France’s top audit body questions feasibility of EDF’s nuclear plans

The report noted that the EPR2 program still lacks a final cost estimate and financing plan, while state-owned energy company EDF remains heavily indebted. The Cour des Comptes recommended withholding a final investment decision until financing is secured.

France’s Cour des Comptes has issued a warning about rising nuclear energy costs. It is urging state-owned utility EDF to reduce its financial risks in international projects.

Solar Power Portal, February 3, 2025 Emiliano Bellini, https://www.pv-magazine.com/2025/02/03/frances-top-audit-body-questions-feasibility-of-edfs-nuclear-plans/

France’s supreme audit institution, the Cour des Comptes, has released a report on the feasibility of the nuclear plans unveiled by the government in 2022, concluding that the industry is “far from being ready” for the challenge.

The Cour des Comptes said the plan to develop EPR2 nuclear reactors – pressurized water reactors designed by EDF and Framatome – remains unclear.

“The expected profitability of the EPR2 program remains, at this stage, unknown, especially as the financing conditions of this program have still not been determined,” the authors of the report said. “When these conditions will be clear, an additional year or more will be needed to obtain their approval by the European Commission. These delays and uncertainties, which also concern the number of power plants to be built, reduce the visibility that stakeholders in the sector need to engage in industrial projects of this magnitude and obtain financing.”

The report noted that the EPR2 program still lacks a final cost estimate and financing plan, while state-owned energy company EDF remains heavily indebted. The Cour des Comptes recommended withholding a final investment decision until financing is secured.

These precautions aim to prevent cost overruns similar to those seen in EDF’s Olkiluoto EPR project in Finland, the Hinkley Point plant in the United Kingdom, and the Flamanville 3 facility in France.

“EPR reactors operating in China and Finland have experienced multiple technical malfunctions in recent years, with significant financial impacts and damaging consequences for the credibility of the EPR2 program,” said Cour des Comptes. “EDF had to record in its 2023 financial report a depreciation of this asset which reduced its results by €11.5 billion ($11.77 million),” they added referring to the Hinkley Point C project, whose costs rose to GBP 33 billion ($40.6 billion), a 100% increase versus the initial estimated cost.

The court also said that a proposal to expand EDF’s Sizewell plant in the United Kingdom could be rejected if the French utility fails to reduce its financial exposure for Hinkley Point C. It warned that the industrial strategy implemented by EDF does not yet guarantee the accountability of stakeholders and noted that the incentives that are essential to the success of the EPR2 program.

“The EDF group’s strategy, which plans to continue promoting nuclear reactors internationally, should no longer make excessive equity commitments or take excessive risks in terms of profitability and operational coordination between the different projects,” the court said, noting that these financial risks may slow down the schedule of EPR2 program in France.

The report concluded that efforts to strengthen the nuclear industry remain inadequate, particularly in rebuilding skills and capacity.

Nuclear- not good vibrations in France

Renew Extra 25th Jan 2025, https://renewextraweekly.blogspot.com/2025/01/nuclear-not-good-vibrations-in-france.html

France is having problems with nuclear power. It was once the poster child for nuclear energy, which, after a rapid government funded build-up in the1980s based on standard Westinghouse Pressurised-water Reactor (PWR) designs, at one point supplied around 75% of its power, with over 50 reactors running around the country. Mass deployment of similar designs meant that there were economies of scale and given that it was a state-run programme, the government could supply low-cost funding and power could be supplied to consumers relatively cheaply.

But the plants are now getting old, and there has been a long running debate over what to do to replace them: it will be expensive given the changed energy market, with cheaper alternatives emerging. At one stage, after the Fukushima disaster in Japan in 2011, it was proposed by the socialist government to limit nuclear to supplying just 50% of French power by 2025, with renewables to be ramped up.

That began to look quite sensible when, in 2016, faults were found with the steel forgings of some of the old PWR plants. There was an extensive programme of reactor checks, with some units having to be shut down for the duration. But the industry, though chastened by stories about cover-ups, survived, and, with a new government in power led by Macron, the 50% limit was delayed. Indeed, proposals were made for significant expansion, based in part on an upgrade European Pressurised-water Reactor (EPR) design.

Macron said ‘Our energy & ecological future depends on nuclear power; our economic and industrial future depends on nuclear power; and France’s strategic future depends on nuclear power’:

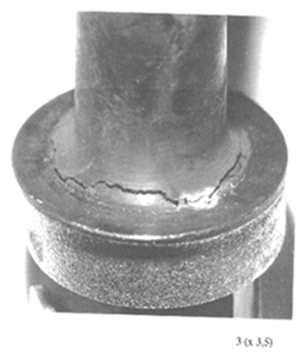

The first EPR in France has been built at Flamanville on the Normandy coast, but all did not go well. It was 12 years late and four times overbudget. And new vibration problems could mean that it may not be able to run at full power. In addition, more problems (this time with stress corrosion) have been found with some of the old plants.

With at one stage, 28 of them shut down for tests and/or repairs, EDFs financial situation became increasingly weak. And, it has got worse. With, in 2024, the French government and economy also being in some disarray, it looked as if plans for more projects might have to be reconsidered, their being reports that ‘in the absence of financial commitment from the State, EDF (is) raising the possibility of halving the investments planned in the EPR2 program in 2025.’

It was the same for EDFs programme of building more EPRs in the UK- with one at Sizewell in Suffolk being proposed to follow on from the part-built one at Hinkley Point in Somerset. Indeed, the French Court of Auditors has just recommended ‘not approving a final investment decision for EDF in Sizewell C before obtaining a significant reduction in its financial exposure in Hinkley Point C’.

So what next? The somewhat beleaguered French government evidently wants the European Commission to revise EU renewable energy directive to also provide support for new nuclear! But back home, it is arguably ‘far from ready’ for a new nuclear expansion programme. And, with nuclear costs rising, the idea of treating it as ‘low risk’ compared with renewables in EU plans is being resisted. Then again EDF evidently think some new nuclear options are too risky- it has pulled out of work on its initial design for a Small Modular Reactor, so it is no longer a contender for the UK SMR competition.

What does all this mean for the UK? Well, although its overall finances are not good, up until recently, EDF has done quite well out of the UK, still running its fleet of old AGRs and its single PWR, with the UK’s funding subsidy schemes providing support for French profit-making via surcharges on UK consumers bills – in the case of the proposed new RAB scheme for Sizewell C, in advance of project completion. Indeed, some might say EDF’s exploitation of the UK has been overdone and not helpful!

Certainly, EDF’s current troubles add to the increasing level of uncertainty about Sizewell C. China had provided some backing for Hinkley, but, with there being growing concerns about security, the UK government decided that China could not be allowed to back Sizewell. So the hunt was on for new backers. However, it has proven to be hard, and with talk of the bills for these projects ballooning, allegedly to £46bn for Hinkley, the opposition lobby is getting more assertive. Hinkley Point C was originally meant to start up in 2017, but may finally get going in 2031 or so. It is a giant project, impressive in a way, but arguably not what is needed, with renewables getting so much cheaper. Same for Sizewell C- it’s getting increasingly hard to justify it.

EDF do seem to be having it tough with nuclear of late, but although the costs of the EPRs may be disputed, whatever they turn out to be, it’s far from clear if the French EPRs will be value for money. The UK has done quite well so far with renewables, which have helped it get its emissions down by a half between 1990 and 2022, compared to a 23% reduction in France, where nuclear is still predominant and renewable are, so far, less developed. Time for a change everywhere? Certainly, back in 2021, the IEA and RTE Agency in France produced a study asking if it was technically possible to integrate very high shares of renewables in large power systems like that in France. It concluded that, if coupled with adequate storage and system balancing, for renewables to supply 85-90% of power by 2050 and 100% by 2060. However, it would be expensive. But then so would continuing with nuclear, maybe more so.

“A question arises in terms of nuclear power – should EDF give up its international ambitions?”

The Court of Auditors is concerned about the electricity company’s ability to support the French fleet renewal program, while it finds itself financially exposed in the costly British projects of Hinkley Point and Sizewell, notes Jean-Michel Bezat, journalist at “Le Monde”, in his column.

Heavily indebted, the company has not yet finished

with its difficulties across the Channel, the Court of Auditors recalled in

a report published on Tuesday, January 14: “The EPR sector: new dynamics,

persistent risks”. The commissioning of the British plant is already five

years behind schedule. The additional cost has reached around 12 billion

euros since 2019, while the departure of the Chinese group CGN, linked to

tensions between London and Beijing, is creating a “worrying financing

constraint” . EDF has had to depreciate 11 billion euros of assets, and the

very profitability of the project is at stake.

Le Monde 20th Jan 2025 https://www.lemonde.fr/idees/article/2025/01/20/une-question-s-impose-en-matiere-de-nucleaire-edf-doit-il-renoncer-a-ses-ambitions-internationales_6506629_3232.html

French energy giant EDF launches search for Hinkley Point finance after damning audit report

EDF Group’s chief executive Luc Rémont has hit

back at the national French auditor’s claims that the energy company

should delay its investment in UK nuclear power project Sizewell C.

He said the regulated asset base (RAB) model for financing the Suffolk nuclear

power station, where the cost of development is shared with the consumer,

should not be correlated with the refinancing of the Hinkley Point C

project in Somerset.

The French state-owned energy company has started a

search for financiers to help refinance the delayed project at Hinkley

Point C, following the French state auditor’s findings yesterday,

according to Rémont.

In October, the energy company issued £500m of

senior bonds to help finance investments in two nuclear reactors at the

site. Rémont said that the funding model for the Sizewell C nuclear power

project on the Suffolk coast “limits” EDF’s capital exposure.

The auditor’s report come a week after a letter was sent to the national

auditor in the UK, the National Audit Office, calling for a review of the

government’s spending assessment for Sizewell C. The campaign group

behind the letter raised concerns of rising costs at Hinkley Point C,

another nuclear power station being built by EDF, now estimated to be in

the region of £46 billion. The letter from Together Against Sizewell C

(TASC) followed a plea by Ecotricity founder Dale Vince, a Labour donor,

for the Treasury’s new Office for Value for Money to review plans to

develop the new nuclear power project in Suffolk.

Energy Voice 15th Jan 2025 https://www.energyvoice.com/renewables-energy-transition/565569/french-energy-giant-edf-launches-search-for-hinkley-point-finance-after-damning-audit-report/

In Flamanville, EPR vibrations weigh down EDF

Blast 15th Jan 2025

https://www.blast-info.fr/articles/2025/a-flamanville-les-vibrations-de-lepr-plombent-edf-27fa5zyHQ6mpDzOKgti6kw

Last week, Luc Rémont, CEO of EDF received a worrying report from the engineers working on the Flamanville EPR. It reveals a recurring problem of excessive vibrations. And indicates that he does not know whether the EPR will be able to operate at full power. Revelations.

At EDF, troubles are flying in squadrons. This Tuesday, January 14, the Court of Auditors published a new report on the Flamanville EPR . The venerable institution on Rue Cambon (Paris) now estimates the final cost of the project at 23.7 billion euros. An amount that is significantly higher than the previous assessment made by the Court in 2020: 19.1 billion.

Kicking the donkey, the report specifies that “the calculations made by the Court result in a mediocre profitability for Flamanville 3” : the tiny margin that EDF could generate will not be enough to repay the cost of the loans! For that to happen, the EPR must one day operate at full power. And of that, even the EDF teams are no longer really convinced.

The scene takes place at a dinner party in Paris late last week. “We were in a meeting in the CEO’s office and everything was going well. But then he received a report from Flamanville and the atmosphere suddenly cooled,” says a senior executive of the electrician present at the meeting. If Luc Rémont, the CEO, did not fall off his seat when he read the report, he came close.

The cause? The engineers working on the reactor’s start-up have a doubt. And a big one. “They don’t know if the EPR will be able to operate at full power,” says this senior executive.

This question, which exists among many employees who worked on the nightmarish reactor construction site (twelve years behind schedule), is now shared by the teams who took charge of the reactor. And it is based on an observation: contrary to what EDF’s communication claims, the vibration problems affecting the primary circuit of the reactor are far from being resolved. “The report confirms that there are still problems with excessive vibrations,” says the decidedly very talkative manager.

At the meeting of the local information committee for the Flamanville nuclear power plant in April 2014, held a few days before the ASN authorised EDF to install nuclear fuel in the tank, the electrician had nevertheless brushed aside the issue of vibrations, stating, clearly a little too quickly, that everything was sorted .

But already in the floors of the general management in Paris, the knives are sharpening and the hunt for the culprit is open. Who will wear the hat? One name is on everyone’s mind: that of Alain Morvan , the director of the EPR project until last October, accused in veiled terms of having hidden too much dust under the carpet.

Contacted by email on Tuesday 14 January late in the morning, EDF indicated that it was sticking to its construction cost of 13.2 billion (excluding interim interest). But it refused to comment on our information on the vibrations. Questioned the same day also by email, the Nuclear Safety and Radiation Protection Authority (ASNR), resulting from the merger of the ASN with the IRSN, did not respond to us.

The EPR nuclear sector: new dynamics show persistent risks -La cour des comptes .

As recommended by the Court, the use of feedback and risk analysis has been

developed.

In addition to the excesses of the Flamanville 3 construction

site, the EPR reactors in operation in China (Taishan 1 and 2) and in

Finland (Olkiluoto 3) have experienced technical malfunctions in recent

years, with significant financial impacts, the consequences of which have

been damaging to the credibility of the EPR 2 programme.

In Great Britain, on the Hinkley Point construction site, EDF is facing a sharp increase in

costs accompanied by a further two-year delay, as well as a heavy

additional financing constraint caused by the withdrawal of the Chinese

co-shareholder.

As regards the new EPR project at Sizewell, delays are

already accumulating, with initial negative consequences in organisational

and financial terms. The Court recommends that a final investment decision

on this project should not be approved until a significant reduction in

EDF’s financial exposure to the Hinkley Point project has been achieved.

The Court also recommends ensuring that any new international nuclear

project generates quantified gains and does not delay the timetable for the

EPR 2 programme in France.

Cour des Comptes 14th Jan 2025, https://www.ccomptes.fr/fr/publications/la-filiere-epr-une-dynamique-nouvelle-des-risques-persistants

Skiing in France is slowly dying.

Skiing in France is slowly dying and many resorts are expected to close

down in a little over 20 years, industry experts have warned. Climate

change, ageing ski lifts and rising costs are driving smaller, mid-altitude

resorts out of business. Five shut down this year and 186 have gone out of

business since the 1950s, mostly in inexpensive ski areas with relatively

few runs that were popular with French families but never attracted large

numbers of foreign holidaymakers.

Times 29th Dec 2024 https://www.thetimes.com/world/europe/article/france-affordable-ski-slopes-shut-why-nqkb3qrk7

FRANCE’S NUCLEAR ENERGY POLICY: A CHRONICLE OF FAILURE – FLAMANVILLE 3.

FRANCE’S NUCLEAR ENERGY POLICY: A CHRONICLE OF FAILURE – FLAMANVILLE 3

25 December 2025

France’s ambitious nuclear energy policy, once hailed as a cornerstone of its energy independence, has faced a long series of missteps, delays, and spiralling costs. The Flamanville 3 reactor, emblematic of these challenges, has taken over two decades from decision to anticipated commercial operation, showcasing the systemic failures in planning, execution, and financial management. This timeline highlights the stark realities behind France’s nuclear endeavours.

TIMELINE: 2002 FRENCH NUCLEAR RENAISSANCE

2002: POLITICAL DISCUSSIONS BEGIN

Discussions around a nuclear renaissance gain traction in France. Policymakers and EDF propose new reactor designs to bolster energy independence and address climate goals.

DECISION: 2004

The decision to build the Flamanville 3 reactor marked the beginning of a new chapter for France’s nuclear ambitions. With an estimated cost of €3.3 billion and a planned construction timeline of 56 months, this European Pressurised Reactor (EPR) was touted as a symbol of technological advancement. However, the project’s initial promise soon gave way to setbacks.

INITIAL WORKS: 2006

Preliminary works commenced in 2006, with optimism running high. The EPR design, developed to enhance safety and efficiency, was heralded as the future of nuclear energy. Yet, from the outset, the complexity of the design began to reveal challenges that would compound over time.

REACTOR CONCRETE: 2007

In 2007, construction on the reactor’s concrete base began, symbolising tangible progress. Simultaneously, the cost estimate was revised to €3.3 billion, as technical adjustments and initial delays started to emerge. Early warnings about budget overruns and scheduling issues were largely ignored.

GRID CONNECTION: 2024

After 17 years of setbacks, the reactor was finally connected to the grid. By this point, the budget had ballooned to €13.2 billion, a nearly fourfold increase from the original estimate. The delays and cost overruns underscored critical deficiencies in project management and regulatory compliance, as over 7,000 design changes required significant material additions.

COMMERCIAL OPERATION: 2025 Q1 The reactor is expected to achieve commercial operation in early 2025, over a decade behind schedule. The protracted timeline—more than 20 years from decision to operation—illustrates the systemic inefficiencies plaguing France’s nuclear energy strategy.

COST OVERRUNS AND FINANCIAL STRAIN

The financial fallout from Flamanville 3 is emblematic of broader challenges in the nuclear industry. Initially budgeted at €3.3 billion, the project’s costs had soared to €19.1 billion by 2020, with further increases likely. These overruns mirror similar issues faced by EDF’s international projects, such as Hinkley Point C in the United Kingdom and Olkiluoto 3 in Finland. Hinkley’s budget has nearly doubled to an estimated £46 billion, with completion now pushed to 2029–31.

EDF’S MOUNTING DEBTS AND CHALLENGES

EDF, the state-owned utility tasked with leading France’s nuclear initiatives, has been burdened by mounting debts. With a €65 billion debt load and a near €18 billion loss in 2022, EDF’s financial woes have raised questions about its capacity to handle multiple large-scale projects. Efforts to stabilise its finances through state support and electricity price adjustments have provided temporary relief but have not addressed structural issues.

BROADER IMPLICATIONS

The delays and cost overruns at Flamanville and other EPR projects have cast doubt on the viability of France’s nuclear renaissance. President Macron’s commitment to building six to 14 new reactors appears increasingly untenable given EDF’s financial and operational struggles. Moreover, these challenges have weakened France’s position as a global leader in nuclear technology, with international competitors advancing at a faster pace.

A FAILED STRATEGY

The failure of France’s nuclear energy policy is evident in its inability to deliver projects on time and within budget. The Flamanville 3 reactor, once a beacon of innovation, has become a cautionary tale of mismanagement and overreach. As France doubles down on nuclear energy, it must confront the hard truths of its flawed approach and consider whether a pivot to more agile and cost-effective renewable energy solutions is necessary to ensure its energy security and economic stability.

France connected its first nuclear reactor to the grid this century. Construction was to take 56 months.

2002 TIMELINE STARTS THE

FRENCH NUCLEAR RENAISSANCE

Initial works: construction was to take 56 months.

Timeline:

• decision: 2004

• initial works: 2006

• reactor concrete: 2007

• grid connection: 2024

• commercial operation: 2025 Q1

22 December 2024 Reports

We don’t know the final cost of France’s new #nuclear reactor at Flamanville, but guestimates it’ll be a few hundred $million higher than the 2020 figure:

• 2007 cost estimate: €3.3bn

• 2020 cost estimate: €19.1bn

France’s most powerful nuclear reactor joins grid after €13bn holdup

RFI 20th Dec 2024

France’s flagship Flamanville nuclear reactor in Normandy was to start supplying electricity to homes on Friday when it’s reconnected to the power grid after a dozen costly years of technical setbacks.

…………………………………………. The start of the new generation European Pressurized Reactor (EPR) comes 12 years behind schedule after a slew of delays and cost overruns.

The cost of the project, initially estimated at €3.3 billion, has ballooned to over €13 billion.

A test run in September had to be interrupted after one day due to an “automatic shutdown”, before starting again days later.

Betting on nuclear

Flamanville 3 is the fourth EPR reactor in the world and the most powerful in France, with a capacity of 1,600 MW. It is the 57th reactor in the French nuclear fleet, which generates around three fifths of the country’s energy.

France continues to bet on nuclear as a way of providing relatively cheap and carbon-free electricity.

The government has committed to building six new-generation EPR2 reactors at a cost of tens of billions of euros, with plans to eventually increase this number to 14.

But questions remain about EDF’s ability to deliver on its ambitions. The energy giant is already heavily in debt, as is the French state – EDF’s sole shareholder……………………………… https://www.rfi.fr/en/france/20241220-france-s-most-powerful-nuclear-reactor-joins-grid-after-%E2%82%AC13bn-holdup-flamanville

France deal raises concerns over EDF dominance – Collective intelligence or failure?

Montel News 13 Dec 24, https://montelnews.com/it/videos/101197195/video-slot-1?v=107667717

The recent collapse of France’s minority government has deepened uncertainty about the future of a controversial deal state-owned EDF struck with the government a year ago with the aim of replacing the Arenh regulation. Arenh, which expires in 2026, required EDF to sell about a third of its annual nuclear output to rival suppliers at a fixed rate of EUR 42/MWh, but this new deal does away with a fixed price and allows EDF to sell all its atomic output on the wholesale market.

The firm says it will aim to sell this output an average price of EUR 70/MWh via long-term supply contracts, auctions, and a tax on wholesale nuclear output. Not only has this provoked fierce criticism from rival suppliers and intensive power consumers who will probably be forced to pay more for their power supplies, but it has also spectacularly failed to attract any takers for EDF’s long-term supply contracts due to lower wholesale prices, potentially endangering the company’s ability to service its huge debts or maintain and expand its nuclear fleet. So, what should France do next? Reporting by Chris Eales, Editor France. Additional reporting by Caroline Pailliez. Contributor: Andreas Rudinger, energy transition expert, IDDRI.

France’s New Nuclear Power Plant Is a Ticking Bomb

Nuclear power plants are vulnerable to climate change, and the rampant rush to revive the nuclear power industry should be stopped.

President Emmanuel Macron’s ambitious plan to revive France’s nuclear energy industry aims for carbon neutrality by 2050. It highlights significant challenges, including climate risks to nuclear sites, such as the Gravelines plant, which faces flooding threats due to rising sea levels. Additionally, the article points to workforce shortages, economic inefficiencies, and geopolitical risks, such as France’s reliance on uranium from Niger, as critical obstacles.

By Rim Longmeng, December 13, 2024 , https://www.fairobserver.com/more/environment/climate-change-news/frances-new-nuclear-power-plant-is-a-ticking-bomb/

Despite Europe’s growing skepticism of nuclear technology in the wake of Fukushima, in 2021, French President Emmanuel Macron announced the revival of his country’s nuclear energy industry. Macron’s ambitious program aims to end the country’s dependence on fossil fuels and make France carbon neutral by 2050. The plan will require the construction of 14 new nuclear reactors. At first glance, Macron’s plans seem logical, as nuclear energy already accounts for 70% of France’s energy consumption, and cheap nuclear energy has been the backbone of the French economy since the 1970s. However, the populist tactics of the French leader are raising questions among the country’s population and experts, as the problems of the nuclear industry – which will inevitably arise soon – will be left for future generations to solve after Macron leaves office.

No room for improvisation in the face of climate risks

In its report October 3, 2024 Greenpeace harshly criticized the French government’s plans to build two new EPR2 nuclear reactors in northwestern France near Dunkirk due to the risk of flooding. The new units are scheduled to be operational by 2040, but the problem lies in the site chosen for construction. The chosen site is located in a region already at risk of flooding and will become increasingly vulnerable as climate change worsens.

The Gravelines nuclear power plant is currently the most powerful in Western Europe, already consisting of six 900 MW reactors. The French state-owned energy company EDF has promised to build two more reactors at the same plant on an 11-meter-high platform to protect from flooding. According to EDF experts, the NPP project will sufficiently resist climate challenges until 2070. However, this is only the middle of the plant’s lifespan, which is expected to last 60 years until 2100. Its dismantling is scheduled for the middle of the next century, and EDF promises to “adapt” the project to current climate conditions every 10 years after 2070.

It sounds reckless, as the UN Environment Programme warns of a temperature rise of up to +3.1°C in the coming decades, leading to sea level rise and a dramatic increase in extreme climate events. Have the French authorities already forgotten the devastating North Sea flood of 1953 and the numerous disasters in France in recent years? Even today, most of the area around the nuclear power plant is below sea level during high tides, and only protective structures built nearby, turning the NPP into a kind of “island,” have saved the region from disaster. Since 2022, the Gravelines Nuclear Power Station has been surrounded by a 3-kilometer-long protective wall, which costs EDF 35 million euros. How much more will EDF spend to ensure the nuclear plant’s safety, and what will happen if nature proves more potent than the fortifications built?

The EDF project documentation contains too many unanswered questions, which exist only thanks to Macron’s political patronage. The facts indicate that constructing new reactors poses an extreme danger to the local population and the environment. Nuclear power plants are vulnerable to climate change, and the rampant rush to revive the nuclear power industry should be stopped.

New Challenges for Macron’s Nuclear Renaissance

By announcing the revival of nuclear energy in the country, President Macron has formally taken a step toward reviving France’s economic, industrial and military power. However, the French economy is not yet ready to fully support such ambitious plans.

Macron’s ambitious plans to build 14 new nuclear power units will face a glaring shortage of qualified personnel. The French nuclear industry currently employs about 220 thousand people. To achieve Marcon’s objectives, the industry will need a significant influx of skilled workers, particularly in the workforce. By 2030, according to EDF estimates, their number needs to be at least doubled. The proposed construction timeline is also impressive. The first Gravelines unit with the EPR-2 reactor is expected to take only eight years to complete. It is worth mentioning the notorious Flamanville nuclear reactor in Normandy, which ended up costing 4 times its initial budget, reaching €13.2 billion, and was launched more than a decade behind schedule.

The Loss of African Uranium Deposits

France is particularly concerned about the exploitation of uranium from Niger and the potential consequences of losing its supply. For more than four decades, the Orano company, owned by the French state by 45%, has been developing uranium in African countries. Niger is one of the three largest suppliers of this valuable natural resource to France. However, the recent revocation of Orano’s uranium mining license in Niger has cast doubt on France’s energy independence. Representatives of the new Nigerien authorities have stated that uranium has been used to supply Europe with electricity for decades. Still, West Africa remains one of the poorest countries in the world and has not benefited much from exports. Additionally, the economic risks for the French nuclear industry include uranium prices that have reached historical highs, primarily due to European countries’ search for new energy suppliers after 2022.

According to Macron, promoting nuclear technologies in France should lead the country to complete independence from foreign energy supplies and secure France’s status as the flagship nuclear industry in the EU. The problem is that Macron knows it will not be up to him but to future generations of French politicians to address the problems mentioned above regarding his misleading nuclear policy.

[Tara Yarwais edited this piece.]

France postpones financing decision of 6 new reactors – report

the firm’s Flamanville latest European pressurised reactor project cost EUR 19bn, almost six times the initial cost and faced significant delays.

(Montel) The official body responsible for a financing decision regarding six French new generation reactors has postponed approval from December until early next year amid political uncertainty, French daily Les Echos reported on Thursday.

Reporting by: Muriel Boselli28 Nov 2024

The government was mulling a zero interest loan to help EDF finance the project, it added, though there was a current budget stand-off following a snap election this summer.

This loan option, considered quicker to implement, would cut financial risks due to a mechanism approved by the European Commission, already used in the Czech Republic for its new nuclear project, the daily reported.

The loan would include a zero interest rate for the duration of the works, before moving to a “reasonable” rate once the reactors had been commissioned, the sources said.

This financial package could reduce the total cost of the project, estimated at EUR 67.4bn.

EDF aims to build six and possibly 14 new reactors by 2050, with construction due to start at the Penly nuclear power plant on the Channel coast by 2027. The utility plans to take a final decision in 2026.

However, the firm’s Flamanville latest European pressurised reactor project cost EUR 19bn, almost six times the initial cost and faced significant delays.

France is weighing zero-interest loan for 6 nuclear reactors, sources say

- Summary

- EDF faces financing challenges due to high debt and project delays

- French government faces no-confidence vote over budget with spending cuts

- EU approval needed for state aid in nuclear projects

PARIS, Nov 27(Reuters) Reporting by Benjamin Mallet; additional reporting by Leigh Thomas; writing by Dominique Patton; editing by Nina Chestney and Tomasz Janowski- https://www.reuters.com/business/energy/france-is-weighing-zero-interest-loan-6-nuclear-reactors-sources-say-2024-11-27/

French officials are drawing up plans to provide an interest-free loan to state-owned power utility EDF to finance a significant portion of the construction of six new nuclear reactors, two people familiar with the matter said.

The financing would clear a major hurdle for one of the country’s biggest public projects in years.

The plans are similar to financing agreed recently for a single reactor in the Czech Republic, and although the size of the loan is not yet known, it shows the growing need for state support in financing new nuclear projects in Europe.

The plans also include a long-term guaranteed price for the power generated, known as a contract for difference (CfD), said the people, who declined to be identified because they are not authorised to speak with media.

The Ministry of Finance and EDF declined to comment.

The discussions on financing the projects that could cost well over 50 billion euros ($52.60 billion) come as the French government faces a potential no-confidence vote over a proposed budget that contains measures to cut spending and raise taxes to contain the country’s soaring debt.

President Emmanuel Macron announced plans in early 2022 for six new reactors with a total production capacity of about 10 gigawatts to partly replace an ageing nuclear fleet and secure future energy supplies.

Construction of the first reactor is due to start in 2027 but Macron has never said who would pay for the project, which at the time was estimated to cost around 52 billion euros. Recent media reports suggest costs may be higher, reaching as much as 67 billion euros.

France’s current 57 nuclear reactors in operation were largely financed by EDF, which was a publicly-listed company until it was fully nationalised last year.

But the company is unlikely to be able to secure private financing for new projects, given its already high debt, and there have been multiple delays and cost overruns at recent projects like Flamanville in France and Hinkley Point in England.

CZECH MODEL

While there is general agreement to provide a zero-interest loan to EDF during the construction phase, the amount is not yet decided and there are still “intense discussions” on matters such as the sharing of risk between the utility and the state from any additional costs and delays, one of the sources said.

The plan also needs approval from the finance minister once EDF submits a final costing for the projects, expected early next year.

As a form of state aid, it also needs to be cleared by the European Commission.

French officials have been encouraged, however, by Brussels’ approval for a similar financing structure for one 1 gigawatt Czech unit at Dukovany, the sources said.

Under the Czech arrangement, interest on a state loan increases to at least 2% after the plant begins operating.

Europe is seeing a resurgence of interest in nuclear power projects, with nations including Poland and the UK planning new plants to shore up their energy self-sufficiency after a major energy crisis in the region.

Financing remains a huge challenge, with construction risks weighing on utilities’ balance sheets and credit ratings.

The British government recently pledged more than 5.5 billion pounds ($6.93 billion) to help fund early development of the 3.2 GW Sizewell C project.

Another project in Britain, EDF’s 3.2 GW Hinkley Point C plant, which is expected to cost between 31 billion pounds and 34 billion pounds based on 2015 values, is also backed by a contract for difference scheme.

($1 = 0.9506 euros)

($1 = 0.7931 pounds)

The secret audit that crucifies most French nuclear start-ups.

Classified as a top secret, the results of the audit conducted in the spring by the High Commissioner for Atomic Energy and submitted to the Élysée Palace reveal that many subsidized nuclear start-ups will not keep their promises.

By Géraldine Woessner Le Point 22nd Nov 2024

This is what could be called a vast smokescreen operation. On November 19, the start-up Naarea, founded in 2020 to develop fourth-generation modular reactors, with molten salts and fast neutrons, published a triumphant press release on its LinkedIn account: “It is a great honor to have been able to discuss with the High Commissioner for Atomic Energy the conclusions of his report,” the company trumpeted, proudly announcing to potential investors that the audit conducted by the experts had “not identified any unavoidable blocking point” concerning the deployment of its program……… (Subscribers only) https://www.lepoint.fr/economie/exclusif-l-audit-secret-qui-crucifie-la-plupart-des-start-up-francaises-du-nucleaire-22-11-2024-2575980_28.php

Gravelines nuclear power plant: EDF refuses to respond on flood risks and tries to silence whistleblowers

Greenpeace France reminds that Monday morning’s action in the perimeter of the Gravelines power plant carries a message of public interest on the risks of marine submersion and flooding on the Gravelines power plant, an area combining climatic, industrial and nuclear vulnerabilities. For Greenpeace France, in light of the forecasts of scientists and the large uncertainties of the different climate scenarios, it is too dangerous to build two new nuclear reactors on this site, as EDF aims to do.

Greenpeace France 30th Oct 2024, https://www.greenpeace.fr/espace-presse/gravelines-edf-refuse-de-repondre-sur-les-risques-dinondations-et-tente-de-faire-taire-les-lanceurs-dalerte/

After more than 48 hours of deprivation of liberty, 10 of the 12 activists arrested have just been released. This arrest follows the action of Greenpeace France in the perimeter of the Gravelines power plant . Since 9 a.m. this morning, a gathering has been taking place in front of the Dunkirk Judicial Court, at the initiative of several local organizations that came to support the activists. The court informed the activists that a trial would be held on March 3, 2025 at 1:30 p.m. for intrusion into a civil facility housing nuclear materials in assembly. EDF has filed a complaint [1].

After spending two nights in police custody, the activists were brought before the Dunkirk Judicial Court in the early morning, at the request of the public prosecutor. The first activist to be released was deprived of his liberty for a total of 52 hours.

Greenpeace France reminds that Monday morning’s action in the perimeter of the Gravelines power plant carries a message of public interest on the risks of marine submersion and flooding on the Gravelines power plant, an area combining climatic, industrial and nuclear vulnerabilities. For Greenpeace France, in light of the forecasts of scientists and the large uncertainties of the different climate scenarios, it is too dangerous to build two new nuclear reactors on this site, as EDF aims to do.

While EDF refused to respond to Greenpeace France’s questions sent during the summer concerning the consideration of the impacts of climate change on the choice of the Gravelines site and the construction of new nuclear reactors, Greenpeace France dug into the subject and examined EDF’s project file, which resulted in the publication of a report on October 3 demonstrating the underestimation of the seriousness of climate change and the risks inherent in this project to build new reactors.

Greenpeace France also got involved in the consultation areas, particularly the ongoing public debate in Gravelines, and repeated its questions to obtain information on flood risks and the protective measures planned for the new reactors, ahead of the meetings on nuclear safety (theme of 19 November) and climate change (theme of 10 December). After Monday’s action, media reported that EDF did not wish to comment.

For Pauline Boyer, Energy Transition campaign manager at Greenpeace France: ” EDF is ignoring our questions about the risks that the construction of the two EPR2 reactors in Gravelines would create for the population, the workers at the plant and for the environment. In line with its behavior during the public debate for its similar project in Penly, it is clearly sending a signal of contempt for questions from the public, whether NGOs or residents. EDF is operating a diversion strategy by taking activists to court over the form of their action, in order to better evade the substantive issues. EDF is losing more points of trust. EDF will not succeed in gagging the whistleblowers. “

For Marie Dosé, the activists’ lawyer: ” The custody measures are unjustified and have only one purpose: to dissuade activists from alerting the population on a subject of general interest. All of them could have been the subject of a free hearing but, once again, the prosecuting authority preferred to make them sleep two nights in cells and bring them hastily before the court. “

Two activists remain in court at the time of writing this press release.

-

Archives

- January 2026 (283)

- December 2025 (358)

- November 2025 (359)

- October 2025 (376)

- September 2025 (258)

- August 2025 (319)

- July 2025 (230)

- June 2025 (348)

- May 2025 (261)

- April 2025 (305)

- March 2025 (319)

- February 2025 (234)

-

Categories

- 1

- 1 NUCLEAR ISSUES

- business and costs

- climate change

- culture and arts

- ENERGY

- environment

- health

- history

- indigenous issues

- Legal

- marketing of nuclear

- media

- opposition to nuclear

- PERSONAL STORIES

- politics

- politics international

- Religion and ethics

- safety

- secrets,lies and civil liberties

- spinbuster

- technology

- Uranium

- wastes

- weapons and war

- Women

- 2 WORLD

- ACTION

- AFRICA

- Atrocities

- AUSTRALIA

- Christina's notes

- Christina's themes

- culture and arts

- Events

- Fuk 2022

- Fuk 2023

- Fukushima 2017

- Fukushima 2018

- fukushima 2019

- Fukushima 2020

- Fukushima 2021

- general

- global warming

- Humour (God we need it)

- Nuclear

- RARE EARTHS

- Reference

- resources – print

- Resources -audiovicual

- Weekly Newsletter

- World

- World Nuclear

- YouTube

-

RSS

Entries RSS

Comments RSS