The clock is ticking on the nuclear renaissance

Last week, Georgia Power revealed the latest delay to the expansion of

Plant Vogtle, a nuclear power station near Augusta which contains the first

new reactors built entirely from scratch in the US for more than three

decades. The company said unit 4 of the plant would not begin generating

power before the end of March due to the discovery of vibrations in a

cooling system in the reactor.

A similar problem affected the launch of

unit 3 before it finally began operating this past July, after seven years

of delays. Georgia Power said the problem with Vogtle’s unit 4 had been

fixed and it should begin operating in the second quarter.

But the disclosure marks the latest in a series of delays and cost overruns at the

flagship US project, which is forecast to cost more than double the

original price tag of $14bn.

Across the Atlantic, the UK’s plan to reboot

its nuclear sector has also run into trouble. Last month, French utility

EDF announced that Britain’s flagship Hinkley Point C power plant had

been delayed until 2029 at the earliest, with the cost spiralling to as

much as £46bn in today’s prices. The initial budget was £18bn, with a

scheduled completion date of 2025, but the project has faced repeated

setbacks. EDF cited the complexity of installing electromechanical systems

and intricate piping at the site in Somerset for the most recent delay.

The French government is pressing London to plug a multibillion-pound hole in

the budget of nuclear power projects being built in Britain by EDF. Both

projects are showcases for new, advanced, pressurised water reactors —

EDF’s EPR in the UK and Westinghouse’s AP1000 in the US —

underscoring the critical importance of getting them up and running as soon

as possible to encourage other customers to commit to the technologies.

US officials warn time is running out for the nuclear industry to prove it can

contribute to the country’s 2050 climate goals due to the long lead times

required to build reactors. Between five to 10 contracts to build new units

need to be signed within the next two to three years to enable the sector

to reach the commercial lift-off required to provide enough clean power by

the middle of the century.

FT 6th Feb 2024

https://www.ft.com/content/3777fb7f-4e7c-4ced-91b9-8de12a0cd428

Czech Republic / Government Seeks Binding Tenders For Four Nuclear Reactors From EDF And KHNP

By Kamen Kraev, 1 February 2024

Prague hopes to cut down new-build costs via a ‘package’ deal

The Czech government announced on Wednesday (31 January) that it will be seeking binding bids from two technology vendors, France’s EDF and South Korea’s KHNP, for the construction of up to four new reactor units at the existing Dukovany nuclear power station……. (Subscribers only) m https://www.nucnet.org/news/government-seeks-binding-tenders-for-four-nuclear-reactors-from-edf-and-khnp-2-4-2024

EDF’s Hinkley Point woes pile pressure on global nuclear push.

When in 2016 France’s EDF signed up to build Britain’s first new

nuclear power plant in two decades, defenders of the costly Hinkley Point C

project included Emmanuel Macron, then economy minister. “If we believe

in nuclear power, we have to do Hinkley Point,” France’s now president

told a parliamentary enquiry, rejecting some lawmakers’ concerns that

state-backed EDF, which was already struggling to deliver a new French

prototype plant in Normandy, may not have the financial bandwidth to take

on the British site, originally estimated to cost £18bn.

Eight years on, with cost overruns surging at Hinkley due to repeated delays and EDF on the

hook for at least another £5bn on top of previous budget revisions,

Macron’s government is on a mission to ensure the French nuclear operator

can indeed withstand the fallout — and keep on top of ballooning

investments and orders at home.

French ministers are trying to get the British state to stump up some support for the soaring Hinkley bill, which could reach a total of £46bn at today’s prices for the two reactors,

people close to the talks have said.

That would be roughly double the original budget in 2015 prices, compared with an EDF project in Finland that ended up costing more than twice what it was supposed to and a plan

for one reactor at Flamanville in France that is running four times over

budget, at €13.2bn.

But the Hinkley setbacks have also revived a core

strategic question that is becoming more pressing than ever for EDF, a

former French electricity monopoly that operates Europe’s biggest fleet

of 56 domestic reactors: whether it is equipped to handle multiple projects

at once, internationally and at home, and financially as well as from an

industrial perspective. Already an issue in 2016, when French labour unions

at the group opposed the Hinkley plans on the basis that the financial

set-up was risky, this tension now has a different edge to it.

FT 29th Jan 2024

https://www.ft.com/content/d401e42b-d953-4ef0-b3ea-ed80e974249a

France limits its investment in Britain’s Sizewell C, as the global nuclear industry requires massive government subsidies

Why are nuclear power projects so challenging? Increasing nuclear energy

capacity is not easy. Projects across the globe have been fraught with

delays and budget overruns, with the Financial Times revealing last week

that France is pressing the UK to help fill budget shortfalls at the

Hinkley Point C project in England, being built by EDF.

The International Energy Agency (IEA) says nuclear projects starting between 2010 and 2020

are on average three years late, even as it forecasts nuclear power

generation will hit a record high next year and will need to more than

double by 2050. Technical issues, shortages of qualified staff,

supply-chain disruptions, strict regulation and voter pushback are the key

factors developers and governments are grappling with. In the US, Georgia

Power is scheduled to complete work within weeks on the second of two

gigantic new nuclear reactors that are at the vanguard of US plans to

rebuild its nuclear energy industry.

But the expansion of Plant Vogtle is

seven years late and has cost more than double the original price tag of

$14bn due to a series of construction problems, highlighting the complexity

of nuclear megaprojects. These complexities, high costs and long build

times — as well as strict regulation due to risks of nuclear accidents

— make nuclear power a daunting prospect for many investors.

As a result, the sector is heavily subsidised by governments. Many reactor suppliers for

large-scale projects are state-owned, working alongside the private sector

to build the full plant. But countries also have a limit on how much they

are willing to spend. EDF, now fully owned by the French state, will limit

its stake in its next planned UK plant, Sizewell C, to 20 per cent.

FT 1st Feb 2024

https://www-ft-com.ezproxy.depaul.edu/content/6d371375-b7be-4228-a3d5-2ad74f91454a

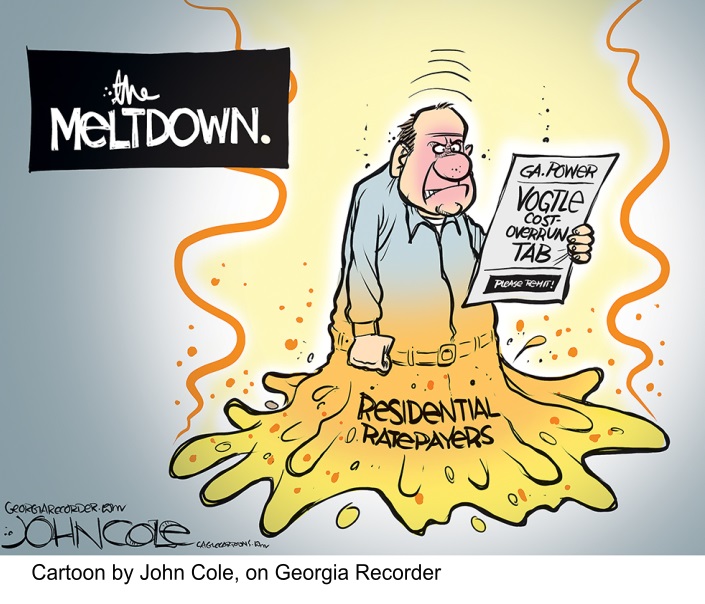

Vibrations in cooling system mean new Georgia’s Vogtle nuclear reactor will again be delayed, and costs blow out

Daily Mail, By ASSOCIATED PRESS, 2 Feb 24,

ATLANTA (AP) – Georgia Power Co. said Thursday that vibrations found in a cooling system of its second new nuclear reactor will delay when the unit begins generating power.

Plant Vogtle’s Unit 4 now will not start commercial operation until sometime in the second quarter of 2024, or between April 1 and June 30, the largest subsidiary of Atlanta-based Southern Co. announced.

The utility said in a filing to investors that the vibrations “were similar in nature” to those experienced during startup testing for Unit 3, which began commercial operations last summer, joining two older reactors that have stood on the site near Augusta for decades………

Georgia Power said it’s likely to lose $30 million in profit for each month beyond March that Unit 4 isn’t running because of an earlier order by state utility regulators. The five members of the Georgia Public Service Commission ordered that the company can’t earn an additional return on equity through a construction surcharge levied on Georgia Power’s 2.7 million customers after March 30.

The typical residential customer has paid about $1,000 in surcharges over time to pay for financing costs.

Georgia Power said it’s likely to lose $30 million in profit for each month beyond March that Unit 4 isn’t running because of an earlier order by state utility regulators. The five members of the Georgia Public Service Commission ordered that the company can’t earn an additional return on equity through a construction surcharge levied on Georgia Power’s 2.7 million customers after March 30.

The typical residential customer has paid about $1,000 in surcharges over time to pay for financing costs…………………………………..

The new Vogtle reactors are currently projected to cost Georgia Power and three other owners $31 billion, according to calulations by The Associated Press. Add in $3.7 billion that original contractor Westinghouse paid Vogtle owners to walk away from construction, and the total nears $35 billion.

The reactors were originally projected to cost $14 billion and be completed by 2017…………..

……even as government officials and some utilities are again looking to nuclear power to alleviate climate change, the cost of Vogtle could discourage utilities from pursuing nuclear power……….https://www.dailymail.co.uk/wires/ap/article-13036013/Vibrations-cooling-mean-new-Georgia-nuclear-reactor-delayed.html—

COP28 pledge to expand nuclear capacity is out of touch with reality.

Tripling the scale of the world’s nuclear fleet by 2050 could cost upwards of $11 trillion.

PV Magazine 30th Jan 2024, M V Ramana,

The 2023 Conference of Parties (COP) climate change summit held in Dubai in December ended with a call to contribute to a transition “away from fossil fuels in energy systems.” The discussion at the COP about how to replace fossil fuels included two pledges. One was ambitious but within the realm of possibility. The other pledge was plain wishful thinking. The first, signed by 123 countries, was enshrined in the final COP28 document. The second was unofficial and attracted only 25 countries. One concerned renewable energy and energy efficiency, the other, nuclear energy. No prizes for guessing which pledge corresponded to which energy source.

Historical trends can help us understand why a goal of tripling nuclear energy generation capacity by 2050 is unattainable. According to the latest edition of the “World Nuclear Industry Status Report (WNISR2023),” the operating power generating capacity of all nuclear plants in the world is 365 GW, as of July 2023. Tripling this by mid century, 27 years from now, would mean close to 1.1 TW of nuclear capacity.

Twenty-seven years ago, in 1996, the world had 344 GW of nuclear generation capacity. Since then, when the capacity added by new nuclear reactors is tallied and that of old reactors that have been shut down is subtracted, the global nuclear fleet has grown an average of 800 MW per year. At that rate, nuclear capacity in 2050 would be a mere 386 GW, assuming that a large number of reactors would be built to replace the aging nuclear fleets of most countries. In other words, the likely nuclear capacity in 2050 would be a mere fraction of what is desired by the COP28 pledge.

Falling share

A second trend should also be acknowledged. Since 1996, the share of global electricity produced by nuclear reactors has declined from 17.5% to 9.2%, according to “WNISR2023.” That is in stark contrast to the corresponding trends for renewables, especially solar and wind energy. Between 1996 and 2023, the share of global electricity produced by modern renewable forms of energy has grown from 1.2% to 14.4%, according to the Energy Institute’s “2023 Statistical Review of World Energy.” The actual increase in the amount of energy produced by renewable sources is even more dramatic because the total energy flowing in the world’s electricity grids has more than doubled over that period.

The phenomenal growth of renewables is fueled by an even more astonishing decline in the cost of generating solar and wind power. Between 2009 and 2023, the levelized cost of generating electricity from utility scale photovoltaic farms and onshore wind farms in the United States has decreased by 83% and 63%, respectively, according to the “2023 Levelized Cost of Energy+” report published by Lazard. Nuclear electricity costs have escalated by 47% over the same period.

For recently constructed reactors, each gigawatt of generation capacity costs around $15 billion, meaning a bill of around $11 trillion to build the 730 GW needed to triple current capacity. The cost would be even more when taking into account the need to replace some of the old reactors shut down over the same period……………………………………………….

Some nuclear proponents argue that small modular reactors (SMRs) will change this picture. These will not benefit from economies of scale, however. A reactor that generates three times as much power as an SMR will not require three times as much concrete or three times as many workers. As a result, building and operating SMRs will cost more than large reactors for each megawatt of generation capacity. In turn, the electricity from small reactors will be more expensive than electricity from bigger sites, as was seen in the case of the many small reactors built in the United States before 1975. Those were financially uncompetitive and shut down early.

NuScale

The higher cost per unit of generating capacity was also seen in the case of the proposed NuScale reactor, which was planned for Utah, in the United States. The now abandoned project, which was to be developed by NuScale for electric utility Utah Associated Municipal Power Systems, would have involved six SMRs with a total generation capacity of 462 MW for an eye-popping $9.3 billion. At that rate, building a gigawatt of nuclear capacity would cost $20 billion, not $15 billion.

That cost would likely have been greater if the project had actually gone ahead and the reactor was built.

PV Magazine 30th Jan 2024 https://www.pv-magazine.com/2024/01/30/cop28-pledge-to-expand-nuclear-capacity-is-out-of-touch-with-reality/

Is this the World’s Most Expensive and Most Delayed Power Project?

By Leonard Hyman & William Tilles – Jan 31, 2024,

Yes, they are still building the Hinckley Point C nuclear power station in the United Kingdom, and yes the latest estimated cost is more than the previously estimated cost and the completion date has receded another two years into the future.

This nuclear project received its license for construction in 2012, with an estimated cost of £18 billion and completion date in 2025. The last estimate calls for 2029-2031 completion at a cost of £46 billion. To the extent that these estimates can be trusted, the plant would end up costing double the original estimate in real terms. In the same time period, solar and wind costs will decline by at least one half. We are not sure yet whether Hinckley Point will set an all-time record as the most expensive and most delayed power-related project in history, but it certainly will be a contender.

As is the case for so many climate- or security-related projects, the UK government offered significant subsidies to the builder. But in a different way. Most governments, nowadays, offer start-up subsidies in order to bring production levels up to a point where economies of scale kick in, after which costs drop rapidly and consumers get real benefits. The cost curves for wind, solar, and energy storage show how well this strategy works. Give the industry a kickstart and watch the action take place.

Not so with nuclear, where costs seem to rise with encouragement rather than fall. Opting for nuclear, then, seems more like an ideological rather than a technological or economic choice, especially for British Conservative politicians. “Nuclear has to be part of the package”, they seem to say. Even if the nuclear cost per kW installed is five-eight times higher than non-fossil alternatives. But, fortunately, the UK government is not directly on the hook for the added costs, the Chinese co-investor in the project has declared that it will not contribute more, and it looks as if French utility EDF will bear the increased costs if it does not get a new power contract. But if the UK decides to stick EDF with the bill, what will that decision do to discourage further nuclear construction? Given the perilous nature of that construction (namely the danger of cost inflation), who could take the risk of initiating new projects other than a government agency?………………………………………….

Oil Price 31st Jan 2024

Many challenges stand in the way of a ‘nuclear power renaissance’.

COMMENT Isn’t “challenge” a lovely word? Conjures up pictures of a tennis match, or some exciting venture.

It’s the word they use when they mean something more like “overwhelming frightening costs” ” “worrying safety and proliferation risks”, awful unsolved problem of toxic wastes”

Is this nuclear power’s moment? Many challenges stand in the way of a

‘nuclear power renaissance’. The nuclear power industry is receiving a

lot of attention recently thanks in part to new technological advancements.

That’s excited venture capital groups and private investors, such as Bill

Gates and OpenAI’s Sam Altman. But the industry is also known for its

boom-and-bust cycles. The FT’s US energy editor Jamie Smyth explains

there are many challenges that lie ahead for an industry, which has long

been plagued by controversy.

FT 31st Jan 2024

https://www.ft.com/content/5550dd4f-6399-447d-a220-6132dac19697

UK’s Nuclear “money pit” tops $59 billion.

What a turkey! by beyondnuclearinternational, https://beyondnuclearinternational.org/2024/01/31/what-a-turkey/

Hinkley Point C costs hit a new high but nuclear plant still isn’t roasting Christmas turkeys

By Linda Pentz Gunter

The Great Mosque of Mecca is considered the most expensive building in the world at $115.2 billion. Right behind it comes….a nuclear power plant! The two-reactor 3,260MW Hinkley Point C nuclear site still under construction in the UK will now cost at least £46 billion ($59 billion) according to the latest figures released by its developer, the French energy giant, EDF.

As such, Hinkley Point C has now earned the dubious honor of becoming the second most expensive building in the world. And it’s not even finished. The price could soar still higher.

EDF originally bragged that Britons would be baking their Christmas turkeys powered by Hinkley Point C by 2017. The completion date has now been pushed to “after 2029”.

The nuclear power industry is very good at tripling things. Perhaps not global nuclear installations by 2050 as it bragged would happen during an announcement at the COP28 climate summit last December. But the price tag for a new reactor? Timelines for new reactor construction? Straight A grades all around!

That’s almost what’s happening at Hinkley Point C where the new price is more than double the original estimated cost of £18 billion ($23 billion). Getting to triple the cost still seems eminently achievable given the new completion date.

This not-so-shocking news, given nuclear power’s track record, comes after the recent, overblown announcement by Rishi Sunak’s Conservative government that Britain would launch its “biggest expansion of nuclear power for 70 years to create jobs, reduce bills and strengthen Britain’s energy security.” The plan will of course achieve none of these things.

Far from reducing electricity bills for British consumers, the Hinkley nuclear project will in fact increase them “far above the market electricity price,” predicted Dr Norbert Allnoch, CEO of the International Economic Forum for Renewable Energies (IWR), based in Münster, Germany.

According to estimates by IWR, the cost of the electricity generated by Hinkley Point C will be “significantly higher than the 15 cents/kWh mark” and will continue to rise. This is because the UK government agreed a “state-guaranteed price for nuclear power being paid to EDF, which is linked to the inflation rate,” says IWR.

All of this came after the recent announcement that UK authorities had granted a Development Consent Order (DCO) to EDF’s identical twin EPR reactor project on the Suffolk Coast at Sizewell, while committing £1.3 billion ($1.6 billion) in funding for the project. The French company has already been tearing up pristine countryside there, destroying habitat and disturbing wildlife at the adjacent Minsmere Nature Reserve.

Meanwhile, France is pushing the UK to pay for the cost-overruns at Hinkley and the expected ballooning bills at Sizewell once work begins. France reportedly blames Britain for prompting the Chinese firm CGN to withdraw its 33.5% share from the Hinkley plant after Britain booted China out of the Sizewell C nuclear project.

Chinese investment in UK nuclear projects has been a hot political potato for some time, and came to be viewed as “an unacceptable national security risk.” A proposed new reactor project at Bradwell in Essex, a joint project between China and France, looks unlikely to go forward, at least in part due to security concerns about Chinese involvement.

These challenges prompted the UK government to seek alternative sources of funding, inevitably settling on ratepayers using something called a Regulated Asset Base (RAB). RAB effectively funds future nuclear projects by charging ratepayers up front in their electricity bills for the anticipated costs of nuclear plant design, construction, commissioning, and operation.

“Hinkley Point C has been a shambolic money pit,” said a spokesperson from Together Against Sizewell C on X (formerly Twitter). “It’s been hit by delay after delay and the costs are escalating at an alarming rate. Nobody can say with any confidence when it will go live or how much money will have been wasted on it.”

The story of Hinkley C illustrates that the nuclear sector is “out of control economically,” said Paul Gunter, director of the Reactor Oversight Project at Beyond Nuclear. The cost of EDF’s EPR reactor being built in France at Flamanville and still incomplete, has more than quadrupled to close to $15 billion. Another EPR, at Olkiluoto in Finland, went from $3.2 billion to more than $12 billion and launched 12 years late.

On U.S. soil, two AP1000 reactors at the Vogtle nuclear power plant site in Georgia, will likely come in at a total price tag of at least $35 billion, $20 billion more than originally estimated, with the second of the two reactors still not on line.

EDF, France’s state-owned nuclear company now in a fatal trap, as Hinkley Point C costs soar

Hinkley Point: endless setbacks at nuclear plant highlight political choice to destroy EDF

On January 22nd, state-owned French utilities group

EDF announced new delays in the construction of two EPR nuclear reactors at

the British plant of Hinkley Point. Originally planned to enter service in

2024, the first of the two reactors is now expected to be, at best,

operational in 2029, or possibly “2030 or 2031”.

Seven years after the project was launched, all the warnings against EDF’s involvement in it

made by the group’s staff have proved be right, writes Mediapart

economics correspondent Martine Orange in this op-ed article.

The state-owned group now finds itself in a fatal trap created by Emmanuel

Macron. Following the epic delays with the Olkiluoto nuclear power plant in

Finland, those of Flamanville in France, and those of Taishan in China, the

under-construction plant of Hinkley Point C in south-west England has now

joined the long story of an industrial catastrophe which is the third

generation EPR (pressurised water reactor) first designed by Areva, once

France’s nuclear energy giant.

Mediapart 28th Jan 2024

Are the French going cold on UK nuclear?

‘It would be madness to give Sizewell C the final go-ahead while the questions of whether Hinkley C can be finished, and who pays, are not resolved. Sizewell C is bound to take longer and cost more, but this time it would be we consumers who would bear the risk and pay the price through the “nuclear tax” on our energy bills.’.

The French government, which was previously relaxed about EDF’s forays into UK nuclear, now wants its energy company to work on projects back home in France.

So far, Britain has put £2.5billion into the project in total and taxpayers are the biggest shareholders. Campaigners who vehemently oppose the project are alarmed by the recent comments from Paris, pointing out that if the French back off from Sizewell, taxpayers could be on the hook for huge extra amounts of cash via their bills.

By FRANCESCA WASHTELL , 28 January 2024, https://www.thisismoney.co.uk/money/markets/article-13015713/Are-French-going-cold-UK-nuclear.html

Our nuclear industry is reawakening,’ energy secretary Claire Coutinho

declared in a Government strategy document published earlier this month. In

between invoking Winston Churchill’s enthusiasm for nuclear power and its

ability to help the UK reach net zero, Coutinho added that setting up new

plants would ensure our energy security ‘so we’re never dependent on the

likes of [Vladimir] Putin again’. Fighting talk. But in the space of a

fortnight, Coutinho’s gung-ho attitude has already been dented as a

diplomatic row brews over who should pay for the controversial power

stations.

French state-owned energy company EDF last week lit the blue

touchpaper with the revelation the UK’s flagship Hinkley Point C nuclear

plant in Somerset would be delayed until 2029 at the earliest. The cost, it

added, could spiral to as much as £46billion, from initial estimates of

£18billion.

Few in the industry will have been surprised, particularly as EDF has experienced delays on similar projects in Finland and France. But what was a shock were some incendiary remarks from the French government.

The Elysee Palace began pressing the UK to help plug a funding gap at Hinkley and for good measure cast doubt over its commitment to Sizewell C, the next nuclear power station in the pipeline.

A French Treasury official suggested the Government was trying to leave EDF in the lurch on Hinkley.

The official added that it cannot, at the same time, abandon the French firm to ‘figure it out alone’ on Hinkley and also expect it to plough money into Sizewell. It is, the official said, ‘a Franco- British matter,’ and not one for the French to resolve single-handedly.

This is a bad moment for two critical new nuclear plants – and our broader energy security – to be dragged into a cross-Channel tussle.

The French government, which was previously relaxed about EDF’s forays into UK nuclear, now wants its energy company to work on projects back home in France.

Well-placed UK sources deny the French claims that EDF has been left to shoulder the financing burden alone at Hinkley, or that it has been jettisoned by the British state.

They point to the fact EDF has all along had contractual obligations to shoulder the costs at this stage of the project. The early stages of developing Hinkley were undertaken by EDF along with China General Nuclear.

The Chinese firm has fulfilled its part of the bargain, leaving the onus on the French. ‘It’s all down to the French state,’ a senior industry source told The Mail on Sunday. ‘It’s tough, but they’ve not managed it at all well.’

A Department for Energy Security and Net Zero spokesman said: ‘The Government plays no part in the financing or operation of Hinkley Point C. The financing of the project is a matter for EDF and its shareholders.’

As well as backing Hinkley, EDF several years ago began serious talks with the Government over Sizewell C in Suffolk. Each could power an estimated 6 million homes for 60 years, meaning the two projects are linchpins for meeting future energy demand.

The French group is due to take a 20 per cent stake in Sizewell. The Government has previously indicated it will take 20 per cent. It was hoped the rest would be funded through money from the private sector, such as pension funds and sovereign wealth funds.

So far, Britain has put £2.5billion into the project in total and taxpayers are the biggest shareholders. Campaigners who vehemently oppose the project are alarmed by the recent comments from Paris, pointing out that if the French back off from Sizewell, taxpayers could be on the hook for huge extra amounts of cash via their bills.

The new type of funding structure for Sizewell C means consumers will already face an added tax to help pay for the plant.

Alison Downes of the Stop Sizewell C campaign group said: ‘It would be madness to give Sizewell C the final go-ahead while the questions of whether Hinkley C can be finished, and who pays, are not resolved. Sizewell C is bound to take longer and cost more, but this time it would be we consumers who would bear the risk and pay the price through the “nuclear tax” on our energy bills.’

And another area of the industry is watching the fracas with mounting frustration.

Companies vying to build ‘mini’ stations known as small modular reactors (SMRs) hope this prompts the Government to commit instead to their projects, which are quicker to build and cheaper [?]

The firms include Rolls-Royce SMR, which has already received significant funding from the Government. New nuclear plants of whatever size will almost certainly be part of the UK’s energy mix in the years to come.

The sector had already been championed by Boris Johnson before soaring oil and gas prices in the wake of Russia’s invasion of Ukraine highlighted Britain’s dependence on overseas energy.

Any fisticuffs with France over Hinkley and Sizewell would strain the sector and could fatally damage the level of public. Industry figures are urging ministers to resist stumping up cash the French had agreed to pay.

One senior source said: ‘I hope the Government doesn’t lose its nerve, though there’s no sign of that at the moment. It would be a terrible precedent.’

.

Cost of UK’s flagship nuclear project blows out to more than $A92 billion

But it also has implications for Australia, because one its main political groupings, the right-wing Liberal and National Party coalition, has decided that Australia should abandon its current plan to dump coal for renewables and storage, and wait for nuclear instead.

Australia currently has a target of 82 per cent renewables by 2030, and AEMO’s latest Integrated System Plan suggests it could be close to 100 per cent renewables within half a decade after that.

Giles Parkinson, Jan 29, 2024, https://reneweconomy.com.au/cost-of-uks-flagship-nuclear-project-blows-out-to-more-than-a92-billion/

The cost of the flagship nuclear project in the United Kingdom has blown out again, this time to a potential $A92.6 billion as a result of yet more problems and delays at the Hinkley C project.

The latest cost blowout was revealed last week by the French-government owned EdF, whose former CEO had originally promised in 2007 that the Hinkley project would be “cooking Christmas turkeys” in England by 2017, at a cost of just £9 billion.

But like virtually every major nuclear project built in western economies, that ambitious deadline was never going to be met. The new start-up date is now for 2030, but more likely 2031 – and that is only for one of the two units.

The budget has leaped from the original promise of £9 billion, to £18 billion, and has since blown out multiple times to now reach £31 billion and £34 billion, and it could be more than £35 billion “in 2015 values,” according to EdF. This translates into current day prices, according to Michael Liebreich, the former head of Bloomberg New Energy Finance, of £48 billion, or $A92.6 billion.

“The cost of civil engineering and the longer duration of the electromechanical phase (and its impact on other work) are the two main reasons for this cost revision,” EdF said in its statement. It has also experienced massive cost over-runs and delays at other similar projects in Flammanville in Fance and Olkiluoto in Finland.

It is yet another crippling blow to the UK plans to make nuclear a centrepiece of its green energy transition. EdF has already had to be bailed out by its own government, and ultimately nationalised, because of the cost blowouts and the huge costs of buying replacement power when half its French nuclear fleet went offline in 2023.

China’s CGN had to be brought in to fund one third of the Hinckley project, but is refusing to contribute more funds because China has been frozen out of other UK projects.

Alison Downes of Stop Sizewell C, a campaign group opposed to the planned Suffolk nuclear plant, told the Financial Times that EDF and the Hinkley project was an “unmitigated disaster”.

She added the UK government should cancel Sizewell C, saying state funding for the project could be better spent on “renewables, energy efficiency or, in this election year, schools and hospitals”.

But it also has implications for Australia, because one its main political groupings, the right-wing Liberal and National Party coalition, has decided that Australia should abandon its current plan to dump coal for renewables and storage, and wait for nuclear instead.

The Coalition had been pushing so-called small modular reactors, but after the failure of the leading technology developer in the US last year, and confirmation by the CSIRO and the Australian Energy Market Operator that SMR costs would be three times more expensive than renewables, several key Coalition members pointed to large scale nuclear such as Hinckley.

Australia currently has a target of 82 per cent renewables by 2030, and AEMO’s latest Integrated System Plan suggests it could be close to 100 per cent renewables within half a decade after that.

This switch to low carbon electricity is critical for Australia’s emissions targets, and for emission cuts in other parts of the economy. Any delay in the roll-out of renewables, in the expectation that nuclear would fill its place, will push that timeline out by at least another decade, if not, and blow out the costs of the energy transition.

“It is not like cost over-runs in nuclear projects are a big secret,” Liebreich writes on his Sub-stack blog.

He cites the world’s leading academic expert on project management, Danish Professor Bent Flyvbjerg, author of How Big Things Get Done, who shows that nuclear plants are worse only than Olympic Games in terms of cost over-runs.

“On average they go 120% over the budget, with 58% of them going a whopping 204% over budget,” Liebreich writes.

The Coalition energy spokesman Ted O’Brien complained in December that the CSIRO/AEMO report focused only on the “investment” cost, and not the “consumer cost.”

It’s not clear what he means by that. But as Liebreich notes, while Hinkley’s construction costs are in the £42 to £48 billion range, its first 35 years of electricity at £87.50 or £92.50/MW in 2012 money, adjusted for inflation, will cost UK energy users a gargantuan £111 or £116 billion, or up to $A223 billion.

Hinkley Point is glowing on my doorstep, but that won’t help us get a bus into town

In west Somerset broadband is patchy and childcare is scarce, but there’s always £10bn to spare for a badly run mega-project

In west Somerset broadband is patchy and childcare is scarce,

but there’s always £10bn to spare for a badly run mega-project.

Some 10,000 people work on site there (with another 12,000 associated jobs elsewhere).

Lifting the 245-tonne steel roof onto the first reactor, a few weeks ago,

utilised the world’s largest land-based crane. Hinkley Point C (next to the

original facilities A and B) will power some six million homes and what I

lie in bed at night wondering about is how the hell they feed the 10,000.

The Chinese state-owned CGN has a one-third stake in Hinkley and the French

state-controlled energy company EDF controls the rest.

It’s due to start generating power in 2030 and is the world’s most expensive power station.

Then this week EDF announced that, whoops, they need another £10 billion.

Prices have increased since 2015, design changes require more steel and

concrete and, I imagine, given the French contingent at the facility,

increases in the price of butter have skyrocketed the projected costs of

croissants. The final costs could be around £46 billion with the project

looking at a four-year delay.

All of which is great if you’ve got a job

there, be it in security, catering or nuclear fission, but otherwise this

futurist megalith rather clashes with the neighbouring muddy fields of

Exmoor. There are three key stumbling blocks here: childcare is scarce,

broadband is patchy and there are no buses. Which leaves people feeling

that these infrastructure projects – Hinkley Point, HS2 – are like the huge

sewage pipes that run through the slums of Mumbai. They carve up and

disrupt the landscape and lives of those who exist around it, but it’s only

the comfortable middle classes who benefit.

Telegraph 27th Jan 2024

https://www.telegraph.co.uk/columnists/2024/01/27/william-sitwell-hinkley-point/

Hinkley Point C nuclear could go £28bn over budget, and tax-payer takes larger stake in Sizewell C nuclear.

The Chemical Engineer, by Adam Duckett, 28 Jan 24

EDF SAYS its Hinkley Point C nuclear power plant could be delayed to as late as 2031, with costs rising to £46bn (US$58bn).

The project, which includes building two 1,630 MW nuclear reactors in Somerset, was estimated to cost £18bn when it was first agreed in 2016 and had been scheduled to begin operations in 2025. The project has since struggled with a series of delays and cost hikes. The firm has now outlined three scenarios that push operations back until the end of the decade at the earliest.

The first reactor could begin operations in 2029, or, under a base case scenario that assumes delays in the electromechanical work and testing start-up, could fall back to 2030. Under a third scenario, there could be a further delay to 2031.

In a letter to staff, Stuart Crooks, managing director of Hinkley Point C, said: “Like other infrastructure projects we have found civil construction slower than we hoped and faced inflation, labour and material shortages on top of Covid and Brexit disruption.”

He added that EDF has been required to substantially adapt its reactor design to satisfy British regulations, requiring 7,000 changes that have added 35% more steel and 25% more concrete.

EDF says the delays and extra work will hike costs to between £31-35bn in 2015 values meaning under the worst case scenario the price could reach £46bn.

Hinkley Point C is key to the government’s target to almost quadruple nuclear power output from 6.5 GW today to 24 GW by 2050. To meet this goal, it published a plan earlier this month that includes building at least one other plant the size of Hinkley Point C and Sizewell C that EDF is planning in Suffolk, along with suites of smaller modular and advanced nuclear reactors…………….

News of the delay prompted further criticism from nuclear opponents who argue that governments should invest in renewables instead. There are also concerns that with the Chinese junior partner in Hinkley Point C refusing to contribute any more money to the project that the UK government will be called up on to help meet the climbing costs. A government spokesperson told the Financial Times that any additional costs “will in no way fall on taxpayers”.

Government takes larger stake in Sizewell C

Earlier this week, the UK government announced it would make an extra £1.3bn available to support EDF’s construction of Sizewell C so that construction work can continue ahead of a final investment decision being made later this year. Sizewell will use the same design as Hinkley Point C.

The government’s investment further consolidates its position as the majority shareholder in the project. Last year, it bought out the project’s Chinese state-owned partner China General Nuclear as part of efforts to limit Beijing’s involvement in critical infrastructure.

The government has now invested £2.5bn in Sizewell C and the project is being funded by a so-called regulated asset base model under which surcharges on consumer energy bills help fund the project while it’s being constructed. Last year, the government opened up a bidding process to attract external investors in a bid to raise an estimated £20bn to construct the plant. https://www.thechemicalengineer.com/news/hinkley-point-c-could-go-28bn-over-budget-as-edf-predicts-further-delays/

Growing mountain of wasted money is a radioactive prospect

Alistair Osborne: Growing mountain of wasted money is a radioactive

prospect. Rishi Sunak’s apparent determination to press ahead with

mammoth investment in new nuclear reactors, whatever the cost, might not

prove to be the best solution.

It’s only a week since he set off — again — with his uncosted “nuclear road map”: a plan to have 24 gigawatts of new reactors by 2050, or seven more Hinkley Point Cs. On

Monday, the government sank another £1.3 billion into Sizewell C, so it

could “steam ahead” with that project, too, as Andrew Bowie, the

minister for nukes, put it.

Listen to him and investors are queueing up. So

what better news to encourage them than this jaw-dropper from EDF, the

state-backed French outfit behind both schemes? Hinkley Point’s costs

have shot up by as much as £10 billion to a top-end £35 billion, in 2015

prices.

And, instead of firing up in 2027, the first of the Somerset

nuke’s twin reactors could in an “unfavourable scenario” (the likely

outcome) be delayed until 2031. This is what comes with Hinkley’s

European pressurised reactor tech, as EDF has also proved at France’s

Flamanville, Finland’s Olkiluoto and China’s Taishan.

Indeed, two years after the Chinese nuke became operational, one unit had to be taken offline for a year’s repairs. So why is the government hellbent on a re-run with

Sizewell in Suffolk? Alison Downes from the Stop Sizewell C campaign is no

neutral voice. But she’s right to say the project “epitomises the

definition of insanity: doing the same thing over and over and expecting a

different result”. With Sizewell, though, things would be far pricier.

Under the contracts-for-difference regime, EDF is on the hook for

Hinkley’s costs. Repeat the trick at Sizewell and, under the new

regulated asset base model, consumers would find £10 billion added to

their bills — before the nuke’s even operational.

Times 25th Jan 2024

-

Archives

- January 2026 (138)

- December 2025 (358)

- November 2025 (359)

- October 2025 (377)

- September 2025 (258)

- August 2025 (319)

- July 2025 (230)

- June 2025 (348)

- May 2025 (261)

- April 2025 (305)

- March 2025 (319)

- February 2025 (234)

-

Categories

- 1

- 1 NUCLEAR ISSUES

- business and costs

- climate change

- culture and arts

- ENERGY

- environment

- health

- history

- indigenous issues

- Legal

- marketing of nuclear

- media

- opposition to nuclear

- PERSONAL STORIES

- politics

- politics international

- Religion and ethics

- safety

- secrets,lies and civil liberties

- spinbuster

- technology

- Uranium

- wastes

- weapons and war

- Women

- 2 WORLD

- ACTION

- AFRICA

- Atrocities

- AUSTRALIA

- Christina's notes

- Christina's themes

- culture and arts

- Events

- Fuk 2022

- Fuk 2023

- Fukushima 2017

- Fukushima 2018

- fukushima 2019

- Fukushima 2020

- Fukushima 2021

- general

- global warming

- Humour (God we need it)

- Nuclear

- RARE EARTHS

- Reference

- resources – print

- Resources -audiovicual

- Weekly Newsletter

- World

- World Nuclear

- YouTube

-

RSS

Entries RSS

Comments RSS