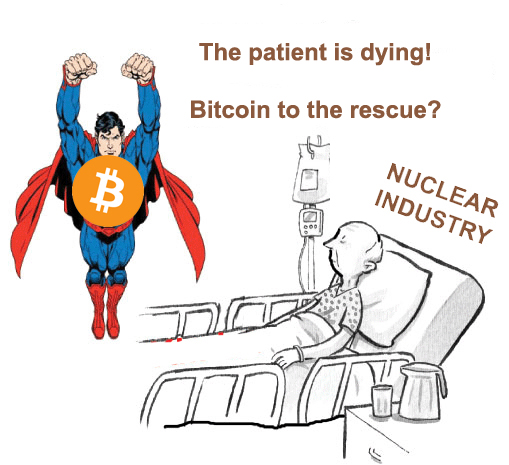

The nuclear industry is dying. Bitcoin to the rescue?

Some lawmakers have called for greater regulation of cryptocurrency, citing the enormous amount of resources required to produce it. “There are computers all over the world right now spitting out random numbers around the clock, in a competition to try to solve a useless puzzle and win the bitcoin reward,” Sen. Elizabeth Warren (D., Mass.) said in June, calling for a crackdown on “environmentally wasteful cryptocurrencies.”

Zero-carbon [?] bitcoin? The owner of a Pennsylvania nuclear plant thinks it could strike gold

Talen Energy plans to build a $400 million bitcoin mine at its Pa. nuclear plant. “I think this is a great opportunity to prolong the life of a lot of nuclear plants.”

Could bitcoin mining be the salvation of the embattled nuclear energy industry in America?

The owners of several nuclear power plants, including two in Pennsylvania, have formed ventures with cryptocurrency companies to provide the electricity needed to run computer centers that “mine” bitcoin. Since nuclear energy does not emit greenhouse gases, [ except that the whole nuclear fuel chain DOES] the project’s investors say, the zero-carbon [ a lie] bitcoin would address climate concerns that have tarnished the energy-intensive cryptocurrency industry.

Talen Energy, the owner of the Susquehanna Steam Electric Station near Berwick, Pa., announced this week that it has signed a deal with TeraWulf Inc., an Easton, Md. cryptocurrency mining firm, to build a giant bitcoin factory next to its twin reactors in northern Pennsylvania. The first phase of the venture, dubbed Nautilus Cryptomine, could cost up to $400 million.

Talen’s project could eventually use up to 300 megawatts — or 12% of Susquehanna’s 2,500 MW capacity. It’s the second bitcoin-mining venture in the last month that involves owners of Pennsylvania nuclear facilities.

Last month Energy Harbor Corp., the former power-generation subsidiary of First Energy Corp., announced it signed a five-year agreement to provide zero-carbon [nuclear is NOT zero-carbon] electricity to a new bitcoin mining center operated by Standard Power in Coshocton, Ohio. Energy Harbor owns two nuclear units in Ohio and the twin-unit Beaver Valley Power Station in Western Pennsylvania.

A nuclear fission start-up, Oklo, also announced last month it signed a 20-year deal with a bitcoin miner to supply it with power, though the company has not yet built a power plant.

In recent years, commercial nuclear operators have struggled to compete in competitive electricity markets against natural gas plants and upstart renewable sources such as wind and solar. Unfavorable market conditions have hastened the retirements of several single-unit reactors, such as Three Mile Island Unit 1 in Pennsylvania. Lawmakers in New Jersey, New York and Illinois have enacted nuclear bailouts, paid by electricity customers, to stave off early retirement for other plants.

The cryptocurrency deals would provide nuclear generators with reliable outlets for their power, and bitcoin miners with predictable sources of power at cheap prices, along with a zero-carbon [nuclear is NOT zero-carbon] cachet…….

The nuclear industry views the crypto craze not as a crutch but as a launching pad for expansion. “U.S. nuclear power plants are ready and able to supply miners with abundant, reliable carbon-free [ but nuclear is NOT carbon-free] power while also providing new business pathways for the nuclear developers and utilities, increasing their operating profits, and potentially accelerating the deployment of the next generation of reactors,” John Kotek, senior vice president of policy development and government affairs at Nuclear Energy Institute, said……

Energy and cryptocurrency experts say several trends are shifting the market in favor of U.S. nuclear power producers.

In May, Chinese regulators announced new measures to limit bitcoin mining in several regions that failed to meet Beijing’s energy-use targets. Bitcoin production levels have fallen since then, forcing bitcoin producers to relocate to places with low operating costs and cool climates to reduce the costs of cooling the bitcoin data centers. The state of Washington, which has lots of inexpensive hydroelectric power, has undergone a huge boom in bitcoin mining.

How mining is done

Bitcoin is a peer-to-peer virtual currency, operating without a central authority, and which can be exchanged for traditional currency such as the U.S. dollar. It is the most successful of hundreds of attempts to create virtual money through the use of cryptography, the science of making and breaking codes — hence, they are called cryptocurrency.

Bitcoin mining is built around blockchain technology, and it involves generating a string of code that decrypts a collection of previously executed bitcoin transactions. Successful decryption is rewarded with a new bitcoin. The supply of bitcoins is limited to 21 million — nearly 90% have already been mined. So the remaining bitcoins become increasingly scarce and more difficult to extract

Data centers operated by bitcoin miners randomly generate code strings, called “hashes,” to solve the puzzle and earn new coins. Worldwide, miners on the bitcoin network generate more than 100 quintillion hashes per second — that’s 100,000,000,000,000,000,000 guesses per second, according to Blockchain.com. The first phase of the Nautilus project in Pennsylvania would generate five quintillion hashes per second.

Such guesswork requires muscular [doncha love that word ”muscular” when they mean ”huge”] computing power, robust internet connections, and lots of electricity. Smaller bitcoin miners have teamed up in consortiums to pool their computing power. Bigger players have built huge data centers devoted exclusively to producing lines of random code.

“Mining cryptocurrency is an international, profitable, and energy-intensive business,” ScottMadden a management consulting firm, said in a paper it published last year. Bitcoin mining consumes an estimated 0.5% of the electricity produced worldwide or about as much as the country of Greece.

Some lawmakers have called for greater regulation of cryptocurrency, citing the enormous amount of resources required to produce it. “There are computers all over the world right now spitting out random numbers around the clock, in a competition to try to solve a useless puzzle and win the bitcoin reward,” Sen. Elizabeth Warren (D., Mass.) said in June, calling for a crackdown on “environmentally wasteful cryptocurrencies.”

………. Unlike other crypto projects in which the power generator is an arms-length electricity supplier, the Nautilus Cryptomine is a 50-50 venture between Talen and TeraWulf. The project would be directly connected to the Susquehanna plant — “behind the meter,” in industry parlance — and would avoid any transmission costs from the grid…….

The cryptomine would be located inside a 200,000-square-foot building — about four football fields. The mining operation would be built on a data center campus that Talen is developing next to the Susquehanna plant……..

“As you look across the United States, and you look at kind of the challenges that are facing nuclear plants, I think this is a great opportunity to prolong the life of a lot of plants,” said Dustin Wertheimer, vice president and divisional chief financial officer of Talen Energy https://www.inquirer.com/business/cryptocurrency-bitcoin-pennsylvania-nuclear-power-talen-susquehanna-20210806.html

1 Comment »

-

Archives

- February 2026 (115)

- January 2026 (308)

- December 2025 (358)

- November 2025 (359)

- October 2025 (376)

- September 2025 (258)

- August 2025 (319)

- July 2025 (230)

- June 2025 (348)

- May 2025 (261)

- April 2025 (305)

- March 2025 (319)

-

Categories

- 1

- 1 NUCLEAR ISSUES

- business and costs

- climate change

- culture and arts

- ENERGY

- environment

- health

- history

- indigenous issues

- Legal

- marketing of nuclear

- media

- opposition to nuclear

- PERSONAL STORIES

- politics

- politics international

- Religion and ethics

- safety

- secrets,lies and civil liberties

- spinbuster

- technology

- Uranium

- wastes

- weapons and war

- Women

- 2 WORLD

- ACTION

- AFRICA

- Atrocities

- AUSTRALIA

- Christina's notes

- Christina's themes

- culture and arts

- Events

- Fuk 2022

- Fuk 2023

- Fukushima 2017

- Fukushima 2018

- fukushima 2019

- Fukushima 2020

- Fukushima 2021

- general

- global warming

- Humour (God we need it)

- Nuclear

- RARE EARTHS

- Reference

- resources – print

- Resources -audiovicual

- Weekly Newsletter

- World

- World Nuclear

- YouTube

-

RSS

Entries RSS

Comments RSS

[…] The nuclear industry is dying. Bitcoin to the rescue? […]