On the hook! Taxpayers to foot much of £38 billion bill for Sizewell C farce.

“It is astounding that it is only now, as contracts are being signed, that the government has confessed that Sizewell C’s cost has almost doubled to an eye watering £38bn – a figure that will only go up”.

NFLA 22nd July 2025, https://www.nuclearpolicy.info/news/on-the-hook-taxpayers-to-foot-much-of-38-billion-bill-for-sizewell-c-farce/

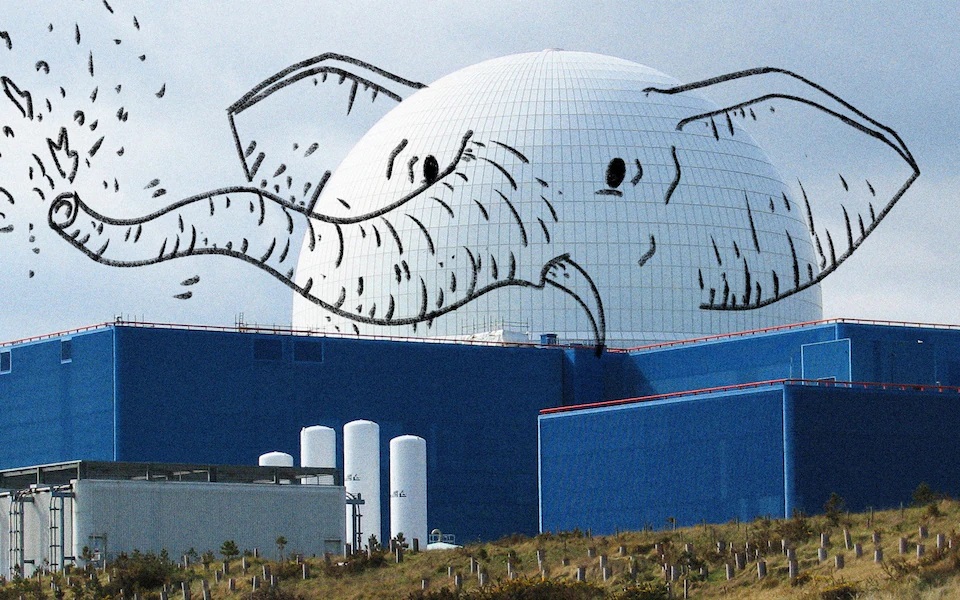

As Energy Secretary Ed Miliband signals the go ahead to the Sizewell C nuclear power plant with today’s approval of the Financial Investment Decision,[i] it is notable that the estimated cost of building the UK’s latest nuclear white elephant has already almost doubled to £38 billion.

Taxpayers will be on the hook for billions, as Ministers have failed to secure the full private sector funding that they desperately wanted and as France has reined in its own commitment.

The UK government’s stake is now 44.9%, whilst Amber Infrastructure (7.6%), Centrica (15%), EDF Energy (12.5%), and La Caisse (20%) will also take stakes. The National Wealth Fund – the government’s principal investor and policy bank – is also making its first investment in nuclear energy.

Interestingly, although much was made of continued French Government involvement through its sole ownership of EDF, President Macron cannot have been very impressed with the hospitality he received on his recent visit to the UK as the French subsequently reduced their stake to 12.5%. Originally both the UK and French Government had each committed to taking a near 20% stake.

The previously published official cost for the project was £20 billion, with the plant expected to be generating in the mid to late 2030s. But sceptics never believed the claimed £20 billion figure and they placed little faith that the delivery date will be met given that Sizewell C is largely a remake of her older sister, Hinkley Point C, which is massively over budget and behind schedule.

This plant under construction in Somerset is now expected to cost £46 billion to complete, and it will be delivered up to six years late; but at least in the case of Hinkley Point C it is French-state owned EDF Energy that must stump up the extra cash.

Clearly some prospective investors baulked at the cost unknowns and project risks of the Suffolk white elephant, and Alison Downes, Director of Stop Sizewell C, said that consequently the latest project had “only crawled over the line thanks to guarantees that the public purse, not private investors, will carry the can for the inevitable cost overruns”.

Whitehall and industry insiders have previously revealed to the press that the £20 billion only represented half the true cost and Julia Pyke, Sizewell C’s Managing Director had conceded that the earlier £20 billion cost estimate failed to account for inflation or risk.

In Sizewell C’s media release today, Ms Pyke revealed the price hike:

“Our plan is to deliver Sizewell C at a capital cost of around £38bn. Our estimate is the result of very detailed scrutiny of costs at Hinkley Point C and long negotiations with our suppliers. It has been subject to third-party peer review and has been scrutinised by investors and lenders and has been subject to extensive due diligence as part of the financing process. A capital cost of £38bn represents around 20% saving compared with Hinkley Point C and demonstrates the value of the UK’s fleet approach.”[ii]

In response, Ms Downes added: “It is astounding that it is only now, as contracts are being signed, that the government has confessed that Sizewell C’s cost has almost doubled to an eye watering £38bn – a figure that will only go up”.

Also commenting, the Chair of a second local campaign group, Together Against Sizewell C (TASC), Jenny Kirtley, said,

“This decision is a financial and environmental disaster for the UK and a betrayal of future generations.

“We are in a climate crisis that needs immediate action, yet this government has chosen to squander billions of public funds on a project that will not be operational until the late 2030s and has already seen a staggering 90% uplift in cost over the last 5 years.

“At nearly double the original £20bn price tag, a figure still being touted by joint managing director Julia Pyke until recently, how can anyone believe that £38bn Sizewell C will provide ‘value for money’ for consumers and taxpayers. The scale of potential exposure of public funds to the Sizewell C project is revealed as a staggering £54.589 billion in the government’s Financial Investment Decision subsidy scheme[iii].

“So much for claims made by EDF and government that there would be huge cost savings from ‘lessons learned’ from the Hinkley Point C build.

“In TASC’s view, the cost of this risky project can only increase as there are still many unresolved issues, including the recently revealed hidden sea defences which were not included by EDF in the 2020 DCO planning application even though EDF knew they would be needed in 2017.[iv] Future generations will have the responsibility to protect the Sizewell C site until the late 2100s and are depending on us to get it right.”

Although disappointing, the news was not unexpected by campaigners. The Nuclear Free Local Authorities are therefore confident that they shall soon pick themselves up and continue the fight, and we shall stand alongside them as the battle continues.

No comments yet.

-

Archives

- January 2026 (306)

- December 2025 (358)

- November 2025 (359)

- October 2025 (376)

- September 2025 (258)

- August 2025 (319)

- July 2025 (230)

- June 2025 (348)

- May 2025 (261)

- April 2025 (305)

- March 2025 (319)

- February 2025 (234)

-

Categories

- 1

- 1 NUCLEAR ISSUES

- business and costs

- climate change

- culture and arts

- ENERGY

- environment

- health

- history

- indigenous issues

- Legal

- marketing of nuclear

- media

- opposition to nuclear

- PERSONAL STORIES

- politics

- politics international

- Religion and ethics

- safety

- secrets,lies and civil liberties

- spinbuster

- technology

- Uranium

- wastes

- weapons and war

- Women

- 2 WORLD

- ACTION

- AFRICA

- Atrocities

- AUSTRALIA

- Christina's notes

- Christina's themes

- culture and arts

- Events

- Fuk 2022

- Fuk 2023

- Fukushima 2017

- Fukushima 2018

- fukushima 2019

- Fukushima 2020

- Fukushima 2021

- general

- global warming

- Humour (God we need it)

- Nuclear

- RARE EARTHS

- Reference

- resources – print

- Resources -audiovicual

- Weekly Newsletter

- World

- World Nuclear

- YouTube

-

RSS

Entries RSS

Comments RSS

Leave a comment