What to know about Elon Musk’s contracts with the federal government

FATONEWS. by Samuel Azevedo, 15/11/2024

Elon Musk is easily the world’s wealthiest man, with a net worth topping $300 billion.

But even he stands to make more money from his association with the federal government after placing a winning bet on Donald Trump’s election to the presidency.

“It’s going to be a golden era for Musk with Trump in the White House,” Wedbush Securities analyst Dan Ives said.

Musk’s aerospace company SpaceX has received billions of dollars in federal contracts, and could be line for more, while his five other businesses could gain from a lighter regulatory touch.

SpaceX

If there’s one Musk business that could profit the most from the incoming Trump administration, it’s SpaceX.

The company, which announced this year it was moving its headquarters from Hawthorne to Texas, already has received at least $21 billion in federal funds since its 2002 founding, according to government contracting research firm The Pulse. That includes contracts for launching military satellites, servicing the International Space Station and building a lunar lander.

However, that figure could be dwarfed by a federal initiative to fund a Mars mission, which is the stated goal of SpaceX.

“Elon Musk is wealthy, but he’s not wealthy enough to completely fund humans to Mars. It needs to be a public, private partnership, because of the tens of billions of dollars that this would cost, or even hundreds of billions dollars,” said Laura Forczyk, executive director of space industry consulting firm Astralytical.

SpaceX has already made big strides testing his Starship rocket, the most powerful ever built. NASA envisions employing the rocket in its Artemis program to return humans to the moon, but it has been designed to have enough thrust to propel a spacecraft to Mars. What’s more, Trump, during his first presidency, speculated on Twitter about why the United States was focusing on the moon instead of Mars…………………………………………………………………………………………..

SpaceX also has Starlink contracts with the military, including a $70-million award from the U.S. Space Force last year, according to Space News.

Tesla

Trump’s policies could reduce the sales of electric vehicles, but with Musk’s influence, his administration’s policies could boost Tesla — though not with federal funding………………………………………………….

xAI

Musk’s startup xAI doesn’t appear to have federal government contracts, but artificial intelligence companies could benefit in other ways under Trump.

Republicans and Musk have expressed support for cutting regulation to fuel AI innovation, a crucial part of the future of tech companies.

xAI

Musk’s startup xAI doesn’t appear to have federal government contracts, but artificial intelligence companies could benefit in other ways under Trump.

Republicans and Musk have expressed support for cutting regulation to fuel AI innovation, a crucial part of the future of tech companies…………………………………………………………..

“It’s going to be a golden era for Musk with Trump in the White House,” Wedbush Securities analyst Dan Ives said.

Musk’s aerospace company SpaceX has received billions of dollars in federal contracts, and could be line for more, while his five other businesses could gain from a lighter regulatory touch.

Trump has named Musk to co-head a new Department of Government Efficiency,” or DOGE — a nod to the cryptocurrency Musk adores. However, federal law bars executive branch employees, which can include unpaid consultants from participating in government matters that will affect their financial interests, unless they divest of their interests or recuse themselves…………………………………………………………………………….more https://fatonews.com.br/2024/11/15/what-to-know-about-elon-musks-contracts-with-the-federal-government/

Nuclear Decommissioning Services Market Expected to Reach $11.79 Billion by 2034 – BIS Research

Industry Today 12th Nov 2024

As nuclear facilities worldwide reach the end of their operational lives, the nuclear decommissioning services market is witnessing substantial growth. The Nuclear Decommissioning Services Market is projected to grow from $6.70 billion in 2024 to $11.79 billion by 2034, fueled by the rising number of decommissioned nuclear facilities and the increasing emphasis on sustainable practices.

Published 12 November 2024

Market Overview

Market Size and Growth Rate

The Nuclear Decommissioning Services Market is projected to grow from $6.70 billion in 2024 to $11.79 billion by 2034, at a CAGR of 5.81% during the forecast period. This growth is driven by the escalating number of decommissioned reactors and a shift toward stringent regulatory frameworks prioritizing safe and sustainable decommissioning processes. …………………………………………………..

Demand Drivers

The market is significantly driven by the retirement of aging nuclear facilities, increased regulatory scrutiny, and advancements in decommissioning technology. Environmental sustainability mandates are pushing the demand for efficient and compliant decommissioning solutions.

Challenges

Complex regulatory requirements and high costs remain key challenges. Additionally, the intricate nature of nuclear waste disposal raises concerns over potential delays and budget overruns in large-scale decommissioning projects. …………………………………………………………………………………………………….

The successful [whaaa-aa-aat!] decommissioning of Japan’s Fukushima Daiichi nuclear power plant highlights the potential for advanced decommissioning technology to manage complex sites safely and efficiently. ……………………………………………..https://industrytoday.co.uk/energy_and_environment/nuclear-decommissioning-services-market-expected-to-reach-1179-billion-by-2034-bis-research

Ratepayers First: The Economic Case Against Nuclear’s Data Center Dreams

Now that data centers are growing and the climate crisis is accelerating, nuclear power is being positioned as a solution to both crises. Yet, this is deeply flawed.

Nov 6, 2024, Powermag 6th Nov 2024

As an energy professional in Georgia with a front row seat to the construction of Plant Vogtle, I found the October 23 Washington Post editorial endorsing nuclear energy as a tool for combating climate change astonishing. Georgia is the first state to build nuclear power in 30 years and the editorial board profoundly mischaracterized what happened here, and as with nearly all essays in support of nuclear, it never mentioned impacts to ratepayers, those of us who are actually paying for Plant Vogtle.by Patty Durand,

Perhaps the editors did not know that Georgia Power added $11.1 billion to its rate base, the assets on which it earns a profit, for its 45.7% share of the project. That amount of money for just 1,020 MW of generation is a horrible thing to do to ratepayers. Plant Vogtle cost eight to 10 times more than any other type of generation and resulted in a 25% rate increase, the largest in Georgia’s history. Yet, this achieved only a 7.5% expansion in Georgia Power’s capacity.

Glib claims that Vogtle was “FOAK” (first of a kind) and lessons learned will reduce future costs ignore the magnitude of the cost overruns and severity of the management failures. Real reasons for cost overruns include leaving expensive components in fields unprotected from weather and without a chain of custody resulting in a failure rate of 80%, and creating materially inaccurate project schedules for Georgia Public Service Commission (PSC) filings to make it appear that construction milestones had been reached when they had not. These and other deceptive behaviors led to costly construction mistakes that are not related to FOAK.

Georgia Public Service Commissioner Tim Echols, a frequent contributor to POWER magazine, was public in his opinion that the commission should not review Vogtle’s construction costs for prudency and reasonableness throughout the 15-year timeline of the project, saying that would happen at the end. A settlement agreement on Vogtle reimbursements between PSC staff and Georgia Power was made two months before hearings were to begin, so the promised prudency hearings were never held. Thus, a shared understanding of Vogtle’s failures never took place, leaving room for nuclear supporters to make up reasons for Vogtle’s cost overruns that have no basis in fact.

Now that data centers are growing and the climate crisis is accelerating, nuclear power is being positioned as a solution to both crises. Yet, this is deeply flawed. The timeline for building nuclear is too slow, the costs are too high, and the corruption that follows nuclear power because of the big money involved is ignored. Using nuclear energy to address these crises means regulators won’t have to fix the perverse cost-plus business model that encourages utilities to slow walk or block the clean energy transition, and data centers can grow while keeping their climate emissions pledges intact.

This is very convenient for everyone but the ratepayer. Few people realize that most large industrial customers are on marginal rate tariffs, which are different than traditional base tariffs. Marginal tariffs do not include capital costs. Instead of paying $0.15–0.19 per kWh as most residential customers do, industrials like data centers pay only $0.05–0.06 per kWh .

The recent announcement that Microsoft would buy all the power from Constellation Energy’s recommissioning Three Mile Island carefully avoids mentioning who is paying the (unknown) billions of dollars in capital costs. And if Constellation Energy secures the $1.6 billion Department of Energy loan they seek, those repayment costs will flow to residential rates too, via the traditional base tariff.

Nuclear is a deeply flawed choice when climate change can be addressed affordably and rapidly with renewables and modern grid technologies, and numerous reports show a path toward meeting data center energy needs without nuclear………………………………………………………………..

Enormous predictions for data center growth projections made by utilities must be verified by independent third parties, and we already know double counting of data center load growth is happening. The continued use of trade secret protection rules by utilities refusing to disclose their prospective data center clients or allow verification of their enormous growth projections is not acceptable

……………………………………………………………… There are numerous voices calling for a measured response to data center load growth, among them AES President and CEO Andres Gluski, who said during an interview with CNBC that “euphoria” over nuclear energy as a power source for data centers is a “little overblown.” He noted that renewables are cheaper, easier to site, and “the future is going to be renewable energy.”

Ratepayers matter, and it’s time that everyone focuses on what’s best for them. And what’s best for them are affordable electricity bills and rapid decarbonization of the electric grid that does not include paying for expensive nuclear energy to serve data centers.

—Patty Durand is the founder and president of Cool Planet Solutions.

https://www.powermag.com/blog/ratepayers-first-the-economic-case-against-nuclears-data-center-dreams/

Hinkley Point C ‘using cheap foreign labour’, say striking workers.

Engineers claim colleagues brought in from outside the UK and EU are paid

less than half their wages.

EDF Energy is investigating claims that a

company in its supply chain is using cheap foreign labour to undercut

British engineers working on its Hinkley Point C and Sizewell C nuclear

power station projects.

The allegation was made by cabling and pipework

engineers who went on strike last week after claiming that they had not

received a pay rise in four years. They allege that since beginning their

dispute last year with Alten, their employer, which provides engineering

services for the projects, they have discovered that foreign colleagues

brought in from outside the UK and EU from places such as India and Nigeria

are being paid about half their wages.

Times 11th Nov 2024 https://www.thetimes.com/business-money/energy/article/hinkley-point-c-using-cheap-foreign-labour-say-striking-workers-g3gw20v65

Occupational exposure to radiation among health workers: Genome integrity and predictors of exposure

Mutation Research/Genetic Toxicology and Environmental Mutagenesis

Volume 893, January 2024, Hayal Çobanoğlu, Akın Çayır

Highlights

- •Significant increase of genomic instability biomarkers reflecting long term disease risk

- •Significant association between radiation exposure and NPB, and NBUD frequencies

- •Work-related parameters have the potential to explain increase of genomic instability

- •Higher risk of exposure in plain radiography field

Abstract

The current study aimed to investigate genomic instabilities in healthcare workers who may experience varying levels of radiation exposure through various radiological procedures. It also sought to determine if factors related to the work environment and dosimeter reading could effectively explain the observed genomic instabilities. Utilizing the cytokinesis-block micronucleus assay (CBMN) on peripheral blood lymphocytes, we assessed a spectrum of genomic aberrations, including nucleoplasmic bridge (NPB), nuclear budding (NBUD), micronucleus (MN) formation, and total DNA damage (TDD). The study uncovered a statistically significant increase in the occurrence of distinct DNA anomalies among radiology workers (with a significance level of P < 0.0001 for all measurements). Notably, parameters such as total working hours, average work duration, and time spent in projection radiography exhibited significant correlations with MN and TDD levels in these workers. The dosimeter readings demonstrated a positive correlation with the frequency of NPB and NBUD, indicating a substantial association between radiation exposure and these two genomic anomalies. Our multivariable models identified the time spent in projection radiography as a promising parameter for explaining the overall genomic instability observed in these professionals. Thus, while dosimeters alone may not fully explain elevated total DNA damage, intrinsic work environment factors hold potential in indicating exposure levels for these individuals, providing a complementary approach to monitoring.

Introduction

Ionizing and non-ionizing radiation constitute inevitable forms of environmental exposure, to which a substantial portion of the global population remains consistently subjected. Among those at heightened risk are individuals employed in radiology, who utilize radiation sources for both diagnostic and therapeutic procedures. More than 30 million medical radiology workers are exposed to low level of radiation worldwide [1], [2], which provides the opportunity to understand the health risks of chronic exposure to low-dose ionizing radiation (IR) [3].

It has been observed that there are increased risks for many cancer types, including skin, leukemia, breast, and thyroid, in medical radiology workers who started working before the 1950 s [4], [5], [6], [7], [8]. These results probably reflect higher occupational radiation exposure of medical radiology workers [5], [9]. Today, even if radiation exposure is less than in the past owing to technological advances and radiation safety measures [9], recent studies show that long-term exposure to low-dose IR may still be a significant health risk [10], [11], [12].

Introduction

Ionizing and non-ionizing radiation constitute inevitable forms of environmental exposure, to which a substantial portion of the global population remains consistently subjected. Among those at heightened risk are individuals employed in radiology, who utilize radiation sources for both diagnostic and therapeutic procedures. More than 30 million medical radiology workers are exposed to low level of radiation worldwide [1], [2], which provides the opportunity to understand the health risks of chronic exposure to low-dose ionizing radiation (IR) [3]. It has been observed that there are increased risks for many cancer types, including skin, leukemia, breast, and thyroid, in medical radiology workers who started working before the 1950 s [4], [5], [6], [7], [8]. These results probably reflect higher occupational radiation exposure of medical radiology workers [5], [9]. Today, even if radiation exposure is less than in the past owing to technological advances and radiation safety measures [9], recent studies show that long-term exposure to low-dose IR may still be a significant health risk [10], [11], [12].

Despite the efforts to minimize radiation exposure, radiation-exposed health workers may frequently encounter low levels of ionizing radiation due to various occupational factors, including excessive work hours, inadequate shielding in their work environment, a high volume of daily imaging procedures, and failure to employ personal protective equipment during imaging activities. Although traditional methods such as physical dosimeters and blood-based clinical assessments are routinely used to monitor worker health, these approaches possess limitations when it comes to assessing the long-term effects of low-dose radiation exposure. Consequently, it is imperative to implement more robust biomarkers to routinely monitor radiology workers………………………………………………………………………………………………………………………………… more Link: https://www.sciencedirect.com/science/article/abs/pii/S1383571824000020

Compelling Economics of Renewables Unmask Fossil Fuels and Nuclear

Posted to Energy November 07, 2024, by Francesco La Camera, Paul Dorfman,

https://dcjournal.com/compelling-economics-of-renewables-unmask-fossil-fuels-and-nuclear/

The renewable energy revolution is happening, but it is running too slow.

Renewables set a record in 2023 with 473 gigawatts added. Yet, we need to triple capacity by 2030 to stay aligned with the Paris Agreement.

While renewables are overtaking fossil fuels and nuclear as the primary choice for new power, the transition isn’t fast enough to limit global warming. In fact, renewable power capacity must triple by 2030, as recommended by International Renewable Energy Agency and agreed on by world leaders in the UAE Consensus at the last U.N. Climate Conference in Dubai.

Peaking fossil fuels is not enough; we need deep and rapid carbon dioxide cuts in the limited time we have to keep within our vanishingly small carbon budget.

The choices we make about the use of technologies will largely determine the success of our climate actions. We need low-carbon, or even no-carbon technologies. The concept of technology neutrality, understood as the capacity to cut carbon dioxide emissions, should also include the dimensions of costs and the time needed to reach the desired outcome.

Recently, nuclear energy has attracted attention as a technology to cut emissions and diversify energy supplies.

We are not challenging the choice of technology as a matter of national sovereignty. Instead, energy technologies (nuclear, renewables, fossil fuels) are compared in the context of the fight against climate change, where time is the most relevant variable.

According to the Intergovernmental Panel on Climate Change, accelerating renewables coupled with energy efficiency measures are the most realistic means to reduce global emissions by 43 percent by 2030 and at least 60 percent by 2035.

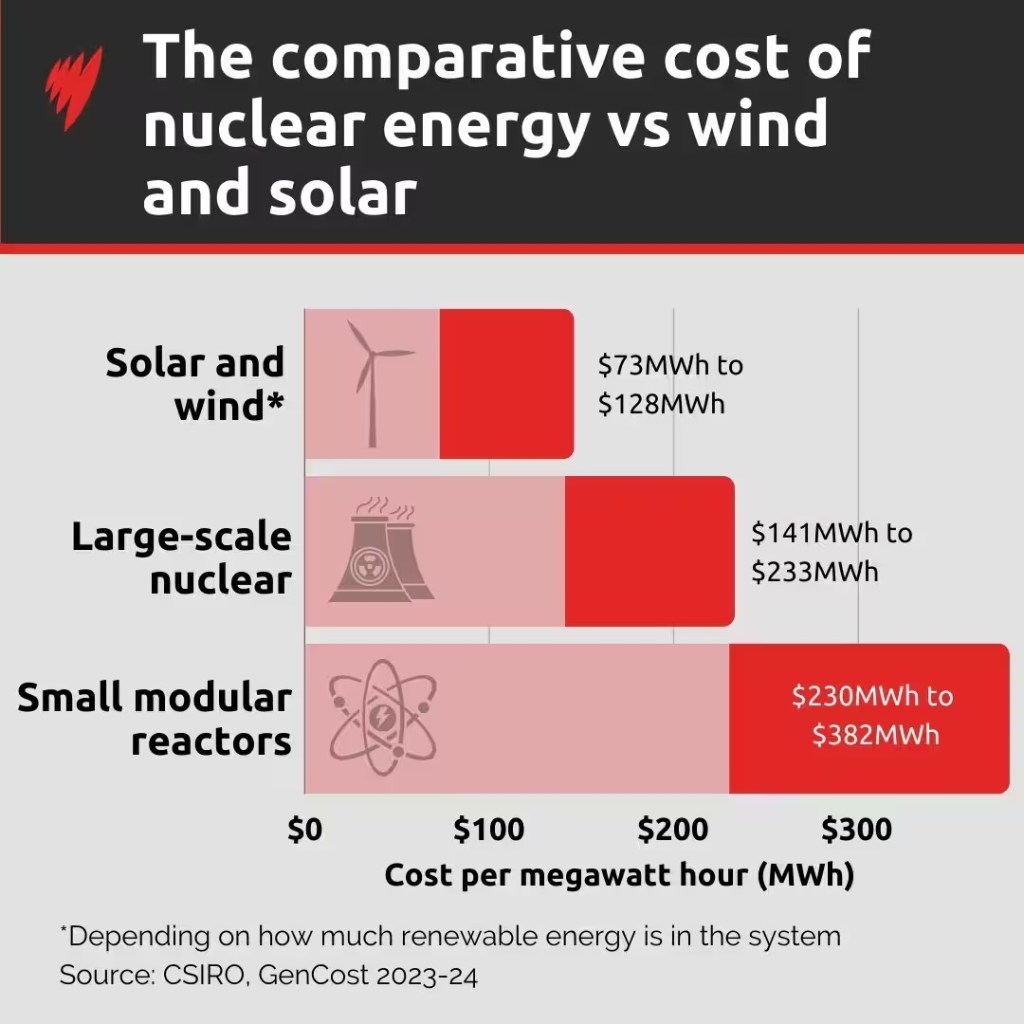

Due to lower cost and higher efficiency, the IPCC has stated that renewables, particularly solar and wind, are ten times more effective at cutting carbon dioxide emissions than nuclear.

Nuclear’s share of global electricity production has almost halved from 1996 to 2023, largely due to the high costs of, and delays to, building and operating nuclear reactors. Far from improving, the latest nuclear reactor designs offer the worst-ever record of delays and cost escalation.

According to studies from Stanford University, new nuclear power plants cost 2.3 to 7.4 times those of onshore wind or solar per kilowatt-hour of electricity, take five to 17 years to deploy, and produce nine to 37 times the emissions per kilowatt-hour as wind.

New nuclear adds only as much electricity in a year as renewables add every few days. For example, China is now installing wind and solar capacity equivalent to five new nuclear reactors weekly.

Nuclear delivers far less power per dollar.

Because of significant costs and delays, the emphasis has moved to small modular reactors (SMRs). Their economics are costly and share the same significant security and waste problems. To date, several key SMR projects have fallen by the wayside.

Instead of wasting money on expensive non-renewable technologies, limited financial resources should be channeled into realistic solutions to climate change, including electrification; the expansion of renewables across all sectors; expansion and modernization of grids; storage, efficiency solutions and smart demand-side management.

The last decade represents a seismic shift in the balance of competitiveness between renewable technologies and incumbent fossil options.

The notion that renewables are expensive is outdated. According to IRENA data, 81 percent of the record renewable additions in 2023 were cheaper than fossil fuel and nuclear alternatives.

The total renewable power capacity deployed globally since 2000 has saved $409 billion in fuel costs in the power sector.

Factoring in the wider economic and environmental benefits of renewable power in reducing fossil fuel imports, improving a country’s balance of payments and enhancing security of affordable energy supply by reducing exposure to volatile fossil fuel prices in global markets makes it even more compelling.

The world is increasingly rallying behind renewables to do the heavy lifting for the net-zero energy transition. We have the knowledge, the technology and the means. We are fully equipped to adjust the trajectory of the transition and reduce the carbon footprint of the global energy system.

We must move faster.

Hinkley workers ‘unfair’ pay claim leads to action

Workers involved in the construction of the Hinkley Point nuclear power

plant have started industrial action after claiming they are being paid

unfairly. Employed by the firm Alten – a supplier for EDF’s Hinkley Point C

– the workers say they have not had a cost of living pay rise in four

years. They walked out of their Bristol office for 24 hours on Tuesday and

have now begun action which Prospect Union described as “short of a

strike”.

BBC 7th Nov 2024,

https://www.bbc.co.uk/news/articles/ckgdlg1ql5no

This is why nuclear power stocks are falling

FINBOLD, 5 Nov 24

Nuclear power stocks faced a major downturn this week after the Federal Energy Regulatory Commission (FERC) rejected Talen Energy’s proposal to supply additional power to an Amazon Web Services (AWS) data center.

The decision, made late Friday, has reverberated throughout the sector, triggering a sharp sell-off in the nuclear power sector.

The FERC decision: A blow to the sector

On November 1, FERC voted 2-1 against PJM Interconnection’s proposed amendment to increase power supply from Talen’s Susquehanna nuclear plant in Pennsylvania to a nearby AWS data center.

The amendment aimed to boost the center’s power capacity from 300 MW to 480 MW. Commissioners Mark Christie and Lindsay See opposed the amendment, citing concerns over grid reliability and public costs, while Chairman Willie Phillips dissented.

Following the decision, Talen Energy’s stock plunged 8.6% on November 5, while Constellation Energy (NASDAQ: CEG) and Vistra Corp (NYSE: VST) saw declines of 13% and 6.7%, respectively.

These declines reflect investor concerns about the broader implications of the FERC decision, which could hinder future deals between nuclear power providers and large tech firms……………………..

Broader implications for the sector

The FERC decision has broader implications for the burgeoning relationship between nuclear power and AI-driven data centers.

In recent months, tech giants such as Amazon (NASDAQ: AMZN), Microsoft (NASDAQ: MSFT), and Alphabet (NASDAQ: GOOGL) have increasingly turned to nuclear power to meet the rising energy demands of AI data centers while maintaining their climate commitments…………………………………………………………………….

https://finbold.com/this-is-why-nuclear-power-stocks-are-falling/

Hinkley Point and Sizewell nuclear plant engineers go on strike.

Specialist workers say they have not had a pay rise in four years and that cheap

foreign labour from India and Nigeria is being used to undercut British

workers. The cabling and pipework engineers, represented by the

professional trade union Prospect, work on the Hinkley Point C nuclear

power station being built in Somerset by EDF, as well as the Sizewell C

project planned for Suffolk.

They claim that since beginning their dispute

last year with their employer Alten, which provides engineering services

for the projects, they have discovered foreign colleagues brought in from

outside the UK and EU, from places such as India and Nigeria, are being

paid about half their wages. A source told The Times: “We started the

dispute about pay rises before it emerged that foreign colleagues were

being brought in on vastly lower wages.

“We are all on between £50,000

and £75,000 but it has since emerged that these foreign colleagues are

being paid less than £30,000. That is absolutely ridiculous for the type of

work they are doing and it is being done to drive down costs and the

internal market rate for these roles.”

The Times 5th Nov 2024 https://www.thetimes.com/business-money/energy/article/hinkley-point-and-sizewell-nuclear-plant-engineers-go-on-strike-xv0fk93dl

Regulators deliver successive blows to Amazon and Meta’s nuclear power ambitions

Amazon, Meta, and Microsoft have placed big bets on nuclear power to secure electricity for their data centers as AI and cloud computing have sent power use surging.

But as Amazon and Meta discovered last week, those bets are far from a sure thing. A series of recent rulings from regulators dashed their hopes of finding a quick fix for their electricity needs. For now, Microsoft’s plans to revive a reactor at Three Mile Island are moving ahead.

Perhaps unexpectedly, the roadblocks have nothing to do with nuclear power itself, illustrating the challenges of building massive data centers without first locking up new sources of electricity.

Meta, for example, is planning to build an AI data center next to an already operating nuclear power plant. But as the project progressed, regulatory hurdles began piling up. CEO Mark Zuckerberg told staff in an all-hands meeting that one hurdle was the sighting of a rare bee species on the land, according to a Financial Times report. (Many bee populations are currently fragile, at best, after decades of exposure to a new generation of pesticides, among other stressors.)

Amazon’s plans have also hit a snag. The company is planning to build a new hyperscale data center next to the nuclear power plant near Susquehanna, Pennsylvania, and use a significant portion of the plant’s electricity. The Federal Energy Regulatory Commission (FERC), which oversees the U.S. electricity and natural gas grids, voted 2-1 on November 1 to deny the expansion of an existing data center power agreement that would have allowed Amazon to connect directly to the power plant.

The concern in Amazon’s case was that other customers would potentially suffer lower reliability — brownouts or blackouts — and higher costs as the data center would divert a significant portion of the massive power plant away from the rest of the region’s electricity grid.

This likely won’t be the last time FERC wades into the power question for hyperscale data centers: The commission has at least another eight large co-location requests to review.

New nukes not a plus for unions

Nuclear power is nothing if not hugely capital, not labour, intensive.

Trades unions should oppose nuclear power as there would be far more jobs in renewables and related industries, argue activists

UK union leaders Mike Clancy of Prospect and Gary Smith of GMB recently appealed to British prime minister Sir Keir Starmer to commit to finalising financial arrangements for the Sizewell C nuclear project in order to ‘help the UK meet its net-zero targets, deliver sustainable energy, and strengthen the economy’.

In response, the activist group Together Against Sizewell C (TASC) has written to the unions’ general secretaries setting out why they need to think again regarding their support for Sizewell C.

What follows is the text of their letter, edited for context and clarity, which also debunks the myths that new nuclear power plants will provide long-term sustainable jobs for union workers. (Note: UK spellings in the original have been retained.)

We write in response to your recent appeals to Sir Keir Starmer to commit to finalising financial arrangements for the Sizewell C nuclear project in order to ‘help the UK meet its net-zero targets, deliver sustainable energy, and strengthen the economy.’

In the first instance, we refer you to two important documents. The first, written by Professors Andrew Blowers, OBE, a social scientist of impeccable pedigree and lecturer at the Open University, and Steve Thomas, Emeritus Professor of Energy Policy at the University of Greenwich, is entitled: It is time to expose the Great British Nuclear Fantasy once and for all.

The second document we are sending you — an open letter to the Labour Party on energy policy — submitted in June 2024 before the election, was written by members of this organisation, which has been fighting Sizewell C for more than a decade.

The truth is that the government nuclear energy policy which is most brazenly and shamelessly represented by Sizewell C is unattainable and a recipe for financial and environmental calamity. Keir Starmer, an apparent subscriber to the ‘duty of candour’, will, at some stage, be required to agree. It is noticeable that in all public statements since the election of the Labour administration, ‘nuclear’ is a word which has been studiously avoided. We don’t believe that’s coincidental.

The final investment decision (FID) for Sizewell C has been delayed because it is a manifestly bad investment option for UK plc and the private investors who have demonstrated their agreement with that view by shunning appeals to invest. Why should the public purse come to the rescue for a venture that was supposed to be ’subsidy-free’, which is already predicted to be at least three times the original cost and years overdue in completion?

There will be no seamless transition of workers and supply chains from Hinkley because the sites and conditions are entirely different in timing and need. Whatever way the Sizewell C employment issue is regarded, each of the 900 long-term jobs created will have cost several tens of millions of pounds to create. That is a very bad investment in itself.

Nuclear power is nothing if not hugely capital, not labour, intensive. It costs billions, the plants are always late and over budget, and it doesn’t do what it says on the tin in terms of climate change and security (it relies upon uranium from abroad and Sizewell C is a French design with a French developer – nothing home-grown about it). ………………………………………………………………………………………………………………………..

Sizewell C will not, in any way, be the salvation of East Suffolk nor UK plc. We are quite simply being swamped by a development which is a Boris Johnson vanity project, one that is unnecessary to the national energy requirements and that will fail to do all the things you and your trades union colleagues have been told to believe it can do.

Trades union support for nuclear power is in itself disappointing when an energy policy based on a similar investment programme to that identified for nuclear could be invested in renewables and storage technology, energy conservation projects, microtechnology, decentralisation, and retrofitting thermal insulation. This can be coupled to the creation of many more job opportunities for today’s young people in industries that do not have the stigma of being linked to the nuclear weapons industry and the mass destruction that implies.

If we need anything right now in the UK, we need Starmer’s duty of candour to be levelled at the nuclear industry and for the trades union movement, of which we are mainly supportive, to help us show the way to a nuclear-free world.

Learn more at Together Against Sizewell C (TASC) and Stop Sizewell C. https://beyondnuclearinternational.org/2024/11/03/new-nukes-not-a-plus-for-unions/—

Will Susan Holt’s new government continue New Brunswick’s nuclear fantasies?

despite the governments’ support, after more than six years of trying, the companies have been unable to entice private investors.

Keeping the Point Lepreau and SMR fantasies alive will require considerable effort from the new government. Susan Holt’s handling of the nuclear file will be an early test—both of her leadership and her commitment to wishful thinking.

BY SUSAN O’DONNELL | October 31, 2024, The Hill Times https://www.hilltimes.com/story/2024/10/31/will-susan-holts-new-government-continue-new-brunswicks-nuclear-fantasies/439671/

Successive New Brunswick governments have been bewitched by two nuclear fantasies: first, that its beleaguered public utility NB Power can connect two experimental reactors to the electricity grid, and second, that the small province can successfully run a nuclear power reactor.

Both fantasies will confront Susan Holt early in her new Liberal government’s tenure. Will she break the spell and end the province’s nuclear delusions? Nuclear energy was not raised during the recent election campaign, but a 2023 CBC interview with Holt offers clues.

The biggest fantasy is connecting two experimental “small modular nuclear reactors” (SMRs) to New Brunswick’s electricity grid. In 2018, Holt was a business adviser to then-premier Brian Gallant when his Liberal government invited two nuclear start-up companies from the U.K. and the U.S. to set up shop in the province and promote their SMR designs, although it’s unknown if she was involved in that decision.

The Gallant government had chosen two “advanced” reactor designs—molten salt and sodium-cooled— that have never operated successfully in a commercial setting. The government gave each company a $5-million incentive and support to apply for federal funding to develop their designs. A recent expert report from the U.S. Academies of Sciences predicted that such designs would have difficulty reaching commercial viability by 2050.

During the subsequent reign of PC premier Blaine Higgs, the province gave $25-million more to the start-ups and the federal government added grants totalling $57.5-million. Both governments also invested in building an SMR business supply chain in New Brunswick and encouraged some First Nations to support the projects.

The Higgs government further supported its plan to have the experimental designs built and connected to the grid by 2035 by passing legislation forcing NB Power to buy electricity, at any price, from SMRs if they are ever built and actually work.

However, despite the governments’ support, after more than six years of trying, the companies have been unable to entice private investors. Each company claims to need $500-million to develop its reactor design to the point of applying for a licence to build one. Where this money will come from is an open question.

This summer, the CEO of one SMR company, ARC Clean Technology, left suddenly and some staff at the Saint John office received layoff notices. The second company, Moltex, was notably absent from an Atlantic energy symposium in Fredericton this September. Until Moltex secures matching funds for its three-year-old $50.5-million federal grant, further federal funding is unlikely.

In her CBC interview last year, Holt said SMRs must be part of the energy transition, but: “I don’t think it needs the province to subsidize the businesses … buying power produced by an SMR is different than putting money into a company building SMR technology.”

The second fantasy—the Point Lepreau nuclear reactor on the Bay of Fundy—has been offline for repairs since April. Cost overruns for its original build and refurbishment represent two-thirds of NB Power’s $5.4-billion debt and crippling (94 per cent) debt-to-equity ratio. The reactor’s poor performance is the main reason the utility loses money almost every year.

Around the globe, it is hard to find an electrical grid as small as NB Power’s with a nuclear reactor. The province’s oversize nuclear ambitions were identified early. In 1972, a federal Department of Finance official warned against subsidizing a power reactor for a utility with “barely enough cash flow to finance its present debt,” calling New Brunswick’s nuclear plans “the equivalent of a Volkswagen family acquiring a Cadillac as a second car.”

New Brunswick lacks even the internal capacity to operate its reactor. When the plant re-opened in 2012 after refurbishment, NB Power first contracted a management team from Ontario Power Generation (OPG) and later hired a manager living in Maine who billed the utility for travel expenses in addition to his salary which reached $1.3-million despite no improvement in the reactor’s performance. In 2023, NB Power ditched the American, and contracted OPG management again.

In her 2023 CBC interview, Holt’s statement that the province’s energy strategy needs to include “wind energy, solar energy, SMR energy, hydro energy, nuclear energy” suggests that her government will continue to support the Point Lepreau plant. However, new developments may give her pause to reconsider.

A recent expert report linked the poor performance of NB Power’s nuclear reactor to the utility’s failure since refurbishment to spend enough on maintenance. If this trend continues, “It is likely that performance could drop even further in the late 2030s into the 2040s.”

The plant’s shutdown for maintenance and upgrades on April 6 this year was originally planned for three months, but the work uncovered serious problems with the main generator. In July, NB Power suggested the plant would re-open in early September and then in August, pushed that date to mid-November.

Energy watchdogs expect the Lepreau plant to remain off-line longer than November due to the serious nature of the generator malfunction. NB Power will be looking to the new government to reassure the public that the utility has its nuclear operations under control. New Brunswickers are facing a 19.4 per cent increase in electricity rates, due in large part to the poor performance of its nuclear reactor, although Holt has already promised to eliminate the 10 per cent PST on NB Power bills to ease the pain.

Holt plans to re-convene the New Brunswick Legislature before the end of November. At that point the Point Lepreau reactor will likely still be mothballed, and the two SMR start-ups will be on life support.

Keeping the Point Lepreau and SMR fantasies alive will require considerable effort from the new government. Holt’s handling of the nuclear file will be an early test—both of her leadership and her commitment to wishful thinking.

Dr. Susan O’Donnell is adjunct research professor and primary investigator of the CEDAR project in the Environment and Society program at St. Thomas University in Fredericton.

IEA: Global clean tech market set to be worth $2tr a year by 2035.

Business Green 30th Oct 2024

The global market for clean technologies such as solar panels, wind

turbines, and electric vehicles (EVs) is set to triple to more than $2tr a

year over the next decade, eclipsing the value of the oil and gas markets

in the process, according to the International Energy Agency (IEA).

In a “first of its kind” analysis today, the IEA estimates the global market for

six leading mass-manufactured clean technologies – solar PV, wind turbines,

EVs, batteries, heat pumps, and green hydrogen electrolysers – is set to

surge in the coming years.

The report estimates that based on today’s

policy settings the global market for these technologies is set to rise

from $700bn in 2023 to more than $2tr by 2035, which would put it on a

similar level to the value of the global crude oil market in recent years.

https://www.businessgreen.com/news/4374453/iea-global-clean-tech-market-set-worth-usd2tr-2035

Czech watchdog prohibits nuclear power contract signing amid appeals

PRAGUE, Oct 30 (Reuters) – The Czech anti-monopoly office UOHS put a temporary block on the conclusion of a contract with South Korea’s KHNP for the construction of a new nuclear power unit following challenges by Westinghouse and EDF.

UOHS said that the preliminary measure to prohibit the conclusion of the contract was not indicative of how the case will be decided and was standard procedure in such a case.

The measure comes after the office started official proceedings work in September on appeals from U.S. group Westinghouse and France’s EDF against the country’s choice in July of Korea Hydro & Nuclear Power Company (KHNP) as preferred bidder to build new nuclear reactors.

The Czech government and majority state-owned utility CEZ (CEZP.PR), opens new tab aim to conclude negotiations with KHNP and sign contracts by next March, and complete the first reactor by 2036.

CEZ said it believed the preliminary measure would not impact the tender’s schedule. “(The company) is convinced it acted in accordance with the applicable laws from the first moment in the selection of the preferred bidder,” it said.

Legal disputes are a potential sticking point in the country’s largest-ever energy procurement deal, expected to be worth up to $18 billion at current prices.

The Czechs plan to use the new nuclear power units, together with small modular reactors and renewable sources, to replace a fleet of coal-fired plants as well as some older nuclear reactors that are nearing the end of their lifespan.

($1 = 23.4270 Czech crowns) Reporting by Jason Hovet; editing by Philippa Fletcher

TODAY. Canadians are waking up to the nuclear scam. Why are the media and other nations pretending that nuclear is just dandy?

I do read quite a few criticisms of the nuclear industry, from various non-profit groups. But lately, there’s a whole heap of them from Canada. And the unnerving thing is that these pesky Canadians are giving “chapter and verse” – facts and figures on how bad things really are, for the nuclear industry.

Of course, the Canadian, and indeed, the global nuclear lobby too, are pretending not to notice this. (But they must be a tad worried, lest too many intelligent people in other countries catch on to this annoying attention to detail)

Susan O’Donnell writes about New Brunswick’s nuclear fantasies – the history of successive governments pouring tax-payers’ money into “advanced” reactor designs that are known by reputable scientists to be commercially unviable. -The Higgs government passing legislation forcing NB Power to buy electricity, at any price, from SMRs if they are ever built and actually work.

The companies involved have been unable to entice private investors, and are unlikely to get federal funding. NB Power’s $5.4-billion debt is mainly due to the poor performance of its Point Lepreau nuclear reactor. New Brunswickers are facing a 19.4 per cent increase in electricity rates. “Keeping the Point Lepreau and SMR fantasies alive will require considerable effort from the new government. “

Another recent example – from the Seniors for Climate Action Now! (SCAN):

They point out :

- the scandal-ridden nuclear history.

- the revolving door between government officials and nuclear industry well-paid jobs.

- the government/industry nuclear pitch to NATO- “Ontario is selling itself as the nuclear North Star to guide the direction of American power”.

- the failure of theNuScale SMR project.

- OPG’s lengthy submission on small nuclear reactors is full of the things that could go wrong.

- the over $40billion cost of refurbishing old end-of-life reactors.

- New nuclear reactors at over $60billion

They raise such awkward questions about “Ontario’s journey to becoming an energy superpower”

But then, I forgot that this comes from Seniors. And I’ve just remembered that the nuclear industry is all about the young cool and trendy.

There are so many views from Canadians exploding the nuclear propaganda. And they’re not all old fogeys.

-

Archives

- February 2026 (141)

- January 2026 (308)

- December 2025 (358)

- November 2025 (359)

- October 2025 (376)

- September 2025 (258)

- August 2025 (319)

- July 2025 (230)

- June 2025 (348)

- May 2025 (261)

- April 2025 (305)

- March 2025 (319)

-

Categories

- 1

- 1 NUCLEAR ISSUES

- business and costs

- climate change

- culture and arts

- ENERGY

- environment

- health

- history

- indigenous issues

- Legal

- marketing of nuclear

- media

- opposition to nuclear

- PERSONAL STORIES

- politics

- politics international

- Religion and ethics

- safety

- secrets,lies and civil liberties

- spinbuster

- technology

- Uranium

- wastes

- weapons and war

- Women

- 2 WORLD

- ACTION

- AFRICA

- Atrocities

- AUSTRALIA

- Christina's notes

- Christina's themes

- culture and arts

- Events

- Fuk 2022

- Fuk 2023

- Fukushima 2017

- Fukushima 2018

- fukushima 2019

- Fukushima 2020

- Fukushima 2021

- general

- global warming

- Humour (God we need it)

- Nuclear

- RARE EARTHS

- Reference

- resources – print

- Resources -audiovicual

- Weekly Newsletter

- World

- World Nuclear

- YouTube

-

RSS

Entries RSS

Comments RSS