Japan earthquake casts cloud over push to restart nuclear plants

January 5, 2024

TOKYO, Jan 4 (Reuters) – The powerful earthquake that hit Japan’s western coast on New Year’s Day has underscored the country’s exposure to natural disasters, casting fresh doubt over a push to bring its nuclear capacity back online.

Nuclear power plants dot the coast of mountainous Japan, which is prone to earthquakes and tsunamis due to its location on the seismically active “Ring of Fire” around the Pacific Ocean.

Monday’s magnitude 7.6 earthquake, which has killed more than 80 people in the Hokuriku region, destroyed infrastructure and left homes without power, struck days after regulators lifted an operational ban on Tokyo Electric’s (9501.T) Kashiwazaki-Kariwa nuclear power plant.

Tepco hopes to gain local permission to restart the plant, which is around 120 kilometres from the quake’s epicentre and has been offline since 2012. The utility was banned in 2021 from operating the plant due to safety breaches including a failure to protect nuclear materials.

“The Japanese public is still generally less positive toward nuclear power now than they were before the Fukushima disaster,” analysts at Rystad Energy wrote in a client note.

“As a result, public sentiment – and potentially government policy – is likely to be sensitive to any new power-plant disruptions caused by the most recent quake or any future ones.”

Japan had planned to phase out nuclear power after the March 2011 tsunami and Fukushima meltdown, but rising energy prices and repeated power crunches have prompted a shift towards restarting idled capacity and developing next-generation reactors.

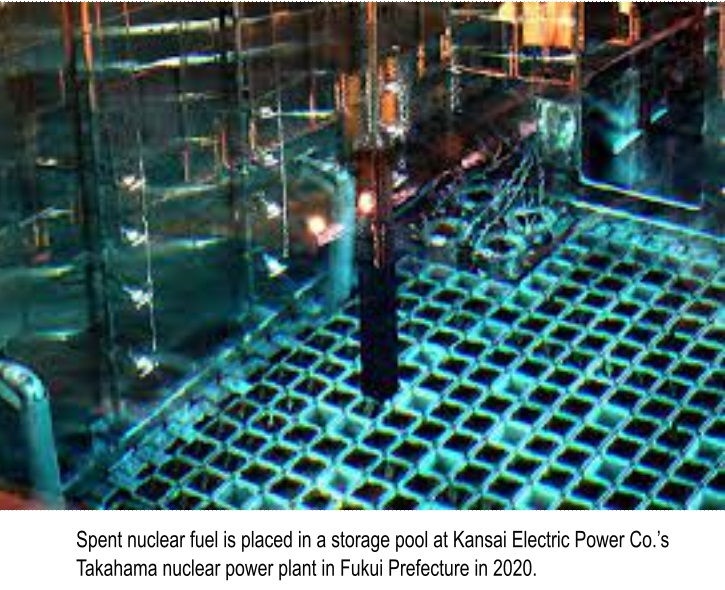

After the Jan. 1 quake Tepco reported water had spilled from nuclear fuel pools at the Kashiwazaki-Kariwa plant – the world’s largest – but said radiation levels were normal.

“Citizens had felt that Tepco could probably be able to restart reactors by the end of 2024, but this earthquake seems to have reignited a sense of fear,” said Yukihiko Hoshino, a Kashiwazaki city assembly member opposing the plant restart.

Monday’s tsunami warning reminded him of the Fukushima disaster, he said.

Tepco shares fell as much as 8% on Thursday, the first trading day since the earthquake, before closing up 2.2%.

Hokuriku Electric (9505.T), whose idled Shika plant is located around 65 kilometres from the earthquake’s epicentre, slid as much as 8% before paring losses to end down 2.2%.

The company, which reported water spill-over from spent nuclear fuel pools and oil leaks at the plant after the quake, hopes to restart the No.2 reactor there sometime after April 2026, it said in October………………………………… Reporting by Kantaro Komiya, Sudarshan Varadhan, Mariko Katsumura and Sam Nussey; Editing by Hugh Lawson

Rokkasho redux: Japan’s never-ending nuclear reprocessing saga

By Tatsujiro Suzuki | December 26, 2023, https://thebulletin.org/2023/12/rokkasho-redux-japans-never-ending-reprocessing-saga/

The policy seeks to at least begin to deal with the huge stocks of plutonium Japan has amassed

According to a recent Reuters report, Japan Nuclear Fuel Ltd (JNFL) still hopes to finish construction of Japan’s long-delayed Rokkasho reprocessing plant in the first half of the 2024 fiscal year (i.e. during April-September 2024). The plant—which would reprocess spent nuclear fuel from existing power plants, separating plutonium for use as reactor fuel—is already more than 25 years behind schedule, and there are reasons to believe that this new announcement is just another wishful plan that will end with another postponement.

One indication of further possible delays: On September 28, 2023, Naohiro Masuda, president of JNFL, stated that the safety review of the reprocessing plant by Japan’s Nuclear Regulation Authority will be difficult to complete by the end of 2023. He nevertheless insisted that the company could still meet completion target date in 2024.

Here is a partial history of past key developments that make completion in 2024 seem unlikely:

1993: Construction starts.

1997: Initial target for completion.

2006-2008: Hot tests conducted, revealing technical problems with the vitrification process for dealing with waste produced during reprocessing.

2011: Fukushima Dai-ichi nuclear plant accident.

2012: New safety regulation standards introduced.

2022: Completion target date postponed to June 2024)

The 2022 postponement was the 26th of the Rokkasho project.

Why so many postponements? There seem to be at least five underlying reasons for the postponements for the Rokkasho plant. First, JNFL lacks relevant expertise to manage such a technologically complex and hazardous project, which is owned by nine nuclear utilities plus all other major companies associated with nuclear power in Japan. Most of the firm’s senior executives are from shareholding companies (especially utility companies) and are not necessarily experts in the field of reprocessing spent nuclear fuel.

Second, the technologies in the plant came from different companies and institutions. The management of the project is therefore technically complex.

Third, the post-Fukushima-accident nuclear facility safety licensing review process is much more stringent than what existed before the accident. For example, the Nuclear Regulation Authority told JNFL at their November 25, 2023 meeting: “JNFL should immediately make improvements because it is clear that JNFL does not understand the contents of the permit well enough to confirm the adequacy of the design of the facilities on site and has not visited the site.”

Fourth, the financial costs to JNFL of postponement are covered by the utilities’ customers, because the utilities must pay a “reprocessing fee” every year, based on the spent fuel generated during that year, whether or not the reprocessing plant operates. The system by which the Nuclear Reprocessing Organization of Japan decides the reprocessing fee is not transparent.

Fifth, the project lacks independent oversight. Even though JNFL’s estimate of the cost of building and operating the Rokkasho plant has increased several-fold, no independent analysis has been done by a third party. One reason is that some of the shareholders are themselves contractors working on the plant and have no incentive to scrutinize the reasons for the cost increases or the indefinite extension of the construction project.

After so many postponements, there is reason to wonder whether the plant will ever operate, but the government and utilities continue to insist that the plant will open soon. Even if Rokkasho were to operate, it may suffer from the same kinds of problems that marked Britain’s light-water reactor spent fuel reprocessing experience, as described in Endless Trouble: Britain’s Thermal Oxide Reprocessing Plant (THORP).

Why does Japan’s commitment to reprocessing continue?

Despite the serious and longstanding problems the Rokkasho plant has faced (and continues to face), Japanese regulators and nuclear operators have doggedly pursued the project. There are four reasons:

Spent fuel management. Currently, most of Japan’s spent nuclear fuel is stored in nuclear power plant cooling pools. But the pool capacities are limited, and the 3,000-ton-capacity Rokkasho spent fuel pool is also almost full. The nuclear utilities must therefore start operating the Rokkasho plant unless they can create additional spent fuel storage capacity, either on- or off-site. The Mutsu spent fuel storage facility is a candidate for additional capacity, but due to the concern that spent fuel could stay there forever, Mutsu city refuses to accept spent fuel unless the Rokkasho reprocessing plant begins to operate. The Rokkasho plant design capacity is 800 tons of spent fuel per year.

Legal and institutional commitments. Under Japan’s nuclear regulations, utilities must specify a “final disposal method” for spent fuel. The law on regulation of nuclear materials and nuclear reactors states that “when applying for reactor licensing, operators must specify the final disposal method of spent fuel” (Article 23.2.8). In addition, there was a clause that “disposal method” should be consistent with implementation of the government policy, which specified reprocessing as the disposal method. Although that clause was deleted in the 2012 revision of the law after the Fukushima accident, the Law on Final Disposal of High-Level Radioactive Waste still bans direct disposal of spent fuel. In addition, the 2016 Law on Reprocessing Fees legally requires utilities to submit reprocessing fees for all spent fuel generated every year since they stated in their applications that “final disposal method” for their spent fuel would be reprocessing.

Commitments to hosting communities. The nuclear utilities committed—albeit tacitly—to the communities hosting nuclear power plants that they would remove the spent fuel to reprocessing plants, since that was the national policy. Separately, JNFL signed an agreement with Rokkasho village and Aomori prefecture that says that if the Rokkasho reprocessing plant faces “severe difficulties,” other measures will be considered—including the return of spent fuel stored at Rokkasho to the nuclear power plants.

Local governments hosting nuclear power plants were not involved in this deal, however. They could therefore just refuse to receive spent fuel from Aomori.

In fact, after the Fukushima accident, when the government was considering amending the nuclear fuel cycle policy to include a “direct disposal option” for spent fuel in a deep underground repository, the Rokkasho village parliament (at the behind the scenes suggestion by the then JNFL president, Yoshihiko Kawai), issued a strong statement asking for “maintenance of the current nuclear fuel cycle policy.”

The statement continued that, if Japan’s fuel cycle policy changed, Rokkasho would: refuse to accept further waste from the reprocessing of Japan’s spent fuel in the UK and France; require the removal of reprocessing waste and spent fuel stored in Rokkasho; no longer accept spent fuel; and seek compensation for the damages caused by the change of the policy.

Institutional and bureaucratic inertia. In Japan, bureaucrats rotate to new positions every two or three years and are reluctant to take the risk of changing existing policies. They therefore tend to stick with past commitments. Institutional inertia becomes stronger as a project becomes bigger. The Rokkasho reprocessing project is one of the largest projects ever in Japan. Changing the project is therefore very difficult.

Will Japan’s new plutonium capping policy have any real impact? In 2018, Japan’s Atomic Energy Commission announced a new policy on “Basic Principles on Utilization of Plutonium” (see also this post). Under the new policy, the commission proposed that Japan would reduce its stockpile of separated plutonium, starting with a commitment not to increase it, and that reprocessing would take place only when a credible plan to use the separated plutonium existed.

The policy seeks to at least begin to deal with the huge stocks of plutonium Japan has amassed, both in European separation facilities (some 36.7 tons) and in Japan (10.5 tons), in anticipation of using the plutonium widely to fuel nuclear reactors—which so far has not materialized. In conjunction with the new Reprocessing Fee Law, the new plutonium policy gives the government legal authority to control the pace of reprocessing.

But it is not clear how the “capping policy” will be implemented. It is not a legally binding document, and no regulation has been introduced to control reprocessing. Utilities must submit specific plans for plutonium use to the Atomic Energy Commission for its review before reprocessing of their fuel begins. But the commission can only give advice to the government about the credibility of these plans, giving rise to questions about whether the policy will lead to sustained changes in reprocessing activity. A similar “paper rule” on plutonium has existed since 2003.

A way out. Japan could extricate itself from its reprocessing and plutonium problems in several ways. All involve significant changes in policy that would:

Find additional spent fuel storage capacity, on- or off-site. Local communities may be more willing to accept on-site dry cask storage of spent fuel if they are told that it is safer than spent fuel pool storage. For example, Saga Prefecture and Genkai-town, which host Kyushu Electric’s Genkai Nuclear Power Plant, have agreed to host dry cask storage starting in 2027. Host communities may want guarantees that spent fuel will be removed after a specified storage period. Such a guarantee could be given by the central government.

Amend the law on final disposal of high-level radioactive waste. An amendment could allow direct disposal of spent nuclear fuel in a deep underground repository. This would provide more flexibility in spent fuel management and make it easier for communities to host interim spent fuel storage.

Amend the Reprocessing Fee Law and shut down Rokkasho. An amendment to the law on reprocessing fees could allow the government to use reprocessing funds to implement a shutdown of the Rokkasho reprocessing plant. Such a plan could include payment of the debt JNFL has incurred while pursuing the Rokkasho project and funds for dry cask interim storage. This would enable the government to finally end the problem-plagued Rokkasho reprocessing plant project.

Mass layoffs at small nuclear reactor companies

Pioneering Nuclear Startup Lays Off Nearly Half Its Workforce. NuScale is the second major U.S. reactor company to cut jobs in recent months.

Huff Post, By Alexander C. Kaufman, Jan 5, 2024,

Almost exactly one year ago, NuScale Power made history as the first of a new generation of nuclear energy startups to win regulatory approval of its reactor design ― just in time for the Biden administration to begin pumping billions of federal dollars into turning around the nation’s atomic energy industry.

But as mounting costs and the cancellation of its landmark first power plant have burned through shrinking cash reserves, the Oregon-based company is laying off as much 40% of its workforce, HuffPost has learned.

At a virtual all-hands meeting Friday afternoon, the company announced the job cuts to remaining employees. HuffPost reviewed the audio of the meeting. Two sources with direct knowledge of NuScale’s plans confirmed the details of the layoffs.

NuScale did not respond to a call, an email or a text message seeking comment.

Surging construction costs are imperiling clean energy across the country. In just the past two months, developers have pulled the plug on major offshore wind farms in New Jersey and New York after state officials refused to let companies rebid for contracts at a higher rate.

But the financial headwinds are taking an especially acute toll on nuclear power. It takes more than a decade to build a reactor, and the only new ones under construction in the U.S. and Europe went billions of dollars over budget in the past two decades. Many in the atomic energy industry are betting that small modular reactors ― shrunken down, lower-power units with a uniform design ― can make it cheaper and easier to build new nuclear plants through assembly-line repetition.

The U.S. government is banking on that strategy to meet its climate goals. The Biden administration spearheaded a pledge to triple atomic energy production worldwide in the next three decades at the United Nations’ climate summit in Dubai last month, enlisting dozens of partner nations in Europe, Asia and Africa.

The two infrastructure-spending laws that President Joe Biden signed in recent years earmark billions in spending to develop new reactors and keep existing plants open. And new bills in Congress to speed up U.S. nuclear deployments and sell more American reactors abroad are virtually all bipartisan, with progressives and right-wing Republicans alike expressing support for atomic energy…………

Until November, NuScale appeared on track to debut the nation’s first atomic energy station powered with small modular reactors. But the project to build a dozen reactors in the Idaho desert, and sell the electricity to ratepayers across the Western U.S. through a Utah state-owned utility, was abandoned as rising interest rates made it harder for NuScale to woo investors willing to bet on something as risky a first-of-its-kind nuclear plant.

In 2022, NuScale went public via a SPAC deal, a type of merger that became a popular way for debt-laden startups to pay back venture capitalists with a swifter-than-usual initial public offering on the stock market.

In its latest quarterly earnings, NuScale reported just under $200 million in cash reserves, nearly 40% of which was tied up in restricted accounts……………………………………..

NuScale, which has four other projects proposed in the U.S. and tentative deals in at least eight other countries, isn’t the only nuclear startup navigating choppy waters.

In October, Maryland-based X-energy, which is working with the federal government to develop a next-generation reactor using gas instead of water for cooling, cut part of its workforce and scrapped plans to go public.

In September, California-based Oklo appeared to lose a $100 million contract to build its its salt-cooled “micro-reactors” at an Air Force base in Alaska, as the independent Northern Journal newsletter first reported. ………. https://www.huffpost.com/entry/nuscale-layoffs-nuclear-power_n_65985ac5e4b075f4cfd24dba

Nuclear disasters–in–waiting

RICHARD STONE, Science 4 Jan 24

Having taken a heavy toll on Ukraine’s ecosystems and water resources, the war with Russia threatens to create a another environmental disaster: damage to the region’s extensive nuclear infrastructure—including 15 power reactors and three research reactors.

“There continues to be a highly precarious nuclear safety and security situation across Ukraine,” International Atomic Energy Agency (IAEA) Director General Rafael Mariano Grossi said in a statement after explosions were heard near the Khmelnitsky Nuclear Power Plant and its two Soviet-era reactors on 28 November 2023—the second near-miss in a single month at the site. “All of Ukraine’s nuclear facilities remain vulnerable, either directly if hit by a missile or indirectly if their off-site power supplies are disrupted.”

Russia’s assault on Ukrainian nuclear sites began on the very first day of the full-scale invasion. On 24 February 2022, troops overran the Chornobyl Nuclear Power Plant, infamous for the explosion and fire there in 1986 that sent a plume of radioactive smoke into Western Europe. During 5 weeks of occupation, Russian soldiers ransacked labs and kicked up radioactive soil and dust as they dug trenches and slogged through contaminated forests in the exclusion zone around the defunct plant. To the east that spring, Russian troops frequently shelled the Kharkiv Institute of Physics and Technology, damaging a hall containing a subcritical nuclear reactor.

Shelling has also flared up repeatedly around the Zaporizhzhia Nuclear Power Station, a complex of six reactors that constitutes Europe’s largest nuclear power plant. Russia captured the plant in March 2022 and the reactors were shut down 6 months later, eliminating the risk of a core meltdown. Still, a prodigious amount of nuclear material remains there: The reactor halls hold 1380 tons of fresh and spent uranium oxide fuel, and two repositories store an additional 2100 tons of spent fuel laced with nasty long-lived radionuclides—the ingredients, many Ukrainians fear, of a “dirty bomb” that would use conventional explosives to spread radioactive isotopes……………………………………….

The presence of IAEA observers at the Zaporizhzhia station since September 2022 has deterred the theft of dirty-bomb ingredients. But a major missile strike on one of its spent fuel repositories could turn the plant itself into a dirty bomb, spreading radioactive contamination in a radius of up to 30 kilometers, says Volodymyr Borysenko, a nuclear engineer with the National Academy of Sciences of Ukraine’s Institute for Safety Problems of Nuclear Power Plants (ISPNPP).

Even a smaller strike could contaminate the reactor complex. And the spent fuel is also at risk from repeated electricity blackouts that have struck the plant, the latest in early December 2023. Diesel-fueled generators can supply power for up to 10 days, but a prolonged outage could be dangerous, as power is needed to pump cooling water into the plant’s uranium reactor cores and pools holding spent fuel.

A lesser known radioactive risk is situated about 150 kilometers upstream from the Zaporizhzhia plant on the Dnipro River. During the Cold War, the Prydniprovsky Chemical Plant was one of Europe’s largest uranium ore processing facilities. The complex accumulated some 40 million tons of tailings—leftovers of milling uranium—and other foul residues before it closed in 1992. By early 2022, Ukraine, with help from the European Union, had fenced off highly contaminated areas. But a missile or artillery strike on a tainted building or dump could disperse radioactive dust over the nearby city of Kamianske.

One relative bright spot is Chornobyl, where Ukrainian scientists are restoring labs damaged early in the war. But large parts of the exclusion zone remain off limits because of the threat of mines and unexploded ordinance, says ISPNPP Director Anatolii Nosovskiy. Complicating matters for radiation monitoring, he says, the Ukrainian army has built defensive fortifications in the zone, near the border with Belarus…………………. https://www.science.org/doi/10.1126/science.adn7987

Germany’s coal power production drops to lowest level in 60 years in2023 after nuclear exit

Germany’s coal power production drops to lowest level in 60 years in

2023 after nuclear exit. Germany’s lignite power production fell to the

lowest level since 1963 last year, while hard coal power production even

dropped to the lowest level since 1955, an analysis by research institute

Fraunhofer ISE has found.

The country’s entire coal-fired power

production fell by almost one third (48 TWh), cutting coal’s share of

total net power generation to 26 per cent. Meanwhile, the country sourced

nearly 60 percent (59.7%) of its net power production from renewables,

which generated a total of 260 terawatt hours (TWh), an increase of 7.2

percent compared to 2022. With an increase of more than 17 TWh, output from

wind turbines grew particularly strong, according to the institute’s

annual energy review.

Renew Economy 4th Jan 2024

-

Archives

- February 2026 (59)

- January 2026 (308)

- December 2025 (358)

- November 2025 (359)

- October 2025 (376)

- September 2025 (258)

- August 2025 (319)

- July 2025 (230)

- June 2025 (348)

- May 2025 (261)

- April 2025 (305)

- March 2025 (319)

-

Categories

- 1

- 1 NUCLEAR ISSUES

- business and costs

- climate change

- culture and arts

- ENERGY

- environment

- health

- history

- indigenous issues

- Legal

- marketing of nuclear

- media

- opposition to nuclear

- PERSONAL STORIES

- politics

- politics international

- Religion and ethics

- safety

- secrets,lies and civil liberties

- spinbuster

- technology

- Uranium

- wastes

- weapons and war

- Women

- 2 WORLD

- ACTION

- AFRICA

- Atrocities

- AUSTRALIA

- Christina's notes

- Christina's themes

- culture and arts

- Events

- Fuk 2022

- Fuk 2023

- Fukushima 2017

- Fukushima 2018

- fukushima 2019

- Fukushima 2020

- Fukushima 2021

- general

- global warming

- Humour (God we need it)

- Nuclear

- RARE EARTHS

- Reference

- resources – print

- Resources -audiovicual

- Weekly Newsletter

- World

- World Nuclear

- YouTube

-

RSS

Entries RSS

Comments RSS