Banks Unwilling To Finance $5 Trillion Global Nuclear Development

Oil Price, By Alex Kimani – Apr 14, 2024,

- Nuclear energy is enjoying a renaissance in the U.S. and many Western countries thanks to the global energy crisis.

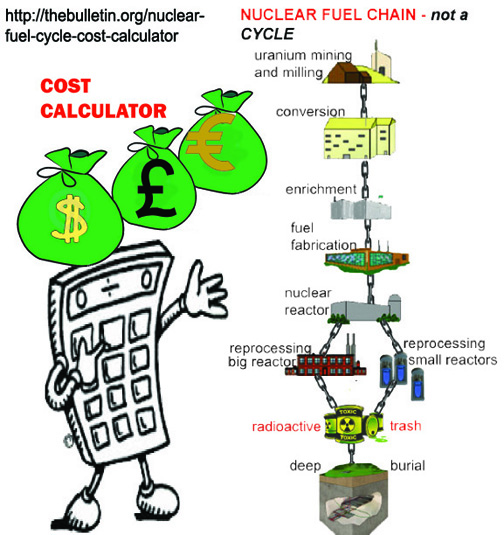

- Bankers appear unwilling to finance the $5 trillion the IAEA estimates the global nuclear industry needs for development until 2050.

- Over the past several years, billions of federal dollars have gone into the development and demonstration of next-generation small modular reactors (SMRs) and advanced fuel cycle reactors.

……. Back in December, at the COP28 summit, 22 countries including the US, Canada, the UK, and France pledged to triple nuclear power capacity by 2050 (from 2020 levels). Last month, 34 nations, including the United States, China, France, Britain, and Saudi Arabia, committed “to work to fully unlock the potential of nuclear energy by taking measures such as enabling conditions to support and competitively finance the lifetime extension of existing nuclear reactors, the construction of new nuclear power plants and the early deployment of advanced reactors.”

…………………. But nuclear’s revival might be dead in the water with lenders balking at financing what they consider a high-risk sector. Last month, the International Atomic Energy Agency convened the first ever nuclear summit in Brussels. Unfortunately, bankers appeared unwilling to finance the $5 trillion the IAEA estimates the global nuclear industry needs for development until 2050.

“If the bankers are uniformly pessimistic, it’s a self-fulfilling prophecy,” former U.S. Energy Secretary Ernest Moniz said after listening to a panel of international lenders.

https://imasdk.googleapis.com/js/core/bridge3.633.0_en.html#goog_1185955437

526.6K

116

China Heavily Subsidized BYD to Expand Its EV Market Share

“The project risks, as we have seen in reality, seem to be very high,” said European Investment Bank Vice President Thomas Ostros, adding that countries need to focus more on renewables and energy efficiency. Ines Rocha, a director at the European Bank of Reconstruction and Development, and Fernando Cubillos, a banker at the Development Bank of Latin America, concurred, saying their lending priorities lean toward renewables and transmission grids. “Nuclear comes last,” Cubillos said.

“We need state involvement, I don’t see any other model. Probably we need quite heavy state involvement to make projects bankable,” Ostros said.

State Involvement

As Ostros has noted, at this juncture, the nuclear sector probably requires considerable government support if it’s to really take off. In the past, the U.S. government has been involved in nuclear energy mainly through safety and environmental regulations as well as R&D funding in enrichment of uranium projects like HALEU. However, lately, the federal government is becoming more heavily involved in the nuclear energy sector.

Over the past several years, billions of federal dollars have gone into the development and demonstration of next-generation small modular reactors (SMRs) and advanced fuel cycle reactors. U.S. EXIM has been providing financing for overseas nuclear projects for more than a half-century. EXIM has issued Letters of Interest for up to $3 billion for nuclear exports to Poland and Romania. Established in 1934, the Export-Import Bank of the United States (Ex-Im Bank), operates as an independent agency of the U.S. Government under the authority of the Export-Import Bank Act of 1945. Similarly, USTDA has committed funding for the export of nuclear power technologies to Poland and Romania, Ukraine and Indonesia. Much of the funding is for technical activities, and includes a significant focus on the potential export of small modular reactors.

Last month, the U.S. federal government agreed to provide a $1.5 billion loan to restart a nuclear power plant in southwestern Michigan, abandoning earlier plans to decommission it. The Michigan plant will become the first ever nuclear plant in the U.S. to be revived after abandonment……………….

Meanwhile, California regulators have given the greenlight for the Diablo Canyon plant to operate through 2030 instead of 2025 as the state transitions toward renewable power sources. Pacific Gas & Electric, the plant’s owner, says it has received assistance from the federal government to repay a state loan………. https://oilprice.com/Alternative-Energy/Nuclear-Power/Banks-Unwilling-To-Finance-5-Trillion-Global-Nuclear-Development.html

1 Comment »

Leave a comment

-

Archives

- March 2026 (38)

- February 2026 (268)

- January 2026 (308)

- December 2025 (358)

- November 2025 (359)

- October 2025 (376)

- September 2025 (258)

- August 2025 (319)

- July 2025 (230)

- June 2025 (348)

- May 2025 (261)

- April 2025 (305)

-

Categories

- 1

- 1 NUCLEAR ISSUES

- business and costs

- climate change

- culture and arts

- ENERGY

- environment

- health

- history

- indigenous issues

- Legal

- marketing of nuclear

- media

- opposition to nuclear

- PERSONAL STORIES

- politics

- politics international

- Religion and ethics

- safety

- secrets,lies and civil liberties

- spinbuster

- technology

- Uranium

- wastes

- weapons and war

- Women

- 2 WORLD

- ACTION

- AFRICA

- Atrocities

- AUSTRALIA

- Christina's notes

- Christina's themes

- culture and arts

- Events

- Fuk 2022

- Fuk 2023

- Fukushima 2017

- Fukushima 2018

- fukushima 2019

- Fukushima 2020

- Fukushima 2021

- general

- global warming

- Humour (God we need it)

- Nuclear

- RARE EARTHS

- Reference

- resources – print

- Resources -audiovicual

- Weekly Newsletter

- World

- World Nuclear

- YouTube

-

RSS

Entries RSS

Comments RSS

“Nuclear power” was and never will be “too cheap to meter,” what the atomic power industry told us back in the 1950’s. Nuclear power is not cost effective. It is not profitable enough without government subsidizes, tax breaks and liability insurance protections, in the US the “Price-Anderson Act,” which was just renewed. It is just too damn expensive, too capital intensive. It is just not in alignment with the Capitalist Mantra of “Maximizing profits, cutting costs & eliminating labor.” The “invisible hand of the free market,” is killing and should kill nuclear power forever.