The World Bank can now fund nuclear energy projects: Here’s what’s next.

Specifically, the agreement pledges that the IAEA will provide subject-matter expertise to the World Bank Group that will help the group support lifetime extensions of existing nuclear power plants and advance the commercial deployment of small modular reactors (SMRs).

Bulletin, By Marina Lorenzini | August 28, 2025

As a growing number of countries look to strengthen their domestic energy production, meet baseload power generation needs, and manage low-carbon climate goals, they’re increasingly looking to nuclear—and some previous skeptics are looking with them. On June 11th, the World Bank Group (WBG) announced an end to its longstanding ban on funding nuclear power projects. The ban had only been in place formally since 2013, but the last and only time the WBG funded a nuclear power project was 1959—a $40 million loan to build a nuclear power plant in Italy.

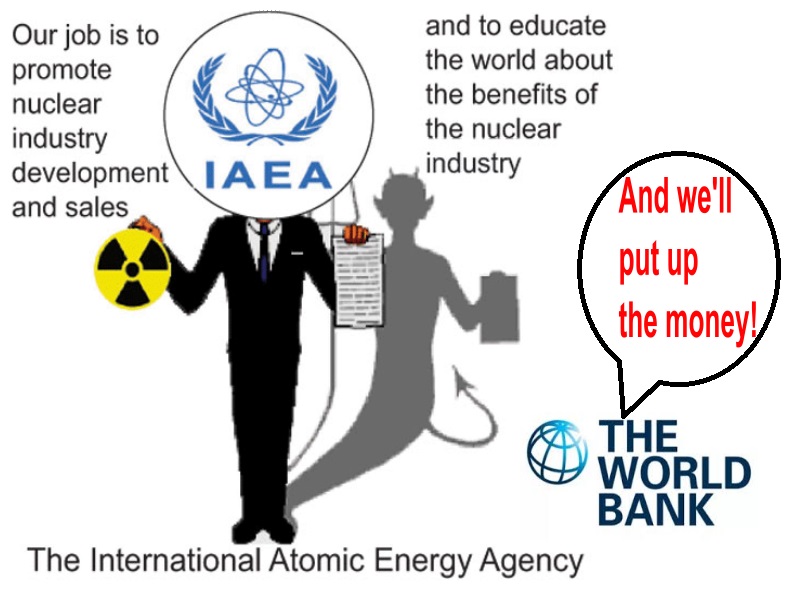

Two weeks after the ban was dropped, the group’s President Ajay Banga signed an agreement with the International Atomic Energy Agency (IAEA), committing to support countries that seek to include nuclear energy as part of their development strategies. The policy change builds on similar commitments from the 2023 climate negotiations in Dubai to triple global nuclear capacity, private financial industry pledges of capital for nuclear energy investments, and bipartisan support for nuclear in Washington, D.C.

The World Bank Group’s policy shift on nuclear energy was enabled by a similar reversal from German leadership, one of the bank’s foremost contributors. Germany has long opposed nuclear energy, famously extending the life of coal-fired power plants while committing to shut down its nuclear fleet at home; Germany’s position on nuclear power is an oft-cited motivation for the Bank’s enduring ban. Although German Chancellor Friedrich Merz would need to overcome significant opposition from within his own governing coalition to resurrect a nuclear power fleet in Germany, at the moment, Merz is increasingly accepting of nuclear power as an energy source at the EU-level and internationally.

The World Bank Group is composed of five affiliated agencies: the International Bank for Reconstruction and Development; the International Finance Corporation; the International Development Association; the International Centre for Settlement of Investment Disputes; and the Mulitlateral Investment Guarantee Agency. The International Bank for Reconstruction and Development and the the International Development Association provide loans and grants to low- and middle-income countries and are commonly referred to as the “World Bank.” The agreement with the IAEA is intended to quickly infuse expertise into all five of the World Bank Group’s teams of economists and country experts. Specifically, the agreement pledges that the IAEA will provide subject-matter expertise to the World Bank Group that will help the group support lifetime extensions of existing nuclear power plants and advance the commercial deployment of small modular reactors (SMRs). While the agreement doesn’t identify specific countries for investment, some parameters have emerged for evaluating likely candidates to receive WBG funding.

Lifetime extensions for existing reactors. There are nearly 440 nuclear power reactors around the world, many of which are approaching or have surpassed their designed lifespans, usually around 40 years. Efforts to upgrade existing power plants and extend their lifetime to 60 or even 80 years can allow countries to continue producing electricity using their original reactors.

There are a few countries seeking lifetime extensions that hold open accounts with the World Bank Group, and four emerge as leading contenders: Argentina, India, South Africa, and Ukraine. If the Bank cannot front the whole cost, the Bank may seek to deepen co-financing partnerships with regional development banks. For example, in February 2025, the Asian Development Bank and the WBG signed a framework allowing borrowers to follow one set of rules related to project design, preparation, appraisal, supervision, completion, and evaluation. In that spirit, other arrangements could be made with the African Development Bank, the Development Bank of Latin America and the Caribbean, or the European Bank for Reconstruction and Development to lessen the burden on one bank.

In the EU, countries may have access to debt or equity financing from the world’s largest multilateral development lender, the European Investment Bank. The most likely candidate in the EU for the WBG’s lending arm is Romania, which already receives funding from the bank. Their nuclear power plant owner recently revealed a proposal for a JP Morgan–led €500 million bond issuance, intended to finance the refurbishment of the nuclear power plant at Cernavoda, which will be submitted to a shareholder meeting in September 2025. However, if that proposal is unsuccessful, WBG may have an opportunity to contribute.

The WBG may later consider expanding its portfolio into new traditional reactor builds on already existing sites, such as in Brazil or Bulgaria, before building completely new sites with traditional reactors.

A longer time horizon for newcomers and SMRs. While less output and per–project costs make SMRs more suitable for emerging economies, the technology may not be commercially viable for the next several years. A measured dose of skepticism is warranted regarding the timelines for any of the SMR designs to be commercially widespread.

As a first step, Banga aims to advance standardization across design variations of SMRs, which would help achieve the economies of scale necessary for commercialization. Standardization at the regulatory and industrial levels is already an active area for the IAEA. The regulatory landscape for nuclear energy varies widely across jurisdictions and each country has unique licensing processes and technical standards for nuclear reactors. A lack of harmonization forces each SMR supplier to customize engineering designs and licensing strategies for each market, a time-consuming and expensive process that hinders the scalability of SMRs.

Banga has also signaled that the WBG may sign purchase agreements with SMR manufacturers to expedite the deployment of prototypes and provide guaranteed revenue. Countries with existing nuclear industries would be obvious prospects for new builds and SMR partnerships. Armenia, for example, operates a Soviet-era VVER-440 pressurized water reactor at Metsamor. The reactor is in the early stages of a lifetime extension with Rosatom, which seeks to sustain the remaining operational reactor until 2036. However, Metsamor’s operation will likely conclude in the coming decade, and preparations must be made for replacing or even expanding Metsamor’s current contributions to the electric grid. With investments from the United States in power-hungry AI computing and physical infrastructure already underway, Armenia could be a strong candidate for the WBG to contribute to the bilateral energy security goals between the two nations.

For countries without a proven track record in the nuclear power industry, the WBG may seek to establish connections with countries already engaged in international agreements and standard setting regarding nuclear technology. This could include countries negotiating a 123 agreement with the United States, which establishes terms for working with US companies on nuclear projects, or adopting the IAEA’s Milestones Approach, an infrastructure development framework for nuclear power newcomers. In addition, prospective countries should have an industrial and manufacturing base, strong electric grid, and proximity to a reliable water source. Under these criteria, Ghana, Indonesia, and the Philippines emerge as potential frontrunners for gaining WBG support……………………………………………………….

Momentum in Washington. Aside from Germany, the Trump administration is a leading driver of the WBG nuclear policy change and will be a key partner in executing the policy……………………………………………..

it is important to recognize that while the WBG’s investment will be transformational for specific sites and countries, the challenge is global. If the group’s funds and expertise can’t improve the industry’s ability to deliver on time and within budget, their presence may only make a marginal contribution to global electricity needs or climate goals in the next decade. https://thebulletin.org/2025/08/the-world-bank-can-now-fund-nuclear-energy-projects-heres-whats-next/?utm_source=ActiveCampaign&utm_medium=email&utm_content=The%20World%20Bank%20s%20nuclear%20projects&utm_campaign=20250825%20Monday%20Newsletter%20%28Copy%29

No comments yet.

-

Archives

- February 2026 (42)

- January 2026 (308)

- December 2025 (358)

- November 2025 (359)

- October 2025 (376)

- September 2025 (258)

- August 2025 (319)

- July 2025 (230)

- June 2025 (348)

- May 2025 (261)

- April 2025 (305)

- March 2025 (319)

-

Categories

- 1

- 1 NUCLEAR ISSUES

- business and costs

- climate change

- culture and arts

- ENERGY

- environment

- health

- history

- indigenous issues

- Legal

- marketing of nuclear

- media

- opposition to nuclear

- PERSONAL STORIES

- politics

- politics international

- Religion and ethics

- safety

- secrets,lies and civil liberties

- spinbuster

- technology

- Uranium

- wastes

- weapons and war

- Women

- 2 WORLD

- ACTION

- AFRICA

- Atrocities

- AUSTRALIA

- Christina's notes

- Christina's themes

- culture and arts

- Events

- Fuk 2022

- Fuk 2023

- Fukushima 2017

- Fukushima 2018

- fukushima 2019

- Fukushima 2020

- Fukushima 2021

- general

- global warming

- Humour (God we need it)

- Nuclear

- RARE EARTHS

- Reference

- resources – print

- Resources -audiovicual

- Weekly Newsletter

- World

- World Nuclear

- YouTube

-

RSS

Entries RSS

Comments RSS

Leave a comment