Google Boss Says Trillion-Dollar AI Investment Boom Has ‘Elements of Irrationality’

November 18, 2025, BBC, Faisal Islam, economics editor and Rachel Clun, business reporter

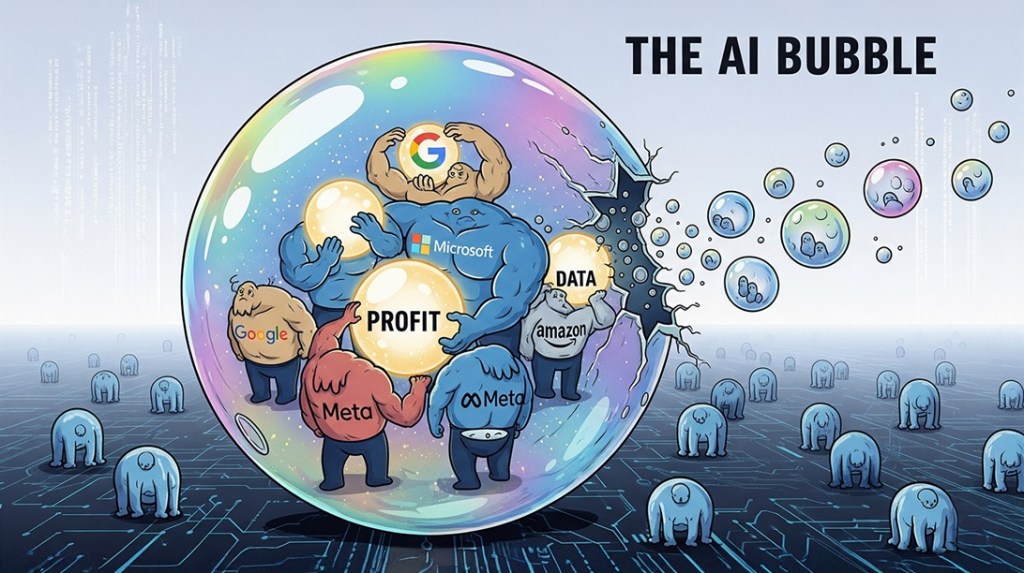

Every company would be affected if the AI bubble were to burst, the head of Google’s parent firm Alphabet has told the BBC.

Speaking exclusively to BBC News, Sundar Pichai said while the growth of artificial intelligence (AI) investment had been an “extraordinary moment”, there was some “irrationality” in the current AI boom.

It comes amid fears in Silicon Valley and beyond of a bubble as the value of AI tech companies has soared in recent months and companies spend big on the burgeoning industry.

Asked whether Google would be immune to the impact of the AI bubble bursting, Mr Pichai said the tech giant could weather that potential storm, but also issued a warning.

“I think no company is going to be immune, including us,” he said…………..

The interview comes as scrutiny on the state of the AI market has never been more intense.

Alphabet shares have doubled in value in seven months to $3.5tn (£2.7tn) as markets have grown more confident in the search giant’s ability to fend off the threat from ChatGPT owner OpenAI.

A particular focus is Alphabet’s development of specialised superchips for AI that compete with Nvidia, run by Jensen Huang, which recently reached a world first $5tn valuation.

As valuations rise, some analysts have expressed scepticism about a complicated web of $1.4tn of deals being done around OpenAI, which is expected to have revenues this year of less than one thousandth of the planned investment.

It has raised fears stock markets are heading for a repeat of the dotcom boom and bust of the late 1990s. This saw the values of early internet companies surge amid a wave of optimism for what was then a new technology, before the bubble burst in early 2000 and many share prices collapsed.

This led to some companies going bust, resulting in job losses. A drop in share prices can also hit the value of people’s savings including their pension funds.

In comments echoing those made by US Federal Reserve chairman Alan Greenspan in 1996, warning of “irrational exuberance” in the market well ahead of the dotcom crash, Mr Pichai said the industry can “overshoot” in investment cycles like this………………….https://www.bbc.com/news/articles/cwy7vrd8k4eo

No comments yet.

-

Archives

- February 2026 (199)

- January 2026 (308)

- December 2025 (358)

- November 2025 (359)

- October 2025 (376)

- September 2025 (258)

- August 2025 (319)

- July 2025 (230)

- June 2025 (348)

- May 2025 (261)

- April 2025 (305)

- March 2025 (319)

-

Categories

- 1

- 1 NUCLEAR ISSUES

- business and costs

- climate change

- culture and arts

- ENERGY

- environment

- health

- history

- indigenous issues

- Legal

- marketing of nuclear

- media

- opposition to nuclear

- PERSONAL STORIES

- politics

- politics international

- Religion and ethics

- safety

- secrets,lies and civil liberties

- spinbuster

- technology

- Uranium

- wastes

- weapons and war

- Women

- 2 WORLD

- ACTION

- AFRICA

- Atrocities

- AUSTRALIA

- Christina's notes

- Christina's themes

- culture and arts

- Events

- Fuk 2022

- Fuk 2023

- Fukushima 2017

- Fukushima 2018

- fukushima 2019

- Fukushima 2020

- Fukushima 2021

- general

- global warming

- Humour (God we need it)

- Nuclear

- RARE EARTHS

- Reference

- resources – print

- Resources -audiovicual

- Weekly Newsletter

- World

- World Nuclear

- YouTube

-

RSS

Entries RSS

Comments RSS

Leave a comment