UK Seeks More Investors as Sizewell Funding Talks Drag On

The UK government is speaking with investors beyond the core group of existing bidders for a stake in the country’s Sizewell C nuclear plant as talks to finalize the project’s funding continue.

Financial Post, Bloomberg News, William Mathis, Priscila Azevedo Rocha and Aaron Kirchfeld, Dec 05, 2024

he UK government is speaking with investors beyond the core group of existing bidders for a stake in the country’s Sizewell C nuclear plant as talks to finalize the project’s funding continue.

The government has recently approached infrastructure and other private investors to provide equity to Britain’s next large-scale nuclear power plant, according to people familiar with the matter. The talks come at a critical time for the UK as it seeks to attract financing to overhaul the country’s power grid this decade.

The country recently delayed funding for the project until at least spring 2025, pushing back a previous target to take a final investment decision by the end of the year. Finding investors willing to participate in new nuclear plants is crucial to plans to cut emissions and reach 2050 net zero goals.

The government has been seeking investors for the Sizewell C project for more than a year and canvassed a wide variety of potential backers before honing in on a smaller group of interested parties, the people said. It’s not clear whether any of the investors being contacted now would be able to join the current fundraising process, or if they would buy into a subsequent round as the government further sells down its stake. ……………………………………

A spokesperson for the Department for Energy Security & Net Zero said the autumn budget confirmed the current equity and debt raising process will move to its final stages shortly and will conclude in the spring. A final investment decision on whether to proceed with the project will be taken in the multiyear spending review, they added.

The Sizewell project — owned by the government and minority stakeholder Electricite de France SA — could eventually cost an estimated £20 billion ($25.3 billion) and take roughly a decade to build.

The government has previously engaged in discussions with investors including Centrica Plc, Emirates Nuclear Energy Corp., Amber Infrastructure Group Ltd. and Schroders Greencoat LLP and the conversations are ongoing, the people said, asking not to be named because the talks are private. Barclays Plc is advising the UK government.

Spokespeople for Barclays and Centrica declined to comment, while representatives for ENEC, Amber Infrastructure and Schroders didn’t immediately respond to queries.

Centrica Chief Executive Officer Chris O’Shea has said on various occasions that the company’s engagement in any UK infrastructure projects, including Sizewell, would hinge on the “right conditions.”

At the moment, the only nuclear power station under construction in the UK is Hinkley Point C, which has been repeatedly delayed and is expected to cost as much as £47.9 billion in current terms. EDF is also holding talks with investors over funding for Hinkley as the French utility grapples with the ballooning cost of the project.

https://financialpost.com/pmn/business-pmn/uk-looks-for-more-investors-as-sizewell-c-funding-talks-drag-on

Delays to nuclear plants giving Sizewell B a new lease of life

EDF is considering plans to keep the power station in Suffolk going for an extra

20 years to underpin Britain’s net zero ambitions after building new

plants proves tricky. Sizewell B in Suffolk, the nuclear power plant that

provides about 3 per cent of the UK’s electricity and has been in the

midst of a 47-day maintenance outage.

Nuclear power has dwindled to about

14 per cent of the UK’s electricity mix, down from about a quarter in the

late 1990s. Of the five plants still running, all of which are operated by

EDF, the French state-backed power group, only Sizewell B is set to be

still running by the end of the decade.

Efforts to revive the industry have

been beset by delays and soaring costs, with Hinkley Point C, the first

plant to be built in Britain in more than two decades, running up to six

years behind schedule and billions over budget. Sizewell B, which began

generating power in 1995, was the last. It is against this backdrop that

the operators of Sizewell B will make the case to EDF in Paris to extend

the life of the plant, capable of powering two million homes, by another 20

years.

Keeping the plant running until 2055 is set to cost roughly £700

million. The plant has relatively fixed costs and has already forward-sold

the majority of power set to be generated next year. However, the

volatility in power prices since the pandemic, exacerbated by the Russian

invasion of Ukraine, has complicated the business case for keeping Sizewell

B running for longer.

The French energy group, which has an 80 per cent

stake in Sizewell B alongside Centrica’s 20 per cent, is attempting to

pay down a debt pile of almost £45 billion. Here in the UK, it is in talks

with private investors to raise between £4 billion and £5 billion to help

meet the spiralling bill to complete Hinkley Point C. Sizewell C is also

competing for EDF capital, even if the company intends to eventually sell

down its stake in the project from 50 per cent to about 20 per cent. Two

nuclear power stations with identical designs in America — Wolf Creek and

Callaway — have already been granted extensions to their operating

licences that will see them run from 40 years to 60 years, providing a

precedent.

Times 2nd Dec 2024 https://www.thetimes.com/business-money/energy/article/delays-to-nuclear-plants-giving-sizewell-b-a-new-lease-of-life-r6fdzx9j5

Why NuScale Power Stock Slumped Today

By Rich Smith – Dec 2, 2024

https://www.fool.com/investing/2024/12/02/why-nuscale-power-stock-slumped-today/

Key Points

GE Vernova is much bigger, with much more cash, and already profitable.

CNBC reported on GE Vernova’s ambitions to dominate the building of small modular reactors.

NuScale Power is a pioneer in this industry, but its business is small and unprofitable.

Will GE Vernova crush NuScale’s nuclear dreams?

NuScale Power Corporation (SMR -0.08%) stock fell 3% through 11:25 a.m. ET — and it has General Electric to blame for it.

NuScale develops small modular nuclear reactors designed to be cheaper and faster to build than traditional nuclear power plants. And as it’s fond of pointing out, NuScale is “the first and only SMR to have its design certified by the U.S. Nuclear Regulatory Commission.” But leaders aren’t necessarily winners, and as CNBC reports this morning, NuScale faces serious competition from a much bigger nuclear player, GE Vernova (GEV 3.56%), the former energy arm of General Electric.

GE Vernova’s threat to NuScale

NuScale and GE Vernova both aim to develop small modular reactors, but “small” is a relative term. If a standard nuclear power plant produces 1,000 megawatts of electricity, Vernova’s BWRX-300 reactor aims to cut that output to 300 megawatts (which is still substantial, enough to power a small city of 200,000 homes), while NuScale’s Voygr reactor goes even smaller with a 77-megawatt output.

In other respects, the two companies are more direct competitors. Both Vernova and NuScale advertise their ability to deploy multiple modules of their basic SMR in a single location, to amp up total power production capacity.

Both target a global market, with GE Vernova “aiming to deploy small nuclear reactors across the developed world over the next decade,” according to CNBC.

Is NuScale Power stock a sell?

What really sets the two companies apart, though, is their financial capacity to deliver on their promises. While valued at $3 billion in market cap, NuScale boasts less than $10 million in annual revenue and is losing $80 million a year. Analysts don’t expect the company to turn profitable before 2030 at the earliest.

GE Vernova is a $92 billion behemoth earning more than $1.2 billion a year and growing its profits at 40% a year. Just the cash alone on Vernova’s balance sheet is worth twice the price of NuScale’s stock. In any direct contest, I know which stock I’d bet on to win — and unfortunately, it’s not NuScale.,

EDF set to extend life of UK nuclear plants as Government replacement plans falter

Power plants in Hartlepool, East Lothian and Heysham are set to have their lifespan extended before the end of the year .

By Ben Gartside, December 2, 2024, https://inews.co.uk/news/nuclear-plants-uk-edf-extend-replacement-3408994

Energy giant EDF is set to announce that it will extend the lifespan of four nuclear power plants across the country amid delays to replacement projects, The i Paper can reveal.

It is the second time EDF has asked to extend the lifespan of the plants in Hartlepool and East Lothian, as well as two in Heysham, despite safety concerns at at least two of the sites.

The decision by EDF is set to be announced before the end of the year. However, The i Paper understands that all four are set to be extended.

The scale of delays to the Government’s nuclear projects including Sizewell C and the Small Modular Reactor Programme, due to Brexit and rampant inflation, was revealed earlier this year.

It threatened to derail Energy Secretary Ed Miliband’s plan to decarbonise the energy grid by 2030 before Labour even entered Downing Street.

The National Energy System Operator has raised doubts over the Government’s ability to deliver on its net zero grid commitments in just five years’ time.

The extension of the four power plants is likely to keep the grid cleaner in the coming years, while new nuclear projects await launch.

Heysham 1 and Hartlepool had been due to close in March this year, but were extended until 2026 by EDF in 2023. They have now been extended beyond 2026.

Heysham 2 and Torness nuclear power stations are currently due to close in 2028, but are set to be extended under the plans.

Torness, near Edinburgh, had its lifespan reduced by two years in 2021 due to cracking in the bricks, according to an Office for Nuclear Regulation report.

It has been reported that any extension to the Torness plant would have been conditional on EDF proving its ability to keep operating beyond 2028.

Meanwhile, a recent steam leak at Heysham 1 could have seriously injured staff according to an Office for Nuclear Regulation report, after a valve controlling stream from the reactor failed.

A number of safety notices have been given this year to EDF by the nuclear regulator, which some in the industry claim is a sign of the ageing power plants.

An industry source said that some of the reactors had already been “extended pretty far”, and that more issues would be likely.

A Department for Energy Security and Net Zero spokesperson said: “The extension of any nuclear power station is a decision for the operator and the independent regulator, the Office for Nuclear Regulation, based on safety and commercial considerations.

“EDF’s ambition is to further extend the lives of four generating nuclear power stations, subject to inspections and regulatory approvals, and a decision will be taken by the end of 2024.”

An EDF spokesperson said: “A decision will only be made after a rigorous review of all the technical factors involved in running these stations and future operation will always be subject to regular inspections and oversight from the independent regulator, the ONR.”

A spokesperson for the Office for Nuclear Regulation, said: “We are conscious of the nation’s energy challenges and government aspirations to achieve net zero and would constructively work with EDF should it have ambitions to extend the lifetime of any of its power stations.

“The ongoing safety of operations at any nuclear site must be fully demonstrated to us as part of ongoing regulation which will be informed though our extensive inspection and assessment regime.

“We will always endeavour to regulate in an enabling manner, but we would not allow any facility to operate unless we are satisfied that it is safe to do so.

France postpones financing decision of 6 new reactors – report

the firm’s Flamanville latest European pressurised reactor project cost EUR 19bn, almost six times the initial cost and faced significant delays.

(Montel) The official body responsible for a financing decision regarding six French new generation reactors has postponed approval from December until early next year amid political uncertainty, French daily Les Echos reported on Thursday.

Reporting by: Muriel Boselli28 Nov 2024

The government was mulling a zero interest loan to help EDF finance the project, it added, though there was a current budget stand-off following a snap election this summer.

This loan option, considered quicker to implement, would cut financial risks due to a mechanism approved by the European Commission, already used in the Czech Republic for its new nuclear project, the daily reported.

The loan would include a zero interest rate for the duration of the works, before moving to a “reasonable” rate once the reactors had been commissioned, the sources said.

This financial package could reduce the total cost of the project, estimated at EUR 67.4bn.

EDF aims to build six and possibly 14 new reactors by 2050, with construction due to start at the Penly nuclear power plant on the Channel coast by 2027. The utility plans to take a final decision in 2026.

However, the firm’s Flamanville latest European pressurised reactor project cost EUR 19bn, almost six times the initial cost and faced significant delays.

Only 20% of Great British Nuclear staff employed permanently

Just 30 of 140 currently staff at Great British Nuclear (GBN) are employed

on permanent contracts, it has been revealed. GBN is the government body

running the competition for selecting SMRs to receive taxpayer support for

deployment.

However, its responsibilities in the wider UK nuclear picture

are unclear and criticism has been made about how it interfaces with Great

British Energy. GBN chair Simon Bowen was asked by House of Commons Energy

Security and Net Zero select committee chair Bill Esterson on 20 November

2024 about the proportion of permanent staff at GBN. Bowen said: “The

headcount currently runs at about 140, 30 of which are permanent

employees.”

Explaining why only roughly one-in-five (21%) of the staff

are permanent, he added: “It took us many, many months to get a pay

agreement through the various government processes, understandably, which

really slowed down our recruitment, but we’re now starting to accelerate

and to bring people into the organisation.”

New Civil Engineer 29th Nov 2024

https://www.newcivilengineer.com/latest/only-20-of-great-british-nuclear-staff-employed-permanently-29-11-2024/

Civil and military nuclear programmes: will they be derailed by skills shortages?

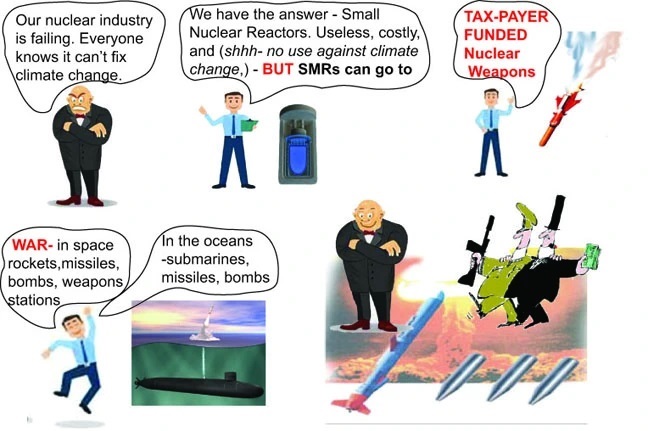

Because of the continuing problems, efforts are increasing to share resources and costs between the civilian and military nuclear programmes [11]. Rolls Royce is promoting ‘modular’ nuclear power stations with reactors similar to those used in submarines. Also the new industry recruitment website ‘DestinationNuclear.com’ abandons the old pretence that civil nuclear power is separate from the production of nuclear weapons:

It is time for a nuclear reality check.

it looks likely that in future the contribution of nuclear power to UK energy supplies will be small.

Scientists for Global Responsibility 27th Nov 2024, https://www.sgr.org.uk/resources/civil-and-military-nuclear-programmes-will-they-be-derailed-skills-shortages

Alasdair Beal takes a look at the UK nuclear industry – and finds that the proposed expansion has a workforce problem.

The incoming Labour government has inherited two major nuclear programmes – new power stations and new Trident missile submarines. Both are behind schedule and over-budget but the government says it wants them to continue. This article looks at the difficulties mobilising the skilled workforces required.

Nuclear programmes off-track

In 2010, the Conservative-led government announced its aim for work to be started on eight new nuclear power stations by 2025 [1]. Plans and timetables have been repeatedly revised since then but, currently, only one is actually under construction – Hinkley Point C (HPC) in Somerset. The 2024 ‘Civil Nuclear: Roadmap to 2050’ [2] stated that the aim is now to “secure investment decisions to deliver 3-7GW [gigawatts] every five years from 2030 to 2044, to meet our ambition to deploy up to 24GW of nuclear power by 2050.” This would amount to up to eight more plants the size of HPC. Even this appears unrealistic, given the serious problems building current reactor designs [3].

The military nuclear programme is also in trouble. Recently, Vanguard class submarines – armed with Trident nuclear missiles – have three times operated sea patrols lasting over 6 months, setting new Royal Navy records [4]. These occurred because two submarines were out of service for repairs, leaving only two in seaworthy condition. Numerous other problems have also been reported, including a faulty depth gauge leading to a nuclear-armed submarine taking a potentially catastrophic “unplanned dive” [5], and a major fire in the building used to assemble new submarines [6].

Construction of the Vanguard class submarines started in 1986 and they entered service between 1993 and 1999 with a design life of 25 years, later extended by 5 years. Construction of the replacement Dreadnought class began in 2016, with the first planned to enter service in 2028. However, this has now been delayed to “the early 2030s”, [7] which will require the existing submarines to operate until they are 40 years old, i.e. 15 years longer than their original design life and 10 years beyond their extended design life.

Major skills shortages

Skills shortages could also be a problem for both projects. In 2015, a government document [8] stated that to construct five or more new power stations by 2030, decommission existing power stations, and develop new nuclear missile submarines, “the workforce must grow by 4,700 people a year over the next 6 years. Over the same period 3,900 people are expected to leave the sector, mostly due to retirement. This means that the sector must recruit 8,600 people every year.”

Since then the schedule for new power stations has been delayed but there is now also a contract to construct new SSN-AUKUS nuclear-propelled ‘attack’ submarines. According to a House of Commons Science, Innovation and Technology Committee 2023 report [9]:

“If the UK is to achieve a contribution of 24GW of nuclear power by 2050 it will need to plan for, and achieve, a massive increase in the nuclear workforce … 50,000 full time equivalent employees would need to be recruited by 2040, even without an expansion of nuclear power … Under a scenario which envisages 19GW of nuclear capacity by 2050 … 180,000 workers will need to be recruited by 2050 – including an average of 7,234 recruits each year until 2028, compared to the current inflow of around 3,000 a year. Recently, vacancies in the nuclear sector are running at twice the rate of the general engineering and construction sector.”

With existing vacancies unfilled and recruitment insufficient to maintain present staff numbers, let alone those required for government expansion plans, the potential shortage of skilled staff is serious.

However, the situation is actually worse than the bare numbers suggest: those retiring will include many knowledgeable people with experience of designing and constructing previous nuclear submarines or power stations, or else of working with those who did. New recruits can fill the vacant seats but they cannot replace the loss of knowledge. Books, training courses and videos can help but in advanced engineering work nothing beats the passing on of accumulated knowledge and experience directly between generations of engineers.

Experience counts

I am a professional civil and structural engineer and after graduation I worked on long-span bridge design with the engineers who had designed and supervised construction of some of the biggest bridges in the world. I learned a lot from them – not only about stress calculations but also about the thinking required to produce a successful design. Much of this could not have been learned from courses or books.

The case of Rolls Royce in 1971 illustrates why this is important. Problems with their new RB211 jet engine had forced the company into liquidation and it had to be nationalised. To rescue the situation , the new directors had to persuade retired former senior engineers to return to work to lead the process of redesigning the engine to overcome the problems.

This issue may also be contributing to current problems at HPC. Existing UK nuclear engineers have only limited experience of Pressurised Water Reactor (PWR) construction and in any case they are likely to be fully occupied decommissioning the UK’s old AGR reactors and dealing with historic nuclear waste. Therefore construction of HPC depends heavily on French expertise.

French companies have constructed 58 nuclear power stations based on the Westinghouse PWR design, the last of these being ordered in 1990. No more were ordered for 15 years until Finland ordered a power station based on the new European Pressurised Water Reactor (EPR) design in 2005. By then many of the engineers and other workers who constructed France’s PWRs are likely to have retired or changed occupations, making it difficult to assemble teams with the necessary knowledge and experience to build a new power station to a new design. Maybe we should not be surprised that major problems have been encountered constructing the EPRs at Olkiluoto in Finland, at Flamanville in France – each of which has taken 17 years to build [10] – and at HPC.

Similar problems may also be affecting construction of the new Dreadnought submarines. By the time these were ordered in 2016, many of the engineers with experience of designing and constructing their predecessors would have retired or be close to retirement, taking their knowledge and experience with them.

Because of the continuing problems, efforts are increasing to share resources and costs between the civilian and military nuclear programmes [11]. Rolls Royce is promoting ‘modular’ nuclear power stations with reactors similar to those used in submarines. Also the new industry recruitment website ‘DestinationNuclear.com’ abandons the old pretence that civil nuclear power is separate from the production of nuclear weapons:

“Nuclear plays a vital role in shaping the UK’s future in broader ways. Nuclear power produces carbon-free electricity that lights homes, fuels businesses, and keeps the economy moving.

The impact of nuclear goes beyond power grids. The expertise within the sector plays a crucial role in ensuring the strength and effectiveness of the UK’s nuclear deterrent, contributing to global peace and security. Nuclear is not just an energy source; it’s a critical part in building a secure future for the UK.”

While the claims made in this statement can be criticised on many grounds, most relevant for this article is the apparent assumption that people who are concerned about climate change are also likely to be enthusiastic about nuclear weapons – which could trigger a catastrophic ‘nuclear winter’ if used [12]. If they are, then public acknowledgement of the link between the civil and military nuclear programmes is a clever move and will boost recruitment. However, if they are not, this strategy could backfire badly.

Time for a rethink

It is time for a nuclear reality check.

In 1994, the UK had 16 functioning nuclear power stations (total capacity 12.7GW) but in 2024 there were only 5 (total capacity 5.9GW) and by the end of 2028 there will be just one: Sizewell B (1.2GW) [13]. Completion of the HPC first unit (1.6GW) is now expected between 2029 and 2031, with its second unit following some years later [14]. When the effects of potential skills shortages are considered alongside the problems of current nuclear reactor designs, the idea of achieving anything like 24GW capacity by 2050 seems like a fantasy. Given the rapid growth of renewable energy and related technologies – which is set to continue – it looks likely that in future the contribution of nuclear power to UK energy supplies will be small.

Meanwhile, the programme for new Trident nuclear missile-armed submarines is a gamble based on two risky assumptions: (i) despite industry skills shortages, there will be no further delays in completing the new submarines; and (ii) the existing submarines will be able to continue operating for at least 10 years after the end of their design life. If either assumption proves incorrect then, after all the arguments over ‘unilateral’ or ‘multilateral’ nuclear disarmament, we could end up instead with a rather British outcome: ‘Unintentional Nuclear Disarmament’. At that point, the government would finally have to face up to the dangerous flaws in the idea of ‘nuclear deterrence’ and plan instead for a nuclear-free future.

The conclusion is clear: current plans for new nuclear power stations and new nuclear missile-carrying submarines should both be cancelled and the resources diverted to:

(a) reducing energy consumption and accelerating the development and deployment of alternative renewable energy supplies; and

(b) supporting international arms control and disarmament initiatives, such as the United Nations Treaty on the Prohibition of Nuclear Weapons.

Alasdair Beal BSc CEng FICE FIStructE is a chartered civil engineer, based in Leeds, and a former member of SGR’s National Co-ordinating Committee.

References : …………………………………………………………………………………………..

France is weighing zero-interest loan for 6 nuclear reactors, sources say

- Summary

- EDF faces financing challenges due to high debt and project delays

- French government faces no-confidence vote over budget with spending cuts

- EU approval needed for state aid in nuclear projects

PARIS, Nov 27(Reuters) Reporting by Benjamin Mallet; additional reporting by Leigh Thomas; writing by Dominique Patton; editing by Nina Chestney and Tomasz Janowski- https://www.reuters.com/business/energy/france-is-weighing-zero-interest-loan-6-nuclear-reactors-sources-say-2024-11-27/

French officials are drawing up plans to provide an interest-free loan to state-owned power utility EDF to finance a significant portion of the construction of six new nuclear reactors, two people familiar with the matter said.

The financing would clear a major hurdle for one of the country’s biggest public projects in years.

The plans are similar to financing agreed recently for a single reactor in the Czech Republic, and although the size of the loan is not yet known, it shows the growing need for state support in financing new nuclear projects in Europe.

The plans also include a long-term guaranteed price for the power generated, known as a contract for difference (CfD), said the people, who declined to be identified because they are not authorised to speak with media.

The Ministry of Finance and EDF declined to comment.

The discussions on financing the projects that could cost well over 50 billion euros ($52.60 billion) come as the French government faces a potential no-confidence vote over a proposed budget that contains measures to cut spending and raise taxes to contain the country’s soaring debt.

President Emmanuel Macron announced plans in early 2022 for six new reactors with a total production capacity of about 10 gigawatts to partly replace an ageing nuclear fleet and secure future energy supplies.

Construction of the first reactor is due to start in 2027 but Macron has never said who would pay for the project, which at the time was estimated to cost around 52 billion euros. Recent media reports suggest costs may be higher, reaching as much as 67 billion euros.

France’s current 57 nuclear reactors in operation were largely financed by EDF, which was a publicly-listed company until it was fully nationalised last year.

But the company is unlikely to be able to secure private financing for new projects, given its already high debt, and there have been multiple delays and cost overruns at recent projects like Flamanville in France and Hinkley Point in England.

CZECH MODEL

While there is general agreement to provide a zero-interest loan to EDF during the construction phase, the amount is not yet decided and there are still “intense discussions” on matters such as the sharing of risk between the utility and the state from any additional costs and delays, one of the sources said.

The plan also needs approval from the finance minister once EDF submits a final costing for the projects, expected early next year.

As a form of state aid, it also needs to be cleared by the European Commission.

French officials have been encouraged, however, by Brussels’ approval for a similar financing structure for one 1 gigawatt Czech unit at Dukovany, the sources said.

Under the Czech arrangement, interest on a state loan increases to at least 2% after the plant begins operating.

Europe is seeing a resurgence of interest in nuclear power projects, with nations including Poland and the UK planning new plants to shore up their energy self-sufficiency after a major energy crisis in the region.

Financing remains a huge challenge, with construction risks weighing on utilities’ balance sheets and credit ratings.

The British government recently pledged more than 5.5 billion pounds ($6.93 billion) to help fund early development of the 3.2 GW Sizewell C project.

Another project in Britain, EDF’s 3.2 GW Hinkley Point C plant, which is expected to cost between 31 billion pounds and 34 billion pounds based on 2015 values, is also backed by a contract for difference scheme.

($1 = 0.9506 euros)

($1 = 0.7931 pounds)

Hinkley Point C: Hundreds down tools over concerns

By Seth Dellow, Bridgwater Mercury 28th Nov 2024

HUNDREDS of workers at Hinkley Point C have stood down today over unresolved concerns.

The action short of strike began at 9am this morning with workers claiming it concerns fingerprint scanners in a small area on site. They have claimed there are only five scanners serving 13,000 workers on site but this is strongly denied by EDF which runs the Hinkley Point site. Electricians, pipe fitters and welders are all said to have walked out.

The number of affected workers could be up to 1,600 as the action only involves some of the MEH workers on site. MEH has contracted staff doing work on the Hinkley Point site.

Earlier, workers claimed between 2,000 and 6,000 workers had walked out.

One electrician, who spoke anonymously to the Bridgwater Mercury, said that workers were “being taken advantage of.”

The nuclear power station is already behind schedule and is expected to be operational between 2029 to 2031.

Workers are planning on taking full strike action on Monday, December 2, 2024, as they say they will be blocked from entering the site because of their actions today.

It follows recent strike action which saw EDF workers walk out over pay concerns. ………………

https://www.bridgwatermercury.co.uk/news/24757425.hinkley-point-c-6-000-workers-walk-concerns/

East Suffolk Council offering grants to convert homes to accommodate nuclear workers.

By Dominic Bareham, East Anglian Daily Times 23rd Nov 2024

Homeowners in east Suffolk are being offered the chance to access grants of up to £7,000 to provide accommodation for workers at the new Sizewell C nuclear power station.

Two new grant schemes, administered by East Suffolk Council, are set to open soon – with the first, the Renovation Grant, supporting the conversion of homes, spare rooms, annexes or non-residential buildings into safe and suitable accommodation for Sizewell C workers.

Under this scheme, up to £7,000 is available per bed space to cover structural works, electrical wiring, heating installation, windows and doors, plumbing, installing kitchen and bathroom facilities and additional parking………………………………………………….

https://www.eadt.co.uk/news/24745238.east-suffolk-council-offering-grants-convert-homes/

Nuclear Industry Association members seek to expand into weapons sector

“defence is being seen as a major source of growth for the nuclear industry.”

“If the industry’s hopes for a new generation of civil reactors does not materialise, it could end up being the only source of growth.”

By Tom Pashby New Civil Engineer 22nd Nov 2024

The Nuclear Industry Association (NIA) is exploring ways to aid firms involved in civil nuclear projects to attain opportunities in nuclear weaponry, at the request of its members.

The NIA describes itself as the trade association “for the UK’s civil nuclear industry” and has more than 280 member companies from “across the supply chain to ensure more nuclear power is deployed”.

In a post from the trade association titled Update from NIA Chair Dr Tim Stone, CBE, Stone said he had commissioned an independent review of the scope, work and structure of the NIA “in the context of changes in the sector”.

He pointed in particular to “the advent of Great British Nuclear”, the new government and “the development of greater international and direct industrial interest in nuclear”.

In addition to the trends noted by Stone, construction of Hinkley Point C is well underway and Sizewell C is anticipating a final investment decision in 2025.

Meanwhile, the AUSUK submarine agreement has been , which will see the UK supporting with the building of new nuclear-powered submarines for Australia, has been launched.

On the UK’s domestic military site, the UK Government is committed to expanding its stockpile of nuclear warheads from 225 to 260 under the Integrated Review 2021.

………………………..One of the areas of interest which NIA members requested more focus on was nuclear weapons and military applications of nuclear power.

…………………. the NIA has run events in partnership with nuclear security technology firm Atomic Weapons Establishment (AWE) “to help engage the wider supply chain in opportunities there”.

Additionally, the NIA is co-ordinating activity with both the aerospace, defence and security trade associations ADS and Make UK Defence “to broaden understanding”, with there being “some exciting initiatives under development aimed at simplifying work across the sector”.

…..AWE was recently renationalised and is responsible for renewing and building new warheads for the UK’s Trident nuclear weapon programme.

…………………..Concerns raised about links between nuclear power and weapons industries

Nuclear industry and weapons experts said the letter is evidence of increasingly close collaboration between the civil nuclear power and nuclear weapons sectors.

University of Sussex professor of science and technology policy Andy Stirling said it “provides yet more evidence of pressures to hide military costs behind supposedly civil nuclear activities”.

“In a recent study funded by the Foreign Office, research showed that resulting added burdens falling on taxpayers and electricity consumers, amount at least to £5bn per year,” Stirling Added.

The study referred to was titled Irreversible nuclear disarmament – Illuminating the ‘UK Nuclear Complex’: Implications of hidden links between military and civil nuclear activities for replacing negative with positive irreversibilities around nuclear technologies and was published by the University of York in March 2024.

Strling went on: “By concealing in this way the full costs of the UK military nuclear industrial base, democracy is undermined, energy strategies misdirected and climate action made slower, more expensive and less effective.”

The Nuclear Information Service (NIS) investigates the UK’s nuclear weapons programme and publishes “accurate and reliable information to stimulate informed debate on disarmament”.

NIS director David Cullen said: “In recent years we’ve seen an increased frankness in defence policy documents about the linkages between the civil and military nuclear sectors, both in terms of skills and supply chains.

“With the [UK’s] new Astrea warhead programme gathering steam, and working beginning on AUKUS, it’s unsurprising that defence is being seen as a major source of growth for the nuclear industry.”

The A21/Mk7 or Astraea is the next generation of nuclear warheads being manufactured by AWE in the UK. It will be installed on top of Trident missiles, which are manufactured by Lockheed Martin and carried by Vanguard-class submarines, built by BAE Systems Marine.

Cullen continued: “If the industry’s hopes for a new generation of civil reactors does not materialise, it could end up being the only source of growth.” https://www.newcivilengineer.com/latest/nuclear-industry-association-members-seek-to-expand-into-weapons-sector-22-11-2024/

UK Sees Privatization ‘Opportunities’ in Ukraine War

A recent project update from the Foreign Office is explicit about the goals. It states these should see “the invasion not only as a crisis, but also as an opportunity”

privatisation ……..can create private monopolies, reduce accountability to government and overcharge the public.

British aid is being used to open up Ukraine’s wrecked economy to foreign investors and enhance trade with the UK.

DECLASSIFIED UK, MARK CURTIS, November 21, 2024

Amid the devastating war in Ukraine, British economic aid to the country is focused on promoting pro-private sector reforms and on pressing the government to open up its economy to foreign investors.

Recently-published Foreign Office documents on its flagship aid project in Ukraine, which supports privatisation, note that the war provides “opportunities” for Ukraine delivering on “some hugely important reforms”.

The government in Kyiv has in recent months been responding positively to these calls. Last month, president Volodymyr Zelensky signed a new law expanding the privatisation of state-owned banks in the country.

It follows the Ukrainian government’s announcement in July of its ‘Large-Scale Privatisation 2024’ programme that is intended to drive foreign investment into the country and raise money for Ukraine’s struggling national budget, not least to fight Russia.

Large assets slated for privatisation currently include the country’s biggest producer of titanium ore, a leading producer of concrete products and a mining and processing plant.

Ukraine envisaged privatising the country’s roughly 3,500 state-owned enterprises in a law of 2018, which said foreign citizens and companies could become owners.

The process stalled as a result of coronavirus and then Russia’s invasion in February 2022. But hundreds of smaller-scale enterprises are now being privatised, bringing in revenues of UAH 9.6bn (£181m) in the past two years.

“The resumption of privatisation amid the full-scale war is an important step, which is already yielding results,” Ukraine’s economy minister Yulia Svyrydenko said last month.

Another law enacted in June 2023 allows large-scale assets to be sold to foreigners or Ukrainians during the current martial law regime.

‘Good governance’

Britain’s main economic aid project in Ukraine runs from 2022-25 and is called the Good Governance Fund. One of its aims is to ensure that “Ukraine adopts and implements economic reforms that create a more inclusive economy, enhancing trade opportunities with the UK”.

A recent project update from the Foreign Office is explicit about the goals. It states these should see “the invasion not only as a crisis, but also as an opportunity”…………………………………………………………………

Advancing privatisation

One key strand of the Good Governance Fund project is direct support to privatisation in Ukraine.

This involves a seven-year sub-programme called SOERA (State-owned enterprises reform activity in Ukraine), which is funded by USAID with the UK Foreign Office as a junior partner.

SOERA works to “advance privatization of selected SOEs [state-owned enterprises], and develop a strategic management model for SOEs remaining in state ownership.”

UK documents note the programme has already “prepared the groundwork” for privatisation, a key plank of which is to change Ukraine’s legislation. ………………………………………………………………

Declassified made a freedom of information request asking the Foreign Office to provide the briefing notes for then foreign secretary James Cleverly for the conference. It replied saying the request was “too broad”.

“The UK is hoping to reap benefits for UK firms from Ukraine’s reconstruction”, observes a report on British aid to Ukraine earlier this year by the aid watchdog, ICAI.

Conditionality

Britain’s privatisation agenda in Ukraine is part of a wider push by the World Bank and the International Monetary Fund (IMF), which routinely promote privatisation in low income countries, often as a condition of providing aid.

Zelensky’s recent announcement on state-owned banks is based on World Bank recommendations and gives international donors a role in selecting financial advisers for the sales.

……………………………………….Rustem Umyerov, the head of the State Property Fund, which presides over Ukraine’s privatisation strategy, said in July that “international partners support the start of large-scale privatization and are ready to facilitate pitches to the business communities in their countries.”

……Foreign investment in rebuilding Ukraine’s economy is being coordinated by the world’s largest asset manager, Blackrock.

…………………privatisation ……..can create private monopolies, reduce accountability to government and overcharge the public.

The key goal for Western states supposedly ‘aiding’ Ukraine’s privatisation process is to find access to new markets, and to bring Ukraine into their commercial orbit, fully detaching it from their rival, Russia.

A sign that the Ukrainian public needs persuading about this Western-backed privatisation is that the US/UK’s SOERA project includes a public relations dimension. One of its goals is to “assist the government in strategic communications to enhance reforms”. https://www.declassifieduk.org/uk-sees-privatisation-opportunities-in-ukraine-war/

The enriched uranium market is all at sea, with USA the largest importer of Russian material

Five days after Russia imposed tit-for-tat restrictions on exports of

enriched uranium to the US, a 14-year old vessel remains anchored outside

the port of Saint Petersburg, its crew presumably unsure whether the

radioactive cargo they were due to collect for a US-based client can still

be shipped.

Moscow’s new measures, announced on Friday, come with

caveats. Just as US import restrictions introduced in May still allow

companies to seek waivers allowing uranium shipments when they can’t

obtain supplies elsewhere, so the Russians “didn’t say they’re

outright ending all deliveries to the US,” says Jonathan Hinze, president

of UxC, a consultancy specialising in the nuclear industry.

Russia’s cash requirements and control of almost half of global enrichment capacity,

coupled with the energy needs of the world’s biggest economy, mean “the

US stands out conspicuously as the largest importer of Russian material,

both prior to Moscow’s invasion of Ukraine and since,” writes Darya

Dolzikova, a research fellow at Royal United Services Institute.

FT 20th Nov 2024,

https://www.ft.com/content/ec09bcff-3771-4679-b0d0-4ec7062b7072

Shares in nuclear reactor company OKLO bite the dust

Sam Altman-Backed Oklo Slumps After Kerrisdale Says It’s Shorting Stock

By Carmen Reinicke and Will Wade, November 20, 2024 , https://www.bnnbloomberg.ca/investing/2024/11/20/sam-altman-backed-oklo-slumps-after-kerrisdale-says-its-shorting-stock/

Shares of Oklo Inc., the nuclear fission reactor company backed by OpenAI Inc’s Sam Altman, tumbled Wednesday after Kerrisdale Capital said it is shorting the stock.

The report alleges that “virtually every aspect of Oklo’s investment case warrants skepticism,” sending the stock down as much as 10%. Shares pared much of the decline and were down about 6% in midday trading in New York.

Oklo shares have whip-sawed recently, rallying more than 20% this week through Tuesday’s close after falling 25% on Friday following its earnings release and the expiration of a lockup period that allows key investors like Peter Thiel’s venture capital firm to start selling shares.

Oklo declined to comment.

Since the company went public via a special purpose acquisition merger in May, its shares have soared more than 150%.

“In classic SPAC fashion, Oklo has sold the market on inflated unit economics while grossly underestimating the time and capital it will take to commercialize its product,” the Kerrisdale report said.

The company is among a wave of firms developing so-called small modular reactors that are expected to be built in factories and assembled on site. Advocates say the approach will make it faster and cheaper to build nuclear power plants, but the technology is unproven. Only a handful have been developed, and only in Russia and China.

Oklo has said it expects its first system to go into service in 2027, but the Kerrisdale report highlights numerous technical and regulatory hurdles that may delay that schedule. Oklo is pursuing a new technology that it said will make its design safer and cheaper than conventional reactors in use today. The company’s design doesn’t have approval from the US Nuclear Regulatory Commission, a process that typically takes years.

Wall Street is split on the company thus far. Of the four analysts covering Oklo, two have buy-equivalent ratings and two are neutral. The average price target implies about 5% return from where shares are trading.

Besides Altman and Thiel, the company has another potentially high-profile connection. Board member Chris Wright was nominated by President-elect Donald Trump to lead the Energy Department last week.

Great British Nuclear to put £1.8bn worth of mini-nuke contracts up for grabs

Successful bidders will work with winners of delayed SMR design

competition. Nearly £2bn worth of construction contracts for Britain’s

first mini-nuclear power plants will be up for grabs next year as officials

prepare sites for the pioneering energy projects.

Great British Nuclear(GBN), the government body tasked with spearheading the development of small modular reactors (SMRs), expects to put the work out for tender

between February and July 2025, according to official documents.

The biggest jobs available will be at least two £800m “delivery partner”

contracts to manage the construction of the SMRs over a period of 10 years.

Smaller contracts for an “owner’s engineer”, “foundation project

management” and “foundation engineering” will also be open to

bidding.

They will work with technology companies designing the reactors

which will be selected in GBN’s ongoing SMR design competition, which has

been delayed multiple times.

Telegraph 18th Nov 2024 https://www.telegraph.co.uk/business/2024/11/18/great-british-nuclear-to-put-18bn-worth-mini-nuke-contracts/

-

Archives

- January 2026 (127)

- December 2025 (358)

- November 2025 (359)

- October 2025 (377)

- September 2025 (258)

- August 2025 (319)

- July 2025 (230)

- June 2025 (348)

- May 2025 (261)

- April 2025 (305)

- March 2025 (319)

- February 2025 (234)

-

Categories

- 1

- 1 NUCLEAR ISSUES

- business and costs

- climate change

- culture and arts

- ENERGY

- environment

- health

- history

- indigenous issues

- Legal

- marketing of nuclear

- media

- opposition to nuclear

- PERSONAL STORIES

- politics

- politics international

- Religion and ethics

- safety

- secrets,lies and civil liberties

- spinbuster

- technology

- Uranium

- wastes

- weapons and war

- Women

- 2 WORLD

- ACTION

- AFRICA

- Atrocities

- AUSTRALIA

- Christina's notes

- Christina's themes

- culture and arts

- Events

- Fuk 2022

- Fuk 2023

- Fukushima 2017

- Fukushima 2018

- fukushima 2019

- Fukushima 2020

- Fukushima 2021

- general

- global warming

- Humour (God we need it)

- Nuclear

- RARE EARTHS

- Reference

- resources – print

- Resources -audiovicual

- Weekly Newsletter

- World

- World Nuclear

- YouTube

-

RSS

Entries RSS

Comments RSS