The £40bn nuclear project at risk of becoming another British white elephant.

Telegraph 9th Feb 2025, Matt Oliver. Industry Editor,

On the Suffolk coast, an army of yellow diggers and dump

trucks are levelling fields and preparing the ground for one of Britain’s

biggest infrastructure projects. It is here that thousands of workers plan

to raise Sizewell C, a multibillion-pound nuclear power station, in the

late 2030s, eventually providing power for some 6m homes. If approved in

the coming months, the scheme would replace capacity lost elsewhere over

the next decade as other nuclear plants from the 1970s and 80s gradually

shut down.

Yet that is still a big “if”, with Labour ministers

currently weighing up whether the benefits of Sizewell C are worth the

gargantuan costs, which will reportedly exceed £40bn (the original budget

given to HS2). On one hand, it is a shovel-ready project that promises to

boost energy security and economic growth – something Rachel Reeves, the

Chancellor, is in desperate need of.

Hanging over the project, however, is

the shadow of its sister scheme: Hinkley Point C in Somerset, which is

running years behind schedule and has gone dramatically over-budget.

Should Sizewell C spiral into disaster, like Hinkley, it could easily become a

white elephant that kills off the prospects of any future successors. And

unlike its sister scheme, which was funded entirely by EDF and other

investors, British taxpayers will be on the hook if things go wrong, with

the Government playing the role of anchor investor.

“There is no transparency around Sizewell C,” says spokesman Alison Downes, who lives

nearby. “Why, despite government support, does its likely eye-watering

cost and impact on households remain shrouded in secrecy? Hinkley has

morphed into the most expensive nuclear power station ever built, by some

distance. Originally budgeted at £18bn, it is now estimated to cost

£46bn. Miliband quietly initiated a review of the nuclear programme last

year and there is speculation he could soon axe the Wylfa proposal in

favour of focusing on mini nuclear plants known as small modular reactors

(SMR) instead.

https://www.telegraph.co.uk/business/2025/02/09/sizewell-c-becoming-another-british-white-elephant/

It’s money that has stopped nuclear power, not planning problems

David Toke, Feb 09, 2025, https://davidtoke.substack.com/p/its-money-that-has-stopped-nuclear

Of all the nonsense about nuclear power that one hears, the idea that somehow it is planning problems rather than financial issues that stop its development surely takes the biscuit. The Government bats away any formal planning objection made to its nuclear plant when companies want to build them. Yet the UK government is flogging nuclear planning problems as a scapegoat for the technology’s failure for all it is worth. And it is talking about the non-existent concept of small modular reactors (see HERE). Is this a smokescreen to hide its problems with financing Sizewell C?

The real reason for the failure of the Wylfa project

There was a silly story published in most leading newspapers about the proposed Wylfa plant in North Wales being knocked back in 2019 because of ‘language’ objections (see HERE). The reality was that the proposal was scrapped for financial reasons. This involved the Government being unable to offer enough incentives to keep Hitachi interested in developing the project. In January 2019 the BBC reported that ‘Japanese tech giant Hitachi said it was suspending construction of the new plant in north Wales as the project’s cost continues to spiral.’ (see HERE). The National Grid cancelled plans for pylons needed for the project (see HERE).

The reporting at the time failed to mention any planning issues, only the financial ones. Indeed, once Hitachi announced its withdrawal, that was the effective end of the plans. However, the company set up to make the planning application continued what looks to me like it was going through the motions. It didn’t matter that the Planning Inspector rejected the application. If the proposal was a real one (in an economic sense), the government would surely have overruled the Inspector without delay. -As indeed happened in 20122 with the planning application for Sizewell C.

By contrast, the recent coverage of the planning objections to the Hitachi proposal seems to completely omit any mention of the real reason why the project was abandoned.

Problems with the Government’s nuclear programme

Hitachi originally bought the ‘Horizon’ option from RWE and E.On. It consisted of the proposed development at Wylfa and another at Oldbury in Gloucestershire. RWE/E.ON had withdrawn from the proposal in 2012. This (Horizon) was one of three consortia set up in 2009 to constitute the Government’s new nuclear programme. This was announced by Ed Miliband in 2009 in his last manifestation as Energy Secretary.

The second consortium to fall apart, the so-called ‘NuGen’ consortium, was supposed to build a new nuclear project at Sellafield called ‘Moorside’. This consortium was originally owned by Iberdrola, the Spanish company and the French company GDF Suez (now Engie). However, they lost interest and the consortium was bought up instead by Toshiba in 2013. Then in 2017, Toshiba decided to ‘mothball’ the project. Again, financial reasons were always cited as the reason for this. Once again this had nothing to do with planning issues.

This left the third consortium led by EDF. They advanced their Hinkley C project. Eventually, they agreed the controversial deal whereby they would receive £92.50 per MWh over 35 years in 2012 prices, now worth over £130 power MWh in today’s money. They also agreed on a contract for Sizewell C so that if that went ahead as well both projects would receive £89.50 per MWh.

I knew at the time this was a bit of PR and that EDF would never go ahead with the agreement in respect of Sizewell C. They did not. Instead, they have agreed on a deal whereby, in effect, most of the costs, including the inevitable large overruns, will be paid by the British taxpayer or electricity consumer.

So, none of the privately owned companies originally involved in the British nuclear programme went ahead with the proposals. Centrica was also involved with the Hinkley C proposal at one stage, but it withdrew in 2013. Only the French-state-owned EDF has gone ahead with building a nuclear power plant, ie Hinkley C. EDF can carry on the construction. This is despite the mounting construction cost overruns. The French state pays!

Planning and paying for Sizewell

In effect, the French taxpayer is paying for a British nuclear power plant in the shape of Hinkley C. However, the French have said that this cannot happen again (ie they paying (most of) the cost overruns for a British nuclear power station). Hence Sizewell C will be funded mostly by the British taxpayer and electricity consumer, with the Brits taking the main liabilities, not the French.

The UK Government is currently arguing within itself and with EDF about how much Treasury funding the UK Government is going to put into the project. There has been a charade of looking for private investors. The only way private investment could be achieved would be for the investors to be effectively guaranteed their profits at the taxpayers’ or energy consumers’ expense.

Interestingly, in 2022 the Planning Inspector said they could not recommend the Sizewell C project without a more convincing plan to ensure a sustainable water supply. However, this objection was batted aside by the then Energy Secretary, Kwasi Kwateng, in 2022 (see HERE). This affair received little publicity because everybody knew that the Government could easily dismiss this problem, and override recommendations by Planning Inspectors. The Government saw no reason at the time to make a big deal out of it. After all, why would the Government want to publicise doubts about the water supply for Hinkley C when it wanted the project to go ahead?

Indeed in the summer of 2022, all the talk was on how to pay for Sizewell C. With planning consent having been sorted, Boris Johnson wanted to go full steam ahead and give the final go-ahead, something that did not please the Treasury. According to a report in The Times (see HERE) ‘Simon Clarke, the chief secretary to the Treasury……………. wrote to Johnson and Zahawi warning that a signoff for Sizewell would compromise the new prime minister’s ability to cut taxes or spend more on the cost of living’. Apparently, even Liz Truss did not want to take on the costs of Sizewell C.

But fast forward to February 2025 (with still no final go-ahead for Sizewell C), and the Government saw fit to make a very big deal out of a planning debating point regarding an already-abandoned project in Wales. Why? Maybe, I think to distract attention from the fact that it is the financing of nuclear power and its delivery that is the big problem. One can almost hear Sir Humphrey intoning ‘The public does not need to be overloaded with such details’. Otherwise, the politicians might stop blaming each other about things (eg costs of nuclear power) over which they have no control and focus on things that they do have some control.

Planning (or not?) for heat pumps

One thing that the politicians do control are the building regulations which could be making heat pumps and solar PV mandatory in new buildings. Alas, this has been kicked into the long grass by a press release a few weeks ago (see HERE). The Government has full control over the regulations, but it has given way to pressures from the construction industry. Yes, that is the same industry who are so keen on building nuclear power stations.

Can the nuclear industry find a better way to build?

The sector is hopeful that using copies of established reactors can help keep costs down and

prevent delays for new projects.

On a construction site sitting behind the

beach at Sizewell, on England’s East Anglian coast, mountains of soil

make it hard to see two small, blue signs. These indicate the spots where,

in the middle of the next decade, two nuclear reactors should start

generating enough energy to power 6mn homes.

The extraordinary thing about

the 900-acre site is not its scale but that it has an identical twin —

for reasons that reveal a lot about the latest thinking on building nuclear

power stations. The new Sizewell C plant has been designed to be as close

as possible a copy of Hinkley Point C, a project 280 miles away on the

other side of the country. Building there started in 2016, eight years

before that at Sizewell.

The replication is part of a push across Europe and North America to tackle what Bent Flyvbjerg, an academic studying project management, calls the nuclear power industry’s “negative learning” problem. More simply: for an industry that has become infamous

for massive cost overruns and endless delays, maybe the solution is just to

build exact copies of established reactors.

The IEA has found that nuclear

plants delivered since 2000 in the US and Europe were on average eight

years late and cost two-and-a-half times their original budget. The UK

government on Thursday announced planning reforms intended to make it

easier to build nuclear plants quickly and cheaply. Tom Burke, founder of

E3G, a London-based clean energy consultancy, is far more sceptical, saying

the information from the countries claiming better records lacks

credibility. “Where the publicly available information is reliable — if

you look at what happened in Finland, the United States and the United

Kingdom — people have not built reactors to time and budget, ever,”

Burke says. EDF has said UK regulations meant there were 7,000 changes to

the design for Hinkley Point from that at Flamanville — although the

UK’s Office for Nuclear Regulation has disputed the figure.

Many developers’ hopes are hanging on a new breed of reactors — small

modular reactors. The devices are intended to be small enough to

mass-produce on a highly standardised basis in the controlled environment

of a factory. They will then be taken to power station sites for

installation. Most SMRs will have a capacity below 300MW, less than 10 per

cent of the 3.2GW capacity at Sizewell C, and will be far smaller.

Yet sceptics such as E3G’s Burke are far from convinced. Asked if he thinks

steady orders and standardisation can bring the sector’s costs under

control, Burke replies: “I think that’s one of the biggest ‘ifs’

I’ve ever seen.”

FT 10th Feb 2025

https://www.ft.com/content/5e563e3f-575d-4a90-bd46-4d0a3083f707

Belgium wants an atomic U-turn, but its nuclear operator doesn’t

Engie said nuclear power is no longer part of its strategic planning, and that it is no longer investing in nuclear power.

David Rogers, Global Construction Review, 5 Feb 25

The Belgian government wants to extend the lives of its five nuclear reactors and start building their replacements, repealing a 2003 law banning new nuclear construction, the Belga news agency reports.

But the company that owns the reactors – France’s Engie – is not interested.

The country is governed by a five-party coalition that formed in January after seven months of negotiations. It’s led by prime minister Bart De Wever……………

Belgium opted out of nuclear power in 2003, when the government of Guy Verhofstadt passed a law forbidding the construction of nuclear reactors………

De Wever’s government aims to repeal this law, and to further extend the life of the existing reactors……… De Wever wants another life extension for them, and a life extension for the country’s oldest reactors, Doel 1 and 2 and Tihange 1, which are already being decommissioned and are set to shut down this year.

Nuclear operator Engie opposes De Wever’s plans.

Engie Belgium chief executive Vincent Verbeke said it would be possible to extend Doel 4 and Tihange 3 until 2035, but to put off decommissioning beyond that was “unthinkable”.

Engie said nuclear power is no longer part of its strategic planning, and that it is no longer investing in nuclear power.

That means the government will have to either find a new operator, or nationalise the nuclear power plants before their lives can be extended again………………………. https://www.globalconstructionreview.com/belgium-wants-an-atomic-u-turn-but-its-nuclear-operator-doesnt/

France’s top audit body questions feasibility of EDF’s nuclear plans

The report noted that the EPR2 program still lacks a final cost estimate and financing plan, while state-owned energy company EDF remains heavily indebted. The Cour des Comptes recommended withholding a final investment decision until financing is secured.

France’s Cour des Comptes has issued a warning about rising nuclear energy costs. It is urging state-owned utility EDF to reduce its financial risks in international projects.

Solar Power Portal, February 3, 2025 Emiliano Bellini, https://www.pv-magazine.com/2025/02/03/frances-top-audit-body-questions-feasibility-of-edfs-nuclear-plans/

France’s supreme audit institution, the Cour des Comptes, has released a report on the feasibility of the nuclear plans unveiled by the government in 2022, concluding that the industry is “far from being ready” for the challenge.

The Cour des Comptes said the plan to develop EPR2 nuclear reactors – pressurized water reactors designed by EDF and Framatome – remains unclear.

“The expected profitability of the EPR2 program remains, at this stage, unknown, especially as the financing conditions of this program have still not been determined,” the authors of the report said. “When these conditions will be clear, an additional year or more will be needed to obtain their approval by the European Commission. These delays and uncertainties, which also concern the number of power plants to be built, reduce the visibility that stakeholders in the sector need to engage in industrial projects of this magnitude and obtain financing.”

The report noted that the EPR2 program still lacks a final cost estimate and financing plan, while state-owned energy company EDF remains heavily indebted. The Cour des Comptes recommended withholding a final investment decision until financing is secured.

These precautions aim to prevent cost overruns similar to those seen in EDF’s Olkiluoto EPR project in Finland, the Hinkley Point plant in the United Kingdom, and the Flamanville 3 facility in France.

“EPR reactors operating in China and Finland have experienced multiple technical malfunctions in recent years, with significant financial impacts and damaging consequences for the credibility of the EPR2 program,” said Cour des Comptes. “EDF had to record in its 2023 financial report a depreciation of this asset which reduced its results by €11.5 billion ($11.77 million),” they added referring to the Hinkley Point C project, whose costs rose to GBP 33 billion ($40.6 billion), a 100% increase versus the initial estimated cost.

The court also said that a proposal to expand EDF’s Sizewell plant in the United Kingdom could be rejected if the French utility fails to reduce its financial exposure for Hinkley Point C. It warned that the industrial strategy implemented by EDF does not yet guarantee the accountability of stakeholders and noted that the incentives that are essential to the success of the EPR2 program.

“The EDF group’s strategy, which plans to continue promoting nuclear reactors internationally, should no longer make excessive equity commitments or take excessive risks in terms of profitability and operational coordination between the different projects,” the court said, noting that these financial risks may slow down the schedule of EPR2 program in France.

The report concluded that efforts to strengthen the nuclear industry remain inadequate, particularly in rebuilding skills and capacity.

Nuclear delusion in Ynys Môn will deny islanders green jobs

NFLA 3rd Feb 2025

Welsh antinuclear campaigners believe that the continued fixation of certain Senedd politicians and civil servants on bringing a new nuclear project back to Wylfa amounts to a delusion which will deny local people of Ynys Môn the opportunity to take up green jobs in the interim and make of Ynys Môn a true ‘green energy island’.

Former Labour First Minister Vaughan Gething MS convened an inaugural meeting of the Nuclear Energy Senedd Cross-Party Group recently with the primary objective of bringing a new nuclear power plant to Wylfa. In the gushing pre-amble accompanying the meeting invite the organisers describe such a project as the ‘single biggest inward investment opportunity in Welsh history’, without seemingly being cognizant that such a project will be costly and uncertain with a previous gigawatt project being derailed by the enormous financial cost and a condemnatory Planning Inspector’s report setting out clear and valid reasons for refusal.

Antinuclear campaigners are adamant that new nuclear cannot deliver ‘clean Welsh power, good jobs and skills and investment in communities’; they believe there should instead be a focus on renewable energy technologies, which will guarantee new ‘green’ jobs and a boost to the Ynys Môn economy.

The promise of such a strategy was outlined in the publication a ‘Manifesto for Mon’, authored by the late renowned Dr Carl Clowes, who identified that the development of sustainable industries, including renewable energy, on the island could create 2,500 – 3,000 jobs for local people. Existing jobs decommissioning the old Wylfa plant would be retained as the project will take decades to complete.

In July 2022, campaign groups met in Caernarfon to adopt a declaration outlining their common goals in opposing new nuclear power and affirming the commitment to achieving a renewable energy future for the nation.

Of nuclear power, the declaration states that ‘it costs too much; takes too long; will come too late [to address the energy or climate change crisis]; is accompanied by operational risks; causes long-term damage to the natural environment; is dependent upon foreign technology, finance, and uranium; is inevitably linked to the production and possession of nuclear weapons; always represents a potential target for terrorists or hostile powers in times of war; and creates toxic waste, left for future generations to deal with.’ ………………………………………………………………………………………………

the reality, as established at the two existing gigawatt projects, at Hinkley Point C in Somerset and increasingly at Sizewell C in Suffolk, is that, for these large construction projects, large national and multinational civil engineering contractors are engaged, with experience in delivering mega projects at this scale, and they bring with them specialist subcontractors with their own transient workforces. These workers require housing and landlords, recognising that they are in highly paid employment and able to pay higher rents, displace existing tenants to free up houses for the workforce. Alternately local holiday camps have been acquired to house the workers denying this accommodation to tourists for years. It is hardly likely that any more than a tiny minority of this workforce would be local or Welsh-speaking.

Referencing specific concerns about its impact on Welsh-speaking Gwynedd and Ynys Môn, the Declaration states that new nuclear ‘will inevitably lead to a huge influx of temporary workers, most of whom will not use Welsh as their first language. This will lead to a dilution in the first use of the Welsh language for daily conversations and transactions, and inevitably adversely impact the linguistic heritage of the region.’

Wylfa was described by former Conservative Prime Ministers Boris Johnson and Rishi Sunak as the ‘best site for new nuclear in Europe’ without either backing this bold statement with any evidence. The Planning Inspectorate clearly had a contrary view as they published a report recommending refusal of Hitachi’s proposal to build the Wylfa Newydd plant.

Energy company Horizon – a subsidiary of Hitachi – needed a Development Consent Order to allow their £16bn project to go ahead, but refusal of the DCO was recommended on several grounds. Although the project was expected to create 1,000 permanent jobs and 9,000 temporary construction posts, planning officers believed that ‘on balance, the matters weighing against the proposed development outweigh the matters weighing in favour of it’ for their assessment identified that the project would displace the Arctic and Sandwich tern populations from Cemlyn Bay where the plant was set to be built, and that the influx of thousands of building workers would have an adverse impact on the local economy and tourism, put huge pressure on local housing, and dilute the prevalent use of the Welsh language.

For the reality, as established at the two existing gigawatt projects, at Hinkley Point C in Somerset and increasingly at Sizewell C in Suffolk, is that, for these large construction projects, large national and multinational civil engineering contractors are engaged, with experience in delivering mega projects at this scale, and they bring with them specialist subcontractors with their own transient workforces. These workers require housing and landlords, recognising that they are in highly paid employment and able to pay higher rents, displace existing tenants to free up houses for the workforce. Alternately local holiday camps have been acquired to house the workers denying this accommodation to tourists for years. It is hardly likely that any more than a tiny minority of this workforce would be local or Welsh-speaking.

In May 2024, Energy Secretary Claire Coutinho announced that Wylfa was the Conservative Government’s ‘preferred site’ for a third large-scale nuclear power plant. Although the Welsh Nuclear Free Local Authorities had urged the Welsh Government to themselves purchase and redevelop the site as a renewable energy hub as a step towards making Ynys Mon a ‘green energy island’, this suggestion was declined and instead the site was eventually bought by the British Government from the former owners – Hitachi – who had wound up its Horizon Nuclear Power subsidiary in March 2021 after failing to secure a satisfactory public subsidy from Conservative Ministers and must have been keen to sell the site, with Oldbury, for £160 million.

It remains unlikely that any third new gigawatt plant at Wylfa will be developed. With two similar projects currently in development securing the necessary finance for a third remains the overriding challenge.

Hinkley Point C is being developed at its own expense by EDF Energy, which is owned by the French state. It is significantly above budget and will be delivered years late. The original estimated cost was £18 billion, but this has risen to £34 billion, based on 2015 prices. Although the project was first expected to be generating by the end of 2017, it is now unlikely to be completed before 2031.

British newspapers have recently reported comments attributed to sources close to the Sizewell C project that the likely budget has doubled to £40 billion. EDF Energy is also a minority stakeholder in this project, but, based on their sobering experience in backing Hinkley Point C, French state auditors have just recommended that no further significant investment be made in such foreign enterprises. The UK Government is the majority stakeholder. It has so far burnt through, or committed, £5.5 billion of taxpayer cash to finance preliminary works, whilst conducting an extensive and, so far, elusive, search for committed private sector partners upon which to offload much of its stake.

With future French and British Government financial support likely to be limited or non-existent, with Chinese state investment being currently effectively excluded by government diktat, and with private finance so difficult to find, it is highly unlikely a third gigawatt project at Wylfa can be funded. Indeed, the Final Investment Decision to proceed at Sizewell C has been put on hold pending the conclusion of an overall Government Spending Review, amidst a backdrop of more and more cross-party voices in both Houses calling for its abandonment.

Prior to the 2024 general election, Conservative Ministers courted the American nuclear concerns Bechtel and Westinghouse as potential suitors to develop the site. The Welsh NFLAs have previously highlighted their very chequered history of working on the Vogtle and V C Summer projects in the United States, with huge cost overruns, work being charged to state taxpayers which has never been delivered, senior executives being prosecuted for corruption, a corporate bankruptcy, and, in South Carolina, $9 billion being squandered on an incomplete and abandoned nuclear plant which shall never generate electricity. Such businesses, averse to risk, focused on profit, and hooked on grift, would be looking for a big public handout to pique their interest; a handout which Chancellor Rachel Reeves, already contemplating the price tag of Sizewell C and an alleged £22 billion blackhole inherited from the Tories to boot, would baulk at.

With a gigawatt plant at Wylfa then unlikely, what then is the new Senedd committee seeking?

Well, the invite gives a big clue as it references potential developments in the spring. This could of course allude to the outcome of the Spending Review, but equally it might refer to the much-delayed decision about which two Small Modular Reactor designs the Department for Energy Security and Net Zero should take forward with support from the public purse (again) following the conclusion of the SMR competition that is being conducted by Great British Nuclear. Four designs are in the running, with the expectation that two will be selected and offered money and development sites for deployment.

As antinuclear campaigners have previously, and repeatedly, pointed out none of these SMR designs have yet fully navigated the regulatory road to approval for deployment, nor have any been built or operated, and it is uncertain where the finance would come from. It is also unlikely that any will be deployed before the early or mid-2030’s, even if they work; are economically viable; and an acceptable solution to the management and disposal of radioactive waste can be identified. Like gigawatt plants, these modular projects will be assembled on-site by specialist teams who doubtless will be moved from site to site by the developer. Operators will thereafter be often specialists who will be relocated with no family or Welsh connections to Wylfa.

Even were new nuclear to eventually come to the ‘energy island’, it would come far too late to help address the energy and climate change crisis we face now. Remember those 2,500 – 3,000 jobs for local people predicted in the Manifesto for Mon; they could be delivered far more quickly and at a much lower cost, and with local people engaged in renewable energy technologies they would also be contributing to reducing the carbon footprint of Wales and generating the affordable energy the nation’s electricity consumers need……………………………………… https://www.nuclearpolicy.info/news/nuclear-delusion-in-ynys-mon-will-deny-islanders-green-jobs/

Vistra, Constellation lead S&P losers as DeepSeek market rout takes down nuclear plays

Seeking Alpha, Jan. 27, 2025, By: Carl Surran, SA News Editor

Nuclear plays tied to the AI revolution are among the biggest losers in Monday’s early trading, as investors weighed the implications of Chinese startup DeepSeek’s launch of a free open-source artificial intelligence model to rival ChatGPT, which appears to use lower-cost chips and less data.

Tech stocks are hammered as the news seemingly challenges the widespread bet in markets that AI will drive demand along a supply chain from chipmakers to data centers, which has powered a huge inflow of capital into the equity markets and racked up record highs.

The DeepSeek model has caused a jolt of uncertainty about the growth of AI’s energy consumption, raising sudden doubts about nuclear power’s role as an answer to data centers’ appetite for power.

As a result, data centers rank among the day’s biggest decliners on the S&P 500, with Vistra (NYSE:VST), Constellation Energy (NASDAQ:CEG) and NRG Energy -23.5%, -18% and -12.4% respectively; Talen Energy (TLN) recently traded -21.6%.

The links to infrastructure companies also are clear: Vertiv Holdings (VRT), which says it offers cooling solutions that “solve the complex challenges arising from the AI revolution,” GE Vernova (GEV) says its gas turbines provide “sustainable solutions for uninterrupted data center operations,” and Quanta Services (PWR), infrastructure services provider for the electric power and pipeline industries – their shares are -24.3%, -17.4% and -16.6% respectively.

Uranium producers and nuclear technology names also trade substantially lower, including Nuscale Power (SMR) -23.8%, ASP Isotopes (ASPI) -23.2%, Oklo (OKLO) -22.7%, Nano Nuclear Energy (NNE) -22%, Lightbridge (LTBR) -11.4%, Centrus Energy (LEU) -11.4%, NexGen Energy (NXE) -10.5%, Uranium Energy (UEC) -10.1%, Cameco (CCJ) -9.6%, Ur-Energy (URG) -9.1%, Denison Mines (DNN) -8.6%, Uranium Royalty (UROY) -7.7%, Energy Fuels (UUUU) -7.1%………………………………………………more https://seekingalpha.com/news/4398929-vistra-constellation-lead-sp-losers-as-deepseek-market-rout-takes-down-nuclear-plays

China AI startup rattles US new nukes plan

January 30, 2025, https://beyondnuclear.org/china-ai-startup-rattles-us-new-nuke-plan/

Innovative computer modelling with AI doesn’t need the most expensive and dangerous energy from nukes

The much touted second-coming of a “nuclear renaissance” in the United States fueled by the projected soaring global demand to power artificial intelligence (AI) just got a major setback with the surprise January 20, 2025 overnight emergence of an apparently more competitive and efficient Chinese AI startup company, DeepSeek. The US stock market plummeted for the S&P 500 nuclear power companies that have been financially scaling up as the most reliable 24/7 electricity supply for a massive expansion of energy intensive data centers. China’s surprise rollout of DeepSeek and sudden rise to international acclaim at the start of 2025 has seriously disrupted the US claim to global dominance in cloud computing, networking and data storage services powered by extravagantly expensive atomic energy.

US-based AI technology firms, including Nvidia, which lost nearly $600 billion in the January 27th record breaking single day’s largest stock selloff, have led the way in rebranding nuclear power as the preferred choice as the 24/7 power supplier for a massive AI surge. The sudden emergence of DeepSeek, only two months in the making, is being compared to a “sputnik moment” for the US AI market, referencing the former Soviet Union’s launch of the first artificial satellite into orbit in 1959 that triggered a US technological panic and launched America into a “space race” with Russia. DeepSeek has just as suddenly now laid claim to competitively take the technological lead to advance mere computer modelling to an innovative era of computer reasoning.

Starting in 2023 and swelling in 2024, there was sort of a “gold rush” of fast money that sprang up to finance AI deals with new reactor licensing and construction of still unproven Small Modular Reactor (SMR) designs as well as repowering uneconomical, permanently closed reactors like Three Mile Island Unit 1. The Big Tech corporate promotion was primarily driven by the leading hyperscalers including Google, Amazon, MicroSoft, Meta Platforms (aka Facebook) and Oracle. A series of deals have since been cut with the established S&P 500 nuclear corporations led by Constellation Energy, Vistra, and the usual suspects of nuclear start-ups including Oklo Power, NuScale, Talen Energy Corp and TerraPower.

However, like a bolt from the blue, the US nuclear industry has been rattled on the stock market. The S&P 500 nuclear power giants Constellation Energy (CEG) and Vistra (VST) are under scrutiny as international energy analysts reevaluate the energy needs of AI data centers along with that same host of nuclear power start-ups.

NuScale Power Corporation (SMR) Stock Plunges 25% Amid DeepSeek AI Concerns and Reevaluation of AI-Driven Energy Demand

Yahoo! Finance, Ghazal Ahmed, Thu, January 30, 2025

We recently published an article titled These 29 AI Electricity, Infrastructure Stocks Are Crashing Due to DeepSeek News. In this article, we are going to take a look at where NuScale Power Corporation (NYSE:SMR) stands against the other AI stocks.

Investors are pulling back from the artificial intelligence trade. Previously, a report by the Lawrence Berkeley National Laboratory highlighted that US data centers are expected to use 6.7% to 12% of all power by 2028. However, one artificial intelligence startup has upended these estimates, leaving investors wondering whether the anticipated surge in power demand and data center expansion still holds.

Energy, infrastructure, and real-estate stocks were tanking on Monday, even though they were known to be less crowded alternatives to stocks such as Nvidia. Monday’s broad-market selloff has revealed how a vast number of energy-related companies have been banking on the AI boom and the anticipated power surge it was expected to bring.

DeepSeek, an artificial intelligence startup from China, caused a frenzy in the AI world after launching its latest AI models. The company claims that these models built are at par or better than industry-leading models in the United States. They require fewer chips and are made at a fraction of the cost. All of these updates are now threatening to upset the technology world. Once the best-performing securities over the past 18 months, US electricity providers are now one of the hardest hit sectors with investors reevaluating their outlooks toward artificial intelligence and the magnitude of money that they are spending………………………………….

DeepSeek AI is also threatening the dominance of current leaders in the artificial intelligence world. This could potentially slow down the deployment of their data centers. However, an energy economist at the University of Houston noted that the wider adoption of AI could be positive news…………………………………………………………

NuScale Power Corporation (NYSE:SMR)

Number of Hedge Fund Holders: 18

Share Price Decline: (25.02%)

NuScale Power Corporation (NYSE:SMR) designs and markets small modular reactors (SMRs). Another stock heavily tied to the AI world, Corvallis-based NuScale has previously benefited from the idea that AI-driven electricity demand increases could boost its small modular reactor business. Now that Wall Street is reevaluating the energy requirements of AI, energy and related utilities stocks have been tanking. In particular, NuScale saw its shares plunge by 25% following the news regarding DeepSeek. Not only do DeepSeek’s AI models use less computing power and chips, but the model released is also open-source. This move has made it harder for competitors to justify the huge costs that they have been spending on hardware, software, and expertise needed to develop similar systems…………….https://finance.yahoo.com/news/nuscale-power-corporation-smr-stock-015431414.html

Power stocks plunge as energy needs called into question because of new China AI lab

Mon, Jan 27 2025, Spencer Kimball, CNBC

- Constellation Energy, Vistra Corp., Talen Energy and GE Vernova tumbled as China’s DeepSeek AI lab debuted, scaring investors with a lower-cost business model.

- Constellation, Vistra and GE Vernova were leading the S&P 500 this year as investors speculated on AI’s power needs.

- Now, the arrival of DeepSeek is raising questions about how much power will actually be needed.

Power companies that are most exposed to the tech sector’s data center boom plunged Monday, as the debut of China’s DeepSeek open-source AI laboratory led investors to question how much energy artificial intelligence applications will actually consume.

Vistra closed nearly 30% lower, erasing its gains for 2025. Constellation Energy, Talen Energy and GE Vernova tumbled more than 20%, with the latter two stocks also giving up this year’s gains.

Before Monday’s selloff, Constellation, Vistra and GE Vernova had surged to top of the S&P 500 as investors speculated that AI data centers will boost demand for enormous amounts of electricity………………

DeepSeek released an AI model on Christmas Day that Scale AI CEO Alexandr Wang described in an interview with CNBC last week as “earth shattering.” Scale AI provides training data for AI applications.

DeepSeek followed up last week with the release of a reasoning model named DeepSeek-R1 that competes with OpenAI’s o1 model. DeepSeek has since risen to the top of mobile app stores. Wang said DeepSeek has essentially caught up with OpenAI.

“Their model is actually the top performing, or roughly on par with the best American models,” Wang told CNBC’s Andrew Sorkin in a Jan. 23 interview at the World Economic Forum in Davos, Switzerland.

Microsoft CEO Satya Nadella has described DeepSeek as “super-compute efficient.” Bank of America analysts said in a Monday note that DeepSeek is “challenging the notion of U.S. leadership in AI and raising doubts about the high expectations for cloud capex, chip growth and power requirements.”

The tech companies have anticipated needing so much electricity to supply data centers that they have increasingly looked to nuclear power as a source of reliable, carbon-free energy.

Constellation, for example, has signed a power agreement with Microsoft to restart the Three Mile Island nuclear plant outside Harrisburg, Pennsylvania. Talen is powering an Amazon data center with electricity from the nearby Susquehanna nuclear plant…………………………

Nuclear- not good vibrations in France

Renew Extra 25th Jan 2025, https://renewextraweekly.blogspot.com/2025/01/nuclear-not-good-vibrations-in-france.html

France is having problems with nuclear power. It was once the poster child for nuclear energy, which, after a rapid government funded build-up in the1980s based on standard Westinghouse Pressurised-water Reactor (PWR) designs, at one point supplied around 75% of its power, with over 50 reactors running around the country. Mass deployment of similar designs meant that there were economies of scale and given that it was a state-run programme, the government could supply low-cost funding and power could be supplied to consumers relatively cheaply.

But the plants are now getting old, and there has been a long running debate over what to do to replace them: it will be expensive given the changed energy market, with cheaper alternatives emerging. At one stage, after the Fukushima disaster in Japan in 2011, it was proposed by the socialist government to limit nuclear to supplying just 50% of French power by 2025, with renewables to be ramped up.

That began to look quite sensible when, in 2016, faults were found with the steel forgings of some of the old PWR plants. There was an extensive programme of reactor checks, with some units having to be shut down for the duration. But the industry, though chastened by stories about cover-ups, survived, and, with a new government in power led by Macron, the 50% limit was delayed. Indeed, proposals were made for significant expansion, based in part on an upgrade European Pressurised-water Reactor (EPR) design.

Macron said ‘Our energy & ecological future depends on nuclear power; our economic and industrial future depends on nuclear power; and France’s strategic future depends on nuclear power’:

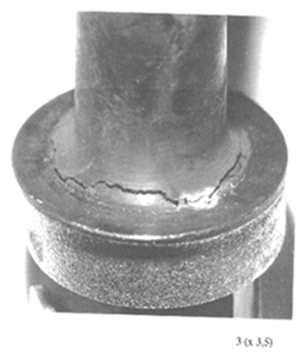

The first EPR in France has been built at Flamanville on the Normandy coast, but all did not go well. It was 12 years late and four times overbudget. And new vibration problems could mean that it may not be able to run at full power. In addition, more problems (this time with stress corrosion) have been found with some of the old plants.

With at one stage, 28 of them shut down for tests and/or repairs, EDFs financial situation became increasingly weak. And, it has got worse. With, in 2024, the French government and economy also being in some disarray, it looked as if plans for more projects might have to be reconsidered, their being reports that ‘in the absence of financial commitment from the State, EDF (is) raising the possibility of halving the investments planned in the EPR2 program in 2025.’

It was the same for EDFs programme of building more EPRs in the UK- with one at Sizewell in Suffolk being proposed to follow on from the part-built one at Hinkley Point in Somerset. Indeed, the French Court of Auditors has just recommended ‘not approving a final investment decision for EDF in Sizewell C before obtaining a significant reduction in its financial exposure in Hinkley Point C’.

So what next? The somewhat beleaguered French government evidently wants the European Commission to revise EU renewable energy directive to also provide support for new nuclear! But back home, it is arguably ‘far from ready’ for a new nuclear expansion programme. And, with nuclear costs rising, the idea of treating it as ‘low risk’ compared with renewables in EU plans is being resisted. Then again EDF evidently think some new nuclear options are too risky- it has pulled out of work on its initial design for a Small Modular Reactor, so it is no longer a contender for the UK SMR competition.

What does all this mean for the UK? Well, although its overall finances are not good, up until recently, EDF has done quite well out of the UK, still running its fleet of old AGRs and its single PWR, with the UK’s funding subsidy schemes providing support for French profit-making via surcharges on UK consumers bills – in the case of the proposed new RAB scheme for Sizewell C, in advance of project completion. Indeed, some might say EDF’s exploitation of the UK has been overdone and not helpful!

Certainly, EDF’s current troubles add to the increasing level of uncertainty about Sizewell C. China had provided some backing for Hinkley, but, with there being growing concerns about security, the UK government decided that China could not be allowed to back Sizewell. So the hunt was on for new backers. However, it has proven to be hard, and with talk of the bills for these projects ballooning, allegedly to £46bn for Hinkley, the opposition lobby is getting more assertive. Hinkley Point C was originally meant to start up in 2017, but may finally get going in 2031 or so. It is a giant project, impressive in a way, but arguably not what is needed, with renewables getting so much cheaper. Same for Sizewell C- it’s getting increasingly hard to justify it.

EDF do seem to be having it tough with nuclear of late, but although the costs of the EPRs may be disputed, whatever they turn out to be, it’s far from clear if the French EPRs will be value for money. The UK has done quite well so far with renewables, which have helped it get its emissions down by a half between 1990 and 2022, compared to a 23% reduction in France, where nuclear is still predominant and renewable are, so far, less developed. Time for a change everywhere? Certainly, back in 2021, the IEA and RTE Agency in France produced a study asking if it was technically possible to integrate very high shares of renewables in large power systems like that in France. It concluded that, if coupled with adequate storage and system balancing, for renewables to supply 85-90% of power by 2050 and 100% by 2060. However, it would be expensive. But then so would continuing with nuclear, maybe more so.

UAE’s nuclear company seeks to capitalise on AI-induced energy demand in US

Enec’s CEO says it plans to expand overseas after rapid growth in its home market

Malcolm Moore in Abu Dhabi, Ft.com 26 Jan 25

The United Arab Emirates wants to build and consult on nuclear projects around the world, with the US as the fastest-growing market, the head of the country’s state-owned nuclear company has said.

Emirates Nuclear Energy Company has become a major player since it was established in 2009. It completed the four reactors of its Barakah nuclear power plant, the first in the Arab world, in under 12 years, and on budget. The project was developed in partnership with Korea Electric Power Corp.

The company, known as Enec, has built up investment and research and development teams to explore opportunities beyond the UAE, chief executive Mohamed Al Hammadi told the Financial Times. AI is set to drive a surge in demand for electricity to power data centres.

………………………………………………………Enec has been in discussions to invest in the UK’s Sizewell C project but Al Hammadi declined to comment on whether the company would proceed, only saying that negotiations had “been going through different cycles in the last year”.

The UK has pushed back the final investment decision on Sizewell, which was expected last year, to after the next government spending review expected in the spring, while the estimated cost of the project has doubled from less than five years ago.

Al Hammadi suggested that the US is seeing the fastest growth in demand for nuclear power because of the boom in AI computing. …………………………………………………………………………………. https://www.ft.com/content/f949780a-3eb2-44f2-9db1-f69ce16161b7

Nuclear power: Engie CEO criticises Arizona ambitions to extend Doel and Tihange lifespan.

Brussels Times, 25 January 2025, https://www.brusselstimes.com/news/1409124/nuclear-power-engie-ceo-criticises-arizona-ambitions-to-extend-doel-and-tihange-lifespan

Negotiators for the new federal government can kiss goodbye their plans to extend additional nuclear reactors or keep Doel 4 and Tihange 3 running for another 20 years. In a frustrated communication on Friday, Engie Belgium’s managing director Vincent Verbeke branded the plans “unthinkable today.”

The work Engie must carry out on Belgium’s nuclear sites is already “colossal”, Verbeke stressed. He points in particular to the dismantling of nuclear power plants that have already been shut down, work to secure the reactors that are due to close in 2025 and above all, the extension of Doel 4 and Tihange 3 until 2035.

It is therefore simply unthinkable to plan to keep Tihange 1 open any longer, insists the head of Engie Belgium. “We’re concentrating on what we’ve agreed, in particular the ten-year extension. This already represents a gigantic amount of work.”

Furthermore, nuclear power is no longer part of Engie’s “strategic ambition”, Verbeke says. The French energy giant is focusing more on renewable energies and flexibility. “We are no longer investing in nuclear power,” adds the CEO.

Plans to extend Doel 4 and Tihange 3 for a further ten years also appear to have fallen on deaf ears for the time being. “A 20-year extension is a different project. It doesn’t exist.” Verbeke reiterated that nuclear power is too expensive and the cheapest option is to invest in renewable energies.

“We are no longer investing in nuclear.”

“We are focusing on what we agreed upon, namely the extension by 10 years.

That is already a gigantic job,” says Vincent Verbeke. According to him,

nuclear is no longer part of Engie’s “strategic ambition”.

The French energy giant focuses on renewable energy and flexibility. “We are no longer

investing in nuclear.” The plans to extend Doel 4 and Tihange 3 by another

10 years seem to fall flat on their face. “A 20-year extension is a

different project. It doesn’t exist,” says Verbeke. He thinks nuclear

energy is too expensive. “The cheapest option is to invest in renewables.”

VRT News 24th Jan 2025, https://www.vrt.be/vrtnws/nl/2025/01/24/bijkomende-verlenging-doel-4-en-tihange-3-ondenkbaar-zegt-eng/

East Suffolk MP warned “billions worthlessly invested” in Sizewell C

Campaigners have written to Member of Parliament for Suffolk Coastal, Jenny

Riddell-Carpenter, about the billions spent on nuclear project Sizewell C,

after costs were speculated to end up spiralling to £40 billion.

The long-term expense of the project has come into question after it emerged

that spending on another nuclear power station that is being built by

French state-owned developer EDF is expected to be in excess of £40bn.

Cour des Comptes, the French state auditor, last week advised the energy

company to delay an investment decision on the nuclear power station in

Sizewell, after Hinkley Point C hit delays and refinancing difficulties.

It advised EDF to slash its financial exposure to the Hinkley Point C project

before making a final decision regarding its investment in Sizewell C.

Campaign group Together Against Sizewell C (TASC) said the auditor’s

advice “demonstrates there are external factors that are outside the

control of the UK government that mean the project might not be

completed”.

Energy Voice 23rd Jan 2025, https://www.energyvoice.com/renewables-energy-transition/nuclear/565933/east-suffolk-mp-warned-billions-worthlessly-invested-in-sizewell-c/

-

Archives

- January 2026 (127)

- December 2025 (358)

- November 2025 (359)

- October 2025 (377)

- September 2025 (258)

- August 2025 (319)

- July 2025 (230)

- June 2025 (348)

- May 2025 (261)

- April 2025 (305)

- March 2025 (319)

- February 2025 (234)

-

Categories

- 1

- 1 NUCLEAR ISSUES

- business and costs

- climate change

- culture and arts

- ENERGY

- environment

- health

- history

- indigenous issues

- Legal

- marketing of nuclear

- media

- opposition to nuclear

- PERSONAL STORIES

- politics

- politics international

- Religion and ethics

- safety

- secrets,lies and civil liberties

- spinbuster

- technology

- Uranium

- wastes

- weapons and war

- Women

- 2 WORLD

- ACTION

- AFRICA

- Atrocities

- AUSTRALIA

- Christina's notes

- Christina's themes

- culture and arts

- Events

- Fuk 2022

- Fuk 2023

- Fukushima 2017

- Fukushima 2018

- fukushima 2019

- Fukushima 2020

- Fukushima 2021

- general

- global warming

- Humour (God we need it)

- Nuclear

- RARE EARTHS

- Reference

- resources – print

- Resources -audiovicual

- Weekly Newsletter

- World

- World Nuclear

- YouTube

-

RSS

Entries RSS

Comments RSS