Uranium the “dead cat” investment

Of all the problems confronting uranium, and a reason to stay clear, the biggest is the energy glut and the fact that most alternatives forms of power are easier to develop and require much less government scrutiny than nuclear power.

Uranium Is Hot, But Not For Investors, Forbes, Tim Treadgold, 18 Nov 14 At a time when most commodity prices are falling it is hard to ignore a metal outlier that has just had its best week in 18 years, but in the case of uranium ignorance could save you money.

Last week’s 14% rise in the price of the nuclear fuel took most observers by surprise though when

analyzed it seems that the much of rise in the short-term price from $36.75 a pound to $42/lb was in a category called dead-cat bounce.

analyzed it seems that the much of rise in the short-term price from $36.75 a pound to $42/lb was in a category called dead-cat bounce.

For anyone unfamiliar with market slang a dead-cat bounce is the height a cat rises off the footpath after falling 20 floors – it’s an irrelevant recovery, and the cat’s still dead………

even as Japan re-fuels its fleet of nuclear reactors, and China presses ahead with a major nuclear building program, there are four reasons to be cautious about the uranium outlook, and even more wary of uranium exploration and mining companies.

Firstly, there is a global energy glut with prices for oil, coal and gas depressed by an over-supply of all fossil fuels hitting a sluggish global economy.

Secondly, the uranium market is divided into three distinct categories of short, medium and long-term and what happened last week was a sharp price movement, in very thin trading, at the short end of the market with no price change, yet, in medium or long-term pricing.

Thirdly, there is no shortage of uranium in the world, and while squeeze points could develop, such as Russia withholding high-grade fuel in a tit-for-tat reaction to the sanctions slowing its economy, there is plenty of other material available.

Fourthly, most uranium mines still in the planning stage require a price of at least $60/lb to be profitable, or attract the finance to fund their development.

Other factors weigh on the uranium industry, including a long line of projects-in-waiting which were taken through to the planning stage a decade ago when the price hit $135/lb but cancelled when the price collapsed……..

Of all the problems confronting uranium, and a reason to stay clear, the biggest is the energy glut and the fact that most alternatives forms of power are easier to develop and require much less government scrutiny than nuclear power.

If the short-term price rises closer to the $60/lb mark it might be time to take uranium seriously, but only if the long-term price moves higher as well. http://www.forbes.com/sites/timtreadgold/2014/11/17/uranium-is-hot-but-not-for-investors/

No comments yet.

-

Archives

- March 2026 (76)

- February 2026 (268)

- January 2026 (308)

- December 2025 (358)

- November 2025 (359)

- October 2025 (376)

- September 2025 (258)

- August 2025 (319)

- July 2025 (230)

- June 2025 (348)

- May 2025 (261)

- April 2025 (305)

-

Categories

- 1

- 1 NUCLEAR ISSUES

- business and costs

- climate change

- culture and arts

- ENERGY

- environment

- health

- history

- indigenous issues

- Legal

- marketing of nuclear

- media

- opposition to nuclear

- PERSONAL STORIES

- politics

- politics international

- Religion and ethics

- safety

- secrets,lies and civil liberties

- spinbuster

- technology

- Uranium

- wastes

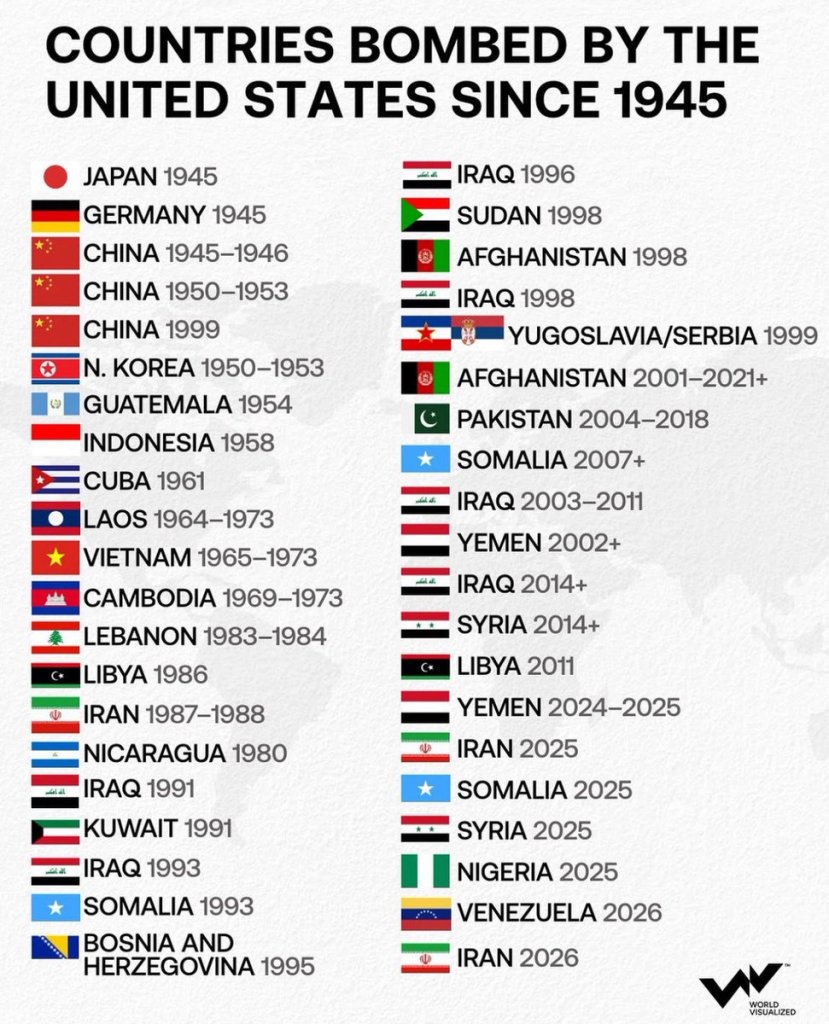

- weapons and war

- Women

- 2 WORLD

- ACTION

- AFRICA

- Atrocities

- AUSTRALIA

- Christina's notes

- Christina's themes

- culture and arts

- Events

- Fuk 2022

- Fuk 2023

- Fukushima 2017

- Fukushima 2018

- fukushima 2019

- Fukushima 2020

- Fukushima 2021

- general

- global warming

- Humour (God we need it)

- Nuclear

- RARE EARTHS

- Reference

- resources – print

- Resources -audiovicual

- Weekly Newsletter

- World

- World Nuclear

- YouTube

-

RSS

Entries RSS

Comments RSS

Leave a comment