Busting the Spin on Small Modular Reactors – the CATO Institute !

At the heart of the case for SMRs is the claim that being smaller, they will be cheaper, quicker, and easier to build and easier to site. While this argument might appear plausible, it is not supported by any evidence.

the output of the 470MW Rolls Royce SMR is about the same size as that of the Fukushima Daiichi 1 reactor that melted down in 2011.

a large PWR or BWR will create less waste than the same capacity of SMRs.

an operating reactor requires few permanent employees, and those workers typically have highly specific skills unlikely to be found among the local population. …………………..The number of factory jobs that are created is likely to be small and will mostly not be in the country buying the reactor.

The CATO Institute, Fall 2025 • Regulation

……………………………………………………………………Instead of another round of large nuclear plants, one of the focal points of the new renaissance is Small Modular Reactors (SMRs). The International Atomic Energy Agency (IAEA) defines SMRs as having an electrical output of 30MW–300MW.

Among their ostensible virtues:

- They are cheaper and easier to build and so are less prone to cost and time overruns, making them easier to finance.

- They are safer; for example, some are said to be meltdown-proof and “walk-away safe.”

- They produce less waste (per kW of capacity) than large reactors.

- Being smaller, there will be less opposition to their siting.

- They will create large numbers of new jobs.

SMR proponents give the impression that large numbers of the units are being ordered around the world. These claims are unproven or misleading or simply wrong. No current SMR design is under construction, much less operating, so these claims—notably those on cost and construction time—are unproven and no more than marketing hype. There are two SMR-sized units under construction, in China and Russia, but they are prototypes or one-offs. The true SMR project nearest to construction start (as defined by pouring of first structural concrete) is the Darlington project for Ontario, Canada, for up to four GE–Hitachi BWRX–300s (explained below). The Ontario government approved construction of the first reactor in May 2025.

No SMR design that is expected to be offered as a commercial reactor has completed a full safety review by an experienced and credible regulator. The Canadian Nuclear Safety Commission will examine the design during the Darlington construction phase rather than before construction starts. Until a comprehensive safety review is successfully completed, it will not be known if the design is licensable or what the costs will be.

The designs most likely to progress to commercial availability are those based on the PWR and BWR designs in LWR large reactors. There are 65 years of operating experience with these types of reactors, so there is a reasonable expectation that SMR LWRs could be reliable, if not necessarily economic, sources of power.

Many designs for these units are said to be under development, but only a handful have progressed beyond the conceptual stage and are being offered by firms with the credibility to deliver a facility expected to cost several billion dollars. The main options are the GE–Hitachi BWRX–300, the Holtec SMR300, the Rolls Royce SMR, and the Westinghouse AP300. Below are overviews of these four designs, along with some other possibilities.

GE–Hitachi BWRX–300 / General Electric, along with Westinghouse, has by far the longest and most extensive experience in designing and supplying nuclear power reactors. The 300MW BWR is based on its ESBWR 1,500MW reactor design. Although the ESBWR completed US Nuclear Regulatory Commission (NRC) safety review in 2014, GE–Hitachi has won no orders, and it currently does not appear to be actively marketing the unit.

Like the ESBWR, the BWRX–300 relies heavily on passive safety features. GE–Hitachi received an order for up to four of the reactors to be built at the Darlington site. It has completed a pre-licensing review in Canada and a construction license has been given. A detailed review of the design will be carried out during construction prior to an operating license being granted.

The BWRX–300 was one of four designs shortlisted by Great British Energy–Nuclear (GBE–N), with the UK government-owned energy organization expected to choose two designs for installation in Scotland and England. But in June 2025, GBE–N announced only that it had selected the Rolls Royce SMR design, discussed below.

The UK Office of Nuclear Regulation (ONR) is carrying out its Generic Design Assessment (GDA) on the BWRX–300, and it completed the first of the three stages of the GDA in December 2024 (primarily information exchange). GE–Hitachi has only committed to carry out the first two stages of review, and is unlikely to undertake the third stage given that it was not selected by GBE–N.

Holtec SMR 300 / Holtec has a long history in the spent-fuel handling and plant decommissioning sectors of the nuclear power industry, but not as a reactor designer and vendor. It launched its PWR SMR design in 2010, initially proposing a 160MW reactor. The unit is designed to be housed deep underground, relying on passive safety (claimed to be “walk-away safe”). In 2023, Holtec doubled the thermal output of the plant and renamed it SMR 300. It is not willing to say when it decided to make that change or why, but the most likely explanation is to gain scale economies.

Its main sales prospect is to initially build two reactors at Holtec’s Palisades site in Michigan, adjacent to an 801MW reactor Holtec owns and is preparing to reopen after it was idled in 2022.

It was one of the four designs shortlisted by GBE–N. ONR is carrying out its GDA on the Holtec SMR 300, but like GE–Hitachi, Holtec is unlikely to carry out the third stage given that it was not selected by GBE–N.

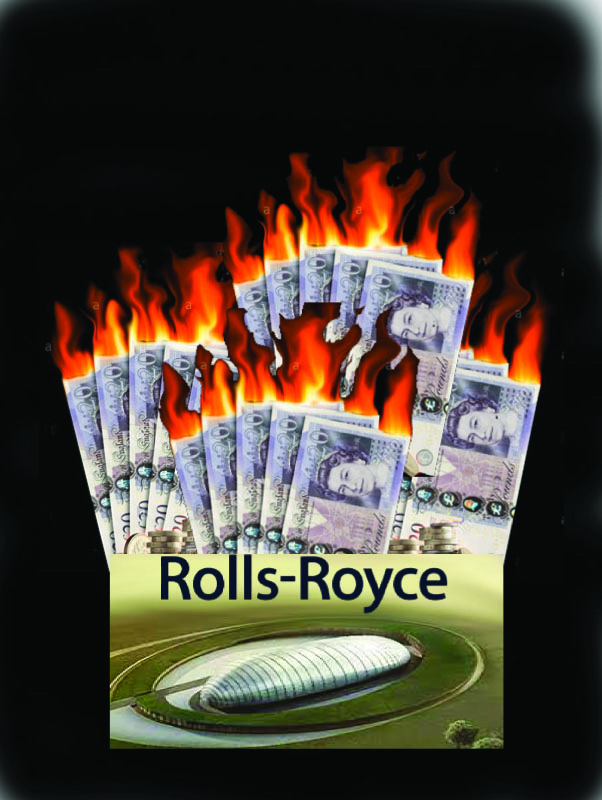

Rolls Royce SMR / Rolls Royce has a long history of supplying nuclear submarine reactors based on US designs. It is not clear how well this equips the firm to design and supply land-based power reactors. Its design is a 470MW PWR, making it significantly larger than the top of the IAEA’s range for SMRs.

Unlike the other three designs, it is much more conventional, not relying so much on passive safety and not housed underground. Its main sales prospects are in the UK and the Czech Republic. In the UK, it submitted a Final Tender to GBE–N in April 2025 and was selected by the government. ONR is carrying out its GDA on the reactor. It completed the second of the three stages in July 2024, and the third stage is expected to be completed in 2026.

Rolls Royce signed a deal in October 2024 with the Czech utility CEZ for it to help develop the design. It expects that three initial orders will be placed for the Czech Republic, with them coming online in 2034–2037. In February 2025, there were reports of tension between Rolls Royce and CEZ—in particular, over how much local Czech content there would be in reactor orders.

Westinghouse AP300 / Westinghouse has supplied substantially more power reactors worldwide than any other vendor. Its SMR design, the AP300 PWR, was launched well after its competitors in May 2023 and is based on the AP1000 large reactor design. It relies on passive safety.

In the UK, it applied for the design to undergo a GDA. In August 2024, it passed the government’s “readiness” test and was allowed to move on to a GDA. However, by December 2024, no funding package to pay for this process (expected to be funded by the vendor) had been agreed upon, and Westinghouse asked ONR to defer the start of the GDA. By May 2025, the GDA had not started, and there is no indication whether Westinghouse expects to proceed.

It chose not to respond to GBE–N’s Invitation to Submit Final Tenders for its project discussed above. Westinghouse has not commented on its decision not to proceed with the GDA or its decision not to submit a Final Tender to GBE–N. It may be that it has halted work until there is more concrete buyer interest in the design. If the design is not pursued, this would be the second time Westinghouse has carried out development work on an SMR design only to abandon it before it had won any orders, the previous attempt being halted in 2014.

Other possibilities / Besides those reactors, the French nuclear engineering firm Framatome began developing a design, Nuward, in 2019. It abandoned the design in the summer of 2024 in favor of a more conventional layout, and there is no timeframe for when this new design might be available.

A US firm, NuScale, has a design that has been under development since 2005. It started out as a 35MW PWR, then expanded to 40MW, 50MW, 60MW, and finally 77MW. The design, which successfully completed NRC review in May 2025, is “integrated” with all components housed within the reactor containment and would be built underground. It was designed to be built in clusters of 12 reactors, but the 77MW version is now also offered in clusters of four and six reactors. It appeared to have won an order in 2015 from Utah Associated Municipal Power (UAMPS) for a cluster of 12 reactors of 50MW, which then evolved into a cluster of six 77MW reactors, but the project was abandoned in December 2023 because of sharply escalating cost.

Arguments for SMRs / At the heart of the case for SMRs is the claim that being smaller, they will be cheaper, quicker, and easier to build and easier to site. While this argument might appear plausible, it is not supported by any evidence. The first reactors from more than 60 years ago were 150 MW or less, and reactors subsequently became larger, increasing in size 10-fold, primarily to gain scale economies. The case for this is clear: A 1,500MW reactor vessel will, all things being equal, be cheaper than ten 150MW reactor vessels. So, SMRs start with a disadvantage compared to large reactors because of the lost scale economies over large designs.

However, there is no clear evidence on why the real cost of large reactors has continuously increased over the history of nuclear power. Is it because of their size or because of how complex the designs have become? If it is complexity, why would SMRs be less complex than large reactors? The most obvious way this could happen is if not all the safety systems added to large reactors over the past 40 years were required for SMRs. Given that the SMRs on offer are not that small, this seems unlikely. For example, the output of the 470MW Rolls Royce SMR is about the same size as that of the Fukushima Daiichi 1 reactor that melted down in 2011.

The history of the Westinghouse AP design reactors illustrates the nuclear industry’s confusing position on reactor size. Its 1989 AP600 design was found to be uneconomic and was scaled up to the AP1000 in 2002, then scaled up again in 2013 to the CAP1400 and, in 2023, scaled down to the AP300.

Safety Many SMR safety claims are based on their use of passive safety measures. The intuitive impression is that because passive safety does not require the operation of an engineered system, it would be cheaper and, because it is passive, it cannot fail (Ramana 2024). Neither assumption is true. Building reactors underground appears likely to increase site work and make it more difficult and expensive. The ESBWR and AP1000 large reactor designs are both heavily reliant on passive safety, yet the ESBWR was too expensive to win any orders and the AP1000 proved very expensive to build in practice. That experience does not support the contention that passive safety will reduce costs. If all the safety systems required for large reactors are required for SMRs, this will adversely affect their economics.

Ease of production The idea that SMRs would emerge in several modules from factories and be transported to the site on the back of trucks, requiring only bolting together at the site, also has an intuitive appeal. However, in practice SMRs are substantial-sized reactors and will inevitably require considerable on-site civil works to provide the foundations and services required.

The narrative of factory production lines conjures an image of a conveyor belt producing multiple identical reactor modules, perhaps similar to automobile production lines producing thousands of cars per year. However, this is not the expected reality. Rolls Royce plans to only produce two reactors per year. Although production lines can be a cheap method of manufacture, they must constantly operate at near capacity to pay off their high fixed costs. If demand is less than planned, the high fixed costs will not be spread across many units of electricity, and if the design changes, the production line will have to be re-tooled. The AP1000 was expected to be built in factory modules, yet this did not prevent all the projects using this design from going far over time and budget.

Waste All things equal, a large PWR or BWR will create less waste than the same capacity of SMRs. Former US NRC chair Allison Macfarlane has said that SMRs would increase the volume and complexity of waste between two- and 30-fold because of such factors as greater neutron leakage.

Jobs Both politicians and nuclear power advocates like to claim a new plant will create many new jobs. But an operating reactor requires few permanent employees, and those workers typically have highly specific skills unlikely to be found among the local population. Nuclear reactors do require large numbers of workers during construction, but they too have specific skills unlikely to be found in the local area, and sometimes these workers have to be recruited from abroad. This is very disruptive to the local area, requiring a large amount of short-term accommodation and facilities.

Moreover, if the promises that SMRs will be cheaper and quicker to build than large reactors are fulfilled, they will create less work and over a shorter period. If factories with production lines are efficient, they will require fewer workers than other manufacturing methods. To minimize costs, the number of factories will have to be minimized, and factories will not be built in most export-country markets. The number of factory jobs that are created is likely to be small and will mostly not be in the country buying the reactor……………………………………………………………………………………………………https://www.cato.org/regulation/fall-2025/next-nuclear-renaissance#small-modular-reactors

No comments yet.

-

Archives

- January 2026 (288)

- December 2025 (358)

- November 2025 (359)

- October 2025 (376)

- September 2025 (258)

- August 2025 (319)

- July 2025 (230)

- June 2025 (348)

- May 2025 (261)

- April 2025 (305)

- March 2025 (319)

- February 2025 (234)

-

Categories

- 1

- 1 NUCLEAR ISSUES

- business and costs

- climate change

- culture and arts

- ENERGY

- environment

- health

- history

- indigenous issues

- Legal

- marketing of nuclear

- media

- opposition to nuclear

- PERSONAL STORIES

- politics

- politics international

- Religion and ethics

- safety

- secrets,lies and civil liberties

- spinbuster

- technology

- Uranium

- wastes

- weapons and war

- Women

- 2 WORLD

- ACTION

- AFRICA

- Atrocities

- AUSTRALIA

- Christina's notes

- Christina's themes

- culture and arts

- Events

- Fuk 2022

- Fuk 2023

- Fukushima 2017

- Fukushima 2018

- fukushima 2019

- Fukushima 2020

- Fukushima 2021

- general

- global warming

- Humour (God we need it)

- Nuclear

- RARE EARTHS

- Reference

- resources – print

- Resources -audiovicual

- Weekly Newsletter

- World

- World Nuclear

- YouTube

-

RSS

Entries RSS

Comments RSS

Leave a comment