The nuclear decommissioning problem – a financial disaster looming

the coming closures could drag on for decades and place unexpected burdens on investors, consumers or taxpayers.

the coming closures could drag on for decades and place unexpected burdens on investors, consumers or taxpayers.The question is who will pay — for Humboldt Bay, and for dozens of other reactors that are in the process of closing or might soon.

Nuclear operators like PG&E are supposed to lay up enough money to cover the costs, similar to how corporations fund pensions. Turns out, most haven’t.

Nuclear operators like PG&E are supposed to lay up enough money to cover the costs, similar to how corporations fund pensions. Turns out, most haven’t.

PG&E’s Humboldt Bay trust fund, for instance, is currently $308 million short, according to a company filing to the U.S. Nuclear Regulatory Commission. PG&E customers will shoulder the cost in the form of higher electricity bills.

“Somebody’s got to pay for it — the money doesn’t come from magic,” said Allison M. Macfarlane, a former NRC chairman. Brittany McKannay, a PG&E spokeswoman, said the company is committed to operating and decommissioning its nuclear plants safely.

The U.S. nuclear industry is feeling its age. Once touted as a source of electricity that would be “too cheap to meter,” plants need expensive upgrades to protect them from terrorism and natural disasters.

At the same time, they face growing competition from renewables and natural gas. Five new reactors are under construction, but current economics give little incentive to build more. Looming is an unprecedented wave of closures.

Yet 82 of the 117 U.S. nuclear power plants, including seven in the process of shutting down, don’t have enough cash on hand to close safely, according to NRC records. And closing tends to cost more than operators expect. Based on NRC filings, the actual combined cost may be somewhere in the neighborhood of $100 billion — $43 billion more than the current balance of the trust funds.

So the coming closures could drag on for decades and place unexpected burdens on investors, consumers or taxpayers.

“The public has a right to demand that all nuclear power plant operators are secure in their funding,” Sen. Edward J. Markey, a Massachusetts Democrat on the Environment and Public Works Committee, said in a statement in response to questions from Bloomberg.

Among the underfunded plants are FirstEnergy Corp.’s Three Mile Island in Pennsylvania, site of the 1979 partial meltdown, and Entergy Corp.’s Indian Point, about 35 miles north of New York City……..http://www.japantimes.co.jp/news/2015/05/05/world/u-s-nuclear-dilemma-reactors-aging-decommissioning-cash-billions-short-permanent-waste-site-eludes/#.VUldaI6qpHw

1 Comment »

Leave a comment

-

Archives

- March 2026 (75)

- February 2026 (268)

- January 2026 (308)

- December 2025 (358)

- November 2025 (359)

- October 2025 (376)

- September 2025 (258)

- August 2025 (319)

- July 2025 (230)

- June 2025 (348)

- May 2025 (261)

- April 2025 (305)

-

Categories

- 1

- 1 NUCLEAR ISSUES

- business and costs

- climate change

- culture and arts

- ENERGY

- environment

- health

- history

- indigenous issues

- Legal

- marketing of nuclear

- media

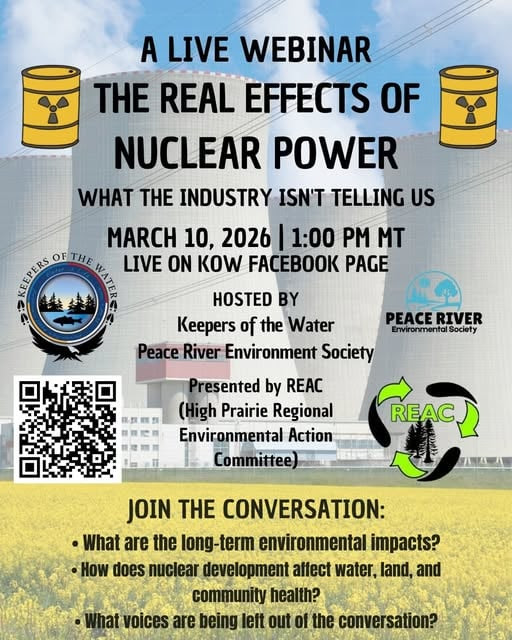

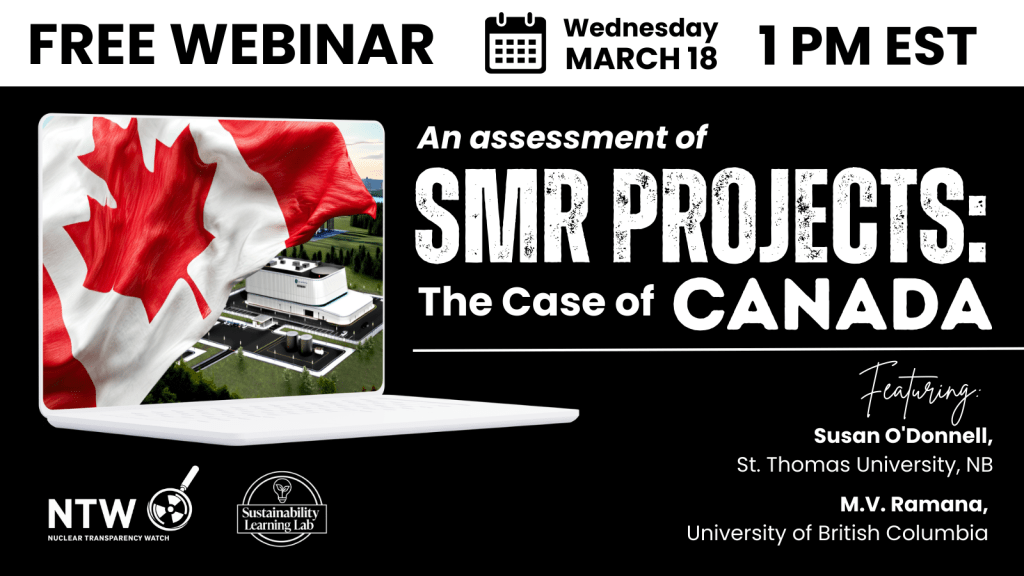

- opposition to nuclear

- PERSONAL STORIES

- politics

- politics international

- Religion and ethics

- safety

- secrets,lies and civil liberties

- spinbuster

- technology

- Uranium

- wastes

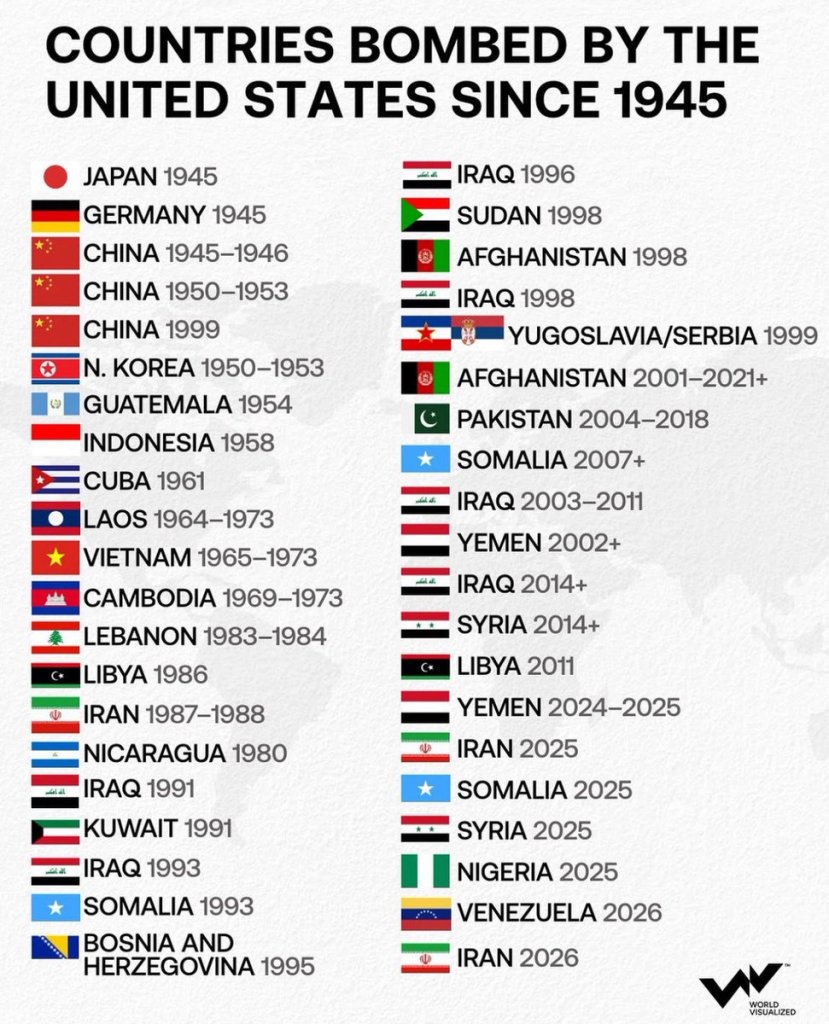

- weapons and war

- Women

- 2 WORLD

- ACTION

- AFRICA

- Atrocities

- AUSTRALIA

- Christina's notes

- Christina's themes

- culture and arts

- Events

- Fuk 2022

- Fuk 2023

- Fukushima 2017

- Fukushima 2018

- fukushima 2019

- Fukushima 2020

- Fukushima 2021

- general

- global warming

- Humour (God we need it)

- Nuclear

- RARE EARTHS

- Reference

- resources – print

- Resources -audiovicual

- Weekly Newsletter

- World

- World Nuclear

- YouTube

-

RSS

Entries RSS

Comments RSS

A Sustainable graphic