar budget overruns at European and the US projects are spooking investors, and scores of reactors already running on borrowed time will need to be replaced. No private investors want to take on construction risks, said Simon Taylor, a financier at the Cambridge Nuclear Energy Centre.

“We’re at a critical juncture of in the history of nuclear energy,” said William Magwood, director general of the Nuclear Energy Agency. “We have to move quickly. Financing is critical.”

Earlier this year, Electricite de France SA said its nuclear project at Hinkley Point in the UK would cost as much as £10 billion ($13 billion) extra to build and take several years longer than planned. In the US, Southern Co.’s Vogtle nuclear facility came in more than $16 billion over budget and seven years behind schedule.

While some private capital has gone toward designing small modular reactors — factory-built units theoretically cheaper to build than traditional plants — those projects have also been plagued by delays pushing full commercialization years later than expected. That leaves nuclear advocates struggling for investor support with the technology at hand.

Can Small Nuclear Reactors Really Help The Climate?

Rothschild & Co.’s Steven Vaughan, an adviser for UK’s proposed Sizewell C nuclear plant, echoed the view that investors are wary of taking on exposure to construction risk.

Equity investment interest in Sizewell, currently owned by the UK government and minority stakeholder EDF, has been muted, with Centrica Plc suggesting it could become a stakeholder.

Compounding nuclear power project risks are the long life span of the assets and the uncertain development of electricity markets. Historically, nations alleviated that risk by building reactors themselves. That’s still the case in China and Russia — the two countries building the most plants………….

“There is a vast need for state involvement,” said Marcin Kaminski, risk manager building Poland’s first reactors at Polskie Elektrownie Jadrowe. https://www.bloomberg.com/news/articles/2024-06-14/building-nuclear-power-is-a-bridge-too-far-for-world-s-private-investors

Are the prospects for Small Modular Reactors being exaggerated? Five key characteristics examined

June 11, 2024 by Ed Lyman, Ed Lyman is Director, Nuclear Power Safety, at the Union of Concerned Scientists

Small Modular Reactors (SMRs) are being presented as the next generation of nuclear technology. While traditional plants face cost overruns and safety issues, SMRs are seen by their champions as cheaper, safer, and faster to deploy. But Ed Lyman at UCS cites evidence that cast these claims into doubt.

In five sections of this article, he lists the reasons why. SMRs are not more economical than large reactors. SMRs are not generally safer or more secure than traditional large light-water reactors. SMRs will not reduce the problem of disposal of radioactive waste. SMRs cannot be counted on to provide reliable and resilient off-the-grid power (for facilities like data centres, bitcoin mining, hydrogen or petrochemical production). SMRs do not use fuel more efficiently than large reactors.

And where problems might be ironed out over time, the learning cycle of such technology is measured in decades during which costs will remain very high. SMRs may have a role to play in our energy future, says Lyman, but only if they are sufficiently safe and secure, along with a realistic understanding of their costs and risks.

Even casual followers of energy and climate issues have probably heard about the alleged wonders of small modular nuclear reactors (SMRs). This is due in no small part to the “nuclear bros”: an active and seemingly tireless group of nuclear power advocates who dominate social media discussions on energy by promoting SMRs and other “advanced” nuclear technologies as the only real solution for the climate crisis. But as I showed in my 2013 and 2021 reports, the hype surrounding SMRs is way overblown, and my conclusions remain valid today.

Unfortunately, much of this SMR happy talk is rooted in misinformation, which always brings me back to the same question: if the nuclear bros have such a great SMR story to tell, why do they have to exaggerate so much?

What are SMRs?

SMRs are nuclear reactors that are “small” (defined as 300 megawatts of electrical power or less), can be largely assembled in a centralised facility, and would be installed in a modular fashion at power generation sites. Some proposed SMRs are so tiny (20 megawatts or less) that they are called “micro” reactors. SMRs are distinct from today’s conventional nuclear plants, which are typically around 1,000 megawatts and were largely custom-built. Some SMR designs, such as NuScale, are modified versions of operating water-cooled reactors, while others are radically different designs that use coolants other than water, such as liquid sodium, helium gas, or even molten salts.

To date, however, theoretical interest in SMRs has not translated into many actual reactor orders. The only SMR currently under construction is in China. And in the United States, only one company — TerraPower, founded by Microsoft’s Bill Gates — has applied to the Nuclear Regulatory Commission (NRC) for a permit to build a power reactor (but at 345 megawatts, it technically isn’t even an SMR).

The nuclear industry has pinned its hopes on SMRs primarily because some recent large reactor projects, including Vogtle units 3 and 4 in the state of Georgia, have taken far longer to build and cost far more than originally projected. The failure of these projects to come in on time and under budget undermines arguments that modern nuclear power plants can overcome the problems that have plagued the nuclear industry in the past.

Developers in the industry and the US Department of Energy say that SMRs can be less costly and quicker to build than large reactors and that their modular nature makes it easier to balance power supply and demand. They also argue that reactors in a variety of sizes would be useful for a range of applications beyond grid-scale electrical power, including providing process heat to industrial plants and power to data centres, cryptocurrency mining operations, petrochemical production, and even electrical vehicle charging station

Here are five facts about SMRs that the nuclear industry and the “nuclear bros” who push its message don’t want you, the public, to know.

1. SMRs are not more economical than large reactors. 2. SMRs are not generally safer or more secure than large light-water reactors. 3. SMRs will not reduce the problem of what to do with radioactive waste. 4. SMRs cannot be counted on to provide reliable and resilient off-the-grid power for facilities, such as data centers, bitcoin mining, hydrogen or petrochemical production. 5. SMRs do not use fuel more efficiently than large reactors

Continue readingShould USS Investment Builder invest in nuclear power?

Government talks about sharing the benefits if the project comes in ahead of time and cost, but this is fantasy land. Nuclear projects are invariably late and overbudget. From a reputational point of view, USS’s investment in Thames Water has been damaging, but association with Sizewell C could turn out far worse.

Steve Thomas, Coordinating Editor, Energy Policy, Emeritus Professor of Energy Policy

Public Services International Research Unit (PSIRU), Business School , University of Greenwich 5 June 24 https://divestuss.org/news/

The British government is scouring the world for investors willing to invest in its Sizewell C project. USS has been named as one of six investors shortlisted for the project, perhaps with a stake of about £600m. Would investing in Sizewell C using the Regulated Asset Base (RAB) model be a wise investment for USS funds? From a wider perspective, would it contribute usefully to the government’s target of ‘net zero’ greenhouse gas emissions by 2050 and would it offer cheap power?

Sizewell’s predecessor, the Hinkley Point C project to build two EPR reactors has been a disaster both for UK consumers and for its main owner, Electricité de France (EDF). In 2008 when the project was announced, EDF claimed Christmas turkeys would be cooked using power from the plant in 2017 and the government claimed the reactors would cost £5.6bn. By the time the final investment decision was taken in 2016, completion had slipped to 2025 and the cost had gone up to £18bn (2015 money). The price consumers would have to pay for the power was high, £92.5/MWh (2012 money) or about £130/MWh in 2024 money. The one saving grace for consumers was that the price was fixed in real terms and when construction costs escalated, they fell on EDF. In January 2024, the cost and time estimate for Hinkley had increased to £31-35bn (2015 money) or up to £46bn in 2024 money with completion in 2029-31.

Luckily, Britain was not relying on Hinkley to keep the lights on. As a result, in its most recent annual report, EDF announced it was writing off €12.9bn, a large proportion of its investment to date. Press reports talk about the Sizewell project, claimed to be a duplicate of Hinkley, costing about £20bn, implying it could be built for less than half the cost of Hinkley and this is clearly implausible. Even if it could be built for 20% less than Hinkley, that would still imply a cost of nearly £40bn.

European predecessor projects using the same technology as Hinkley and Sizewell, Olkiluoto in Finland and Flamanville in France, have also been disasters taking 18 years to build and coming in at 3-4 times overbudget.

Soon after the Hinkley investment decision was taken, EDF realised its error and abandoned plans to build Sizewell using the same financial model as Hinkley.

Continue readingTODAY. Jobs jobs jobs in the nuclear industry – but is it true?

Go to Google news for nuclear information, and you’ll be swamped with glowing stories from the World Nuclear Association, the IAEA, and the big corporate media outlets – all about the wonderful future for the nuclear industry- –

all those jobs! including in the lovely nuclear weapons industry.

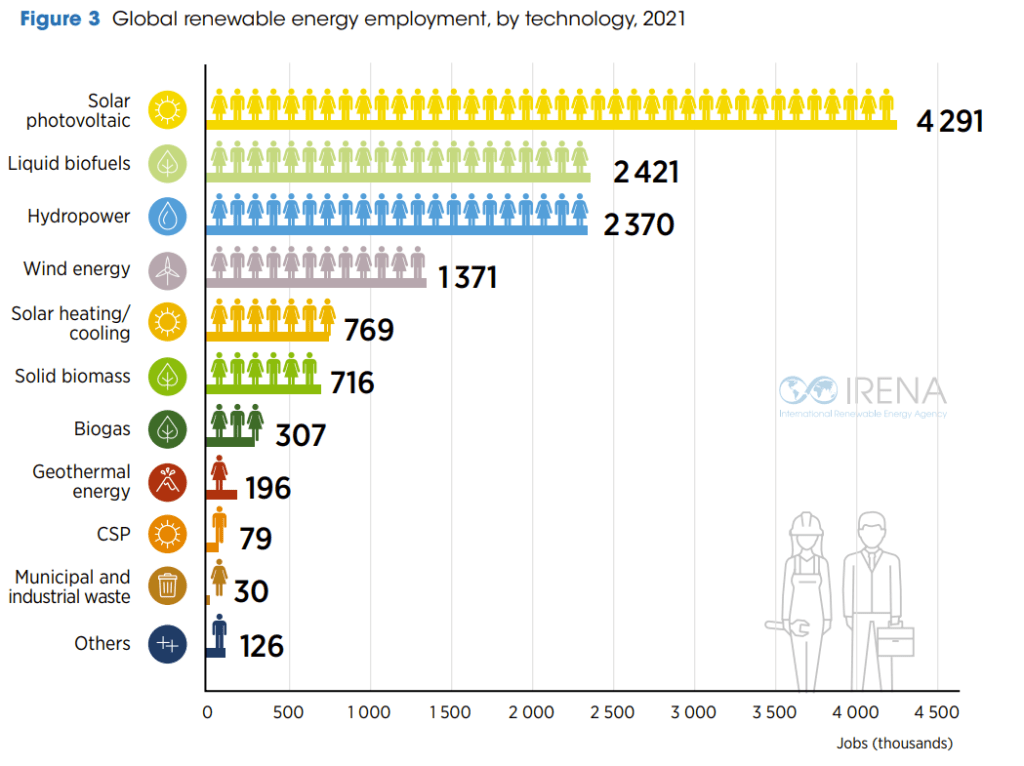

Jobs in renewable energy. This year’s report finds that renewable energy employment worldwide has continued to expand – to an estimated 13.7 million direct and indirect jobs in 2022. We can expect the creation of many millions of additional jobs in the coming years and decades. https://mc-cd8320d4-36a1-40ac-83cc-3389-cdn-endpoint.azureedge.net/-/media/Files/IRENA/Agency/Publication/2023/Sep/IRENA_Renewable_energy_and_jobs_2023.pdf?rev=4f65518fb5f64c9fb78f6f60fe821bf2

Jobs in nuclear power. I have not been able to find any kind of authoritative report on global jobs in nuclear power. I did find one source (on Quora) stating that each nuclear reactor in construction provides 1400-1800 jobs, and in operation 400 -700 jobs. The nuclear industry claims many more, but for construction, we must remember – this is all in the rather distant future.

The figure below is a prediction from many years ago. If we are to believe the nuclear lobby, this prediction should change rapidly.

What we do know is that at present, renewable energy jobs are increasing exponentially, and nuclear power building is almost at a standstill.

The figure on the left is also from many years ago. But I doubt that much has changed.

Of course – this is all about the actual reactors. There are many jobs in uranium mining, milling, transport etc, and of course, in nuclear weapons-making

The quality of jobs.

In energy efficiency there are many interesting and clean jobs. Also, workers know that they are contributing to a healthier planet – something to be proud of.

In renewable energy the jobs are relatively clean and healthy, and there’s again, the knowledge of being in an alternative to the polluting industries – coal and nuclear.

In nuclear energy and nuclear fuel, the workers are involved in the risky area of ionising radiation. There’s a huge amount of documentation on this. It is NOT a healthy job, though I suppose that it’s better to be a highly paid nuclear executive or lobbyist, safe in a nice office.

I doubt that nuclear workers can get much satisfaction about “helping the planet”, as the “peaceful” nuclear industry is so dirty, dangerous, and intimately connected with nuclear weapons.

No doubt some nuclear workers get paid a lot more than renewable energy workers do. But, there’s real value in knowing that your contribution to society is a clean and positive one.

Small Modular Reactors: Still too expensive, too slow and too risky.

Institute for Energy Economics and Financial Analysis.

1 Report SMRs (Small Modular Reactors) Nuclear Transition United States

Institute for Energy Economics and Financial Analysis. May 29, 2024, David Schlissel and Dennis Wamsted more https://ieefa.org/resources/small-modular-reactors-still-too-expensive-too-slow-and-too-risky?fbclid=IwZXh0bgNhZW0CMTEAAR1jnn-FMHaMbUkjLSR0kbe-ku3uRRLcwq5jFcZfx62d4vHIZilLTK73YOg_aem_Abj940YmQyHY2fHN3alfZYFxXGCjmhy7qqSR1SLZ7HipqrGxyOaplVTSCuk7GjV3z8ZxriI0DSoGaIg4KFv_B5L1

Key Findings

Small modular reactors still look to be too expensive, too slow to build, and too risky to play a significant role in transitioning from fossil fuels in the coming 10-15 years.

Investment in SMRs will take resources away from carbon-free and lower-cost renewable technologies that are available today and can push the transition from fossil fuels forward significantly in the coming 10 years.

Experience with operating and proposed SMRs shows that the reactors will continue to cost far more and take much longer to build than promised by proponents.

Regulators, utilities, investors and government officials should embrace the reality that renewables, not SMRs, are the near-term solution to the energy transition.

The rhetoric from small modular reactor (SMR) advocates is loud and persistent: This time will be different because the cost overruns and schedule delays that have plagued large reactor construction projects will not be repeated with the new designs. But the few SMRs that have been built (or have been started) paint a different picture—one that looks startingly similar to the past. Significant construction delays are still the norm and costs have continued to climb.

IEEFA has taken a close look at the data available from the four SMRs currently in operation or under construction, as well as new information about projected costs from some of the leading SMR developers in the U.S. The results of the analysis show little has changed from our previous work. SMRs still are too expensive, too slow to build, and too risky to play a significant role in transitioning from fossil fuels in the coming 10 to 15 years.

We believe these findings should serve as a cautionary flag for all energy industry participants. In particular, we recommend that:

- Regulators who will be asked to approve utility or developer-backed SMR proposals should craft restrictions to prevent delays and cost increases from being pushed onto ratepayers.

- Utilities that are considering SMRs should be required to compare the technology’s uncertain costs and completion dates with the known costs and construction timetables of renewable alternatives. Utilities that still opt for the SMR option should be required to put shareholder funds at risk if costs and construction times exceed utility estimates.

Investors and bankers weighing any SMR proposal should carefully conduct their due diligence. Things will go wrong, imperiling the chances for full recovery of any invested funds.

State and federal governments should require that estimated SMR construction costs and schedules be publicly available so that utility ratepayers, taxpayers and investors are better able to assess the magnitude of the SMR-related financial risks that they may be forced to bear.

Finally, it is vital that this debate consider the opportunity costs associated with the SMR push. The dollars invested in SMRs will not be available for use in building out a wind, solar and battery storage resource base. These carbon-free and lower-cost technologies are available today and can push the transition from fossil fuels forward significantly in the coming 10 years—years when SMRs will still be looking for licensing approval and construction funding.

Dounreay nuclear site workers strike in pay dispute

More than 500 workers at the Dounreay nuclear site have gone on strike in

a dispute over pay. Unite and GMB members have walked out after rejecting a

revised offer from Nuclear Restoration Services (NRS) made earlier this

month. Prospect union members accepted the deal after previously being

involved in the dispute at the complex near Thurso. Unite and GMB are

planning a further 24-hour strike on 19 June.

BBC 28th May 2024

UK Nuclear Plant Sizewell Continues Fundraising Before Election

- Banks offered to lend as much as £12.5 billion for Sizewell C

By Will Mathis, May 24, 2024

The developer of the UK’s Sizewell C nuclear power plant is pushing ahead to complete

financing for the project this year even as a looming election risks

complicating the timeline.

A group of banks offered to lend as much as

£12.5 billion ($15.9 billion) to help finance the plant in eastern

England, according to a person familiar with the matter. They include HSBC

Holdings Plc, NatWest Group Plc and Banco Santander SA, the person said.

Debt will play a role in a multibillion-pound funding effort that also

includes an ongoing effort to raise equity from private investors.

“The two main political parties are committed to Sizewell C and we are carrying

on with the capital raise, preparing for a final investment decision and

mobilizing teams on our site,” a spokesperson for Sizewell said,

declining to comment on the debt specifically.

HSBC and Santander declined to comment. NatWest didn’t immediately comment.

The government had vowed

to reach a final investment decision on the proposed 3.2-gigawatt Sizewell

C station in the current parliament, a process that was on track to

complete this summer. That means the final stage of the fund-raising

process could be among Labour leader Keir Starmer’s first acts if he

becomes prime minister. “Sizewell needs to move forward at pace,”

Starmer said during a visit to another nuclear plant last year. “New

nuclear has to be part of that mix.”

Bloomberg 23rd May 2024

Taxpayer contribution to Sizewell C nuclear plant could double

24 May, 2022 By Rob Hakimian https://www.newcivilengineer.com/latest/taxpayer-contribution-to-sizewell-c-nuclear-plant-could-double-24-05-2022/

Construction of the Sizewell C nuclear plant in Suffolk could cost taxpayers more than double what the government has suggested, according to new research

Construction of Sizewell C has not yet been confirmed, with the planning decision having recently been pushed back to July.

However, with the UK set to lose all of its functional advanced gas-cooling reactor (AGR) nuclear plants by 2028, the government is keen to push through plans for new plants as it has made nuclear energy a crux point of its net zero strategy and energy security strategy. It has already committed £100M to Sizewell C and, crucially, agreed to use the regulated asset base (RAB) funding model to pay for it.

The RAB model, which has previously been used to fund Tideway and Heathrow Terminal 5, allows investors to recoup some of their money during the construction phase of the project through taxation. The taxpayer pays for the plant through monthly surcharge on their taxes before they reap the rewards. The government says that, while the taxpayer will have to pay the surcharge during construction, they will save £10 a month through this method once the plant is operational.

However, if a project suffers delays and cost increases, this means the risk falls on the shoulders of the taxpayer. As seen by continual delays and cost hikes on Hinkley Point C, nuclear plants are particularly susceptible.

In its own analysis of using the RAB model to fund Sizewell C, the government has said that over the course of the plant’s 13-17 years construction it will add an average surcharge of £1 per month to household bills. However, the University of Greenwich School of Business says that the government’s calculations are based on 2021 prices and do not account for inflation over the course of the next two decades as the plant is built.

Taking into account inflation, based on the Treasury’s target level of 2%, Greenwich Business School has determined that the cost could be up to £2.12 per month on average over the course of the construction time. However, this is a relatively conservative estimate, as inflation could be much greater than 2% over the course of the next 20 years.

The government’s calculation is based on the median expectations for the construction of Sizewell C, i.e. that it will take 15 years (midway between the projected 13-17 years) and cost £35bn (midway between the estimated £26.3bn and £43.8bn).

Greenwich Business School has also looked at the best and worse case scenarios, adding 2% inflation. If the construction were to only last 13 years and cost £26.3bn, the taxpayer would fork out an additional £148.20 over the course (an average of 95p per month). If it is to last 17 years and cost £43.8bn, the taxpayer will pay an additional £431.90 over the duration (an average of £2.12 per month).

This figure could be even higher if the project runs beyond 17 years, costs over £43.8bn and/or inflation rises by more than 2%, all of which are distinct possibilities.

The RAB model, which has previously been used to fund Tideway and Heathrow Terminal 5, allows investors to recoup some of their money during the construction phase of the project through taxation. The taxpayer pays for the plant through monthly surcharge on their taxes before they reap the rewards. The government says that, while the taxpayer will have to pay the surcharge during construction, they will save £10 a month through this method once the plant is operational.

This figure could be even higher if the project runs beyond 17 years, costs over £43.8bn and/or inflation rises by more than 2%, all of which are distinct possibilities.

Both the government’s and Greenwhich Business School’s calculations are based on illustrative figures. More accurate figures will be known once planning has been granted and investment partners found.

This presents another issue, as there are no clear investors champing at the bit. While the government is bullish about nuclear’s potential green benefits, many potential investors are uncertain of its environmental, social and governance (ESG) credentials. Aviva Investors has even called out the government for not providing enough detail for a proper assessment on nuclear’s ESG potential.

University of Greenwich emeritus professor of energy policy Stephen Thomas told NCE: “There are differences between Tideway and Sizewell C. One is scale: Tideway is said to be a huge project, but the cost is not much more than a 10th of what Sizewell C will be, so it will be a big strain on that market.

- You are here: Latest

Taxpayer contribution to Sizewell C nuclear plant could double

24 May, 2022 By Rob Hakimian

Construction of the Sizewell C nuclear plant in Suffolk could cost taxpayers more than double what the government has suggested, according to new research.

Construction of Sizewell C has not yet been confirmed, with the planning decision having recently been pushed back to July.

However, with the UK set to lose all of its functional advanced gas-cooling reactor (AGR) nuclear plants by 2028, the government is keen to push through plans for new plants as it has made nuclear energy a crux point of its net zero strategy and energy security strategy. It has already committed £100M to Sizewell C and, crucially, agreed to use the regulated asset base (RAB) funding model to pay for it.

The RAB model, which has previously been used to fund Tideway and Heathrow Terminal 5, allows investors to recoup some of their money during the construction phase of the project through taxation. The taxpayer pays for the plant through monthly surcharge on their taxes before they reap the rewards. The government says that, while the taxpayer will have to pay the surcharge during construction, they will save £10 a month through this method once the plant is operational.

However, if a project suffers delays and cost increases, this means the risk falls on the shoulders of the taxpayer. As seen by continual delays and cost hikes on Hinkley Point C, nuclear plants are particularly susceptible.

In its own analysis of using the RAB model to fund Sizewell C, the government has said that over the course of the plant’s 13-17 years construction it will add an average surcharge of £1 per month to household bills. However, the University of Greenwich School of Business says that the government’s calculations are based on 2021 prices and do not account for inflation over the course of the next two decades as the plant is built.

Taking into account inflation, based on the Treasury’s target level of 2%, Greenwich Business School has determined that the cost could be up to £2.12 per month on average over the course of the construction time. However, this is a relatively conservative estimate, as inflation could be much greater than 2% over the course of the next 20 years.

The government’s calculation is based on the median expectations for the construction of Sizewell C, i.e. that it will take 15 years (midway between the projected 13-17 years) and cost £35bn (midway between the estimated £26.3bn and £43.8bn).

Greenwich Business School has also looked at the best and worse case scenarios, adding 2% inflation. If the construction were to only last 13 years and cost £26.3bn, the taxpayer would fork out an additional £148.20 over the course (an average of 95p per month). If it is to last 17 years and cost £43.8bn, the taxpayer will pay an additional £431.90 over the duration (an average of £2.12 per month).

This figure could be even higher if the project runs beyond 17 years, costs over £43.8bn and/or inflation rises by more than 2%, all of which are distinct possibilities.

Both the government’s and Greenwhich Business School’s calculations are based on illustrative figures. More accurate figures will be known once planning has been granted and investment partners found.

This presents another issue, as there are no clear investors champing at the bit. While the government is bullish about nuclear’s potential green benefits, many potential investors are uncertain of its environmental, social and governance (ESG) credentials. Aviva Investors has even called out the government for not providing enough detail for a proper assessment on nuclear’s ESG potential.

University of Greenwich emeritus professor of energy policy Stephen Thomas told NCE: “There are differences between Tideway and Sizewell C. One is scale: Tideway is said to be a huge project, but the cost is not much more than a 10th of what Sizewell C will be, so it will be a big strain on that market.

“The second difference is that there is output to sell from Sizewell C. Thames Tideway gets its money by being there and providing a service; if it’s there and it’s not utterly failed then that’s it. Sizewell C has kilowatt hours to sell, and there are risks in that because you don’t know how reliable the plant is going to be, you don’t know what the running costs are going to be, you don’t know what the fuel costs are going to be. So there are risks involved in that.

“The RAB is a bit of an illusion, because the kilowatt hour costs that they will quote are based on whatever it costs to ensure investors make their agreed return, no matter how high the price. It will ignore the surcharge paid during the construction phase, which is a huge subsidy by consumers. It is a blank cheque signed by consumers. It’s a dreadful model.”

A Sizewell C spokesperson said: “The RAB model is a proven financing arrangement which has already been used to raise funds for more than £160bn of infrastructure. Applied to Sizewell C, it will bring the cost of finance down and deliver significant savings to consumers.”

A government spokesperson said: “We firmly stand by our assessment that a large-scale project funded under our Nuclear Act would add at most a few pounds a year to typical household energy bills during the early stages of construction, and on average about £1 a month during the full construction phase of the project.”

European Investment Bank’s (EIB) financing for nuclear reactor construction remains off the agenda

By Paul Messad | Euractiv France, 24 May 24, https://www.euractiv.com/section/energy-environment/news/eib-financing-for-nuclear-reactor-construction-remains-off-the-agenda/

Despite a leak of the European Investment Bank’s (EIB) roadmap containing nothing new or concrete on nuclear financing, the industry continues to hold out for new money from the bank to support its planned expansion.

“The European Investment Bank is open to financing for nuclear”, said Yves Desbazeilles, Director General of NuclearEurope, the Brussels-based association for the defence of nuclear power, responding to the leak in comments to CarbonPulse last week.

The EIB document, which outlines its planned work for 2023-2027, does mention that ‘R&D for small modular reactors (SMRs)’ will be supported by the EIB. Desbazeilles argued that the new document is an open door for “several other” options for EIB support, such as for reactor construction, but no such reference seems likely in the final text.

However, several industry observers have told Euractiv that the document’s references are no more significant than those in the current roadmap (2021-2025), which already mentions R&D support for nuclear fission and fusion but nothing on electricity generation.

Technology-neutral approach

The financing of nuclear power is a live topic in Brussels, mainly since the President of the European Commission, Ursula von der Leyen, spoke positively about the technology at the Nuclear Summit (NES) in Brussels in March 2024. In recent months, the industry and several national governments have made a concerted push for EIB support for nuclear.

The EIB remains cautious about the prospect of financing nuclear energy.

The bank is the EU’s investment arm and between now and 2025, it plans to channel €1,000 billion into environmental and energy projects.

Within this framework, the bank is adopting a technology-neutral approach and is therefore not closed to supporting nuclear power, illustrated by a €145 million loan granted in December 2023 for safety operations in Romania.

However, irrespective of politics, investment in nuclear power is now less financially attractive than it was in the past.

Over the last 24 years, only €1 billion of EIB funds have been earmarked for nuclear power and only for parallel activities (R&D, safety, etc.). The last EIB investments in electricity generation occurred in 1987, for France’s two first Flamanville nuclear reactors.

Plant construction is where finance is most needed – installed nuclear capacity is set to triple between now and 2050 in Europe, including large and small reactors.

Profitability

The construction of reactors faces a severe problem regarding the prospects of EIB support: profitability.

Although it deploys public money, the EIB’s lending operations are intended to generate a return for the bank and the institution’s prestigious ‘AAA’ credit rating allows it to borrow on international markets at low interest rates.

To maintain this rating, the bank cannot lend where there is a significant risk that it will not get a return on the loan. Where the bank deploys riskier loans, it protects itself by seeking guarantees and demanding that the borrowers are financially solid.

While the solvency condition is more easily met when the applicant nuclear company, such as EDF in France, is state-owned, this provision is harder for start-ups and other private companies to satisfy.

Larger reactors built more recently have struggled with systematic cost overruns and delays. This has seriously tested the confidence of financiers, who worry that they will not get back their investments or that it will be too late.

This concern is despite expert arguments that the cost of future large reactors will fall by 20 to 30, as Europe will benefit from serially producing reactors again.

The business model for large reactors is well known, but for SMRs, “which have new applications, the models have yet to be invented”, Valérie Faudon, General Delegate of the French Nuclear Energy Society (SFEN), explained to Euractiv.

Ultimately, the risk of financing nuclear power remains high, as Thomas Ostros, Vice-President of the EIB, put it in mid-March during the Nuclear Energy Summit.

Le consensus

EIB loans must also be approved by national governments. Germany, Italy, Spain, and France have an important voice because of the significant capital they have subscribed to the bank.

As a result, France cannot rely on the support of the ten states members of the nuclear alliance alone, although it does enjoy the support of the institution’s president, Nadia Calvino of Spain. Italy has made positive noises to support SMR but has not yet provided concrete support for new EIB financing.

The EIB declined to comment on the leaked 2023-2027 roadmap.

[Edited by Donagh Cagney/Alice Taylor]

Wylfa nuclear power plan- a financial basket case- and no developer will take on the risks.

Dr Doug Parr, Chief Scientist for Greenpeace UK, said: “Government

announcements about new reactors have a theatrical quality that doesn’t

inspire confidence, particularly when the financial disaster movie of

Hinkley is still rolling in the background.

But Wylfa poses an additional

danger because, after the damage suffered by EDF, no developer will take on

the financial risks of construction. And so in the unlikely event of this

reactor being built, bill payers will be on the hook for billions of cost

overruns.

Just how badly that can play out is revealed by the one location

where the kind of funding structure favoured by the government has been

tried, in South Carolina in the USA. The bill payers of the state have seen

billions added to their bills even though the planned reactors have been

abandoned uncompleted. Even worse, this financial basket case is one of the

reactor designs the government is considering for Wylfa.”

Carmarthenshire News 23rd May 2024

Sizewell C nuclear: Uncertainty surrounds final investment decision as parliamentary session shortened

New Civil Engineer 24 MAY, 2024 BY TOM PASHBY

The final investment decision (FID) for Sizewell C has been thrown into limbo by the early dissolution of parliament, with prime minister Rishi Sunak having called an election for 4 July.

Conservative politicians were caught off guard by the announcement, made at around 5pm on 22 May. This means Parliament will dissolve on Thursday 30 May.

Earlier in the day of the General Election announcement, the energy secretary Claire Coutinho issued a written statement about the proposed nuclear power station at Wylfa in north Wales where she also commented on the in-development Suffolk nuclear station, saying: “We intend to take a final investment decision on Sizewell C before the end of this Parliament.”

It can be assumed that Coutinho was unaware that the end date of the current parliament was due to be brought forward by the calling of the general election.

Nuclear minister Andrew Bowie also said earlier this month that an FID would be announced by end of this Parliament.

With Parliament now to dissolve next Thursday, the period known as ‘wash-up’ is underway where the government tries to pass a selection of remaining pieces of legislation.

The government has to date invested £2.5bn in the project in numerous tranches but intends to find private investors to cover the majority.

The government commenced the search for investment partners in the circa £20bn project last September. It said it is seeking companies with “substantial experience in the delivery of major infrastructure projects” and added “ministers will be looking for private investors who can add value to the project and will only accept private investment if it provides value for money, while bolstering energy security”.

Potential investors were required to register their interest by early October 2023 but there has been little news in the more than half a year since.

The shortening of the current parliamentary period means there is now uncertainty about whether the government will have time to make an FID.

A government source confirmed to NCE that progress continues towards FID.

The source said the government would continue to fund the project in the pre-election period using investment funds which had already been made available and said operations at the site would be business as usual in the lead-up to polling day.

If the current government does not make an FID for Sizewell C, it will fall to the next government due to be elected on 4 July to do so. If there is a hung Parliament, there may be a further delay to the formation of a new government.

A Sizewell C spokesperson said: “We are continuing to engage with investors and prepare for FID and we are moving ahead as planned on our construction site.”

However, campaign group Stop Sizewell C believes it is now impossible for a FID to be made before the General Election.

A spokesperson for the group said that this “lets the Conservatives off the hook for signing away another HS2”.

They continued: “It also presents a likely Labour government, looking to drive down bills and reach net zero by 2030, an opportunity to focus on more cost effective renewable projects.

“We are going to do everything in our power to ensure that this election signals the death knell for slow, expensive, risky Sizewell C.”

The money invested in the Sizewell C project will look to be recouped through a regulated asset base (RAB) model for funding, which would see the investors money returned through a surcharge on consumer energy bills……………………. https://www.newcivilengineer.com/latest/sizewell-c-uncertainty-surrounds-final-investment-decision-as-parliamentary-session-shortened-24-05-2024/

Hinkley C – don’t say I didn’t warn you!

It is worth remembering that while construction costs are in the £42 to £48 billion range, the 35 years of electricity at £87.50 or £92.50/MW in 2012 money, adjusted for inflation will cost UK energy users a gargantuan £111 or £116 billion over the next 35 years. Could we use that money better? You bet.

2016 was a missed opportunity, most likely the last opportunity to scrap the benighted project, one of the worst blunders in the history of public procurement and of the UK’s energy industry

In 2016, I called for Hinkley C to be scrapped. Now its commissioning has been pushed back to the end of the decade and its costs have ballooned to as much as £48 billion in 2024 money. I was right.

Thoughts of Chairman Michael , MICHAEL LIEBREICH, JAN 25, 2024

by EDF in 2017), announced a “Nuclear Renaissance” and was lobbying for a new build programme in the UK to replace aging plants set for retirement. In the absence of evidence, they claimed new plants would produce power for £24 per MWh (£39/MWh in 2024 money, or $50/MWh).

The Labour Party, long dead set against nuclear power, were convinced. In January 2008, Prime Minister Gordon Brown declared, in the preface to a White Paper on nuclear power entitled “Meeting the Energy Challenge” that “nuclear should have a role to play in the generation of electricity, alongside other low carbon technologies.” The White Paper estimated the total cost of building a 1.6GW nuclear plant at £2.8 billion – which would translate into £5.6 billion for Hinkley C’s 3.2GW (£9.0 billion or $11.5 billion in 2024 money).

EDF’s UK CEO Vincent de Rivaz was cock-a-hoop, predicting that Brits would be cooking their turkeys with power from Hinkley C by Christmas 2017. But remember that figure – £9.0 billion for 3.2GW.

By October 2013, Osborne and Davey had agreed a Contract for Difference with EDF for electricity production at a strike price of £92.50/MWh in 2012 money (£132/MWh in today’s money or $169/MWh) – rising with inflation for 35 years, but dropping to £87.50 (£125/MWh in today’s money or $173/MWh) if a second EPR were to be built. That EPR is Sizewell C – of which more later.

At that point, Hinkley C was expected to cost £16 billion in 2015 money (£22 billion in 2024 money or $28 billion). It was due to come online in 2023 and continue cooking Christmas turkeys for 60 years.

Since then, on five separate occasions EDF has announced that costs have increased, and the commissioning date pushed back. The only delay which was not fully in the control of EDF and it suppliers in the nuclear and construction industries was Covid – which can be blamed for around a year of delay and a couple of billion of cost increase, but not more.

Last week – yet another delay and cost increase

So then last week, we learned that the plant would be lucky to open much before 2030 – that’s 13 years after de Rivaz’s 2017 promise – and costs would be between £31 and £35 billion in 2015 terms (2015 is used because the CfD figures were set in 2015 money). That is £42 to £48 billion in 2024 money, or up to $61.4 billion).

Remember, we were first promised it would cost £9 billion in today’s money, so that’s an increase of between 4.6 and 5.4 times.

Now, I know that supporters of the project and hard-core nuclear fans will be bursting blood vessels at this point, desperate to jump in an explain that most of the difference between £9 billion and nearly £50 billion is down to financing cost resulting from the use of the CfD mechanism, regulatory cost, delay in government decision-making and so on. But I’m going to say it: I don’t care.

If the nuclear industry says it can build something for £9 billion, it needs to build it for £9 billion. That’s what happens in other industries. If the right number, including finance costs was £22 billion, it should have said so all along. And if it knows that there is a good chance of cost over-runs more than doubling the cost, it should include an appropriate contingency when it promotes and negotiates projects.

How big things (don’t) get done

It is not like cost over-runs in nuclear projects are a big secret. The world’s leading academic expert on project management is Danish Professor Bent Flyvbjerg, author of How Big Things Get Done, who joined me on Cleaning Up last year. Having build a huge database of projects of different sources, he can definitively show that nuclear plants are worse only than Olympic Games in terms of cost over-runs. On average they go 120% over the budget, with 58% of them going a whopping 204% over budget.

The common trope among nuclear fans is that it is only in the western world that nuclear new build is either problematic or exorbitantly expensive, and this is driven by excessive regulation.

While excessive delays in emerging nuclear powers are certainly less common, there is no transparency over how this is achieved. There are ample examples of problems: the use of fake certification documents, the sealing of deals for reactor sales by military inducements, cutting corners on safety, failure to maintain control of the fuel supply chain, failure to disclose problems and accidents; unexplained accidents on aging plants.

There is also no transparency over the real cost of their plants. Put simply, these are are whatever their leaders say they are: it is they who decide the cost of capital, state guarantees, whether safety standards meet or exceed international standards, whether safety standards are enforced, the environmental standards applied to the supply chain, the speed projects proceed through licencing, the need or not to provision for decommissioning costs, the diversion of costs to military, energy or industrial budgets, and so on.

Back to 2016

Now let’s get back to Hinkley C, and 2016. One of the first things Theresa May did when she took over from David Cameron was to ask her security advisors to review the wisdom of allowing state-owned China General Nuclear to invest £6 billion in the project. In the end May backed down and allowed the investment to go ahead, but that is the background to my piece: the project’s future was in doubt, and it was the last realistic chance to kill it before tens of billions of pounds had been invested. And this is what I wrote: The case for Hinkley Point C has collapsed: It’s time to scrap it.

Perhaps of most interest, given the recent breathless announcements by French ministers of their desire to build a lot more new nuclear power stations, and the money being thrown by the UK government at Sizewell C before it has reached a final investment decision, is this section:

There are at least three ways in which [Greg Clark, the freshly-appointed Minister at BEIS] could potentially replace its supply contribution more cheaply, more quickly, and with more impact on UK industry and exports.

He could mandate more renewable generating capacity, paired with interconnections and a range of technologies to manage intermittency. He could push through a fleet of new gas power stations and get serious about carbon capture and storage. Or he could spend a lot less than £37bn on energy efficiency, simply removing the demand for 3.2 GW of base-load power.

Alternatively, if the government still has a nuclear itch, Clark needs to ask why Hinkley C is the right way to scratch it. After decades of technological stagnation, new nuclear technologies are approaching commercialisation, offering passive safety, so they can’t melt down in the event of a power failure, and smaller scale, so they shouldn’t take 15 years to see the light of day.

It is worth remembering that while construction costs are in the £42 to £48 billion range, the 35 years of electricity at £87.50 or £92.50/MW in 2012 money, adjusted for inflation will cost UK energy users a gargantuan £111 or £116 billion over the next 35 years. Could we use that money better? You bet.

Summary

So there you have it. 2016 was a missed opportunity, most likely the last opportunity to scrap the benighted project, one of the worst blunders in the history of public procurement and of the UK’s energy industry……………… https://mliebreich.substack.com/p/hinkley-c-dont-say-i-didnt-warn-you

US military aid to Ukraine is ‘grift’ – Blackwater founder to Tucker Carlson

The equipment Washington sends to Kiev will never change the tide of battle, Eric Prince has said

https://www.rt.com/news/598015-us-military-aid-ukraine-blackwater/ 22 May 24

US weapons shipments to Ukraine are senseless since they are not capable of changing the course of the conflict, Eric Prince, the founder of private American military contractor Blackwater, told journalist Tucker Carlson in an interview published on Tuesday.

The military aid to Ukraine is nothing but a “massive grift paid by the Pentagon,” Prince stated, adding that the latest major aid package worth $61 billion approved by Congress and signed by President Joe Biden in April will end up lining the coffers of US defense industry giants. Prince, himself a former Navy SEAL officer, resigned and divested from his company after the 2007 Iraqi massacre scandal.

“Most of that money goes to five major defense contractors to replace at five times the cost the weapons that we have already sent the Ukrainians,” the Blackwater founder said, adding that “it does not change the outcome of the battle.”

“The Biden administration believed that all this American weaponry would have saved the day. It has not,” Prince said.

The Russian military has published photos and videos of damaged and destroyed Western-made military equipment in Ukraine, including US-supplied Abrams tanks. One of them ended up at a trophy exhibition in Moscow, alongside a German-made Leopard main battle tank and dozens of other pieces.

Kiev’s forces are already spread “very thin” and are about to face an “ugly summer,” according to Prince. “All the defenses that were supposed to be built by Ukrainians are much smaller or non-existent,” he said, mostly due to “corruption issues.”

Moscow’s forces are “going to have a very good summer” and will seek to “absolutely humiliate the West and make sure they never have a problem with Ukraine again,” the Blackwater founder believes.

The interview comes amid Russian offensives in Donbass and Ukraine’s northeastern Kharkov Region, where Moscow’s forces have been steadily gaining ground. Last month, Russia’s former defense minister, Sergey Shoigu, said Moscow’s forces had seized the initiative and “dispelled the myth of the superiority of Western weapons.”

Prince went on to say that he never believed Ukraine could push Russia out of Donbass and Crimea. “The war should never have [been] started.”

The only thing Washington and its allies will achieve in Ukraine is “facilitating the demise of the Ukrainian men” and “destroying” this nation “for future generations,” the Blackwater founder said.

Moscow has warned that Western arms shipments to Ukraine will only prolong the conflict without changing the outcome. It has also accused the West of forcing Kiev to “fight to the last Ukrainian.” In early May, Shoigu said that Kiev has lost more than 111,000 troops this year alone.

University of Sheffield gets into the nuclear debt web, partnering with Rolls Royce to make “small” nuclear reactors

New facility will help de-risk and underpin the Rolls-Royce SMR programme

( De-Risking, is a strategy that companies apply when they cannot manage the money laundering risks that they have obligations to. )

Mirage News, 21 May 24

- The University of Sheffield and Rolls-Royce SMR are setting up a multi-million pound manufacturing and testing facility in South Yorkshire

- Based in the University of Sheffield AMRC’s Factory 2050, the new facility will produce prototype modules for small modular reactors (SMRs)

- New facility will help de-risk and underpin the Rolls-Royce SMR programme that aims to deploy a fleet of factory-built nuclear power plants in the UK and across the world

…………………… The first phase, announced today, is worth £2.7 million and will be part of a wider £15+ million package of work that will further de-risk and underpin the Rolls-Royce SMR programme.

The new facility at the University of Sheffield AMRC will produce working prototypes of individual modules that will be assembled into Rolls-Royce SMR power plants.

The Rolls-Royce SMR programme is UK’s first home-grown nuclear technology for over a generation and today’s announcement is another vital step towards deploying a fleet of factory-built nuclear power plants in the UK and around the globe.

Victoria Scott, Rolls-Royce SMR’s Chief Manufacturing Engineer, said: “Our investment in setting up this facility and building prototype modules is another significant milestone for our business.

“Our factories will produce hundreds of prefabricated and pre-tested modules ready for assembly on site. This facility will allow us to refine our production, testing and digital approach to manufacturing – helping de-risk our programme and ensure we increase our delivery certainty. https://www.miragenews.com/rolls-royce-smr-sheffield-uni-launch-new-1238675/

-

Archives

- January 2026 (138)

- December 2025 (358)

- November 2025 (359)

- October 2025 (377)

- September 2025 (258)

- August 2025 (319)

- July 2025 (230)

- June 2025 (348)

- May 2025 (261)

- April 2025 (305)

- March 2025 (319)

- February 2025 (234)

-

Categories

- 1

- 1 NUCLEAR ISSUES

- business and costs

- climate change

- culture and arts

- ENERGY

- environment

- health

- history

- indigenous issues

- Legal

- marketing of nuclear

- media

- opposition to nuclear

- PERSONAL STORIES

- politics

- politics international

- Religion and ethics

- safety

- secrets,lies and civil liberties

- spinbuster

- technology

- Uranium

- wastes

- weapons and war

- Women

- 2 WORLD

- ACTION

- AFRICA

- Atrocities

- AUSTRALIA

- Christina's notes

- Christina's themes

- culture and arts

- Events

- Fuk 2022

- Fuk 2023

- Fukushima 2017

- Fukushima 2018

- fukushima 2019

- Fukushima 2020

- Fukushima 2021

- general

- global warming

- Humour (God we need it)

- Nuclear

- RARE EARTHS

- Reference

- resources – print

- Resources -audiovicual

- Weekly Newsletter

- World

- World Nuclear

- YouTube

-

RSS

Entries RSS

Comments RSS