Macron stands by remarks on NATO troops in Ukraine

https://www.sott.net/article/489392-Macron-stands-by-remarks-on-NATO-troops-in-Ukraine— 1 Mar 24

The French president brushed off criticism from fellow NATO members, insisting his words were “thought-through and measured”

French President Emmanuel Macron on Thursday stood by his controversial remarks on Monday about the prospects of deploying troops to Ukraine, which have caused uproar among some NATO members, and has insisted his words were well thought out.

Speaking to reporters on the sidelines of a visit to inspect the 2024 Olympics village near Paris, Macron refused to backtrack on his statements despite a flurry of criticism from some fellow members of the US-led bloc.

“These are sufficiently serious issues; every one of the words that I say on this issue is weighed, thought-through and measured,” Macron claimed.

The French president triggered the political furore on Monday while speaking to reporters after hosting a meeting of European leaders in Paris. Macron insisted that the West should stop at nothing to prevent Russia from getting the upper hand in the conflict, saying the deployment of troops by NATO and other Western countries to Ukraine could not be ruled out.

“There’s no consensus today to send, in an official manner, troops on the ground,” he said. “In terms of dynamics, we cannot exclude anything. We will do everything necessary to prevent Russia from winning this war.”

The statement prompted a wave of denial from NATO members, with multiple major members of the bloc, including the US, the UK and Germany insisting they harbor no such plans. Some lesser members of the bloc, however, namely Estonia and Lithuania, appeared to back Macron, suggesting that sending troops to Ukraine should not be ruled out.

“We shouldn’t be afraid of our own power. Russia is saying this or that step is escalation, but defense is not escalation,” the Prime Minister of Estonia Kaja Kallas told Sky on Wednesday. “I’m saying we should have all options on the table. What more can we do in order to really help Ukraine win?”

Moscow has strongly condemned Macron’s remarks, cautioning the US-led bloc against taking further hostile moves. Should NATO troops actually be deployed to Ukraine, a direct confrontation between the alliance and Russia will become not only “possible” but actually “inevitable,” Kremlin spokesman Dmitry Peskov warned.

From the same source there was:

1 Mar, 2024 06:34

Vast majority of French oppose Macron’s ‘troops in Ukraine’ comment – poll

Survey results published on Thursday by French newspaper Le Figaro showed that 68% of respondents disapproved of Macron’s comments on a possible future NATO deployment to the war-torn state, while just 31% said they agreed. The remainder, just 1%, were undecided.

Given the many cases of having stood up against the popular wind prevailing in France, 31 % is a pretty good score.

Add to this that although Macron has met with resistance to implications of the statements, he has support from a country like Estonia:

29 Feb, 2024 15:59

NATO member backs ‘boots on the ground’ in Ukraine

Estonia is “not afraid” of Russia and thinks sending NATO ground troops to Ukraine ought to be under consideration, Prime Minister Kaja Kallas has told Sky News in an interview aired on Wednesday.

So far, only Estonia and Lithuania have expressed any enthusiasm for the idea of escalating NATO support to Kiev beyond deliveries of weapons, ammunition, and money.

“We shouldn’t be afraid of our own power. Russia is saying this or that step is escalation, but defense is not escalation,” Kallas told Sky. “I’m saying we should have all options on the table. What more can we do in order to really help Ukraine win?”

Earlier this week, French President Emmanuel Macron argued that the US-led bloc should not rule out sending troops to Ukraine, or any other options. Most members of the bloc have sincedistanced themselvesfrom the idea – except two of the former Soviet Baltic republics.

On Tuesday, Lithuanian Foreign Minister Gabrielius Landsbergis urged NATO to “think outside the box.” Meanwhile, the country’sambassador to Sweden, Linas Linkevicius, said the bloc would “neutralize” the Russian enclave of Kaliningrad if Moscow “dares to challenge NATO.”

The Estonian and Lithuanian officials are supported by the US or were they given the cue cards, … like Macron?

29 Feb, 2024 23:57

Pentagon warns of direct Russia-NATO clash

Addressing the US House Armed Services Committee hearing on Thursday, Austin once again urged lawmakers to approve additional funding for Kiev’s war effort, painting a grim picture for NATO allies.

“If you are a Baltic state, you are really worried about whether you are next… And, frankly, if Ukraine falls, I really believe that NATO will be in a fight with Russia,” the Pentagon chief said.

Austin went on to claim that “other autocrats around the world will look at this and will be encouraged by the fact that this happened and we failed to support a democracy.

Macron is probably aware he is in the same situation as Rishi Sunak. That is there are already French “advisors” involved:

29 Feb, 2024 19:14

UK ‘directly involved’ in Ukraine conflict – KremlinThe outlet RTVI asked Peskov to comment a report from The Times which claimed that Admiral Tony Radakin, the head of the UK armed forces, has helped make “battle plans” for Ukraine.

“In general, it’s no secret that the British really provide different forms of support [to Ukraine]. People on the ground and intelligence and so on and so forth,” Peskov said. “That is, they are actually directly involved in this conflict.”

According to the British outlet, citing a Ukrainian military source, Radakin “is understood to have helped the Ukrainians with the strategy to destroy Russian ships and open up the Black Sea,” and seen as “invaluable in coordinating support from other senior chiefs in NATO.”

The admiral also reportedly visited Kiev and met with President Vladimir Zelensky, to discuss Ukraine’s strategy and the ways in which the West could help.

The Kremlin doesn’t have specific information related to Radakin, but “probably our military knows about this,” Peskov said.

Radakin, 58, was due to retire in November after three years as chief of the defense staff, but will stay on the job for another year at Prime Minister Rishi Sunak’s request, the Times reported. One source told the outlet that the British government considered it important to retain“continuity”ahead of the upcoming general election.

France accused of ‘unacceptable’ behaviour after demanding UK taxpayer cash for Hinkley nuclear.

Former energy secretary Chris Huhne says Paris must cover cost overruns

Jonathan Leake, 29 February 2024 •

France’s demands for UK taxpayers to help fund Hinkley Point

C are “wholly unacceptable”, according to the former energy secretary

who helped develop the nuclear project. Chris Huhne, who was energy

secretary from 2010 to 2012, said he was “astonished and saddened” to

hear that both Bruno Le Maire, the French finance minister, and Luc

Rémont, chief executive of EDF, were pressing the UK to help with the cost

overruns.

Mr Huhne was a leading architect of the deal with EDF, France’s

state-owned electricity supplier, to build the nuclear power station. Under

the deal, finally signed off by Mr Huhne’s successor, Ed Davey, EDF was

responsible for all the estimated £18bn costs, with a start date of 2025.

Telegraph 29th Feb 2024

Chris Huhne Letter: Taxpayers shouldn’t be footing bill for EDF failings

I was astonished and saddened by your report that both Bruno Le

Maire, the French finance minister, and Luc Rémont, chief executive of

EDF, are pressing the UK government to help with the cost overrun at

Hinkley Point C, the EDF nuclear plant under construction in the UK.

I regret EDF’s €12.9bn write down, but it is the French company’s

responsibility (Report, February 17). I will save French blushes by not

quoting all the promises that were made by the company about the low cost

of its nuclear energy (a fraction even of what was ultimately agreed). What

is wholly unacceptable, however, is the notion that the UK taxpayer should

in any way be on the hook for cost overruns when it was always made utterly

explicit — by me and my successor — that this would never happen.

A clear condition of the Hinkley project was that EDF would be entirely and

solely responsible for the construction costs and risks, and the UK

government would merely guarantee a price (subsidy-free, taking account of

carbon costs) for the electricity output once the plant started. Nothing

could be more unambiguous either legally, politically or morally.

Neither I nor my immediate successors would ever have agreed any contract — a

contract for difference — on any other basis. Any British minister who

now goes back on that arrangement would be betraying their responsibility

to the exchequer, and would be a legitimate target for the public accounts

committee.

FT 28th Feb 2024

https://www.ft.com/content/175d212b-0a93-48f5-b68c-2a58bd098796

France creates coalition to arm Ukraine with long-range weapons

28 Feb 24 https://www.rt.com/news/593253-france-macron-coalition-long-range-weapons-ukraine/

The aim is to enable Kiev to “carry out deep strikes” amid flagging US support, President Emmanuel Macron has said

France is leading a new coalition that aims to provide Ukraine with “medium and long-range missiles and bombs,” President Emmanuel Macron has announced. He has also not ruled out deploying ground forces to support Kiev in future.

Macron made the remarks following a summit of Ukraine’s backers on Monday, intended to demonstrate unwavering support for Kiev amid the suspension of American aid.

According to the French leader, the newly established coalition seeks to enable Ukraine to “carry out deep strikes.” There is a “broad consensus to do even more and faster together” to support Kiev, Macron added.

The move comes as continued US aid to Ukraine remains in doubt. President Joe Biden’s latest package, which envisages an additional $60 billion for Kiev, has been in limbo for months due to opposition from Republicans in the House of Representatives. Lawmakers have made clear they will only relent if the White House agrees to tighten US border controls and stems the flow of illegal migrants from Mexico.

Speaking on Monday, Macron also claimed that the deployment of Western troops to Ukraine cannot be ruled out, insisting that Paris will “do everything necessary to ensure that Russia cannot win this war.” His remarks were echoed by French Prime Minister Gabriel Attal in comments to the RTL broadcaster on Tuesday.

In response, Kremlin spokesperson Dmitry Peskov warned that “in this case, we have to talk not about the probability, but rather the inevitability” of a direct conflict between NATO and Russia, should Western military personnel be deployed to Ukraine.

Earlier this month, Paris and Kiev signed a bilateral security pact under which France pledged €3 billion ($3.26 billion) worth of defense aid by the end of the year.

In January, Macron revealed plans to provide Ukraine with 40 more SCALP-EG long-range cruise missiles and “hundreds of bombs.”

Paris agreed to ship the rockets, which have a range of over 250km (155 miles), last July, months after the UK agreed a similar move.

Russia has consistently condemned Western deliveries of long-range weaponry, saying it will only serve to prolong the hostilities unnecessarily without changing the final outcome.

Macron and Zelensky sign military deal

18 Feb 2024 , https://www.sott.net/article/489024-Sell-out-Macron-and-Zelensky-sign-military-deal

The ten-year pact mirrors defense agreements Kiev recently signed with Berlin and London

France and Ukraine signed a bilateral security pact on Friday during President Vladimir Zelensky’s visit to Paris. While President Emmanuel Macron did not offer Kiev any ironclad military commitments, he promised another €3 billion in aid over the rest of 2024, as well as “cooperation” in the area of artillery.

The agreement states that France views the prospect of Ukraine’s accession to NATO positively, as “a useful contribution to peace and stability in Europe.” The largely symbolic deal is designed to help “pave the way towards Ukraine’s future integration into the EU and NATO,” French media noted, citing officials.

The pact follows a similar agreement struck with Germany earlier in the day, and another signed with the UK last month. All three are set to last ten years.

Last month, Macron announced that France would supply Kiev with 40 more SCALP-EG long-range cruise missiles and “hundreds of bombs,” promising to finalize the bilateral security agreement on an upcoming trip to Kiev. The trip, which was to run from February 13-14, was called off by the French side due to security concerns, according to French media.

Zelensky is set to ask Western sponsors for more financing at the Munich Security Conference on Saturday, while the situation on the front lines of the Ukraine-Russia conflict is escalating, with Kiev facing severe personnel and ammo shortages.

Moscow has condemned Western deliveries of long-range weaponry such as French SCALP-EG cruise missiles, which Kiev has used to strike Russian infrastructure in Donbass, causing numerous civilian deaths. Russia maintains that further military aid to Kiev will only delay the end of the conflict without changing the final outcome, and lead to unnecessary deaths.

Comment: The ‘leaders’ of Europe are selling out Europe and the welfare of their countries while submitting to a globalist anti-human agenda.

See also:

France’s first 6 EPR2 nuclear reactors will cost much more than the planned 52 billion euros.

Why the first six EPR2s will cost much more than the 52 billion euros

initially planned by EDF. During a hearing in the Senate, the executive

director of EDF’s new nuclear projects, Xavier Ursat, indicated that the

first six EPR2s will cost more than the 52 billion euros announced in 2021.

A first slippage in costs including the new estimate is promised for the

end of 2024.

Why the first six EPR2s will cost much more than the 52

billion euros initially planned by EDF. EDF does not brag about it. But in

the Senate commission of inquiry into the price of electricity, Xavier

Ursat, its executive director in charge of the engineering department and

new nuclear projects, was obliged to talk about it.

As predicted by an expert report in 2021, the construction of the first six EPR2s will indeed

cost more than the 51.7 billion euros, rounded to 52 billion by the State,

calculated by EDF at the time Emmanuel Macron had to decide on the relaunch

of a new nuclear program in France. A relaunch confirmed in his speech on

Belfort’s energy strategy on February 10, 2022. “We are carrying out a

new economic assessment. It led to a figure higher than 52 billion,”

Xavier Ursat declared to the senators. Which, for him, “is not very

surprising”.

L’Usine Nouvelle 12th Feb 2024

Britain must pay more for Hinkley, says France

Push for funding comes weeks after Hinkley Point C costs were revised up to £46bn

Jonathan Leake, 13 February 2024

British taxpayers have been asked to stump up cash to fund nuclear power

plants being built in the UK by the French energy giant EDF. Bruno Le

Maire, France’s finance minister, said on Tuesday he would be asking

Jeremy Hunt for “an equitable sharing of costs” for the power stations

which include Hinkley Point C, in Somerset, and Sizewell C, in Suffolk.

It comes after it emerged that the costs at Hinkley Point C had surged to

£46bn, significantly more than the £18bn proposed when contracts were

signed in 2016. Speaking at an International Energy Agency ministerial

meeting in Paris, Mr Le Maire said he had raised the subject with Claire

Coutinho, the Energy Secretary, and planned to have “discussions” with

Mr Hunt, the Chancellor, about it.

The UK has so far refused to consider

paying more for Hinkley, pointing out that it is not a government project.

Last month a government spokesman said: “Any additional costs or schedule

overruns are the responsibility of EDF and its partners and will in no way

fall on taxpayers.”

There is growing concern in France over the plight of

state-owned EDF which is on the hook for most of the extra costs. If EDF

were to pull out of Sizewell it would cause huge delays and a likely end UK

hopes of building 24 gigawatts of new nuclear capacity by 2050, equating to

about seven new nuclear power stations. These would supply up to a quarter

of the country’s projected electricity demand.

Telegraph 13th Feb 2024

France: EDF Faces Unprecedented Nuclear Workload in France

Energy Intelligence Group, Fri, Feb 9, 2024, Grace Symes, London

As France faces two major nuclear efforts — the refurbishment and life extension of EDF’s domestic operating fleet and a major nuclear newbuild program — there are already signs that the country’s nuclear workforce is struggling to keep up. With 10-year safety reviews, or decennial visits (DVs), of EDF’s 56 domestic reactors growing ever more complex and time-consuming, EDF anticipates flatlined nuclear output from 2025 to 2026, and beyond that France will need to ramp up an industrial effort not seen in generations if it hopes to successfully launch simultaneous large newbuilds (related).

Energy Intelligence 9th Feb 2024

https://www.energyintel.com/0000018d-7944-d1ef-a5cd-fd647d920000

France’s Flamanville EPR has numerous technical problems which mean that its safety issues are not “now closed”

Response from GLOBAL CHANCE to the ASN consultation on the request for

authorization to commission the Flamanville EPR reactor.

Contrary to what the President of the ASN stated on January 30, 2024 in his conference press

and the presentation of one’s wishes, numerous technical subjects which are

as much potential problems for the proper functioning of the EPR and which

call into question the reactor safety, cannot be considered “now closed”.

The problems that hamper the operation and safety of the EPR are numerous.

Most serious are presented in the following chapters in two parts: severe

and persistent then severe and whose solutions are risky. They lead to

asking questions including the answers do not appear in any of the

documents which constitute the file released made available to the public

by the ASN

Global Chance 9th Feb 2024

France’s EDF shuts down two nuclear reactors after fire at Chinon plant

Reuters, February 11, 2024, https://www.reuters.com/business/energy/frances-edf-shuts-down-two-nuclear-reactors-after-fire-chinon-plant-2024-02-10/

—

Nuclear energy operator EDF has shut down two reactors at Chinon in western France after a fire in a non-nuclear sector of the plant in the early hours of Saturday, the company said.

The fire has been extinguished, it said.

“Production unit number 3 at the Chinon nuclear power plant has shut down automatically, in accordance with the reactor’s safety and protection systems,” EDF said in a statement, adding it also shut down reactor number 4, which is coupled to number 3.

France’s nuclear safety watchdog said in a separate statement the fire had led to an electricity cut at the plant that triggered the automatic shutdown.

Chinon is one of France’s oldest nuclear plants.

Reporting by Tassilo Hummel; editing by Barbara L

EDF’s nuclear struggles dampen EU nuclear prospects – the industry “on a slow descent to hell”.

MURIEL BOSELLI, Paris, France, 08 Feb 2024 19:48

(Montel) The latest setbacks at the UK’s new Hinkley Point C nuclear power plant have cast a shadow over Europe’s nuclear revival, experts told Montel, with one former EDF executive saying France’s nuclear industry was “on a slow descent to hell”.

A feud between Paris and London over who should fork out an extra EUR 6-8bn for Hinkley Point C’s (HPC) cost overruns was tarnishing the nuclear industry’s image as pro-nuclear nations try to promote atomic power in the battle against climate change, experts said.

HPC faces a new four-year delay and may not be commissioned until 2031, with completion costs now forecast at between GBP 31-34bn,… (Subscribers only)

Montel 8th Feb 2024

https://www.montelnews.com/news/1537139/edfs-nuclear-struggles-dampen-eu-nuclear-prospects

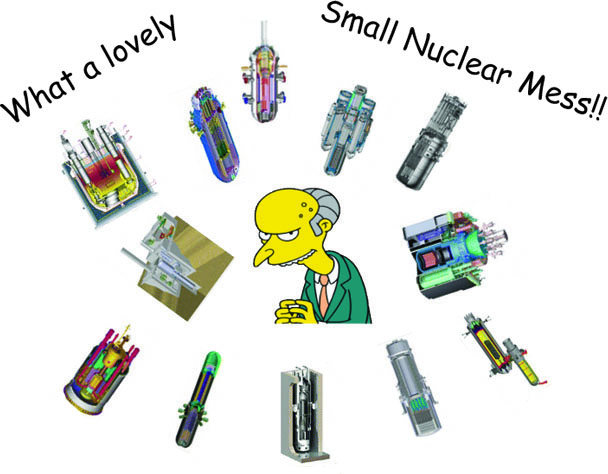

The dangerous craze for SMRs

This is going too far in trivializing risk. And this is not limited to “acceptability” which seems to be ASN’s major concern, but to the risks of such “mixed” installations.

a serious accident situation (AZF, Lubrizol) could damage the SMR unit and transform the accident into a disaster.

Bernard Laponche, Doctor of Science in Nuclear Reactor Physics, President of the Global Chance association, Le Club Mediapart, 5th Feb 2024 https://blogs.mediapart.fr/bernard-laponche/blog/050224/le-dangereux-engouement-pour-les-smr

The development of small modular nuclear reactors (SMR) is the subject of spectacular announcements.Based on the declarations of the Nuclear Safety Authority (ASN) on this

subject, we launch an appeal for reason on the realities and difficulties of such projects, on the technical, safety and security levels .

During his press conference on January 31, 2024, the president of the Nuclear Safety Authority (ASN) addressed the issue of small modular nuclear reactors, known as SMRs, and answered some questions on this subject.

In his presentation, the president highlights the technical and societal questions posed by these new reactors, as well as the safety, security and non-proliferation issues “to be integrated upstream of the projects”.

These are the usual concerns when we are interested in nuclear reactors, which produce heat and possibly electricity from fission and chain reactions of fissile elements (uranium, plutonium), but also products fission and transuranium elements found in irradiated fuels currently intended for reprocessing, leading to the accumulation of radioactive waste in addition to that from the dismantling of reactors. These are the problems that will have to be analyzed for candidate SMR reactors, as for any nuclear reactor and with the same rigor as for conventional reactors.

In the same way that a conventional industrial installation cannot claim to be free from all risk of accident, no nuclear installation can claim to be free of any risk of accident. The declaration “a nuclear accident is possible in France” by successive ASN officials is valid for SMRs, even if, as its current president says, certain innovative SMRs “present potentially promising intrinsic safety characteristics” .

The first “prototype” examples of candidate reactors under the title of SMR, that is to say intended to be mass-produced in a factory before installation on site, will therefore have to be built on nuclear sites, probably those housing research reactors.

As ASN points out, the use of SMR in France would not be of great interest for the production of electricity given the importance of the current fleet of EDF power plants and the announced projects. But, on the other hand, SMRs could be very useful for the production of heat or steam for the process industries (paper, food, chemical industries, etc.) of which there are very many.

It would then be necessary to install the SMR reactor very close to the industrial installation or even, according to ASN, inside this installation.

This is going too far in trivializing risk. And this is not limited to “acceptability” which seems to be ASN’s major concern, but to the risks of such “mixed” installations.

Indeed, we cannot admit the presence of a basic nuclear installation, containing highly radioactive materials within a classic industrial installation, of the ICPE type in which a serious accident situation (AZF, Lubrizol) could damage the SMR unit and transform the accident into a disaster.

Furthermore, it is clear that each promoter of an SMR candidate aims for a large order in the number of copies (of the order of a hundred say some) which will allow the “modular” manufacturing of reactors in a dedicated factory, this allowing the supposed reduction in unit cost.

In this case, by eliminating the solution of an SMR in the plant itself, we would have the creation of a large number of INB-ICPE couples. Even if we admit that the probability of an accident on the SMR is lower than for a conventional reactor (which remains to be demonstrated for each case), this probability is multiplied by the number of reactors, all identical.

In examining the safety files for EDF’s large power reactors and nuclear fuel plants, ASN and IRSN pay very close attention to “external attacks” of natural or malicious origin. What happens to these concerns for SMS located almost everywhere on the territory, on locations which are those of the industrial installation which they must supply with heat and whose location was chosen without any concern for nuclear safety and security? ? How would specific protection be organized which, to be effective, would certainly be expensive, especially since the SMRs concerned would be of low power?

The profusion of candidate projects for SMR, some of which are financially supported by the Government, leads to each being examined by the IRSN and the ASN, as announced by the latter. This examination can be postponed over time depending on the maturity of the projects, all of which currently only exist on file, more or less elaborate.

If this examination is done correctly, that is to say with as much care as for a power reactor, the examination of the technical and safety files of each SMR prototype is a considerable task. We can fear that the “craze” for SMRs that ASN speaks of will exert dangerous pressure on the quality of studies and safety and security injunctions.

Finally, but this is not the problem of the IRSN and the ASN, we would still need to have serious information on the costs. Not only that of the construction of a prototype (the example of NuScale in the United States is edifying) but also that of its exploitation and especially that of the fuel, from its manufacture to its treatment after use, dismantling and management garbage.

When we examine in the light of what we know of the climatic upheavals which are already affecting our territory and will intensify considerably, we can really ask ourselves the question of the fragility and the risk of installing a little small nuclear reactors everywhere which will obviously be subject, depending on the period and their site, to floods, droughts, storms, tornadoes, earthquakes, etc.

All those who today say they want to welcome an SMR on their territory should really think about it seriously.

The future of nuclear: France’s nuclear dreams or nightmares?

The Macron Government has laid out ambitious plans for its capricious nuclear sector, but such optimism should not blind us to potential challenges.

Alfie Shaw, February 5, 2024, Power Technology

t last year’s COP28 climate conference in Dubai, French President Emmanuel Macron triumphantly declared that “nuclear energy is back”. His celebratory remark was uttered after France led a group of 20 countries in signing a pledge to “triple nuclear energy capacity from 2020 by 2050”.

Since the summit, a range of announcements and promises have been made that appear to support France’s ‘nuclear renaissance’. In November, the European Parliament backed the development of small modular reactors (SMRs), a versatile technology that many consider to be the future of the industry. Two months later, Energy Transition Minister Agnes Pannier- Runacher said that France will need to build 14 new nuclear power plants rather than the six currently planned if the country is to meet its energy transition goals.

Is all this optimism warranted? France has long been a nuclear superpower but lost its position as the world’s second-largest producer of nuclear energy to China in 2022, with the US coming in first. It is worth considering whether Macron’s positivity is justified in the context of several issues that currently beset the country’s industry, including EDF’s unpredictable performance, lack of strong allies in the European Council, slow progress on SMR development and Russian interdependence.

EDF’s annus horribilis

Électricité de France (EDF) is the French multinational electric utility company that runs the country’s 56 reactors. Throughout 2022, many were forced offline for maintenance work, causing output to fall below 1990 levels, despite installed capacity being 5GW lower at this time.

Nuclear shutdowns are in themselves not a huge cause for concern. Older power plants need to be updated with the latest technologies and France was planning on widespread shutdowns for its ‘Grand Carénage’ refurbishment programme anyway. However, the nature of these specific stoppages was worrying.

In December 2021, the discovery of cracks in the emergency core cooling systems of four of the newest French reactors led to them being shut down. The four units, which each produce 1.5GW, did not generate a single kilowatt-hour throughout 2022. Other 1.3GW reactors also showed similar symptoms, and by mid-2022, 12 additional reactors were shut down due to the same problem. In its annual electricity review, Réseau de Transport d’Électricité highlighted the crux of the issue, stating, “these outages, or outage extensions to carry out maintenance, tests and repairs where needed, primarily involved the newest reactors in the fleet (N4 and P4 designs), i.e. reactors that were not targeted for investment in the Grand Carénage refit programme”.

Although EDF’s nuclear output was 14.8% higher in 2023 than 2022 as reactors came back online, Macron will have to square his desire for new reactors with the ongoing threat of unplanned shutdowns at existing newer plants. Mycle Schneider, nuclear analyst and author of the annual World Nuclear Status Reports, commented on the ongoing unpredictability of EDF’s output, stating: “We have repeatedly seen that EDF was off by several gigawatts of nuclear capacity availability in predictions for the following week. If you look at availability on a certain day, and then go back one week, nuclear availability is several gigawatts different to the projection made a week previously.”

Seeking international allies……………………………………………….

SMRs – a false dawn?

The creation of the EU SMR Industrial Alliance in November accentuates the blocs’ commitment to modular technology in its nuclear drive. Naturally, France led the group of 11 countries signing the alliance.

The International Atomic Energy Agency (IEAE) defines SMRs as advanced nuclear fission reactors that have a power generation capacity of up to 300MW per unit – around a third of the capacity of traditional reactors. The ‘small’ and ‘modular’ nature of their design means they can be sited at locations unsuited to larger nuclear power plants. Their diminutive size is also meant to save on construction time and cost.

Despite significant optimism around the technology, little progress has been made on the ground. The most advanced SMR project in the western world was forcibly abandoned in November 2023 due to excessive costs. US-based NuScale scrapped the development with a conglomerate of Utah municipalities after the cost estimate of the project increased to $9.3bn, bringing the cost per kilowatt to $20,000 for the plant, around twice the cost of the most expensive European pressurised water reactor.

Subsequently, there are no SMRs in commercial operation in the west. Placing the EU alliance in this context, Schneider said: “We are not talking commercial contracts. It is like this alliance [EU SMR Industrial Alliance], which is kind of nice. Everybody [the 11 signatories] puts a name under it, but it does not mean anything in industrial terms.”

Even in Russia, where SMR output has been achieved (although, not commercially), there have been construction issues. The reactor took more than 12.7 years to build, more than three-times the 3.7-year target. Schneider noted that this “was not really the demonstration of easy, quick feasibility” that SMRs are meant to be. China too has two operational SMRs, but no production or cost figures on the reactors are yet available.

Overcoming Russian interdependency

Russia is still the primary constructor and exporter of nuclear reactors, with the state company Rosatom, as of mid-2023, building 24 out of the 58 constructed around the world. While France has taken part in a host of EU sanctions placed on Russian energy exports designed to curb revenue for the Kremlin’s war on Ukraine, the measures have not included sanctions on the nuclear sector………………………………………………….

While France is looking to build an alliance with EU nations that still have strong links with the Russian nuclear sector, its own institutions are also interlinked. Framatome, an EDF subsidiary, originally planned to set up a joint venture with Rosatom subsidiary TVEL to manufacture VVER fuel elements in its Lingen plant in Germany. However, in spring 2023, it became clear that the German Government would likely oppose the deal, so the Franco-Russian company was set up in France, with TVEL owning 25% of it. Advanced Nuclear Fuels, a Framatome subsidiary that operates the Lingen plant, wants to extend the manufacturing plant with a dedicated VVER-fuel production line. The Lower Saxony Government is opposed to the project, but under the Atomic Law it does not have a veto right. This leaves the decision in the hands of the federal government, which as of January 2024, has not been taken. Schneider noted the irregularity of the Framatome-Rosatom partnership, considering Framatome could have worked with Westinghouse given the US company’s capability to manufacture VVER fuel. He added that although the reason for this decision is unclear and there is limited evidence to illustrate strong reasoning, “it is quite likely to do with technical difficulties” with the Westinghouse fuel.

As France looks to expand its nuclear industry, there will be challenges, both within its domestic industry and its international relations, that the country will have to address. France’s nuclear watchdog recently said there was “lack of rigour and performance” in EDFs supply chain monitoring and this will have to improve if output is to become stable. While Italy has signalled its desire to re-establish nuclear power, if plans remain unrealised, it is unlikely to be a reliable nuclear ally within the EU council – something which France desperately needs if it is to push through nuclear friendly legislation. SMRs could become a key source of nuclear energy if on-the-ground development begins in earnest, but so far progress has been limited to hopeful pledges. As long as it remains largely dependent on the tenuous, unpredictable Russian regime for its nuclear fuel generation, France’s nuclear plans will have an insecure foundation. If France is to materialise its abstract nuclear dreams into everyday energy production, it will need to address each of these issues pragmatically. https://www.power-technology.com/news/france-has-laid-out-ambitious-nuclear-plans-but-challenges-remain/?cf-view&cf-closed

French firm EDF shows its power over the UK govt – no judicial review now required over fish protection from Hinkley nuclear cooling system.

In 2021, EDF was formally told it must fit an acoustic fish deterrent

(AFD) system to the massive seawater intakes of the cooling system. It was

considered necessary to “protect the marine life of the Severn Estuary

catchment area and its nine great rivers: Parrett, Avon, Severn, Wye, Usk,

Ebbw, Rhymney, Taff, Ely and their tributaries where many fish species go

to breed”.

Without AFD it is estimated that 22 billion fish would be

ingested over the planned 60-year life of the plant, of which half would be

killed in the process.

Not so final. EDF appealed against this but in 2022

the then environment secretary, George Eustice, refused the appeal in

definitive terms: “The decision on this appeal is final [and] can only be

challenged in the courts by judicial review.”

Final? EDF, which has been

running rings around the government and bullying ministers (Eyes passim)

since it bought the British nuclear fleet in 2008, simply went

regulator-shopping on the basis that energy ministers are more likely to be

sympathetic. And so it proves: the Department for Environment, Food & Rural

Affairs (Defra) has been reduced to the role of consultee on the “final

final” decision, which will now be taken elsewhere – with no judicial

review required.

Private Eye 2nd Feb 2024

https://www.private-eye.co.uk/sections.php?issue=1616§ion_link=columnists

EDF’s Hinkley Point woes pile pressure on global nuclear push.

When in 2016 France’s EDF signed up to build Britain’s first new

nuclear power plant in two decades, defenders of the costly Hinkley Point C

project included Emmanuel Macron, then economy minister. “If we believe

in nuclear power, we have to do Hinkley Point,” France’s now president

told a parliamentary enquiry, rejecting some lawmakers’ concerns that

state-backed EDF, which was already struggling to deliver a new French

prototype plant in Normandy, may not have the financial bandwidth to take

on the British site, originally estimated to cost £18bn.

Eight years on, with cost overruns surging at Hinkley due to repeated delays and EDF on the

hook for at least another £5bn on top of previous budget revisions,

Macron’s government is on a mission to ensure the French nuclear operator

can indeed withstand the fallout — and keep on top of ballooning

investments and orders at home.

French ministers are trying to get the British state to stump up some support for the soaring Hinkley bill, which could reach a total of £46bn at today’s prices for the two reactors,

people close to the talks have said.

That would be roughly double the original budget in 2015 prices, compared with an EDF project in Finland that ended up costing more than twice what it was supposed to and a plan

for one reactor at Flamanville in France that is running four times over

budget, at €13.2bn.

But the Hinkley setbacks have also revived a core

strategic question that is becoming more pressing than ever for EDF, a

former French electricity monopoly that operates Europe’s biggest fleet

of 56 domestic reactors: whether it is equipped to handle multiple projects

at once, internationally and at home, and financially as well as from an

industrial perspective. Already an issue in 2016, when French labour unions

at the group opposed the Hinkley plans on the basis that the financial

set-up was risky, this tension now has a different edge to it.

FT 29th Jan 2024

https://www.ft.com/content/d401e42b-d953-4ef0-b3ea-ed80e974249a

-

Archives

- February 2026 (199)

- January 2026 (308)

- December 2025 (358)

- November 2025 (359)

- October 2025 (376)

- September 2025 (258)

- August 2025 (319)

- July 2025 (230)

- June 2025 (348)

- May 2025 (261)

- April 2025 (305)

- March 2025 (319)

-

Categories

- 1

- 1 NUCLEAR ISSUES

- business and costs

- climate change

- culture and arts

- ENERGY

- environment

- health

- history

- indigenous issues

- Legal

- marketing of nuclear

- media

- opposition to nuclear

- PERSONAL STORIES

- politics

- politics international

- Religion and ethics

- safety

- secrets,lies and civil liberties

- spinbuster

- technology

- Uranium

- wastes

- weapons and war

- Women

- 2 WORLD

- ACTION

- AFRICA

- Atrocities

- AUSTRALIA

- Christina's notes

- Christina's themes

- culture and arts

- Events

- Fuk 2022

- Fuk 2023

- Fukushima 2017

- Fukushima 2018

- fukushima 2019

- Fukushima 2020

- Fukushima 2021

- general

- global warming

- Humour (God we need it)

- Nuclear

- RARE EARTHS

- Reference

- resources – print

- Resources -audiovicual

- Weekly Newsletter

- World

- World Nuclear

- YouTube

-

RSS

Entries RSS

Comments RSS